Hyperliquid Airdrop Project Overview, Which Ones Are Worth Participating In?

This article compiles a Hyperliquid Airdrop Tier List, including S Tier (Unit, Kinetiq), A Tier (Liminal, Hyperbeat), and B Tier (Hyperlend, Felix, Project X, Ventuals) projects, with each tier representing different opportunities and potentials.

Original Title: My Hyperliquid Airdrop Tier List (How I'm farming the HyperEVM)

Original Author: Aylo

Original Translation: Deep Tide TechFlow

If you've been following my content, you'll know how excited I am about the HyperEVM ecosystem.

In many ways, it reminds me of the late 2023 Solana craze. Currently, I still believe this is a very promising ecosystem with potentially many airdrop opportunities in the future.

Because of this, over the past few months, in my new series "Alpha Apps," I have been introducing a new HyperEVM app every week (if you haven't seen it yet, I highly recommend you check it out).

But today, I want to share my complete Hyperliquid airdrop tier list.

Are you ready? I'm about to drop a ton of value bombs (this took me a long time, haha).

PS: At the end of the article, there is a specific plan on how to take advantage of the HyperEVM as an additional bonus, so be sure to read until the end!

Hyperliquid Bull Case

Before diving into the airdrop tier list, I want to explain why I am so confident in Hyperliquid and its ecosystem.

1. Hyperliquid Embodies the True Spirit of Crypto

Hyperliquid started as a KYC-free, gasless, and well-designed perpetual contract decentralized exchange. It later expanded to build its own L1 blockchain.

Its "secret sauce" comes from the following rare combination:

· Self-Funded: No parasitic private sale funding rounds, the Token Generation Event (TGE) was the starting point of development, not the exit opportunity.

· Successful Airdrop: 30% of the token supply was distributed in the genesis airdrop, and since launch, the HYPE token price has increased over 10x.

· Product-First Strategy: Build a product that users truly need → Gain long-term users → Reward users through large-scale airdrops → Then expand by building your own chain extension (instead of launching an unattractive empty chain).

· Generous Future Rewards: 40% of the HYPE supply (worth billions of dollars) is reserved for future incentives. This may include another airdrop, serving as a significant growth catalyst.

· Robust Tokenomics: 99% of transaction fees are used to buy back the HYPE token.

· Lean and Efficient Team: Only an 11-person team, with each employee averaging an annual income of over 100 million dollars.

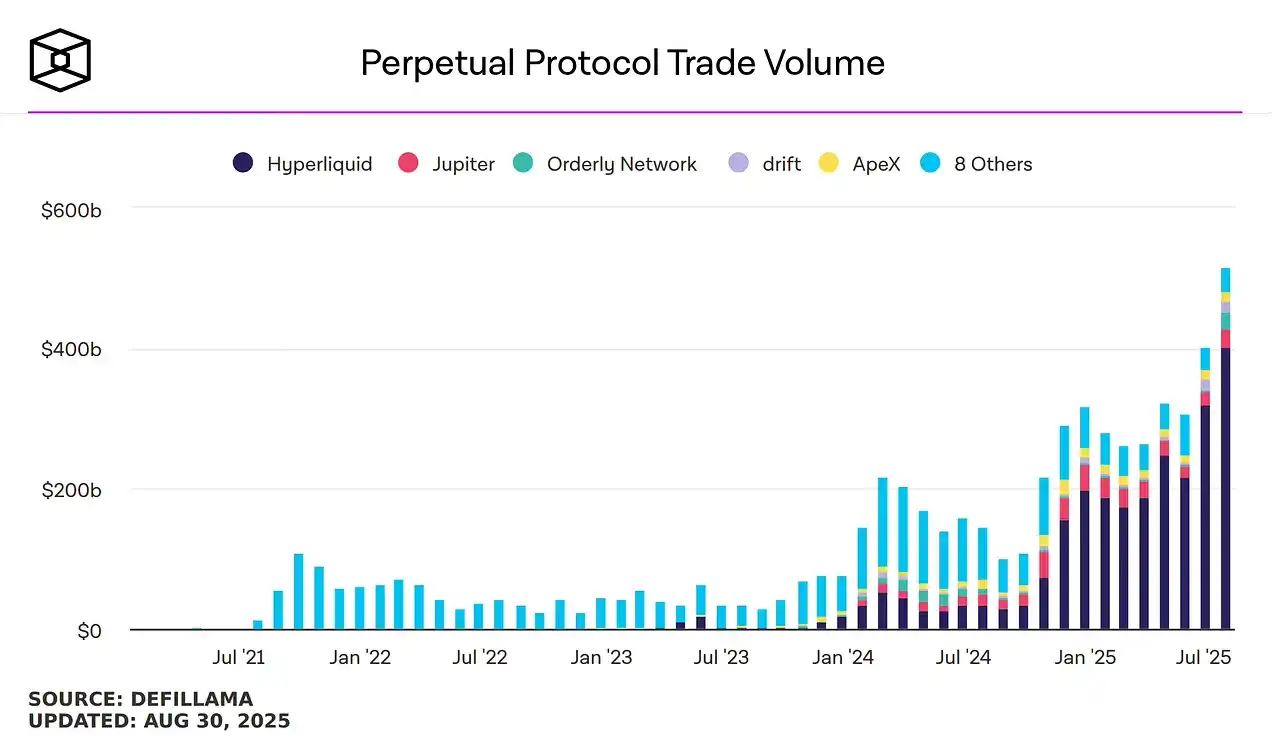

Unlike most projects that gradually disappear after "rug pulls," Hyperliquid has become even stronger post-airdrop. All key metrics are on the rise, positioning itself as the first Decentralized Perpetual Contract Exchange that can truly compete with giants like Binance.

2. Hyperliquid Is a Money Tree, and HYPE Is Undervalued

The current annual revenue is approximately 13.7 billion dollars (based on a monthly fee of around 1.14 billion dollars).

Furthermore, 99% of the revenue is used to buy back HYPE. At this rate, theoretically, all circulating HYPE can be bought back in less than 9 years.

Across the entire crypto industry, no other protocol has such a robust economic model, making it truly unique.

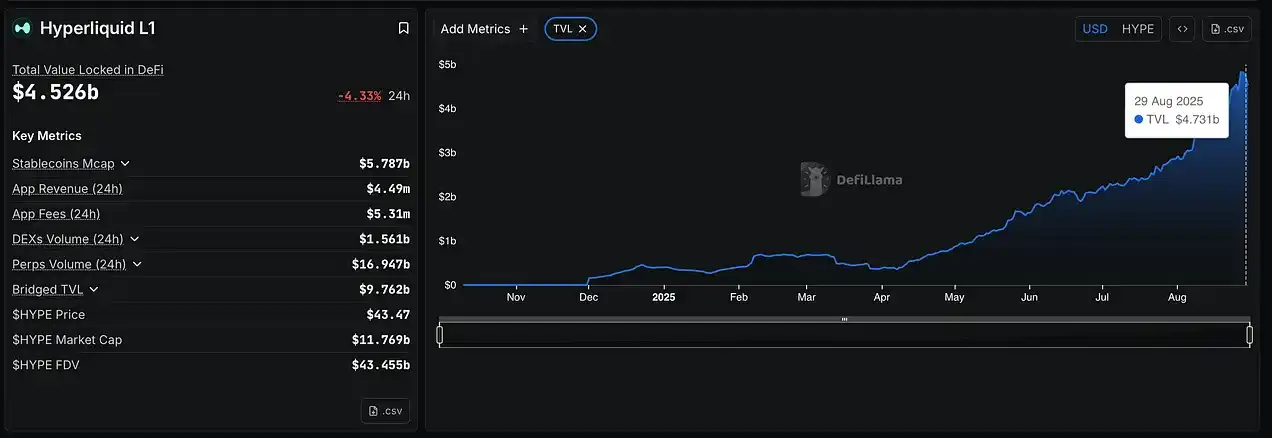

3. The Ecosystem Is Rapidly Growing

The Hyperliquid TVL chart says it all - growth is accelerating.

Some well-known projects in the DeFi space (such as Ethena, EtherFi, Pendle, and Morpho) are expanding to HyperEVM. If these excellent teams are deploying resources here, it is undoubtedly a strong signal that real value exists here.

At the same time, native Hyperliquid projects like Kinetiq and Liminal are also emerging (more details on these will follow).

In addition, a recent native USDC integration has eliminated a significant risk factor, bringing another positive catalyst to the ecosystem.

4. HYPE is a Powerful Collateral Asset

For any L1 blockchain, having a strong collateral token is crucial:

· Ethereum → ETH

· Solana → SOL

· BNB Chain → BNB

Currently, most L1s lack such a token, limiting DeFi's growth.

However, HyperEVM has HYPE, arguably one of the most powerful assets in the crypto industry. This alone is a huge bullish reason.

