WLFI: 272 wallets have been blacklisted, and the freeze is to prevent user losses

ChainCatcher reported that WLFI stated on the X platform that it is aware of the community's concerns regarding the recent wallet blacklist. WLFI emphasized that it will never suppress normal activities. In the past few days, 272 wallets have been blacklisted. This accounts for only a small portion of the total number of holders. The move is purely to prevent user losses, and investigations are underway to assist affected users.

The breakdown of these 272 wallets is as follows: 215 cases (about 79%) are related to phishing attacks: the team has intervened to prevent hackers from stealing funds and is working with legitimate owners to protect/transfer assets. 50 cases (about 18.4%) involved owners reporting violations; at their request, these addresses were blacklisted to help protect/recover funds. 5 cases (about 1.8%) were marked as high-risk exposure (security risks are under review). 1 case (about 0.4%) is suspected of misappropriating funds from other holders; a comprehensive internal review is underway.

WLFI stated that it will not block normal trading activities. When alerts of malicious or high-risk activities that may endanger community members are received, immediate action will be taken. The follow-up measures are as follows: continue to work with legitimate owners to verify control and ensure fund security. After the review is completed, clear results for each category will be announced. Any broader actions affecting holders will be publicly disclosed.

.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Galaxy Digital stakes 387,000 HYPE, worth approximately $18.2 million

Community News: Social protocol Firefly will launch its token soon

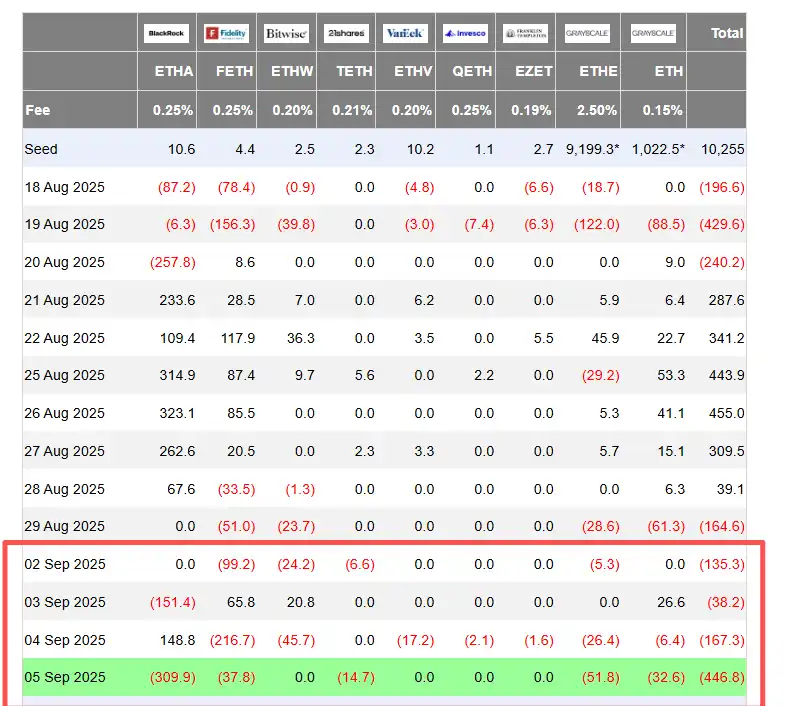

This week, the net outflow from US spot Ethereum ETFs reached $787.6 million.

Ethereum spot ETF saw a total net outflow of $447 million yesterday, the second highest in history.