The SEC extended review deadlines for the Bitwise Dogecoin ETF and the Grayscale Hedera ETF to Nov. 12, 2025, delaying potential approvals; these extensions add to a growing backlog of altcoin ETF applications and push key market decisions into the fall trading period.

-

SEC extends review to Nov. 12, 2025 for Bitwise Dogecoin and Grayscale Hedera ETFs

-

The agency is using full statutory review periods as altcoin ETF filings surge.

-

As of late August 2025, at least 92 crypto-related ETF filings awaited SEC decisions; 31 altcoin spot-ETF applications filed in H1 2025.

Altcoin ETF delays: SEC extends review of Bitwise Dogecoin and Grayscale Hedera ETF to Nov. 12, 2025; monitor deadlines and impacts on LTC/BCH ETF conversions.

What does the SEC extension mean for the Bitwise Dogecoin ETF and Grayscale Hedera ETF?

The SEC extended its review of the Bitwise Dogecoin ETF and the Grayscale Hedera ETF to Nov. 12, 2025. This delay keeps both applications under formal review and joins a wave of altcoin ETF decisions now scheduled later in the fall, increasing uncertainty for market participants.

Why did the SEC push the deadlines back?

The SEC is taking the full statutory review time on many crypto ETF filings amid a surge in applications. Regulators often extend reviews to assess market structure, surveillance, and investor protection issues. The Federal Register publication and subsequent comment periods triggered the extended statutory timeline for these filings.

On Tuesday, the SEC postponed NYSE Arca’s proposal to list the Bitwise Dogecoin ETF; that application was originally filed in March and published in the Federal Register on March 17.

That same day the agency also extended Grayscale’s application to list the Hedera ETF, aligning both deadlines at Nov. 12, 2025.

Grayscale has also updated filings to convert long-standing Litecoin (LTC) and Bitcoin Cash (BCH) trusts into ETFs. Converting trusts to exchange-listed ETFs allows daily share creation and redemption, which typically narrows premiums and discounts versus OTC trading.

How does this fit into the broader altcoin ETF backlog?

The extension is part of broader SEC activity: at least 31 altcoin spot-ETF applications were filed in the first half of 2025, covering tokens such as XRP, Dogecoin, Solana, Litecoin, Avalanche and BNB.

By Aug. 29, 2025, roughly 92 crypto-related ETF products were awaiting SEC decisions, with large institutional interest visible for Solana (eight applications) and XRP (seven applications).