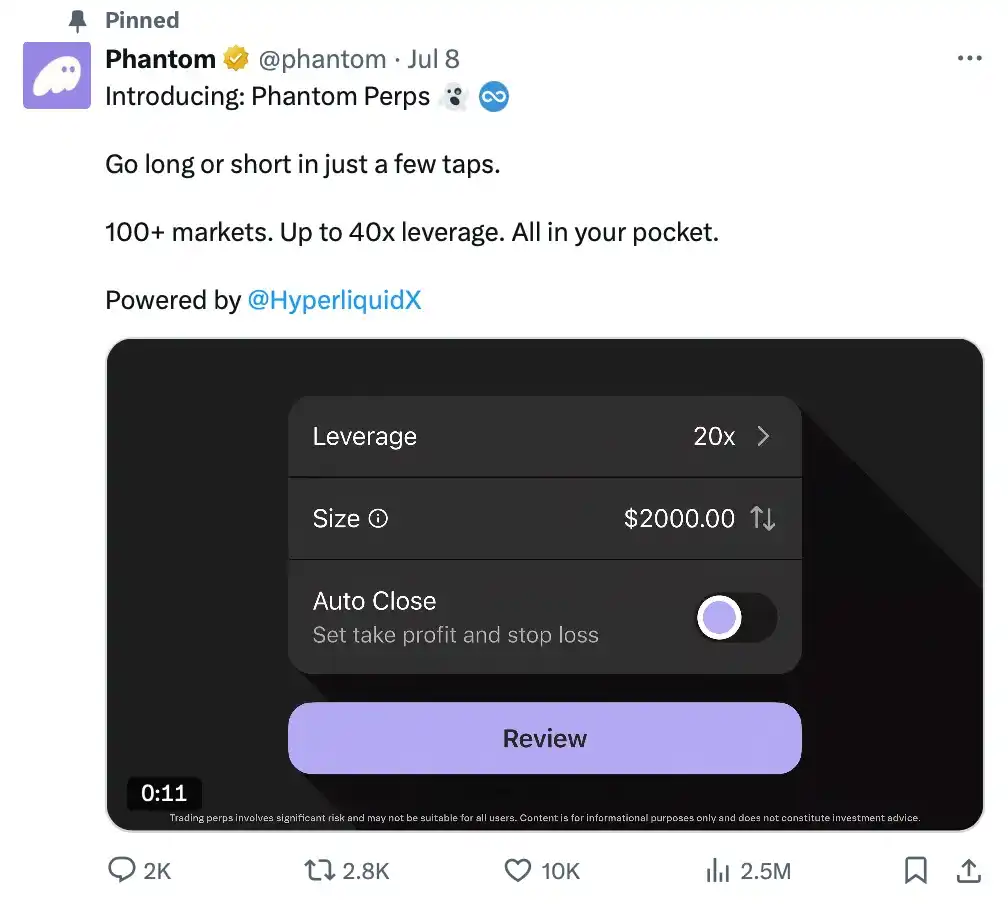

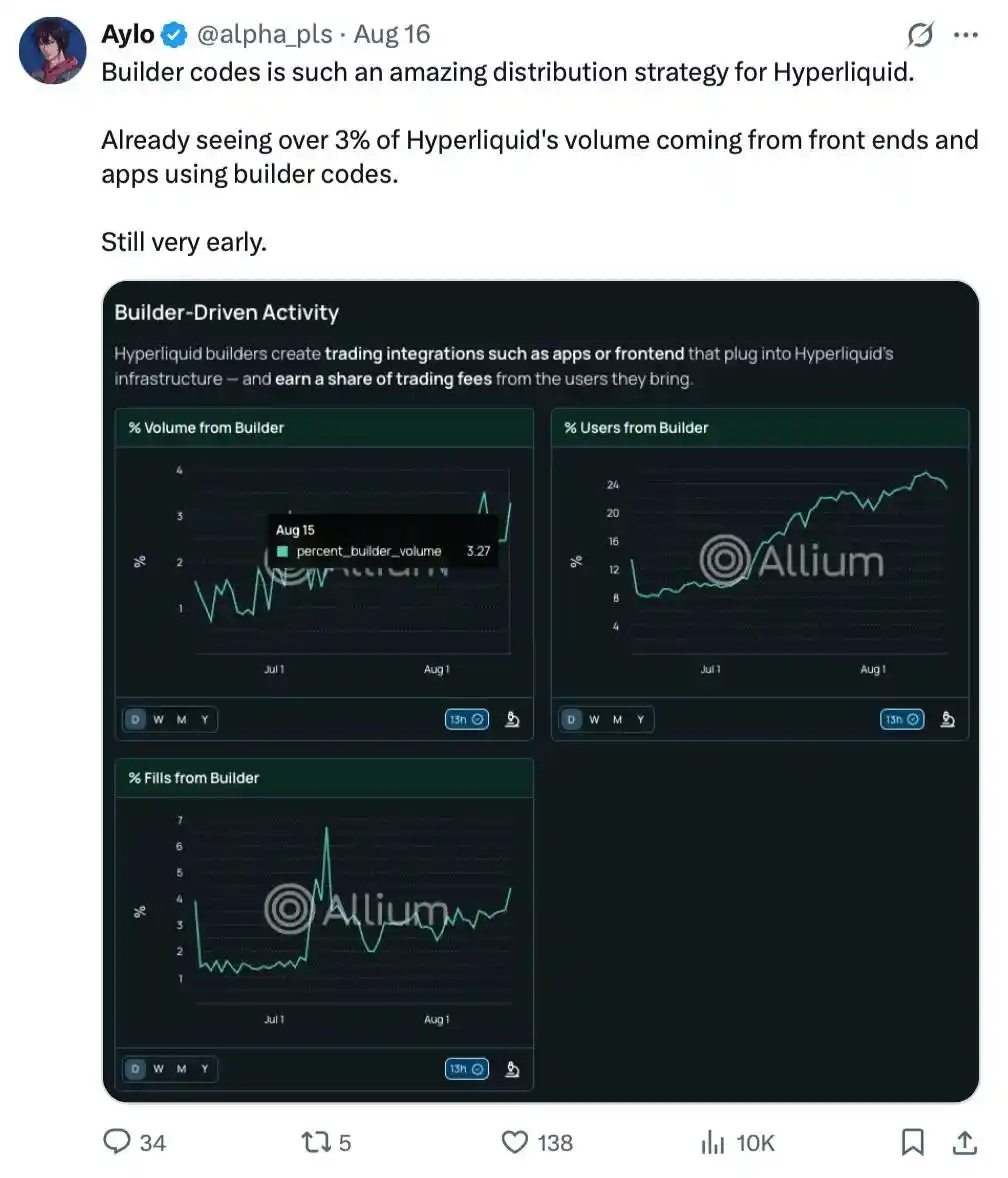

5. Builder Codes: A Brilliant Distribution Strategy

Builder Codes allow developers to build trading apps on Hyperliquid's core infrastructure and receive a share of fees from trades they bootstrap.

This effectively transforms DeFi developers into distribution partners for Hyperliquid, creating a true win-win model.

A prime example is Phantom, which has leveraged Hyperliquid to launch its own perpetual contract trading feature.

Rabby Wallet has also hinted at potentially taking similar actions, while protocols like Ranger Finance and Mass are also utilizing this strategy. It must be said that this is a brilliant growth strategy for Hyperliquid.

6. HIP-3 is Changing the Game

HIP-3 allows anyone to create a new perpetual contract market by staking 1 million HYPE (approximately $42 million). Deployers can set parameters and receive up to a 50% fee split.

Unlike Builder Codes (focused on distribution), HIP-3 focuses on product expansion.

More markets → More users → More fees → More buyback → More attraction.

If you want to dive deeper into the impact of HIP-3, take some time to read the relevant content.

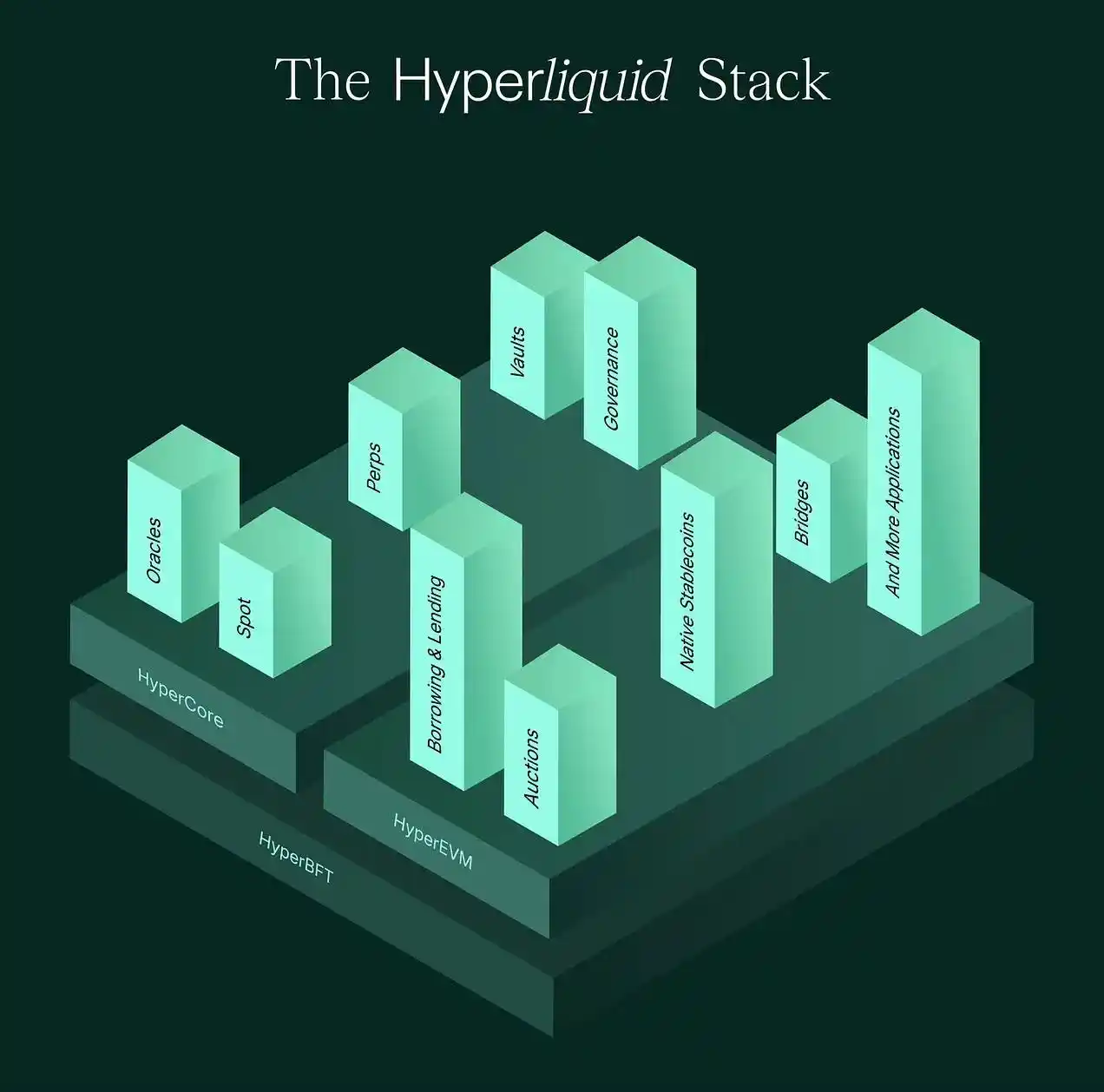

7. Synergy between Hyperliquid and HyperEVM

People often see Hyperliquid and HyperEVM as two separate entities. In reality, they are two aspects of the same ecosystem.

· HyperEVM → Programmability: It extends Hyperliquid's engine, making it programmable and able to interact with other DeFi projects.

· Hyperliquid → Liquidity and Cash Flow: The exchange brings instant trading volume, credibility, and revenue to the chain.

