Nasdaq Lists The Third Largest Solana Treasury Company Despite Recent Scrutiny

Nasdaq’s listing of SOL Strategies highlights growing acceptance of Solana DATs and signals bullish momentum despite rising competition.

The Nasdaq is going to list SOL Strategies, the third-largest corporate Solana holder. Although several competitors have already been listed, these pivoted to crypto from preexisting business ventures.

In other words, this listing shows that the Nasdaq is interested in crypto treasury firms as such. Yesterday, its campaign to scrutinize these firms brought down stock prices across the sector, making this a welcome olive branch.

Solana on the Nasdaq

Digital Asset Treasury (DAT) firms have been a worldwide phenomenon lately, and the Nasdaq is listing several of them. It’s been trading shares in ETH holders, major Bitcoin miner/DATs, and now, the Nasdaq is adding a Solana treasury in the mix:

1/

— SOL Strategies (@solstrategies_) September 5, 2025Major Milestone Alert!SOL Strategies approved for @NasdaqExchange Global Select Market listing under the ticker “STKE” and trading will commence on Tuesday, September 9, 2025! As CEO Leah Wald noted: "This represents more than just an achievement for SOL Strategies, it's… pic.twitter.com/tEJ6uBQahR

SOL Strategies, the third-largest Solana DAT, is the fourth corporate holder to receive a Nasdaq listing, but it has a few distinct advantages.

The other three companies, Upexi, DeFi Development, and Exodus Movement, all began as unrelated firms. They only recently shifted to Solana.

Hidden Benefits and Advantages?

In other words, these companies received Nasdaq listings for unrelated business ventures, not for their Solana treasuries. SOL Strategies, by contrast, has been stockpiling tokens for much longer than its competitors.

A recent study shows that it’s been staking tokens more effectively than them, too, reaping passive income from its holdings.

SOL Strategies might therefore have a chance to stand out in this sector, and this listing could give it the perfect opportunity. Although this Solana DAT won’t start trading on the Nasdaq until September 9, it has already been listed on Canadian exchanges.

By those metrics, today’s development has been highly bullish:

SOL Strategies Price Performance. Source:

SOL Strategies Price Performance. Source:

Still, this Nasdaq listing won’t necessarily guarantee the firm its place as the top Solana DAT. Despite its head-start, commitment to crypto, and aggressive staking, it’s still only the third-largest corporate holder.

Competition is only getting stiffer, especially since a tripartite plan to build a $1 billion SOL treasury made substantial progress today.

For now, though, it’s clear that the Nasdaq is interested in DATs, Solana, or otherwise. Although it recently began a campaign to scrutinize DAT firms for fiscal malfeasance, this doesn’t constitute full-blown aggression.

The Nasdaq’s investigation briefly caused stock prices to dip across this whole sector, so this olive branch is good news as well.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Eyes Cross-Border Crypto Pump-and-Dump Enforcement, Could Include Bitcoin Cases

Michael Saylor’s Net Worth May Be Linked to MicroStrategy Stock Gains and Large Bitcoin Holdings

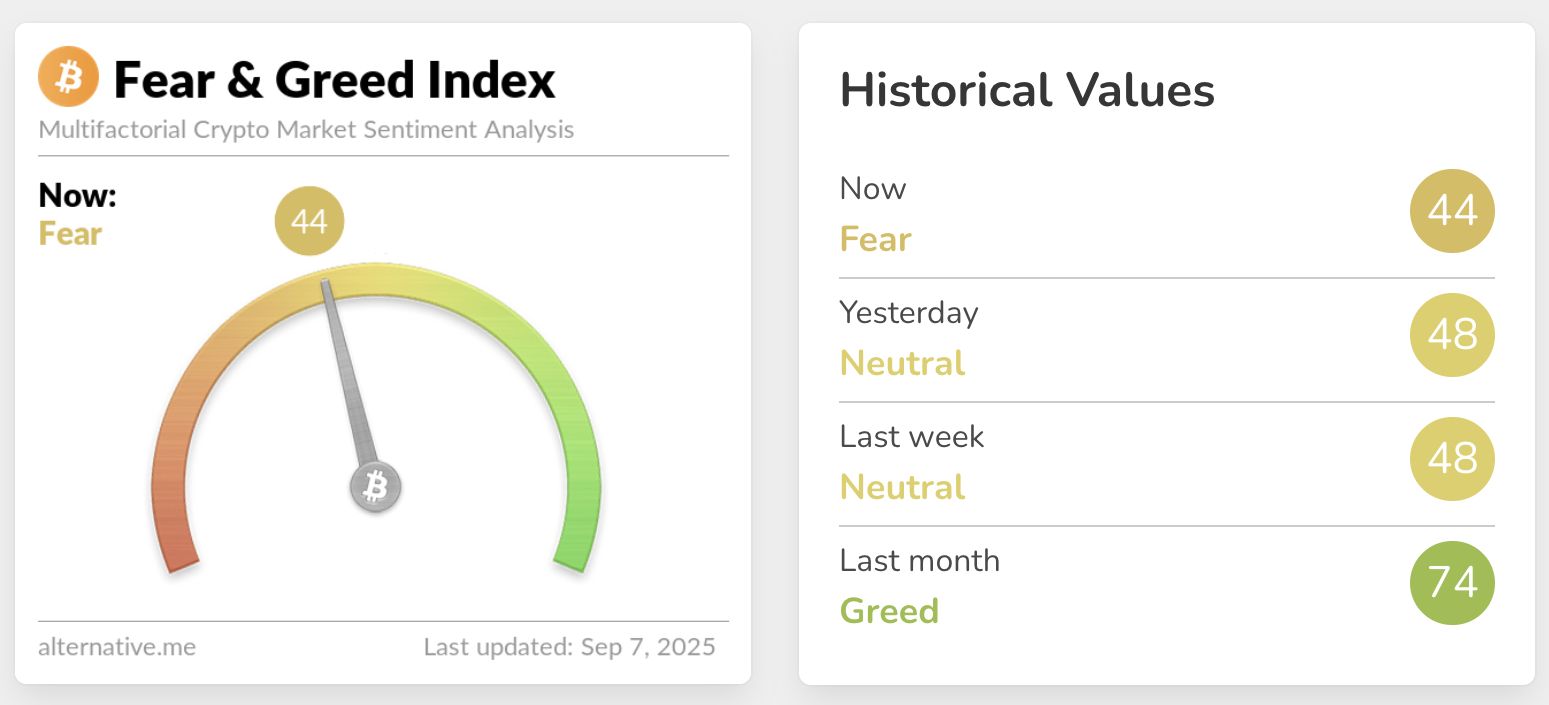

Traders Weigh Which Major Asset May Lead Next Move as Bitcoin Remains Indecisive and Sentiment Cools

Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels