MYX Retests All-Time High After 200% Surge – But a Crash May Be Looming

MYX Finance’s token skyrocketed past 200% with record trading activity, but technicals warn of a looming reversal as skepticism mounts.

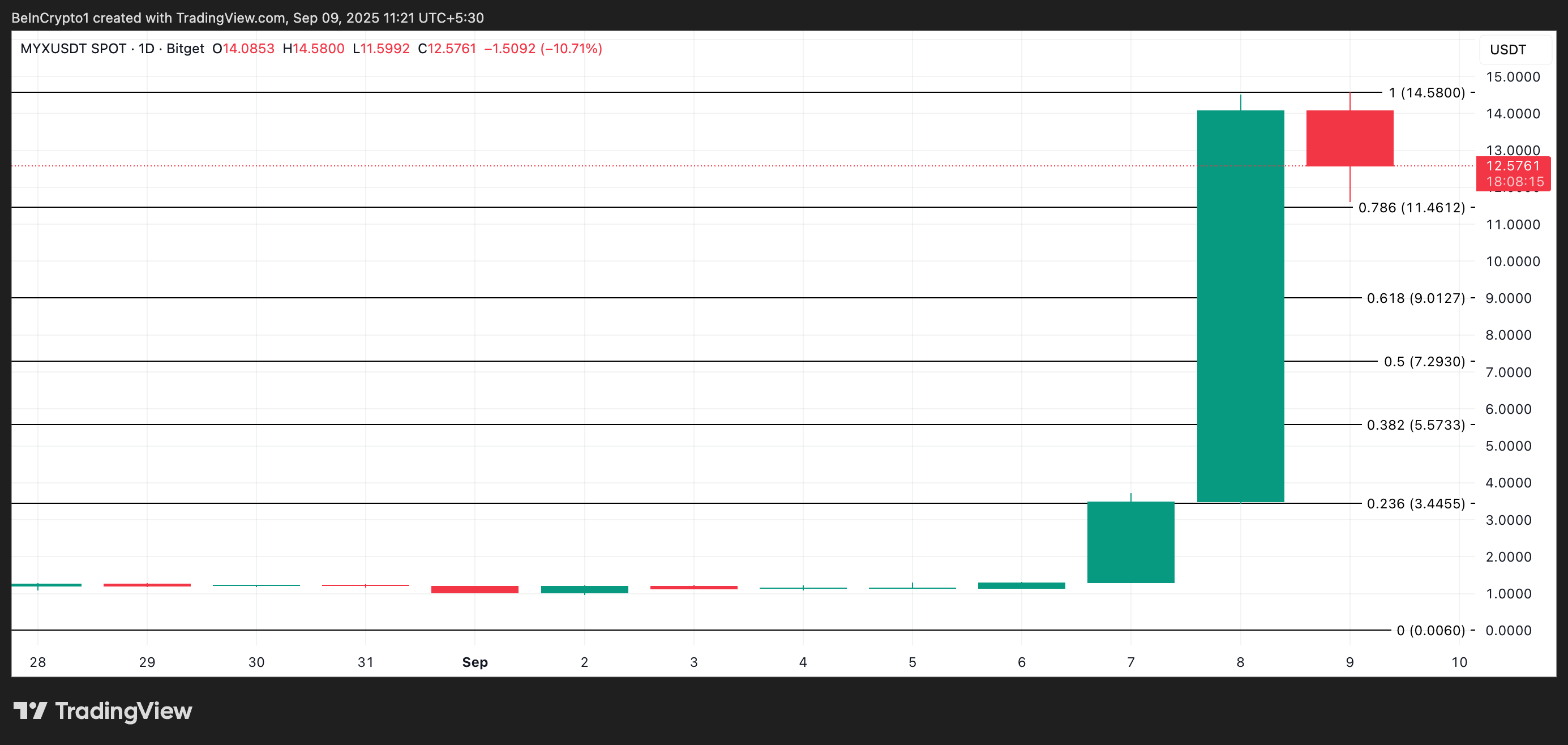

MYX, the native utility token of MYX Finance, has emerged as today’s top gainer, skyrocketing more than 200% in the past 24 hours. The altcoin even retested its all-time high of $14.58 during early Asian trading hours today, before witnessing a pullback to trade at $12.57 at press time.

