Is XRP about to break through $3?

XRP is currently fluctuating within a narrow range around $2.80, but with the Federal Reserve almost certain to cut interest rates this month, volatility is about to return.

The Federal Reserve's September meeting has now become the focus of global markets. Due to the August jobs report falling far short of expectations, the Fed is almost certain to cut rates by at least 25 basis points, and possibly even 50 basis points. For risk assets such as cryptocurrencies, this could be a potential turning point. XRP price has been consolidating in the $2.80–$2.85 range, and if liquidity returns to digital assets, XRP could be one of the main beneficiaries.

XRP Price Prediction: Why Is the Fed's Decision Important for XRP?

Lower interest rates typically increase demand for risk assets. When borrowing becomes cheaper and bond yields fall, capital often shifts to stocks and cryptocurrencies in search of higher returns. Historically, $XRP price not only follows bitcoin but also performs well in liquidity-driven rallies. Therefore, even if the Fed adopts a dovish stance due to economic weakness, it could provide short-term upward momentum for XRP.

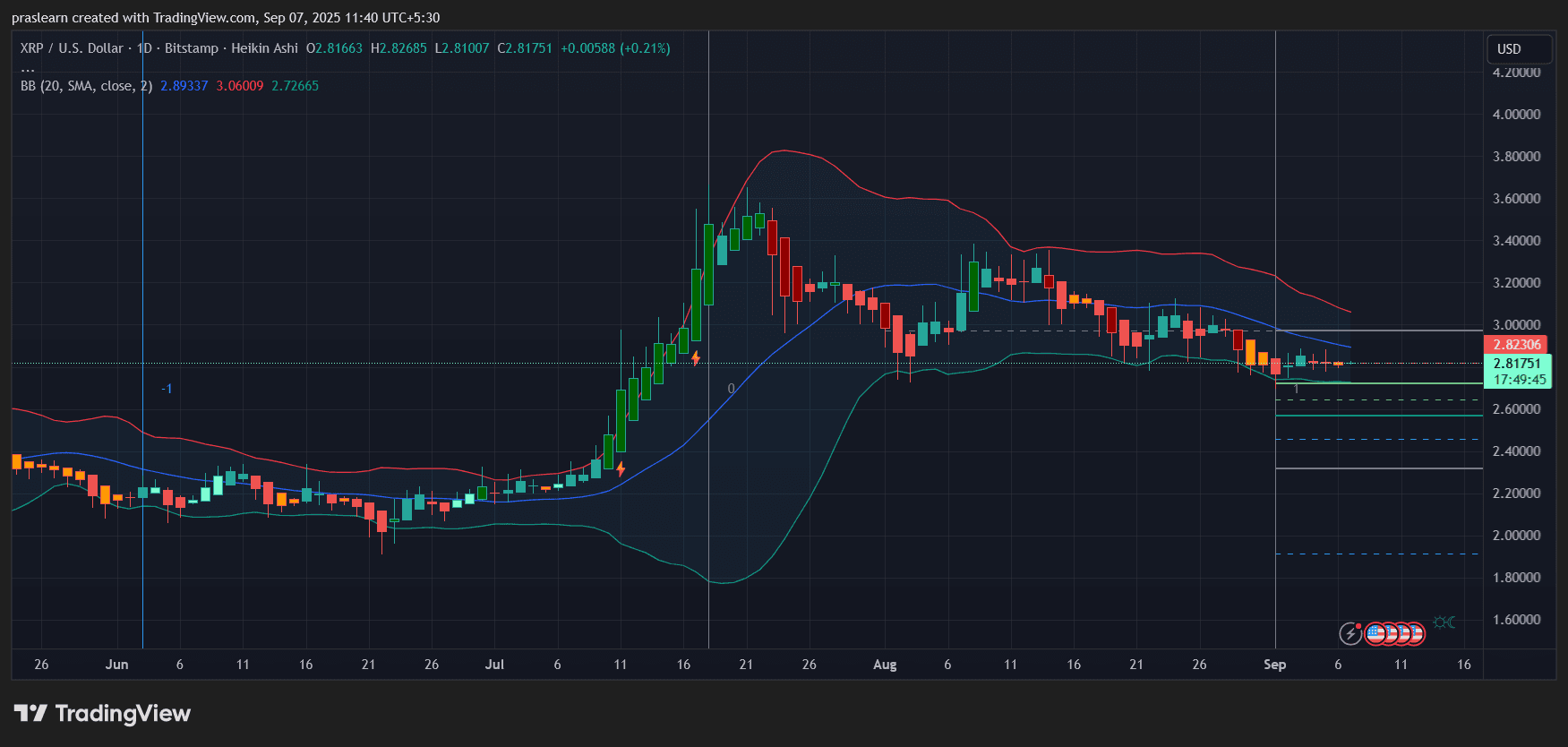

Daily Chart: Testing $2.80 Support

XRP/USD Daily Chart- Tradingview

XRP/USD Daily Chart- Tradingview On the daily timeframe, XRP price is currently hovering around $2.82 after weeks of steady decline from the July highs above $4. The Bollinger Bands show price compressing near the lower band, which usually signals an imminent surge in volatility. The $2.75–$2.80 range has repeatedly served as a support base, making it a crucial line of defense for bulls. A daily close above $2.90 would strengthen the likelihood of a recovery, opening the path to $3.20. However, failure to hold $2.80 would expose XRP to a deeper pullback to $2.60, or even $2.30.