This has created a unique feedback loop: DeFi protocols on HyperEVM can directly leverage Hyperliquid's deep liquidity and order book while still benefiting from the flexibility of EVM smart contracts.

Airdrop Tier List

Now that you've seen this far, you probably agree that Hyperliquid is an ecosystem worth paying attention to and full of potential opportunities.

Next, when it comes to airdrops, a good watchlist will be your most powerful tool. And I have compiled a list of projects worth keeping an eye on for you.

It is important to note that this is not an exhaustive list but rather projects that I personally find notable and have used myself. Be sure to Do Your Own Research (DYOR).

S Tier: Unit, Kinetiq

These two projects are undisputed choices. In my opinion, they are the easiest and most potential airdrop opportunities on Hyperliquid.

Unit

I've mentioned it before, but I want to emphasize again: Unit may be one of the most important airdrop opportunities in the Hyperliquid ecosystem.

Unit is the asset tokenization and cross-chain bridging layer behind Spot Trading on Hyperliquid. It allows users to directly deposit, withdraw, and trade mainstream crypto assets such as BTC, ETH, and SOL on Hyperliquid.

Since its launch, the Unit protocol has performed remarkably well, with a current Total Value Locked (TVL) exceeding $1 billion, an annualized trading volume of over $115 billion, and has contributed significantly to the ecosystem's revenue. To date, over 98% of the revenue has been used directly to buy back the HYPE token.

How to prepare for participation in UNIT and the upcoming HYPE airdrop:

· Deposit BTC, ETH, SOL, and other assets via app.hyperunit.xyz or through the Hyperliquid interface.

· Trade these assets on Hyperliquid's Spot Market.

Furthermore, you can explore cross-chain asset swaps on Hyperliquid or interact with HyperEVM using Unit's assets.

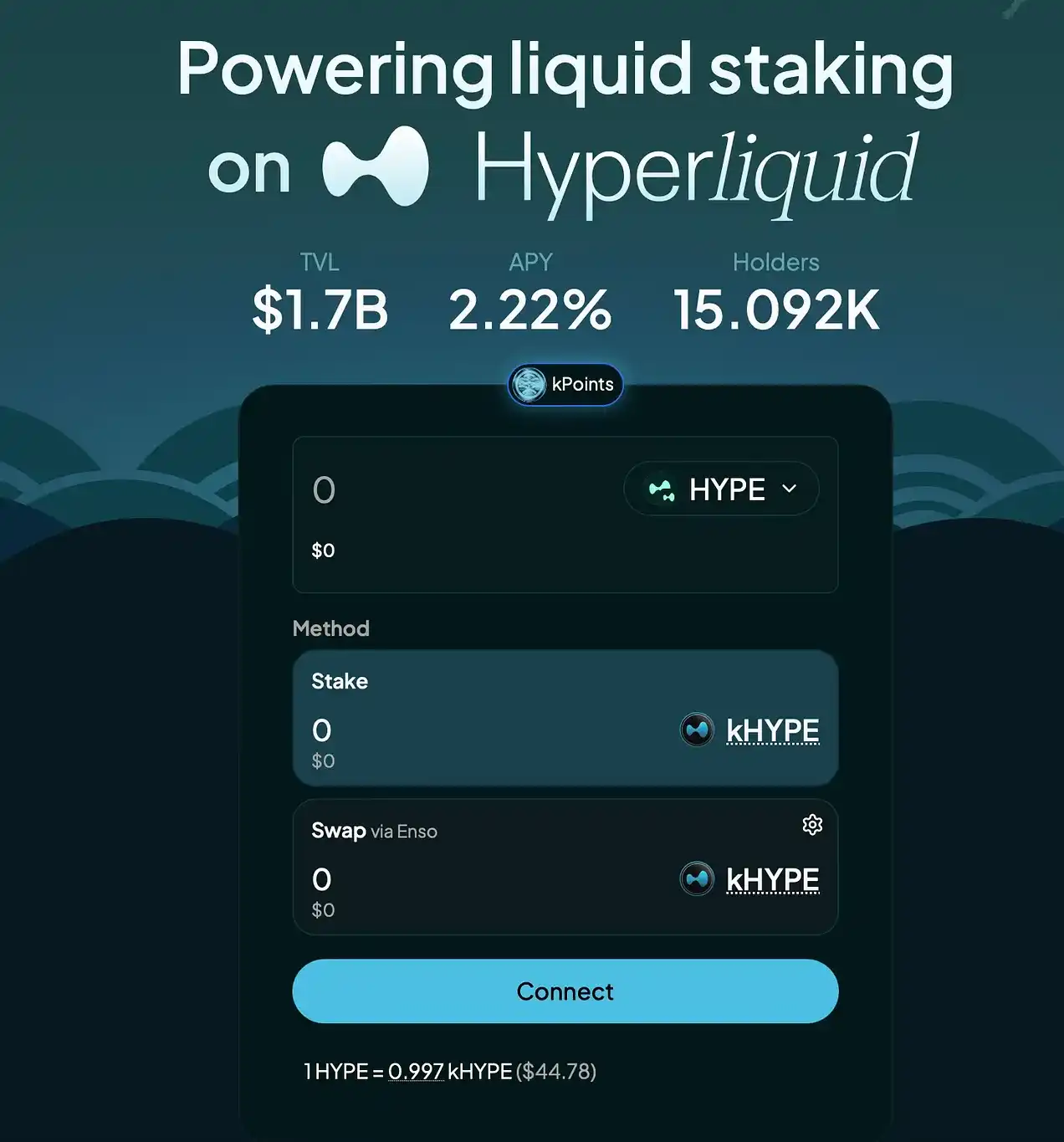

Kinetiq

In my opinion, Kinetiq is another top-tier protocol on Hyperliquid.

Kinetiq is the leading liquidity staking protocol on Hyperliquid, where users can stake HYPE and receive Kinetiq Staked HYPE (kHYPE) as rewards. kHYPE is fully liquid and usable in DeFi, automatically accumulating staking rewards.

As the most anticipated Liquidity Staking Token (LST) on Hyperliquid, Kinetiq has attracted over $1.7 billion in TVL since its launch on July 15, covering 15,000 wallets and becoming a key protocol in the HyperEVM ecosystem.

Kinetiq has initiated a points program, and while specific rules have not been fully disclosed, observations suggest that points are earned through holding kHYPE, using kHYPE in DeFi (with most points currently flowing to Pendle's YT-kHYPE).

If you want a simple way to earn points, you can deposit your kHYPE into Kinetiq's Earn Vault, allowing you to farm multiple protocols simultaneously.

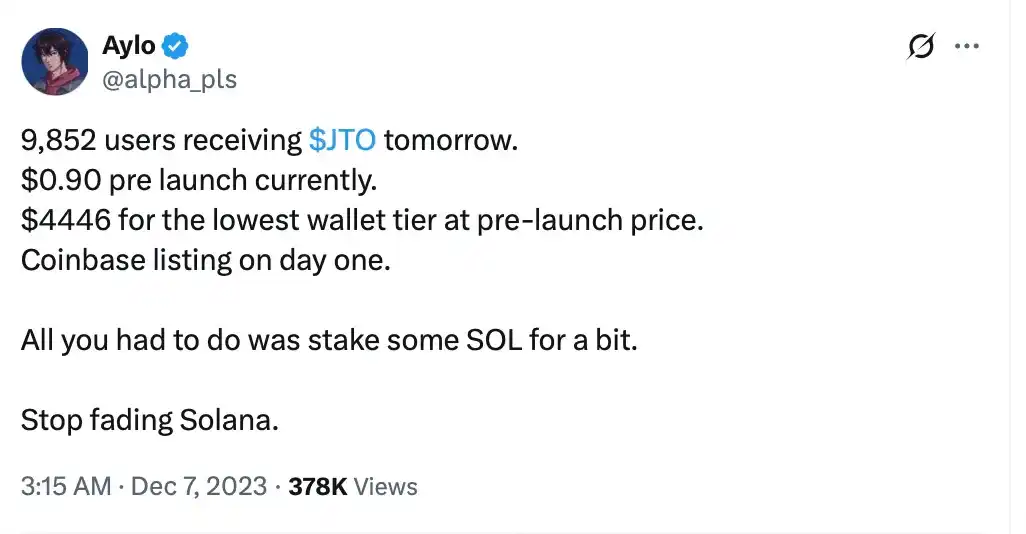

A reasonable way to approach Kinetiq is to view it with a similar valuation ratio as Jito on Solana. Importantly, it has not experienced over-mining yet: the total value locked (TVL) from around 15,000 wallets amounts to $1.7 billion, which is still a healthy ratio.

Another factor that could potentially bring significant Fully Diluted Valuation (FDV) to Kinetiq in the future is its new product: Launch. This is the first Exchange-as-a-Service (EaaS) platform built on HIP-3, allowing anyone to deploy and operate their perpetual contract market without the 1 million HYPE staking requirement.

I just looked back at this tweet I posted before the JTO airdrop, and I feel history is likely to repeat itself here, with a similar order of magnitude for the rewards (in my opinion, this also applies to UNIT).

If you're bullish on HYPE, now you know how to make them work for you.

Grade A: Liminal, Hyperbeat

A robust protocol with strong momentum, intriguing use cases, and still one of the top opportunities on Hyperliquid.