However, the explosive rally is fueling skepticism across the market. Analysts point to familiar signs of manipulation, while overbought signals on the charts warn of an imminent correction.

MYX Trading Frenzy Raises Red Flags

The skepticism around MYX’s rally is fueled by unusually high trading activity, with both spot and derivatives volumes appearing overstretched.

In the last 24 hours alone, MYX has recorded $781.11 million in spot trading volume, a staggering 122% increase compared to the previous day. The derivatives market has seen even more dramatic spikes.

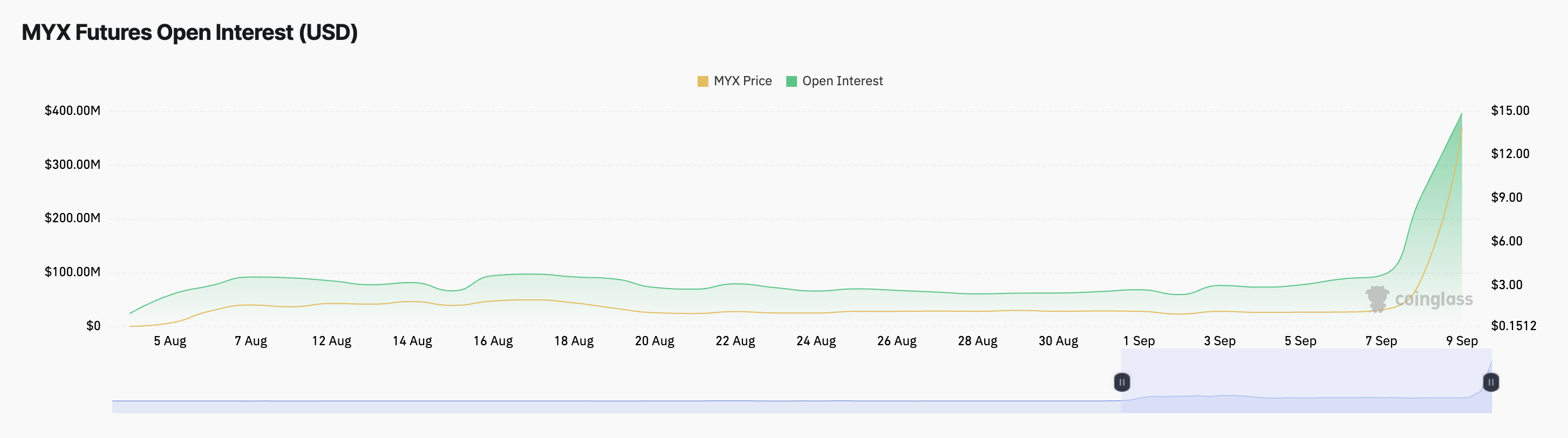

According to Coinglass data, perpetual futures volume has soared 174% to reach $12 billion, while futures open interest has climbed 62% to $396 million.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

MYX Futures Open Interest. Source:

Coinglass

MYX Futures Open Interest. Source:

Coinglass

Such explosive growth in leveraged trading suggests that much of the current rally may be driven by short-term speculation rather than sustained investor conviction.

Moreover, BeInCrypto earlier reported that some analysts continue to view MYX’s rally as the result of manipulation, an allegation the token has faced repeatedly.

In August, MYX’s 1,957% appreciation drew heavy criticism, with some branding it a “trap. ” While the coin later shed some of those gains, it regained momentum in September before hitting its latest peak. Still, doubts persist.