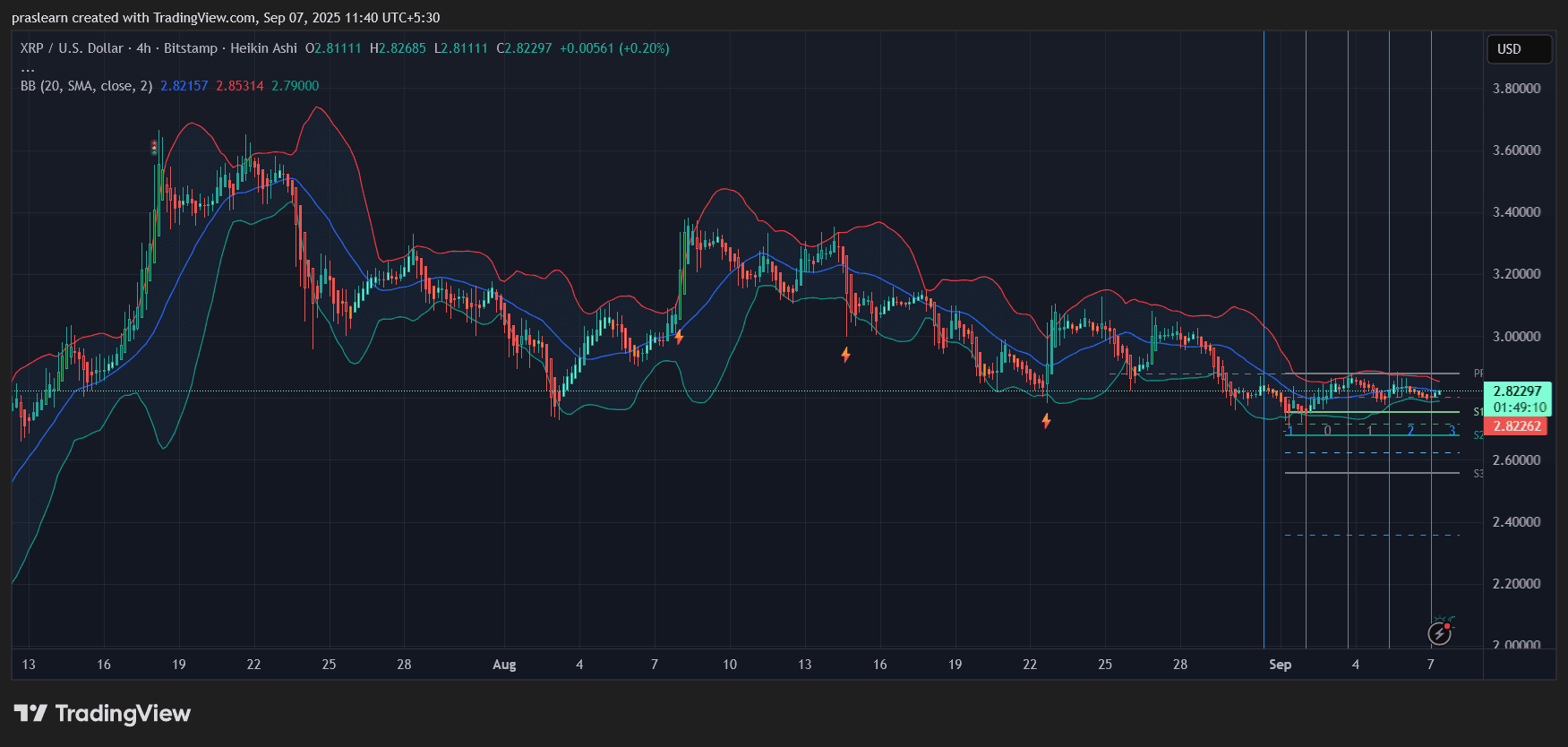

4-Hour Chart: Range-Bound but Consolidating

XRP/USD 4-Hour Chart- TradingView

XRP/USD 4-Hour Chart- TradingView Zooming in to the 4-hour chart, XRP price is trapped in a narrow range between $2.80 and $2.90. The Bollinger Bands are narrowing, indicating declining volatility and suggesting an impending breakout. The past few defenses of the $2.80 line indicate accumulation. If $2.90 is broken, the move could quickly extend to $3.05 and $3.25. On the downside, a break below $2.80 could see a slide toward $2.65.

