BTC vs ETH: The Crypto Tug-of-War Nobody Saw ComingInstitutional Rotation: Bitcoin Takes the SpotlightEthereum’s Silent Strength: Whale AccumulationB

The crypto market is facing a defining moment . While Bitcoin (BTC) is enjoying massive institutional inflows, Ethereum (ETH) is seeing outflows from major funds. At the same time, whales are quietly buying ETH on-chain, setting up a curious contradiction. Is this the start of a new chapter in the BTC vs ETH rivalry, and which coin will ultimately lead the next crypto cycle?

Institutional Rotation: Bitcoin Takes the Spotlight

Bitcoin ETFs have seen record inflows, with BlackRock, Fidelity, and others pouring billions into BTC. Ethereum ETFs, meanwhile, have suffered outflows, raising concerns about ETH’s immediate strength. Institutions are clearly treating Bitcoin as the “digital safe haven,” much like gold.

Ethereum’s Silent Strength: Whale Accumulation

Despite the ETF bleed, Ethereum isn’t being abandoned. On-chain data reveals whales buying hundreds of millions worth of ETH. One wallet alone scooped up nearly $620 million. This suggests long-term conviction in ETH’s unique role as the backbone of DeFi, tokenization, and staking.

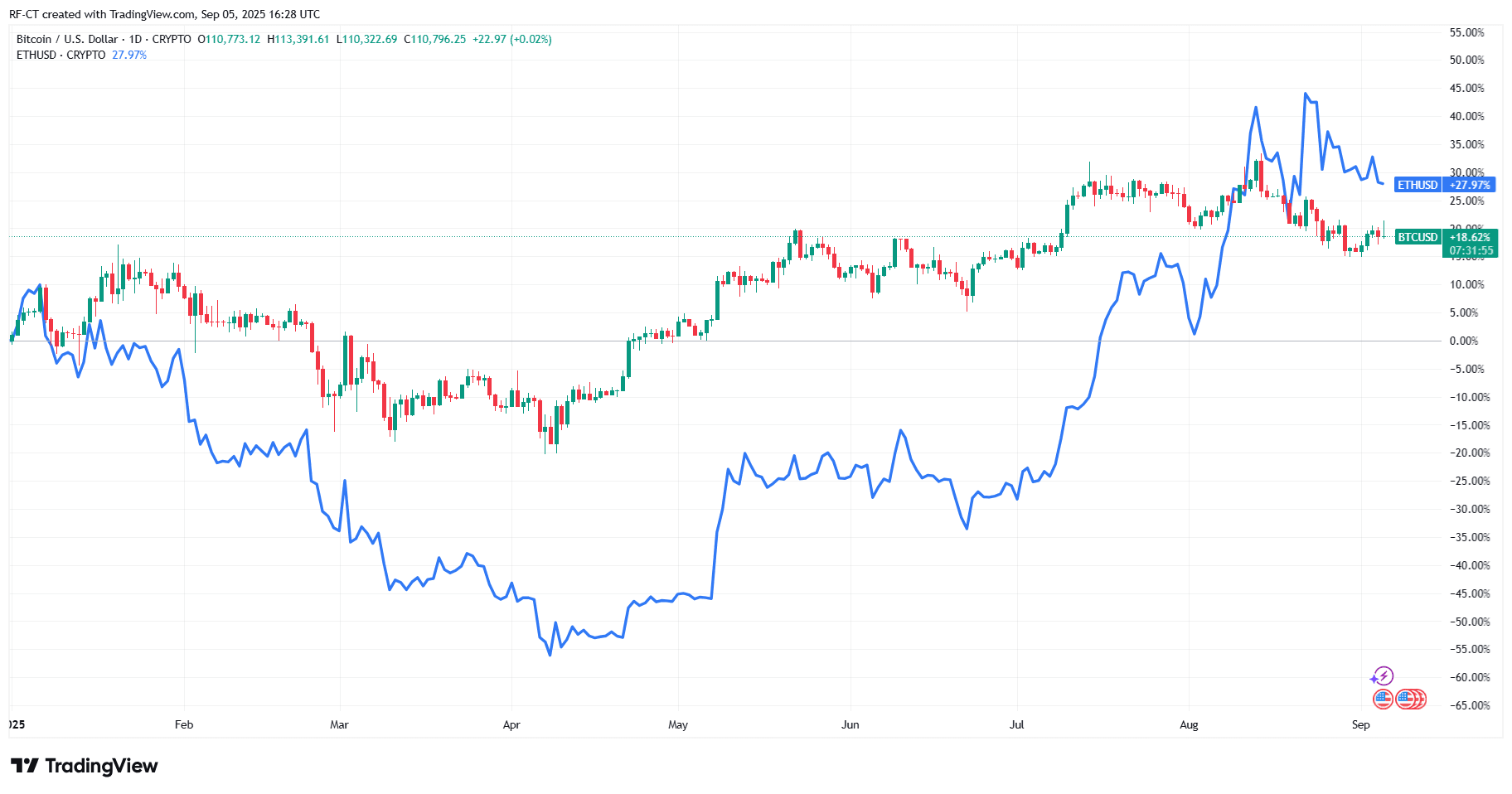

By TradingView - BTCUSD vs ETHUSD_2025-09-05 (YTD)

By TradingView - BTCUSD vs ETHUSD_2025-09-05 (YTD)

BTC vs ETH: Different Roles, Different Cycles

Bitcoin is positioning itself as the store of value, the defensive play when markets are shaky. Ethereum, on the other hand, acts as the growth layer, often outperforming when risk appetite returns. This dynamic explains why BTC is dominating now, while ETH may shine brighter once the bull cycle accelerates.