MYX’s Rally Running on Borrowed Time

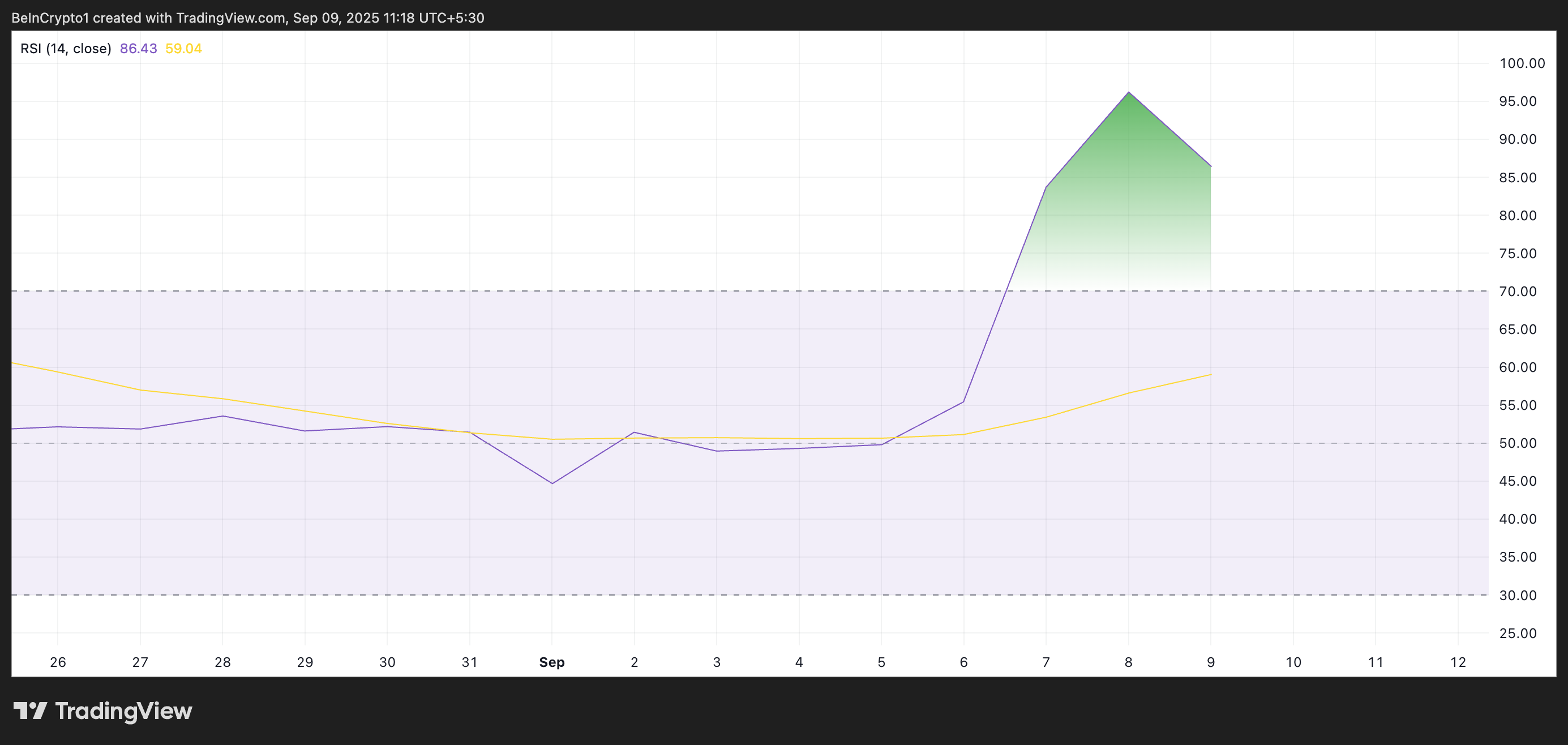

Readings from the token’s one-day further complicate the outlook. MYX currently flashes overbought signals on the daily chart, suggesting that the token may have surged too far and may be due for a reversal.

This is reflected by its Relative Strength Index (RSI), which stands at 86.43 as of this writing.

MYX RSI. Source:

TradingView

MYX RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 86.43, MYX’s RSI suggests that the token is deep in overbought territory, a precursor to a sharp price correction.