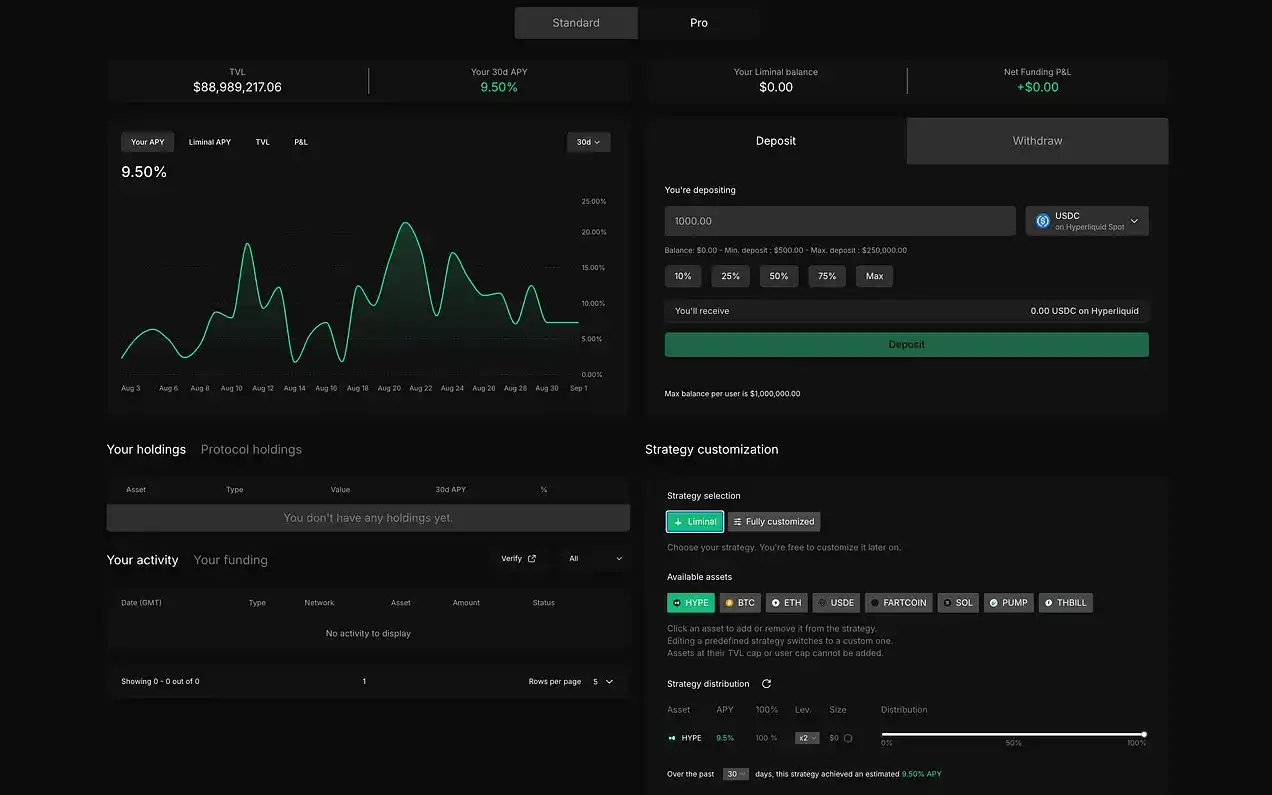

Liminal

Liminal is a Delta-neutral income platform that allows you to earn real and substantial returns without market exposure.

Its operational logic is simple, somewhat akin to Ethena's model, but Liminal offers more flexibility, enabling users to determine the asset allocation for Delta-neutral income strategies.

Here's how it works:

· Deposit USDC into the Liminal platform.

· Choose one of the following two strategies:

-Liminal Classic Strategy: Platform-managed.

- Custom Portfolio: Build a Delta-neutral trading portfolio tailored to individual needs.

· Afterward, all you have to do is relax and wait for the gains without worrying about the market direction.

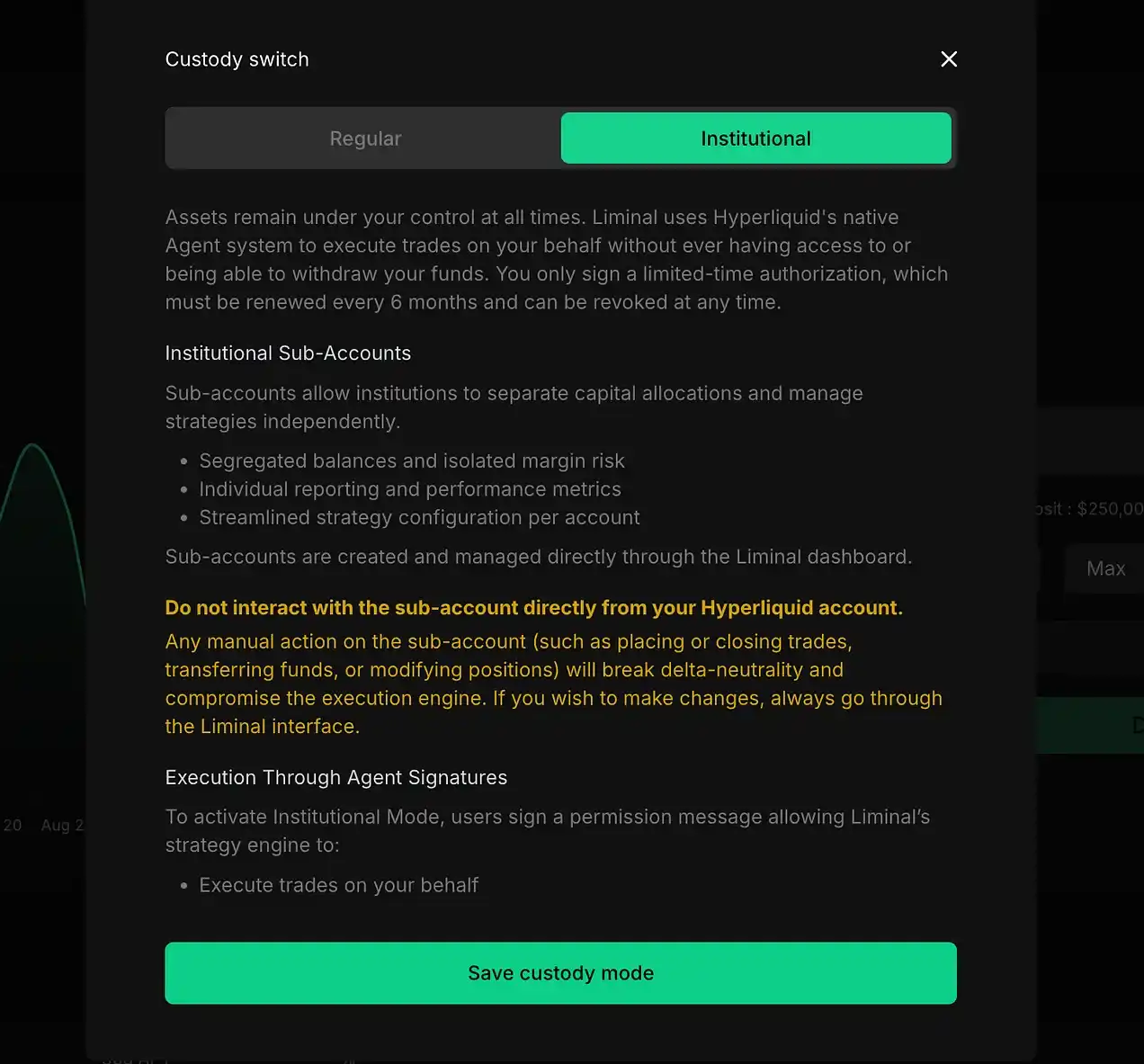

Adjustments to Note:

By default, Liminal is set to "Normal" mode. In this mode, Liminal manages asset custody and strategies for you, making it the simplest option. However, the issue is that your spot and perpetual trading volume may not be counted towards Hyperliquid or Unit account activity, potentially causing you to miss out on Unit airdrop opportunities.

To address this issue, you can switch your account to Institutional mode. In this case, assets are held in your sub-account, and Liminal only executes trades on your behalf (rest assured, your funds are safe as Liminal cannot withdraw your funds).

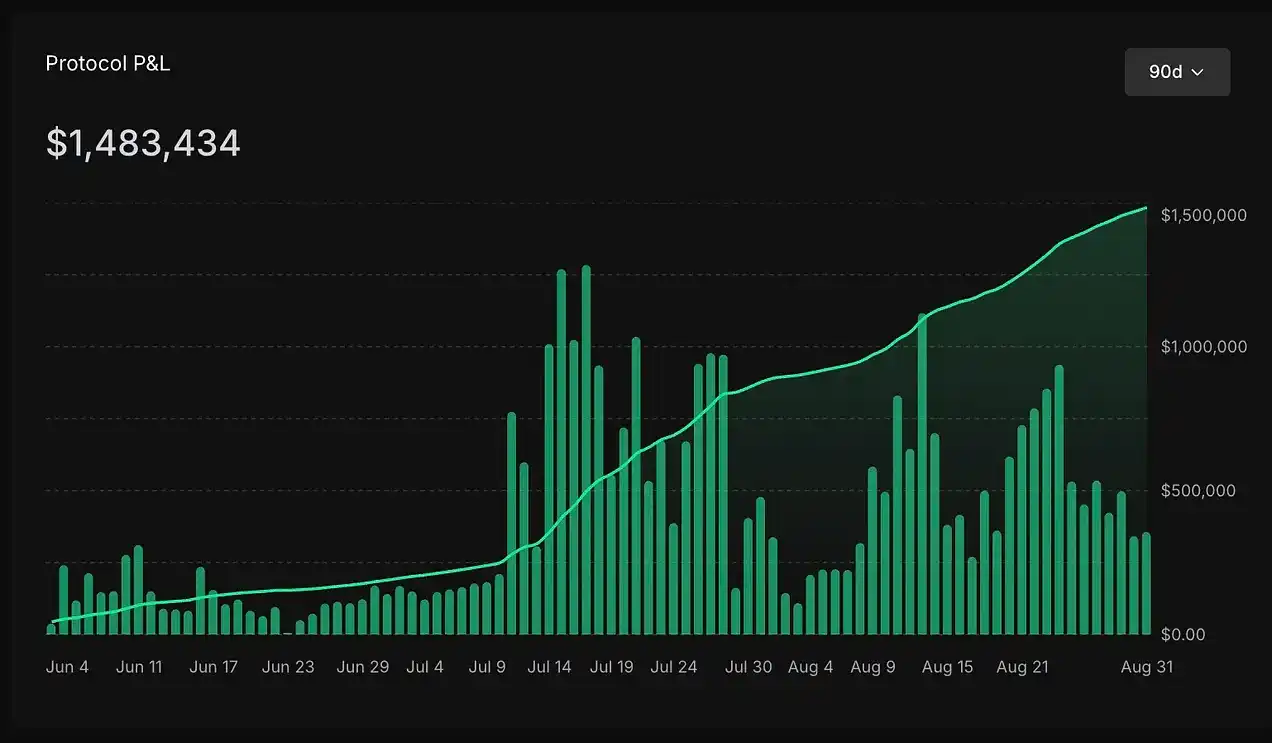

Nevertheless, I am truly excited about what Liminal is building. Liminal is a unique protocol that is becoming a cornerstone of the Hyperliquid yield ecosystem. Since its launch, the platform has distributed over $1.4 million in earnings to users.

