Nvidia ( NVDA ) stock has recently faced a downturn. While the artificial intelligence (AI) giant delivered impressive results for its fiscal 2026 second quarter, much of the stock’s gains happened earlier in 2025. Furthermore, investors are increasingly uneasy about the outlook for Nvidia's operations in China.

The company’s leadership reported that none of Nvidia’s China-focused H20 chips were sold during Q2, nor are any projected sales for these chips included in its forecast for the third quarter. This development worried investors, resulting in Nvidia’s stock extending its decline for a month after the earnings release on Aug. 27.

However, there remains a compelling case for holding Nvidia shares. The recent drop of over 8% in the past month offers a more attractive entry point for potential investors.

Image source: Getty Images.

Nvidia’s future is bright—even without the Chinese market

Investor unease can be traced back in part to comments from CEO Jensen Huang. In an interview from May addressing chip export curbs, Huang remarked that losing access to China’s $50 billion market over the coming years would represent a “significant blow” to American companies.

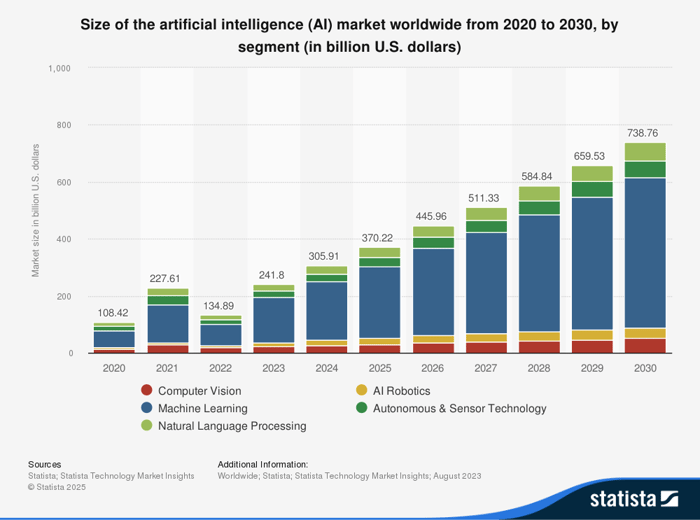

In the latest quarter, Nvidia’s data center revenue only increased by 5% compared to the previous quarter. This modest growth was mainly due to the absence of Chinese sales and marks a sharp slowdown from the rapid quarter-over-quarter growth seen in the past two years. Still, those fixated on the China issue may be missing the larger picture. The global AI sector is expected to see robust, sustained growth for the rest of the decade.

Image source: Statista.

The chart data shows a compound annual growth rate of 16.5% over the next three years, and roughly 15% through 2030. Nvidia is set to remain a key provider as the industry expands. Despite no anticipated sales from China, Nvidia's diverse business allows it to project a 15.6% sequential total revenue increase for the third quarter.

Demand for Nvidia’s products continues to be robust and is expected to stay strong for the foreseeable future. This global outlook should encourage investors to take advantage of the recent pullback in Nvidia’s stock.