Top 3 Reasons to Buy Crypto Before 2026

Very likely, the peak of the cryptocurrency cycle — which started in November 2022 with the recovery post-FTX collapse — is close. At the same time, the coming weeks might bring some opportunities for buying cryptocurrency assets, or at least Bitcoin (BTC) and major altcoins.

Post-halving peak might be near — next one expected in late 2029

Q4 of a post-halving year is normally considered to be the peak of Bitcoin (BTC) performance. Bitcoin (BTC) set its 2017 high in December — the year after the 2016 halving. The situation repeated itself in November 2021, when Bitcoin (BTC) reached its $69,000 top in the year after the 2020 halving event.

The last Bitcoin (BTC) halving happened in April 2024. Thus, Q4 of 2025 will most likely mark the top of this Bitcoin (BTC) rally. While there is a major risk of "buying the top," the volatility in the peak phases of a bullish run might open up space for more income opportunities.

Also, as the segment matures and its net capitalization surges, the cycles are getting longer and longer. Should we assume that the peak comes in Q1, 2026, it might be worth buying Bitcoin or Ethereum in September-December 2025. If not, the next cycle will definitely start from the decline of crypto prices. While the reduced rates open up more lucrative buying opportunities, those who buy Bitcoin or Ethereum in 2026 will be forced to hold until at least late 2029.

Of course, all of these implications only work for long-term holders. Opportunities for futures trading will be available in every period of existing and upcoming cycles.

Institutions are coming for Ethereum (ETH): Price discovery in the cards

What is special about the current bullish rally of cryptocurrencies is that it is really driven by institutions interested in gaining exposure to crypto price volatility. Unlike previously, institutional buyers — family offices, retirement funds, investing conglomerates, banks and TradFi VCs — do not have to find exotic ways to benefit from crypto.