I have personally allocated a portion of stablecoins to Liminal and plan to hold long term.

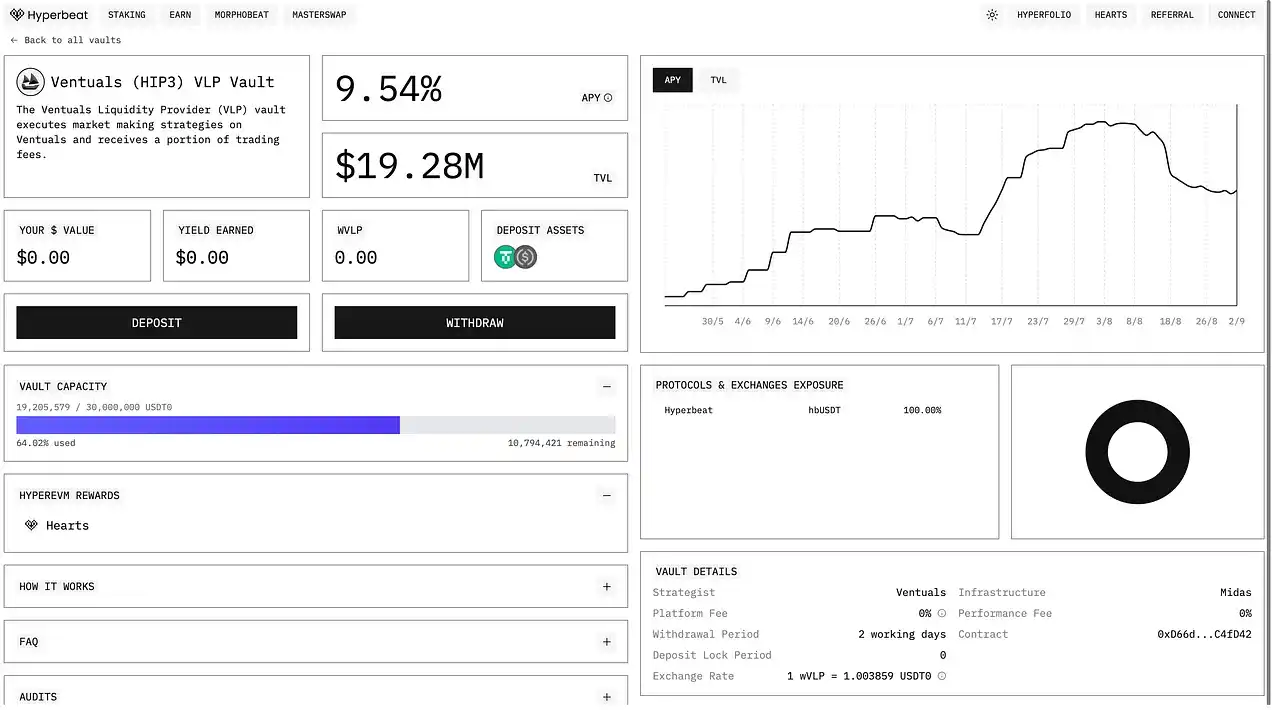

Hyperbeat

Hyperbeat is a one-stop DeFi protocol within the HyperEVM ecosystem.

The platform collaborates with top protocols and infrastructure providers, offering a full suite of products, including:

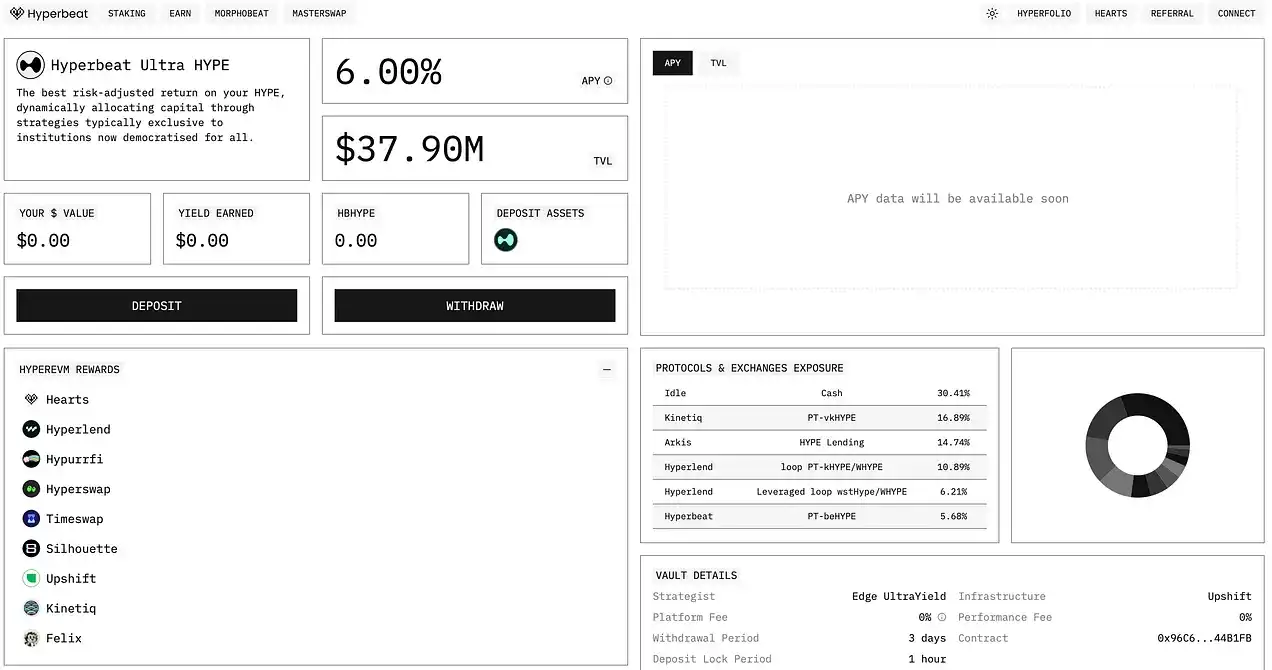

· Staking: You can stake HYPE liquidity in beHYPE built in partnership with EtherFi.

· Yield: HyperBeat partners with top infrastructure providers and strategists to launch various vaults on HyperEVM. The yields are attractive, allowing you to earn rewards across all major HyperEVM protocols.

· Morphobeat: An permissionless and independent lending marketplace supported by Morpho, where you can borrow and lend all your favorite assets on HyperEVM.

· Masterswap: A one-click cross-chain to move assets from any chain to HYPE on the HyperEVM. Hyperbeat will automatically choose the best route - for example, swapping SOL on Solana to HYPE on HyperEVM in one click.

HyperBeat has launched a rewards program with a total supply of 51 million Hearts.

Currently, less than 12% of Hearts are still available. If you want to participate in the potential HyperBeat airdrop, you need to act fast.

It is worth noting that the reward system is divided into six tiers. This setup may suggest that the airdrop will be based on tier allocation, which means starting to use HyperBeat now and increasing your rank is still not too late.

How to start earning Hearts?

Deposit assets into the Treasury, rug pull on various HyperEVM protocols. Whether you hold HYPE, BTC, stablecoins, or gold, there are options available.

Personally, I have deposited HYPE into the Ultra HYPE Treasury, earning a 6% Annual Percentage Yield (APY) and also earning points from six protocols, very efficient.

If you hold HYPE, you can also provide liquidity and stake it into beHYPE (currently with 10 million Hearts available). I have done this too. The good news is that beHYPE will soon be listed as collateral for the EtherFi Card.

HyperBeat offers various capital operation methods, along with the potential for interesting airdrops. Whether through staking, yield farming, or cross-chain asset transfers, HyperBeat has created diverse opportunities for users.

B Tier: Hyperlend, Felix, Project X, Ventuals

Still a reliable high-quality protocol, with a chance to receive a meaningful airdrop. While more complex or uncertain than S-tier and A-tier plays, it remains a potential airdrop opportunity worth paying attention to within the Hyperliquid ecosystem.

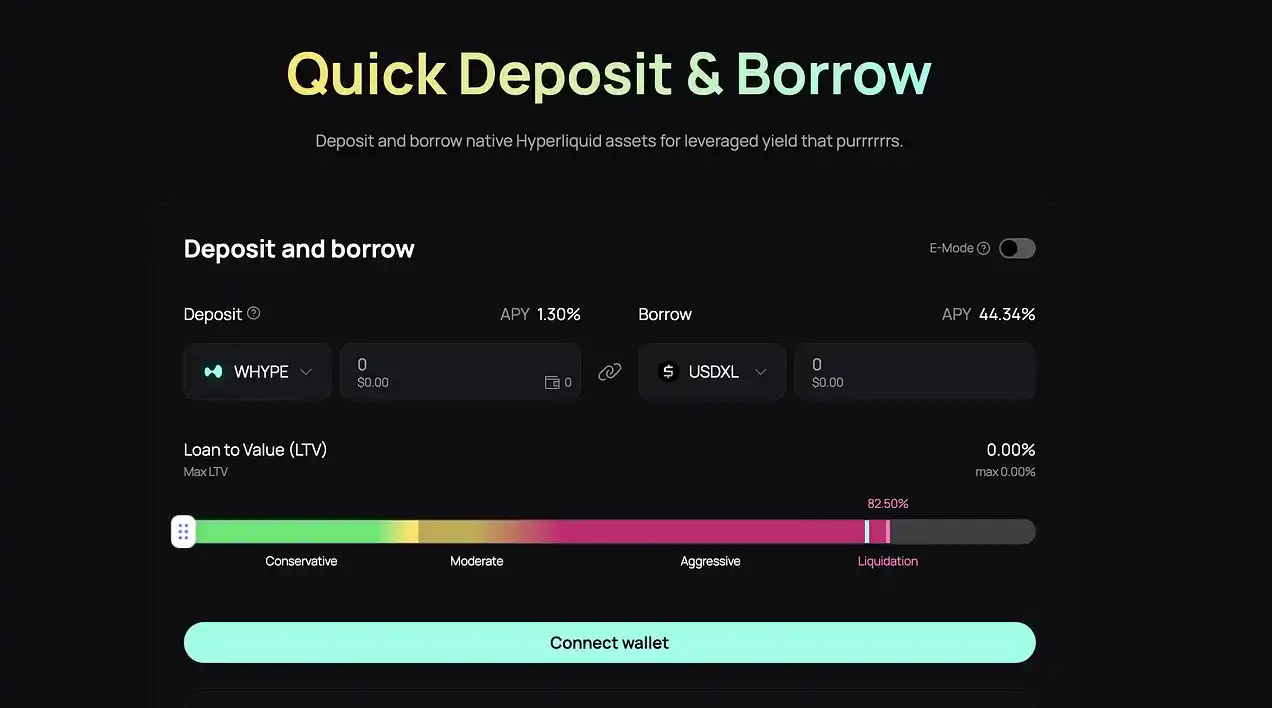

Hyperlend

Hyperlend is a lending protocol built on Hyperliquid and has been recognized by Aave governance as a friendly fork.