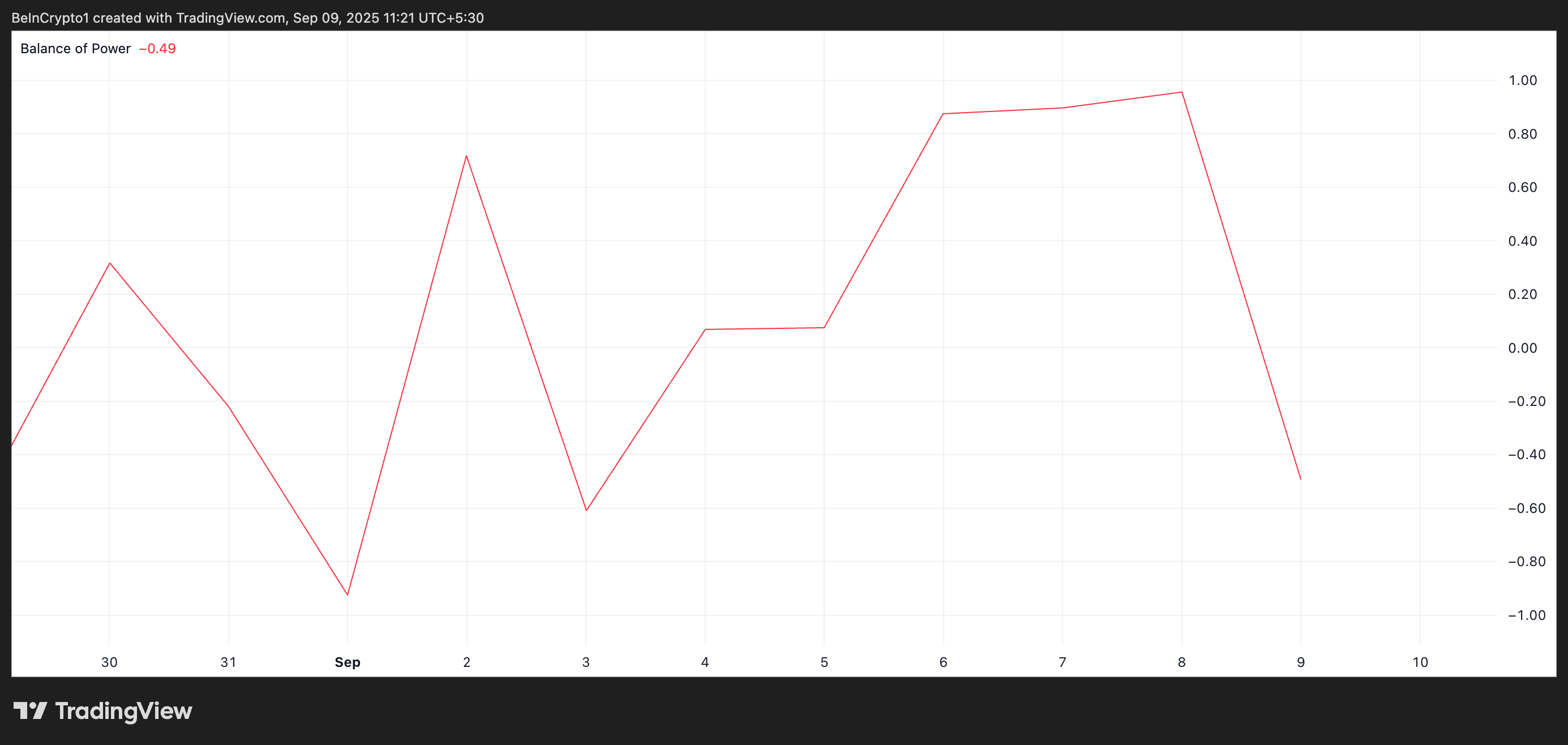

Furthermore, its negative Balance of Power (BoP) supports this bearish outlook. At press time, it was at -0.49 and trending downward, confirming the falling buy-side pressure in the market.

MYX BoP. Source:

TradingView

MYX BoP. Source:

TradingView

The BoP indicator tracks the strength of buyers versus sellers over a given period. A positive reading reflects dominant buying activity, while a negative value indicates that sellers exert greater control.

With MYX’s BoP sitting at -0.49 and trending lower, underlying demand is weakening, and sellers are steadily regaining influence.

This divergence between price action and market strength adds weight to the argument that MYX’s rally may be running on borrowed time.

MYX Stares at $14.58 Resistance, $9.01 Support

Any reversal in MYX’s current rally could see its price fall to test the support floor formed at $11.46. If this level fails to hold, the token’s price could plunge further to $9.01.

MYX Price Analysis. Source:

TradingView

MYX Price Analysis. Source:

TradingView

However, a continuation of the uptrend could see MYX revisiting its all-time high of $14.58 and attempting to rally past it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A Comprehensive Analysis Behind the Volatility of ETH

How does Pieverse seize the x402 opportunity to solve the BNB Chain payment bottleneck?