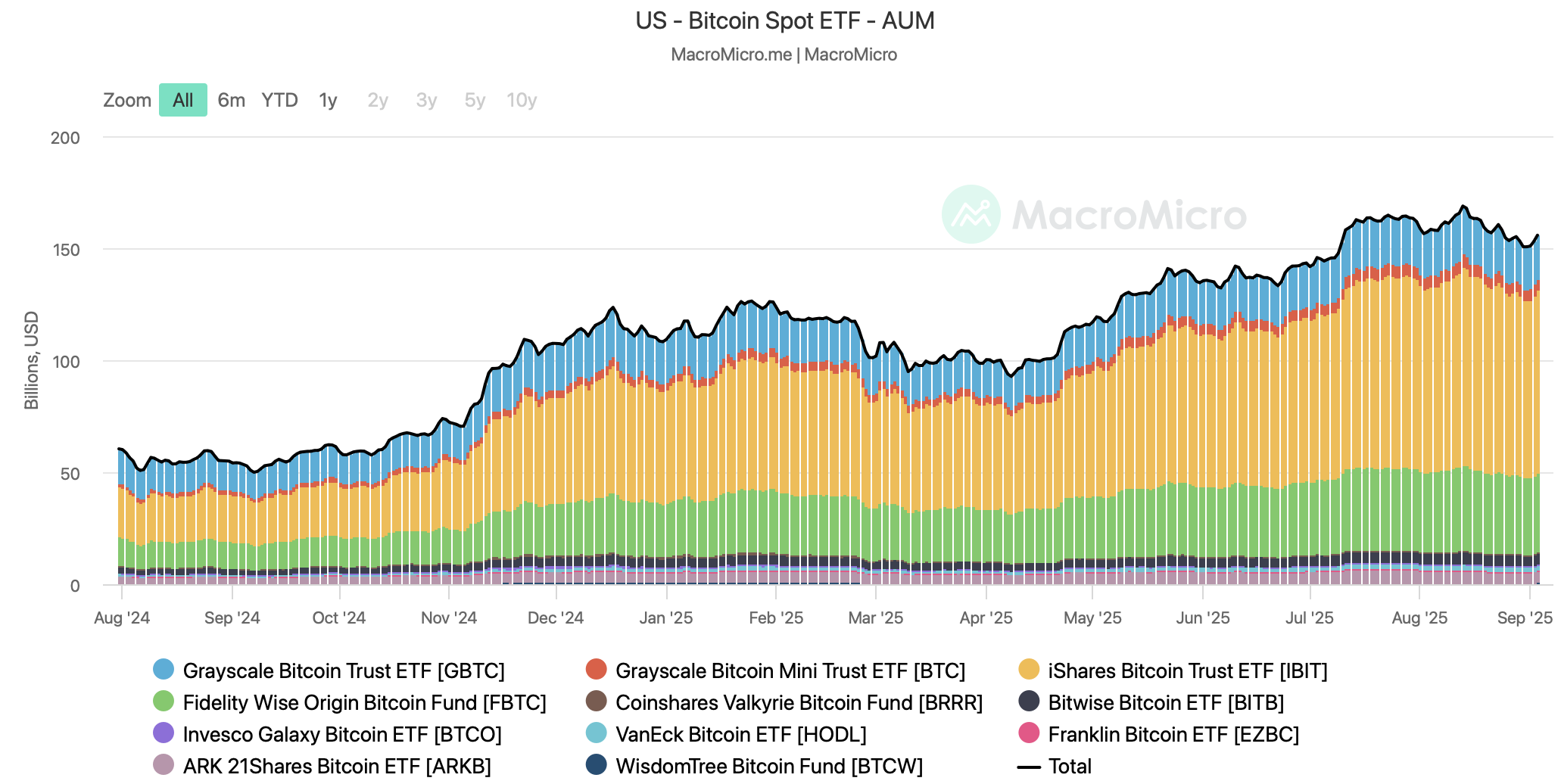

During previous cycles, they were forced to either buy the stocks of mining companies or seek off-shore instruments as well as OTC buying deals. In 2024, cryptocurrency spot ETFs in the U.S. arrived. In January 2024, 11 Bitcoin ETFs went live in the U.S., while in July, they were accompanied by Spot Ethereum ETFs. With these instruments, large-scale investors now have reliable and secure methods to benefit from crypto trading without holding private keys physically.

This resulted in a huge inflow of liquidity into such products. The cumulative volume of Spot Bitcoin ETFs and Spot Ethereum ETFs as of press time is targeting $200 billion. While this is definitely a landmark milestone for Web3 economics and the digital assets segment as such, for regular traders it might result in too-high prices.

Should the institutional inflow accelerate, with Spot ETFs and Digital Assets Treasury companies like Sharplink or ETHZilla siphoning more and more liquidity, Ethereum (ETH) and Bitcoin (BTC) might skyrocket too high for ordinary users. Simply put, you might be interested in buying while you still can buy.

Bitcoin (BTC) security budget under pressure; this might be last big cycle

Also, this cycle might actually be the last in which we see the status quo, with Bitcoin (BTC) dominating here and there. As of press time, the Bitcoin (BTC) dominance rate eyes 60%, even in the context of a decline registered in Q3, 2025.

However, with the inception of quantum computers, Bitcoin’s (BTC) 21 million supply cap — one of its greatest long-term investing narratives — might be destroyed. More and more researchers are warning that if the Bitcoin (BTC) mining mechanism is altered by quantum computers, the asset will not be verifiably scarce any longer. Therefore, its attractiveness to investors will fade.

Also, Bitcoin (BTC) is facing big trouble when it comes to the so-called security budget, i.e., to rewards for miners participating in the Bitcoin (BTC) economy. As covered by U.Today previously, some analysts are sure that Bitcoin (BTC) will not be secure any more in 2030.

Given these facts, there are at least three obvious reasons to consider buying crypto in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

First Pan-European Platform for Tokenized Assets Launched

Mars Morning News | Tether and Circle have minted a total of $12 billion worth of stablecoins in the past month

Tether and Circle have minted $12 billion in stablecoins over the past month; Figma holds $90.8 million in spot bitcoin ETFs; Russia plans to lower the entry threshold for crypto trading; Ethereum ICO participants have staked 150,000 ETH; REX-Osprey may launch a DOGE spot ETF. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Nonfarm payrolls disappoint! Rate cut expectations surge, gold and bitcoin soar

U.S. non-farm payroll data for August fell far short of expectations, with the unemployment rate hitting a new high. Market expectations for a Federal Reserve rate cut in September have risen significantly, causing sharp volatility in the cryptocurrency market. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.