Its main products include:

· Lending Market: Supports borrowing and lending of assets like HYPE, uBTC, and PT-kHYPE on the HyperEVM.

· HLP Vault: HLP is a Hyperliquid vault that participates in market making and liquidation processes, earning trading fee revenue. IOU tokens issued by the vault are transferable and DeFi-compatible, enhancing asset utilization efficiency.

· Hyperloop: Enables one-click leverage loop positions using any two tokens (one deposited, one borrowed).

There are many interesting lending strategies to explore on Hyperlend. For example, the PT-kHYPE loop strategy can help you maximize yield on HYPE (but may miss out on airdrop opportunities).

As the currently most popular lending protocol, Hyperlend's product design and user experience (especially the HLP Vault and Hyperloop features) are outstanding.

That being said, because it is an Aave fork, I place it in the B-tier as historically, forked upside potential is often more limited.

Nevertheless, this is still a reliable protocol worth trying.

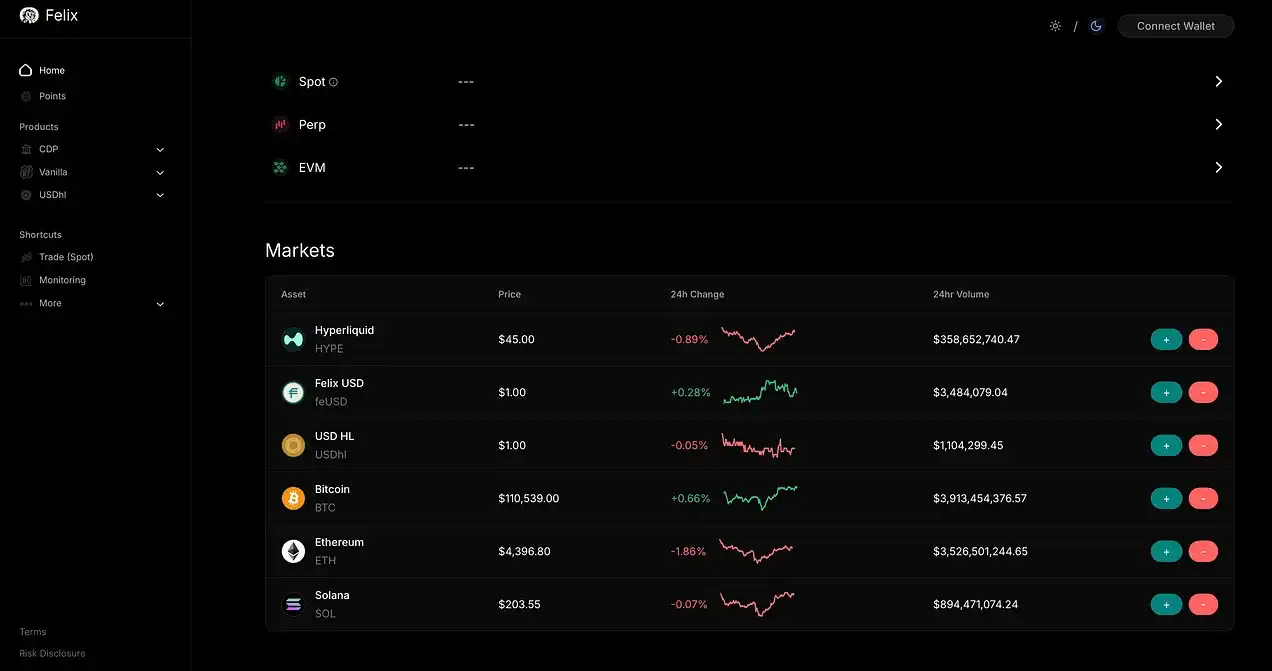

Felix

Felix is another protocol offering a full suite of lending products, similar to Hyperlend but with some unique aspects.

Its core product is a CDP that allows you to deposit assets like HYPE, kHYPE, or uBTC and borrow feUSD against these assets. Additionally, there is a native model built on the Morpho stack.

They have also introduced hUSDL, a treasury-backed stablecoin. It is tailored for the Hyperliquid trading environment and can serve as collateral for borrowing, trade settlement, and the future HIP-3 market. Equally interesting is that the yield from hUSDL can be used to purchase spot HYPE, which is then reallocated as rewards to fuel the growth of HyperEVM.

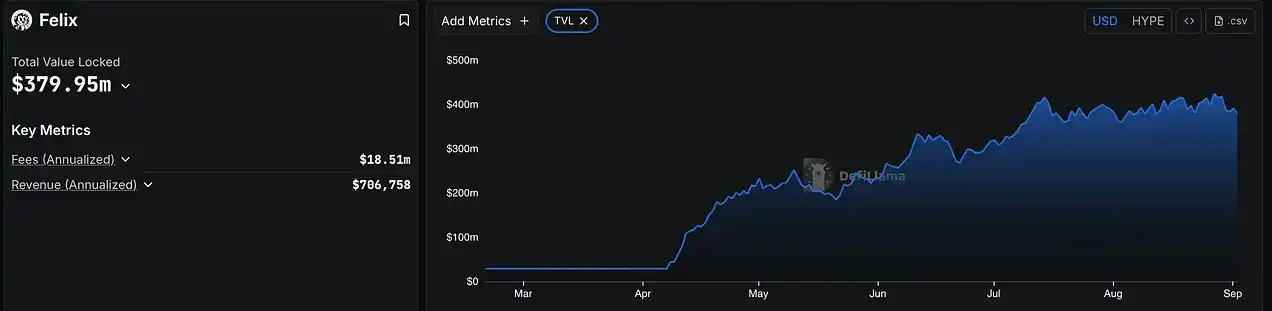

Currently, Felix's TVL has reached $380 million, with an expected annual fee revenue of $18.5 million.

Its incentive program is still ongoing, with less rug pulling compared to Hyperlend, making it a protocol worth trying.

Project X

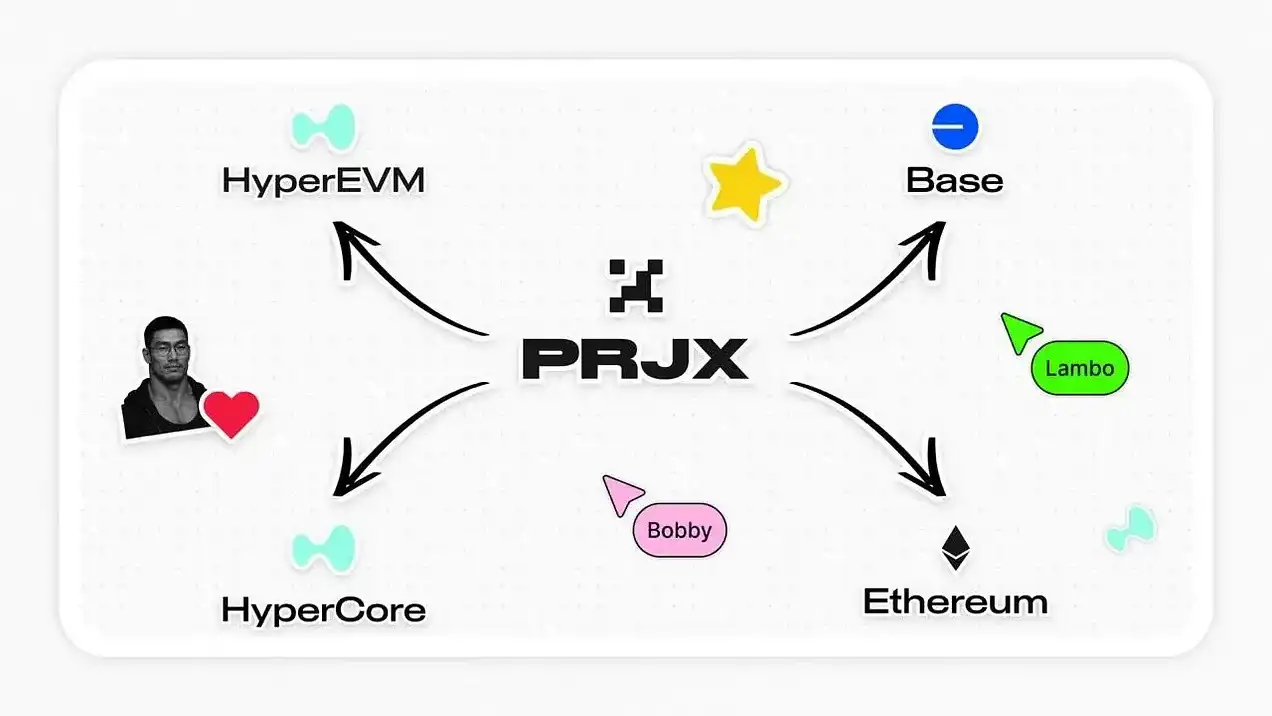

The goal of Project X is to become the leading DEX aggregator across the entire EVM ecosystem.

As a first step, they have just launched their own DEX on HyperEVM. The next step is to evolve into a DEX aggregator within the EVM, with the third phase currently in undisclosed stages.