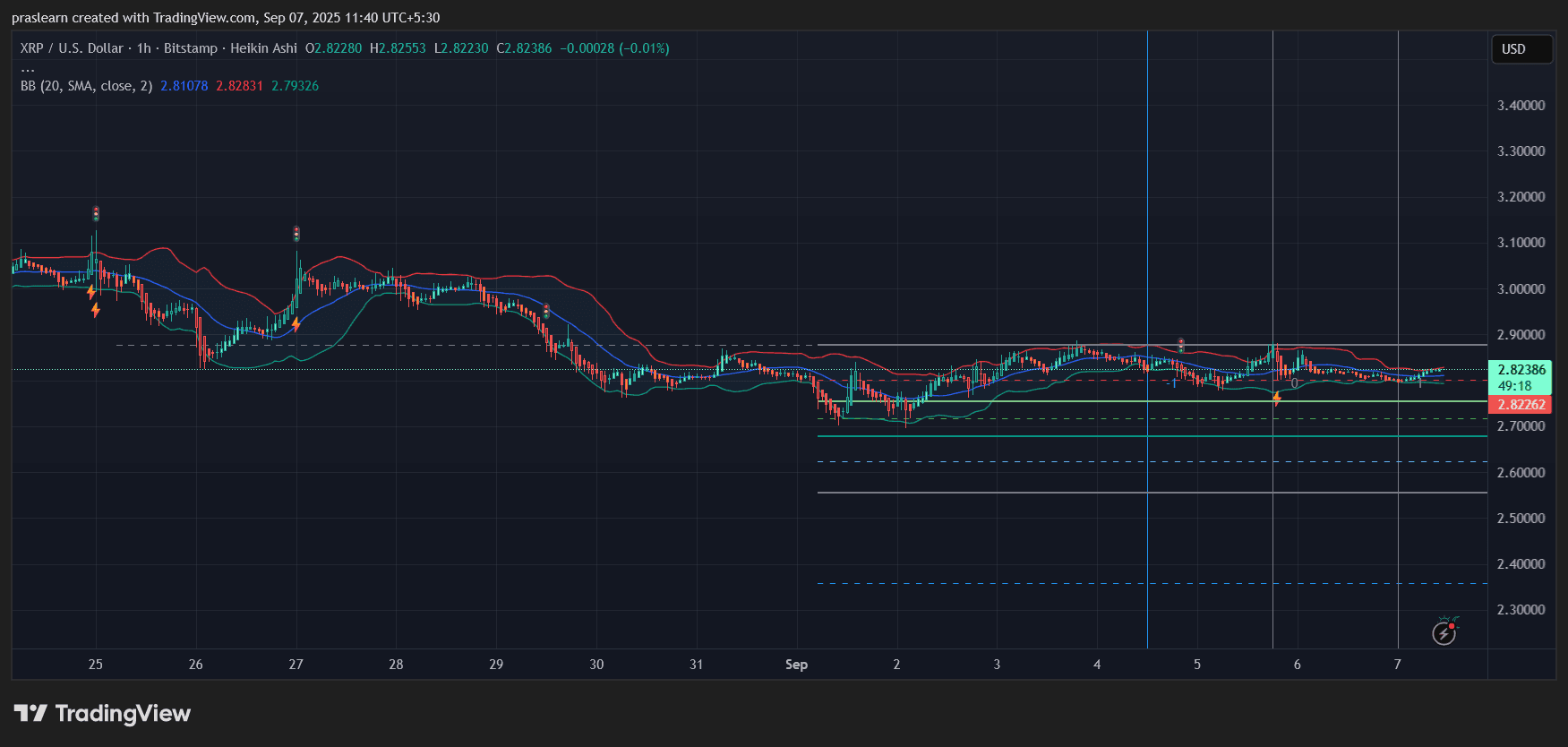

1-Hour Chart: Sideways Drift but Hidden Strength

XRP/USD 1-Hour Chart- TradingView

XRP/USD 1-Hour Chart- TradingView The hourly chart shows XRP price consolidating near $2.82–$2.83 with small-bodied candles. Despite the flat movement, buyers step in every time the price dips below $2.80. This indicates hidden strength. Short-term traders should watch for momentum above $2.85 as the first trigger for a bullish continuation. The psychological $3 mark remains a key magnet for intraday moves after a momentum shift.

