Cardano’s Bearish Retail Crowd Hands Whales a Buying Opportunity

Cardano’s retail base has flipped bearish after weeks of drawdowns, setting up conditions where whales could step in.

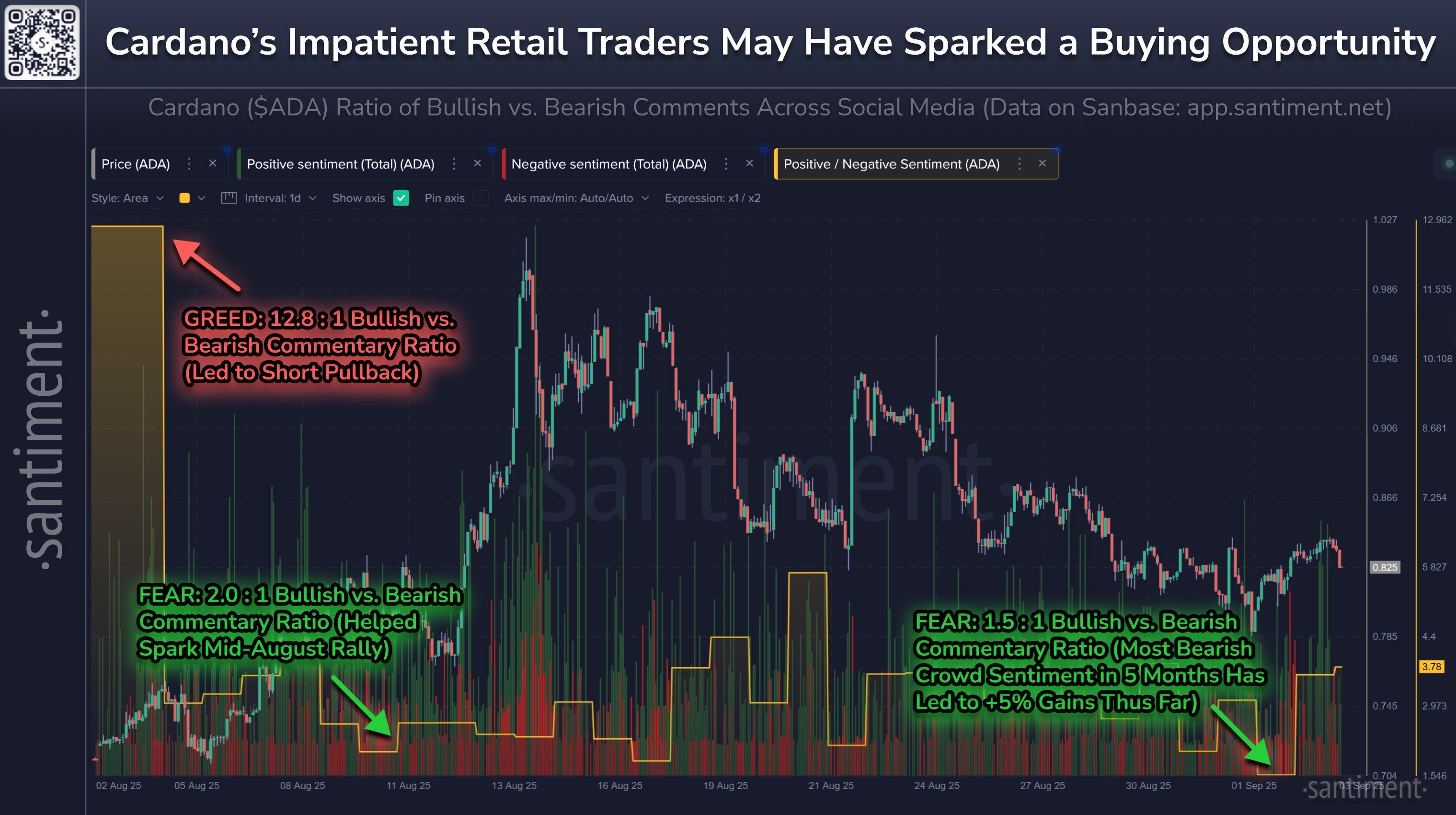

Data from Santiment shows ADA’s bullish-to-bearish commentary ratio slumped to 1.5:1 this week — the lowest in five months. The sentiment dip coincided with a 5% rebound, suggesting traders who sold into frustration may have helped mark a local bottom.

Historically, ADA rallies have tended to begin when retail sentiment is weakest. Santiment flagged a similar setup in mid-August, when a 2:1 ratio aligned with a surge. Conversely, euphoric spikes — like the 12.8:1 ratio earlier this summer — have preceded sharp pullbacks.

Sentiment extremes matter because crypto markets are unusually sensitive to retail psychology. When optimism peaks, the crowd often buys into tops. When pessimism sets in, larger players use the selling pressure to accumulate. That pattern has been visible across multiple assets this year, including bitcoin and XRP.

For Cardano, the shift suggests whales could use current weakness to build positions, especially if retail continues to capitulate.

The crowd-versus-price divergence remains one of crypto’s more reliable short-term trading signals. For now, ADA’s impatient traders may have just handed longer-term investors their entry point.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto recovery: Dead Cat Bounce or the start of a Buy-the-Dip?

BitMine buys $70M ETH while Tom Lee revises Bitcoin prediction

Bitcoin mispricing deepens as BTC trades below $100K, but not for long: Bitwise

Solana on-chain flows flag notable supply shift as SOL trades near key support