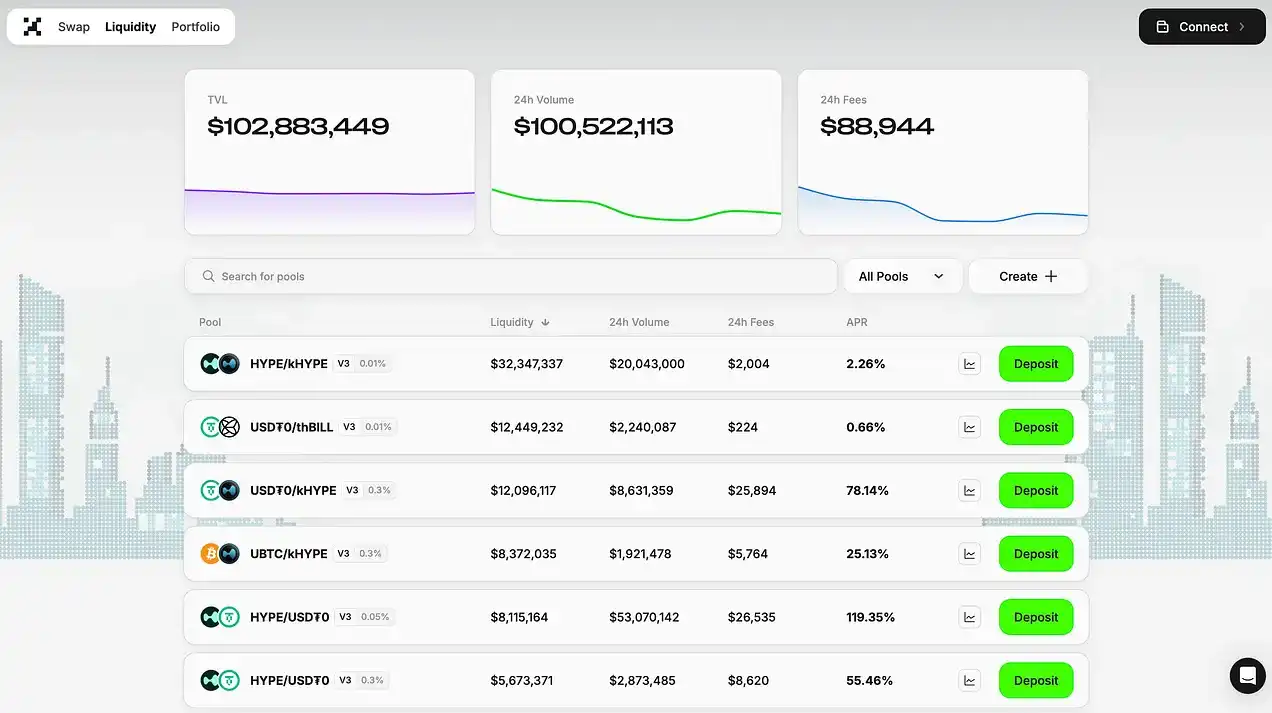

Since its launch, the protocol has gained strong momentum and quickly become the top decentralized exchange on HyperEVM, with a total value locked (TVL) surpassing $100 million. I believe Project X should have no trouble maintaining a lead on HyperEVM.

The real test will be as they move to the next stage, attempting to capture market share in the broader EVM ecosystem.

It is currently unclear how sticky the funds will be post-airdrop and uncertain what the target addressable market (TAM) is for a DEX on HyperEVM, especially for a Uniswap fork project.

Nevertheless, the team has strong marketing capabilities, the project is fully self-funded, and they are actively promoting the upcoming new features. This is also why I classify it as a B-tier project, while I believe its airdrop potential is promising.

How to Participate?

Project X has launched a rewards program.

If you have experience with Liquidity Providing (LP), Project X can be a great option.

For example, if you have already staked HYPE as kHYPE, you can deploy it to the kHYPE-HYPE liquidity pool (currently the largest liquidity pool on Project X).

Here are some other key liquidity pools that you might also be interested in:

Ventuals

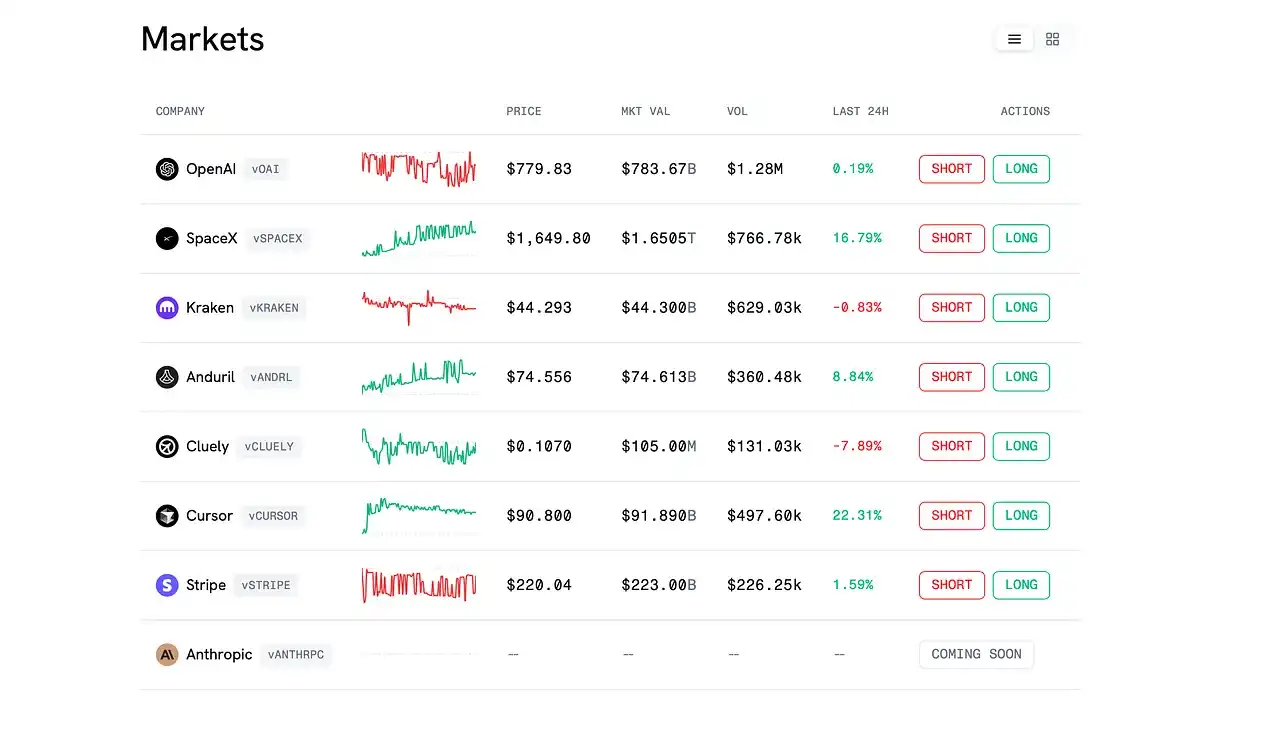

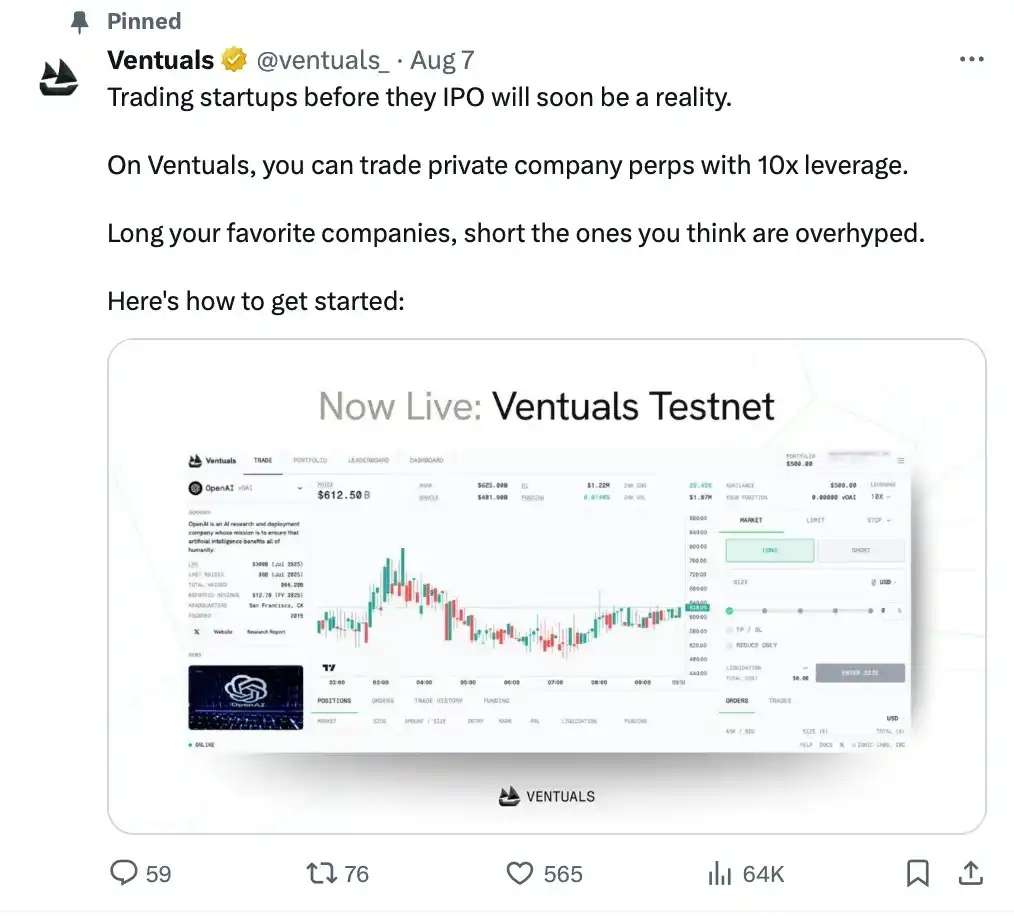

Ventuals' mission is to transform startup valuations into tradable perpetual contracts through HIP-3. This means you can engage in long or short trades on pre-listed companies you believe in and use leverage.

Innovation in the crypto space has always revolved around tokenization and unlocking new markets. For example, ICOs made early-stage project's private fundraising rounds liquid and open to everyone from the start.

Now, through Ventuals, we are entering a new frontier: trading before a company's IPO. This not only adds a layer of market pricing efficiency to startup valuations (decided by the market rather than a few bankers) but also democratizes an asset class that was once restricted to accredited investors.

Currently, Ventuals has not yet gone live on the mainnet, so we need to observe how they execute this mission. But it is certain that this opportunity is very compelling (and perfectly showcases the potential of HIP-3).

How to Participate?

Ventuals is currently only running on a testnet, awaiting the launch of the HIP-3 standard on the Hyperliquid mainnet. In the meantime, you can start testing their product (testnet activities may count towards airdrops).

Another immediate step you can take is to deposit assets into the Ventuals Treasury on Hyperbeat. Currently, this seems to be the best way to get early exposure to Ventuals while also earning Hyperbeat Heart.