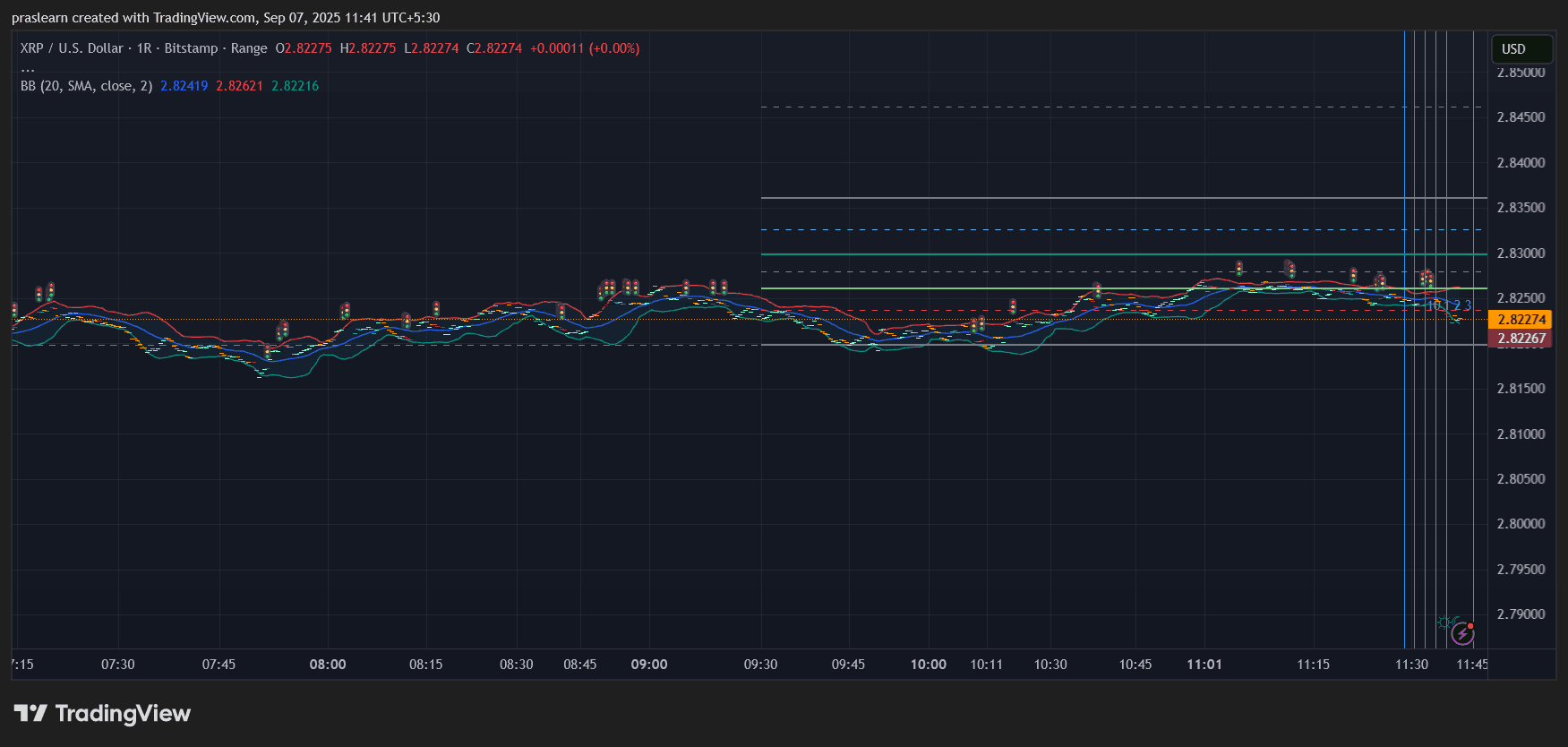

Range Chart: Micro Consolidation

XRP/USD 1-Range Chart- TradingView

XRP/USD 1-Range Chart- TradingView The range chart depicts extremely tight intraday trading. XRP price is locked near $2.82, with the Bollinger Bands compressed. This micro consolidation typically signals a sharp directional move. Given the broader macro backdrop, the probability favors an upside breakout, provided the Fed cuts rates as expected.

