BTC Volatility Weekly Report (September 1 - September 8)

BTC Volatility Weekly Report (September 1 - September 8) Key Metrics (Hong Kong Time: 16:00 on September 1 to 16:00 on September 8) B...

BTC Volatility Weekly Report (September 1 - September 8)

Key Metrics (Hong Kong Time, September 1, 16:00 to September 8, 16:00)

- BTC/USD rose by 1.6% (109,600→111,300 USD), ETH/USD fell by 4.0% (4,470→4,290 USD)

- The BTC spot market has shown unclear trends over the past two months: although it touched the lower edge of the long-term target range (125,000–135,000 USD) in August, the pattern was not ideal, requiring cautious evaluation of subsequent price action. The current technical structure presents a double top pattern, with two rebounds after touching the key level of 125,000 USD, suggesting the market may enter a sideways consolidation phase. If another attempt to break previous highs fails, a deeper correction may follow.

- Short-term resistance levels are at 112,000, 117,000, and 125,000–126,000 USD; downside support/breakdown levels are at 109,000 USD and 100,000–101,000 USD. Based on this price action, realized volatility is expected to remain elevated over the next two months.

Market Themes

- The first week after the summer break saw a tug-of-war between bulls and bears: macro risk assets remained supported (this week’s slowdown in US economic data confirmed the rationale for a 25 basis point rate cut at the September 17 FOMC meeting, driving continued ETF inflows); however, native crypto selling pressure was strong and retail buying was weak (exchange deposits have sharply declined from their peak). The asynchronous hedging between bulls and bears has temporarily trapped BTC in the 109,000–114,000 USD range, but with significant volatility within the range. If either side breaks out, volatility could surge—if selling pressure eases or is absorbed by strong buying, the market could continue its upward trend (BTC skew indicates insufficient local bullish positioning); if the macro environment deteriorates or ETF inflows slow (or even reverse to outflows), selling pressure could quickly suppress spot prices down to 100,000 USD.

BTC Implied Volatility

- Realized volatility over the past two weeks has remained in the 35–38vol range, especially evident in hourly fluctuations. Technical uncertainty, combined with macro positives (ETF inflows) and native selling pressure offsetting each other, has made it difficult for the market to reach equilibrium.

- Options demand remains weak, with the only notable buying coming from short-term put hedges around the non-farm payroll data (positions closed after the event). Due to a lack of volatility buyers, the market is unwilling to price up forward volatility, and implied volatility for late September and October contracts is now close to recent realized levels (35–36vol).