Category C: Hypurrfi, Hyperswap

In my opinion, the airdrop potential of these protocols is slightly lower compared to other projects, but they are still worth mentioning (and may bring some surprises).

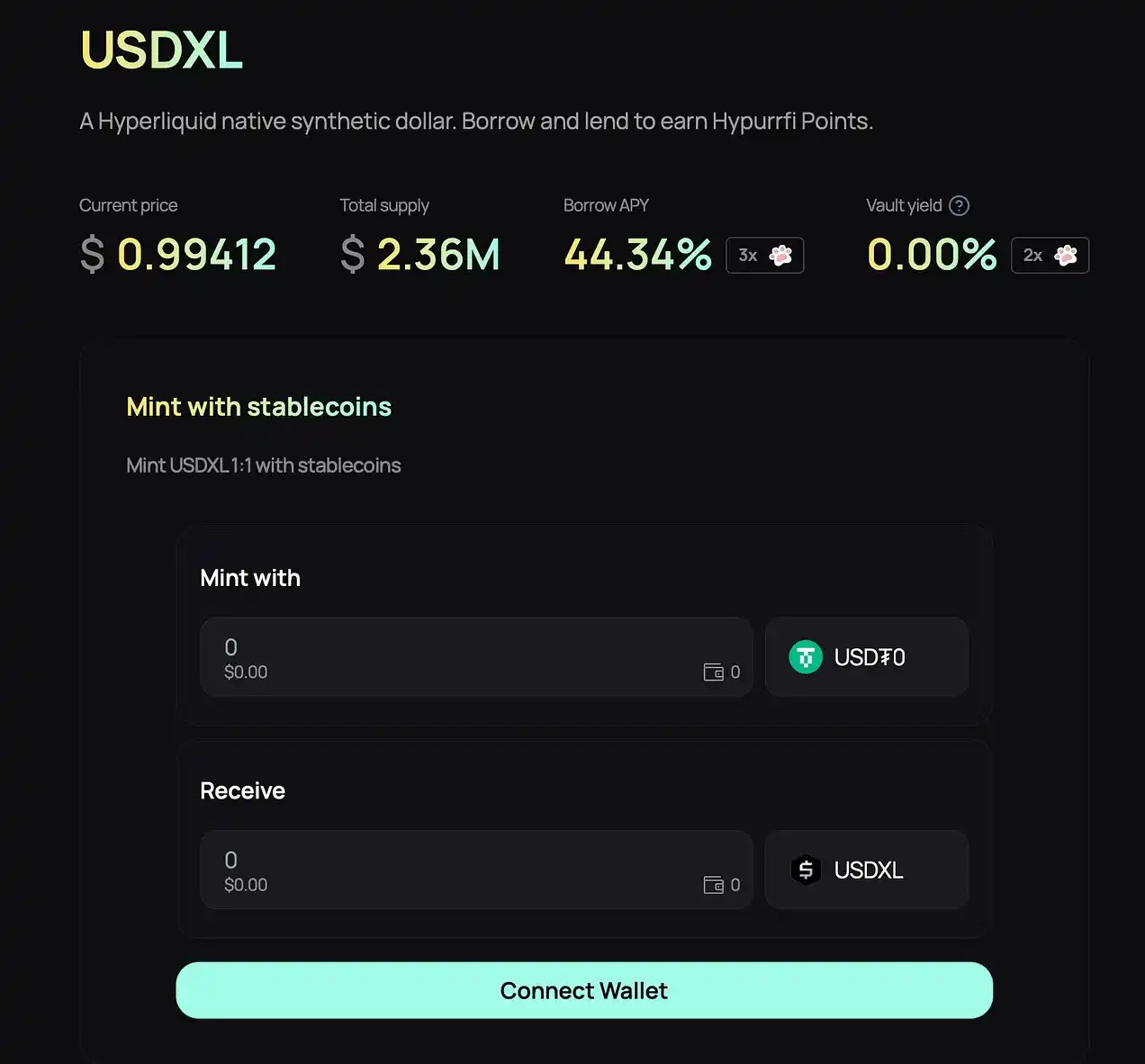

Hypurrfi

Hypurrfi is another non-custodial lending protocol native to HyperEVM, with the following unique features:

1/ HypurrFi provides a seamless user experience and supports multiple assets, allowing users to quickly deposit assets and borrow funds.

Through HypurrFi, you can also quickly access a leveraged position through collateralized borrowing to acquire more assets for leveraged long positions.

2/ HypurrFi is the birthplace of USDXL, a hybrid-supported synthetic dollar, with protocol revenue used to purchase government bonds as an additional protocol safety measure.

3/ They have also partnered with BrahmaFi to introduce a crypto card for specific users based on their ranking on HypurrFi.

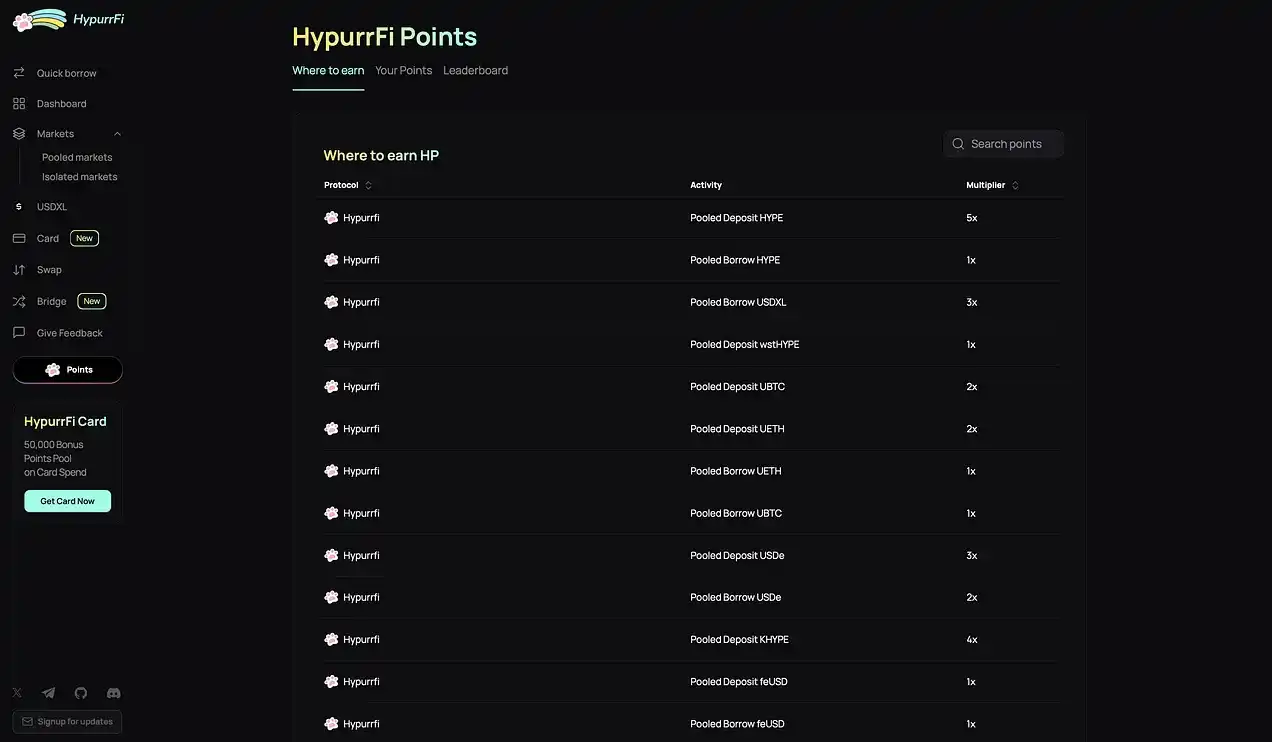

Point System Launched

You can view this page for a clearer understanding of key points and the highest multiplier.

Hyperswap

As the name suggests, Hyperswap is an automated market maker (AMM) DEX native to Hyperliquid, allowing users to swap assets directly on HyperEVM.

Hyperswap is the first native AMM launched on HyperEVM and initially gained significant attention. However, over time, Hyperswap's market share has gradually declined after the launch of Project X.

It is evident from the data chart that the day Project X was launched (with a TVL of $40 million on the first day) marked the peak of Hyperswap's TVL.

Nevertheless, I believe the project's goals are still interesting and worthy of being included in this list—even if its potential may not be as high as other top projects.

If you are interested in their goals, you can read this article for a deeper understanding:

Summary

This article shares my complete tier list for the HyperEVM airdrop opportunity.

Of course, this is entirely subjective and represents only my personal opinion. I hope this article helps you filter out the most interesting and worthwhile protocols to invest your time in.

A Bit of Advice

If your funds are limited, instead of spreading them across too many protocols, it's better to focus on 3-4 projects with the strongest synergies. This has been the strategy I have always adopted, and the results have been quite good.

As GCR said: "A person chasing two rabbits will not catch even one." In the realm of airdrop farming, this is also a good principle worth sticking to.

Additional Content: Airdrop Farming Example

Here is a simple HyperEVM airdrop farming plan you can refer to:

· Conduct spot trading on the Unit platform and convert part of your portfolio into Hyperliquid assets.

· Stake HYPE for liquidity mining to generate kHYPE, then deploy it to the Kinetiq treasury or other DeFi protocols (such as Hyperbeat, Hyperlend, Felix).

· Engage in lending operations with spot assets on the Unit platform (e.g., uBTC or other mainstream assets).

· Allocate stablecoins to Liminal (institutional mode) and Hyperbeat's stablecoin vault.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the biggest on-chain bull market about to break out? Are you ready?

The article believes that the crypto sector is experiencing the largest on-chain bull market in history. Bitcoin remains bullish in the long term, but its short-term risk-reward ratio is not high. There is a surge in demand for stablecoins, and regulatory policies will become a key catalyst. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Solana CME futures open interest hits new high of $1.5B after launch of first US Solana staking ETF

JPMorgan expects September Fed rate cut despite CPI risks and warns of S&P 500 volatility

Ripple Expands Crypto Custody Partnership with BBVA in Spain

Quick Take Summary is AI generated, newsroom reviewed. Ripple and BBVA extend their partnership, offering digital asset custody services in Spain. The service supports compliance with Europe’s MiCA regulation. BBVA responds to growing customer demand for secure crypto solutions.References Ripple Official X Post Ripple Press Release