Hyperliquid vote for the creator of USDH is expected on September 14

Hyperliquid has a favorite for creating a native stablecoin and taking the auspicious USDH ticker. Native Markets, a group led by Stripe, is taking the lead both from validator power and based on Polymarket predictions.

Hyperliquid is days from choosing the creator of the ecosystem’s native token. The perpetual futures DEX announced it had reserved the USDH ticker, in preparation for choosing a team to launch the actual asset.

As Cryptopolitan reported earlier, multiple prominent stablecoin producers applied to Hyperliquid’s stablecoin creation process, including Paxos and Ethena. The Hyperliquid community interviewed each of the candidates for its main ideas on sourcing liquidity, stablecoin backing, and compliance.

Native Markets leads USDH voting competition

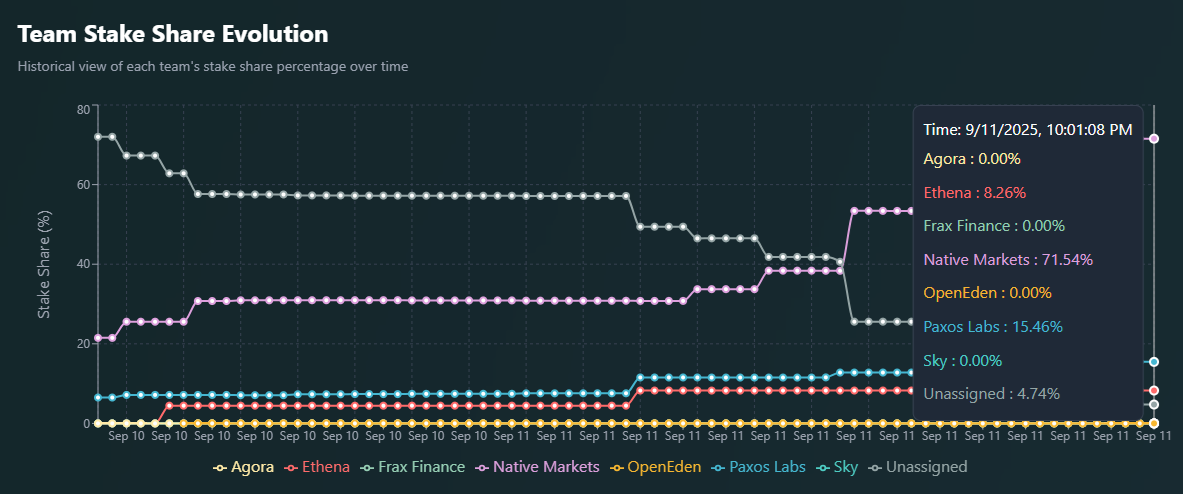

The final vote for the USDH creator will happen on September 14. Until then, validators have already shown their influence, with most voting power concentrated behind Native Markets.

As of September 11, Native Markets, led by Stripe, took off with the biggest share of validator power, rising to over 78%. The big lead turned into dominance as more validators signaled their most probable decision.

The emergence of Native Markets as the probable winner surprised the Hyperliquid community, as some believed Ethena and Paxos offered much better conditions. Paxos was also seen as a potential winner due to its prominence as a stablecoin issuer.

Is Native Markets a bad choice for Hyperliquid?

The Hyperliquid community has shown some skepticism about the potential of Native Markets. Hyperliquid currently carries over $5.6B in USDC tokens, boosting the balance for the issuer Circle.

The new issuer of USDH may receive up to $220M in fees, which will go back to the Hyperliquid ecosystem. In the case of securing the tokens with US government bonds, the passive income from bonds will remain in the Hyperliquid ecosystem.

The Native Markets team gained an advantage by presenting itself as native to Hyperliquid. However, social media reactions point to a rushed vote that pushed Native Markets ahead.

This is a call to all hyperliquid community :

Native markets is going to win the USDH ticker and it's EXTREMELY bearish for @HyperliquidX. (it's not too late)

Here is why 👇

1. ONLY 50% FOR THE ASSISTANCE FUND AND 50% FOR MARKETING (while ethena and paxos proposed 95% for… pic.twitter.com/wMRIk3JATQ

— Yoliu.hl (@Yoliu_) September 11, 2025

The team has proposed to distribute only 50% of the yield to the community, against 95% for other teams. Additionally, the native team will use the Bridge infrastructure by Stripe, creating a centralized dependency.

Despite the flaws, Polymarket voting places a 95% probability on Native Markets as the winner of the vote. At one point, the team was almost tied with Paxos. The rapid advancement of voting stake also led to speculations of a rushed vote with insufficient feedback from the Hyperliquid community. Currently, HYPE stakers may have to actively remove their tokens from the validators supporting the Native Markets team.

Hyperliquid’s goal is to remain sustainable as it grows its share against centralized perpetual futures markets. The Hyperliqud chain already carries $2.7B in value locked, with over $12.8B in open interest.

The voting boosted HYPE, which rallied to another price peak at $55.40. The strong holding ethos and token buybacks have translated the Hyperliquid success into rewards for the community of holders. For that reason, the team selected for USDC is seen as having the potential to expand the bullish trend and make the DEX more liquid.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x POWER: Trade to share 4,387,500 POWER

New users get a 100 USDT margin gift—Trade to earn up to 1888 USDT!

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!