Macro and Crypto Market Context

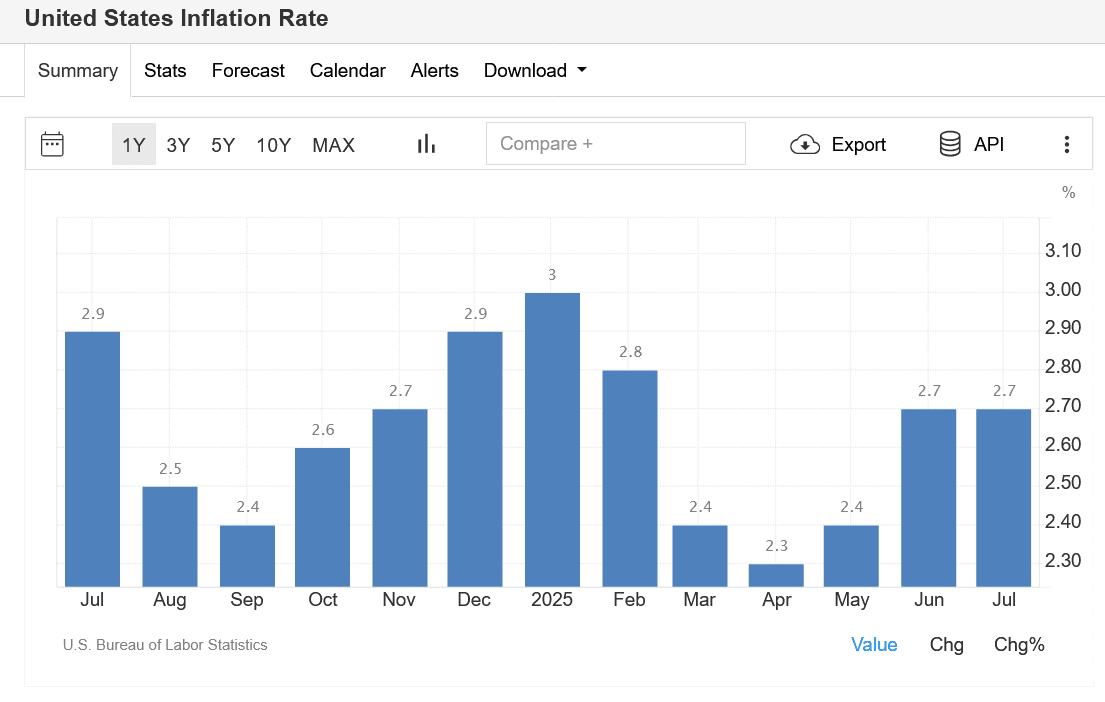

US Inflation Rate: Source: Trading Economics

US Inflation Rate: Source: Trading Economics Inflation remains above target, but the Fed is prioritizing labor market stability. This contradiction—cutting rates while inflation persists—creates a fertile environment for cryptocurrencies. If inflation rises again after a rate cut, bitcoin could rebound as a hedge, driving up XRP price. If the rate cut stabilizes growth, liquidity-driven buying could spill over into altcoins, amplifying XRP's gains.

XRP Price Prediction: What's Next for XRP?

In the short term, XRP's price trajectory is closely tied to the outcome of the Fed's September meeting. Here are the key scenarios:

Bullish scenario: A 25–50 basis point rate cut injects liquidity, pushing XRP above $2.90 and then to $3.20–$3.25 in the coming weeks. If momentum strengthens, $3.50 becomes the next reasonable target.

Bearish scenario: If the Fed disappoints or inflation fears dominate, $XRP could fall below $2.80, with $2.60 and $2.30 as key supports.

Base scenario: XRP holds the $2.80 bottom and rises slowly, awaiting the Fed's decision to confirm direction. Volatility is expected to surge in mid-September.

$XRP is at a decisive level. The charts show compression, the macro backdrop signals liquidity, and the Fed's September decision could be the spark. Traders should closely watch the $2.80–$2.90 range—this is the starting point for the next big move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Paxos proposes to back Hyperliquid’s new USDH stablecoin

Share link:In this post: Paxos has submitted a proposal to support Hyperliquid’s launch of the USDH stablecoin on its platform. The company plans to use 95% of the interest generated by its reserves backing USDH to repurchase HYPE and redistribute it back to ecosystem initiatives. Paxos Labs has also acquired Molecular Labs in a bid to accelerate stablecoin adoption in the Hyperliquid ecosystem.

Crypto sentiment moves into fear terriroty as traders weigh next moves

Share link:In this post: Crypto sentiment has moved into the fear region as investors are now holding off from taking more risks. Santiment has highlighted the focus on larger-cap tokens, noting that traders are presently not open to risks. Analysts and traders question the near-term direction of some of these major assets.

Top 3 Altcoins Worth Buying in September 2025

The crypto market is in a stagnant state, but bitcoin's stability and the altcoin season index indicate opportunities. Here are the top three altcoins worth buying right now.

Bitcoin taps $111.3K as forecast says 10% dip ‘worst case scenario’