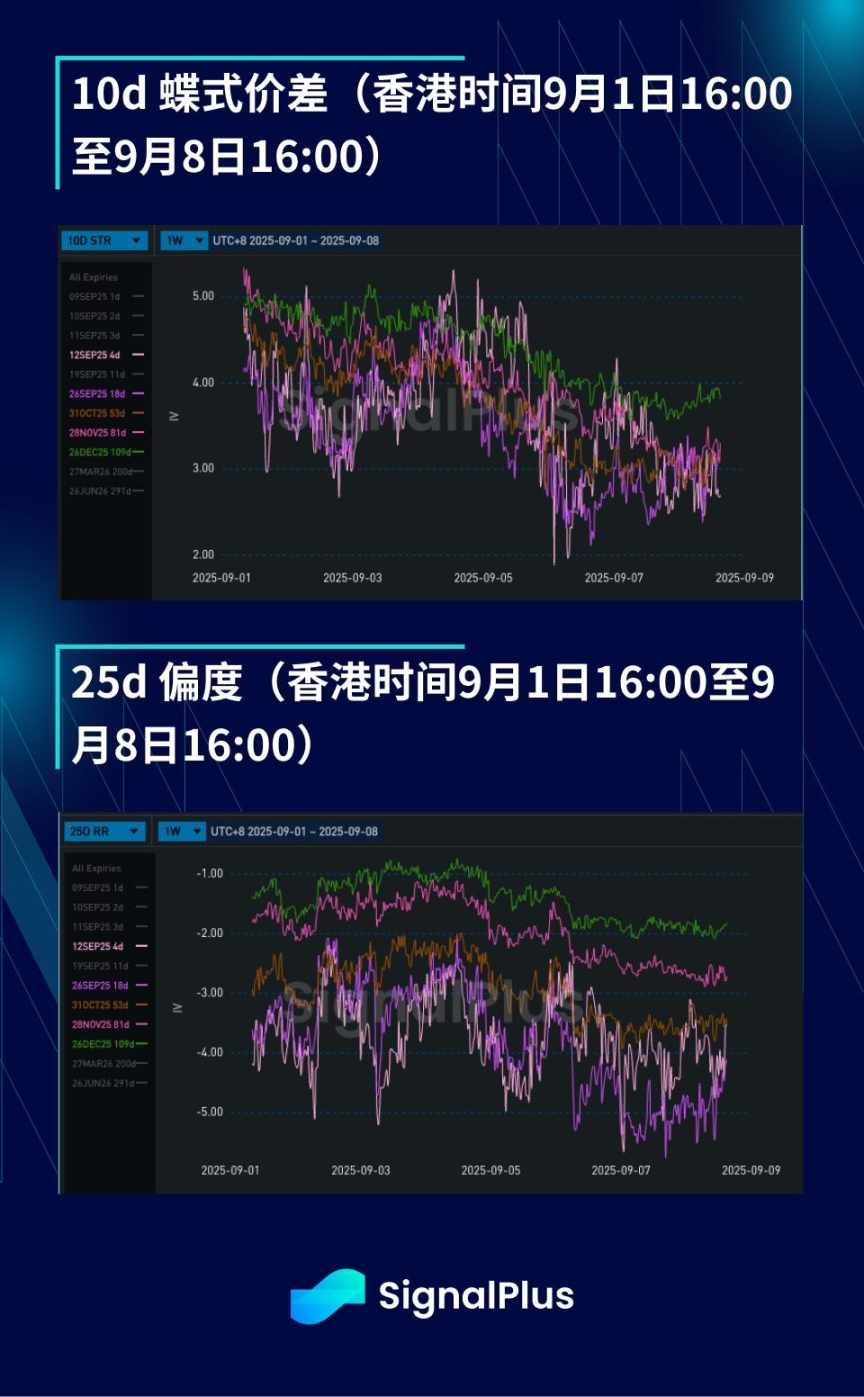

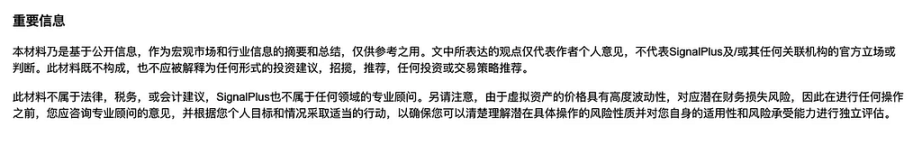

BTC USD Skew / Kurtosis

- Skew remains tilted to the downside: despite positive non-farm payroll data, price action remains weak, and the rapid pullback from 113,000 to 110,000 USD has raised concerns about a deeper correction. Structural bullish participation is sluggish, with only data-driven tactical bullish spreads; meanwhile, there is little interest in volatility for long-dated strikes below 100,000 USD, causing long-term skew to approach parity.

- Kurtosis pricing has generally declined: the market continues to suppress kurtosis, reducing the pricing of extreme tail risks. Although volatility itself has been relatively stable in recent weeks, historical experience shows that the BTC ecosystem can shift rapidly—any major move could cause spot and options liquidity to evaporate instantly, so holding long kurtosis positions is a good choice in the current market.

Wishing you a successful trading week!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The state of the labor market

Ahead of the FOMC September meeting, the labor market continues to embolden a dovish lean

Paradigm bets on centralized public chains, but these advantages of decentralization cannot be replaced

Key infrastructure should be decentralized, while user-facing applications can be centralized; achieving a balance is the optimal solution.

Capital B Raises €5M to Expand Its Bitcoin Treasury Strategy

Bitcoin Diverges Sharply from Nasdaq — History May Repeat Itself