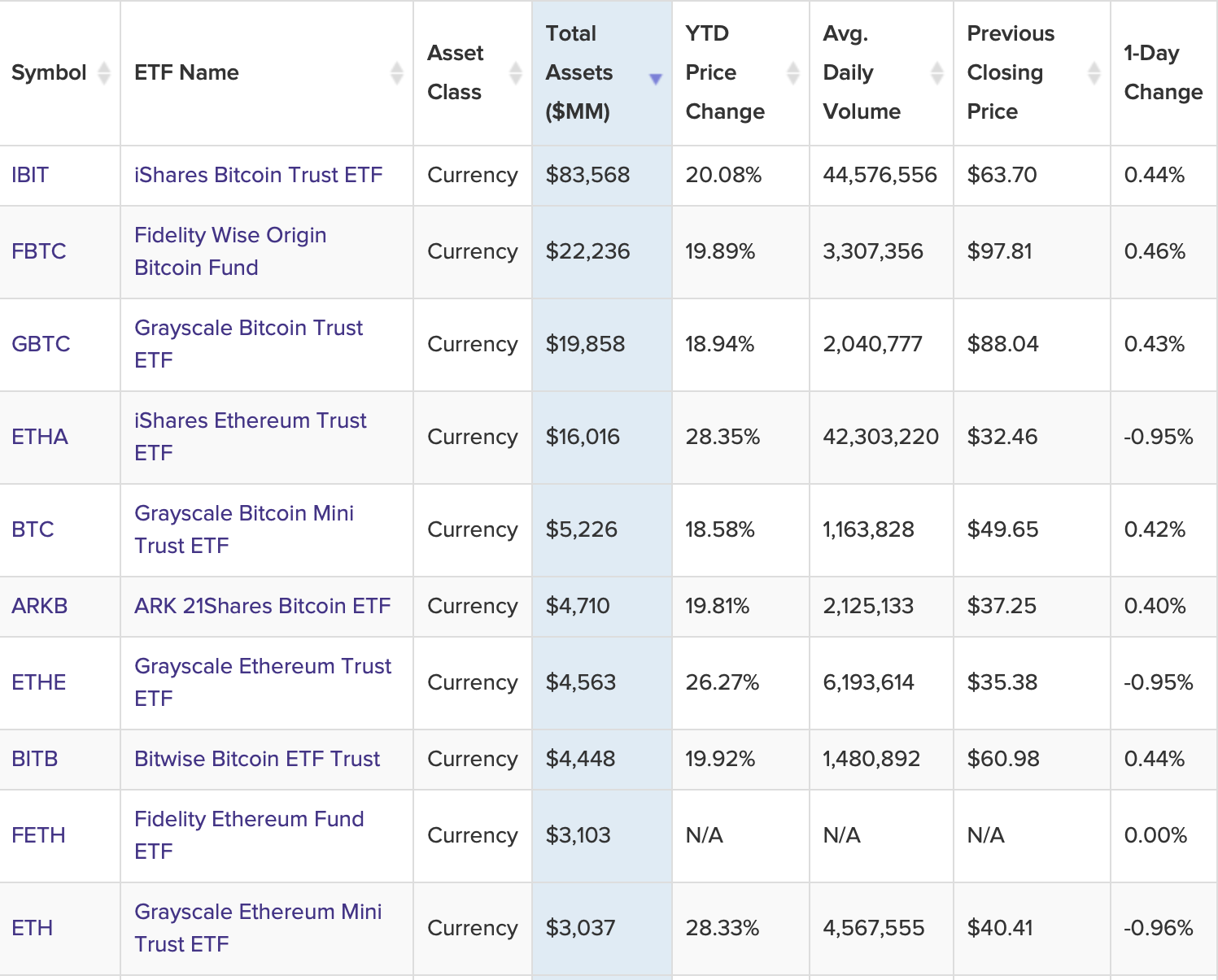

Source: www.etfdb.com

How could Grayscale’s LTC and BCH conversions affect markets?

Converting Grayscale’s LTC and BCH trusts to ETFs is intended to improve price alignment with net asset value. If approved, exchange-listed ETFs enable market makers to create and redeem shares daily, typically reducing large OTC premiums or discounts that have affected trust products.

Grayscale set a precedent in 2024 by converting the Grayscale Bitcoin Trust (GBTC) into the first US spot Bitcoin ETF following a court decision. The company is now applying that model to BCH and LTC, citing improved investor access and tighter price tracking as key benefits.

Frequently Asked Questions

When will the SEC decide on the Bitwise Dogecoin ETF?

The SEC set a new deadline of Nov. 12, 2025 for the Bitwise Dogecoin ETF decision. The agency has consistently used extension periods on many crypto ETF filings.

Will the Grayscale Hedera ETF be decided at the same time?

Yes. The Grayscale Hedera ETF review was extended to the same Nov. 12, 2025 deadline, aligning decisions for both applications on that date unless further extensions occur.

Key Takeaways

- Deadline extended: SEC moved Bitwise Dogecoin and Grayscale Hedera ETF decisions to Nov. 12, 2025.

- Broader backlog: At least 31 altcoin spot-ETF filings in H1 2025 and roughly 92 crypto ETF products awaiting decisions by late August 2025.

- Market impact: Converting trusts to ETFs for LTC and BCH could reduce premiums/discounts and improve price tracking if approved.

Conclusion

The SEC’s extension of review deadlines for the Bitwise Dogecoin ETF and Grayscale Hedera ETF underscores a cautious approach as altcoin ETF filings multiply. Altcoin ETF delays push key approvals into November 2025, reinforcing the need for investors and market participants to track official filings and deadlines closely. COINOTAG will continue to report updates as new decisions are published.