BTC vs ETH: Current Market Dynamics

| Institutional Flows | Strong inflows via ETFs (BlackRock, Fidelity, etc.) | Recent outflows, ~$135M withdrawn last week |

| Whale Activity | Mixed but steady | Aggressive accumulation, single buys >$600M |

| Market Role | Digital gold, safe-haven asset | Growth layer, DeFi & tokenization backbone |

| Short-Term Outlook | Bullish, reclaiming $111K | Neutral to bearish, consolidation near $4,200–$4,500 |

| Medium-Term Outlook | Stability, dominance in ETF market | Recovery potential, targeting $4,800–$5,000 if inflows return |

| Long-Term Strength | Store of value, macro hedge | Utility, staking yields, innovation hub |

Technical Outlook: Short-Term Pain, Long-Term Gain

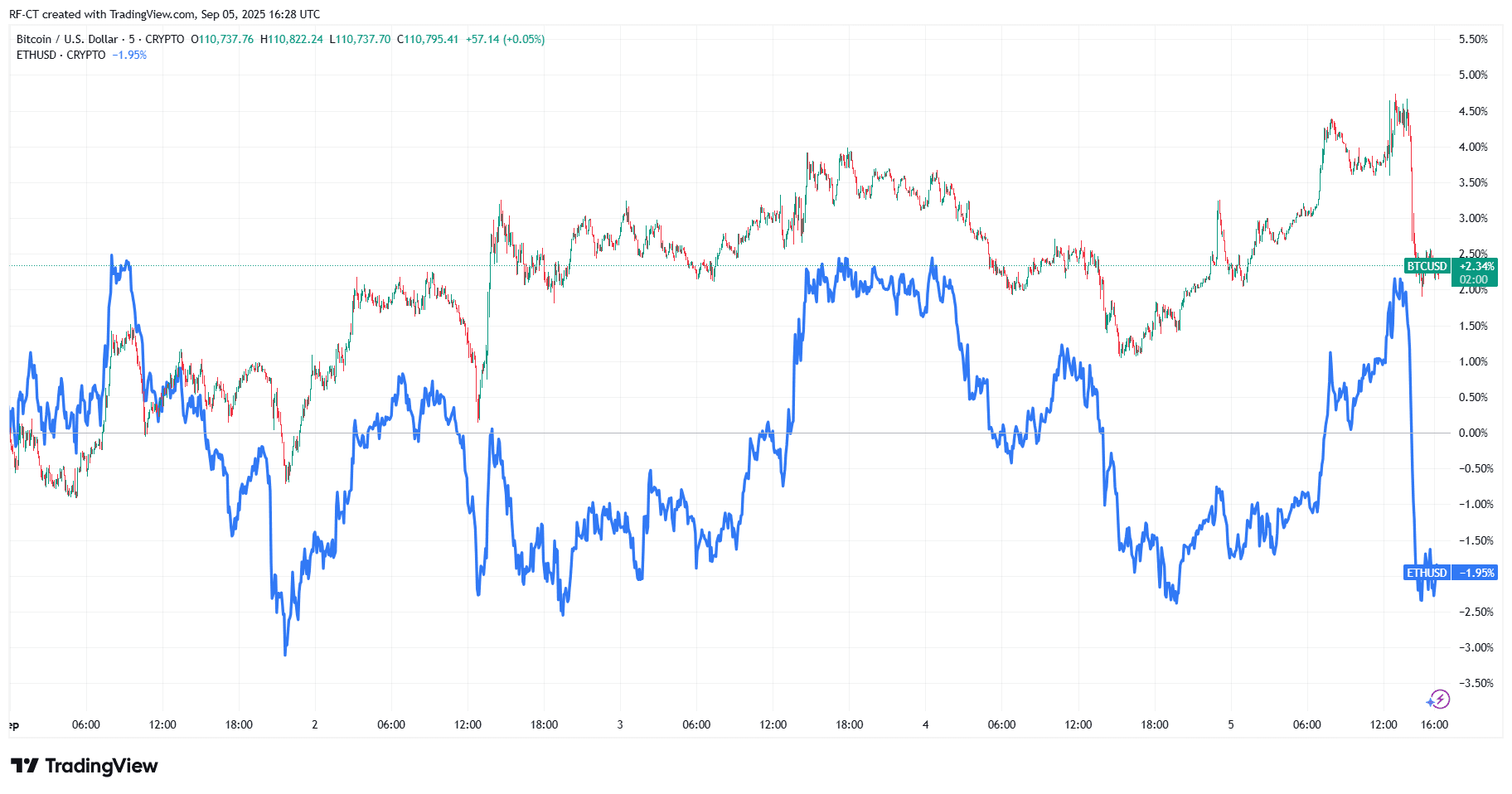

ETH recently dropped toward $4,200 before bouncing back, while BTC reclaimed $111K. Charts suggest ETH may lag behind BTC in the short run, but if accumulation continues, Ethereum could test $4,800–$5,000 in the coming months. The ETH/BTC ratio will be the key signal ,if ETH starts gaining against BTC, it could mark the beginning of ETH’s comeback.

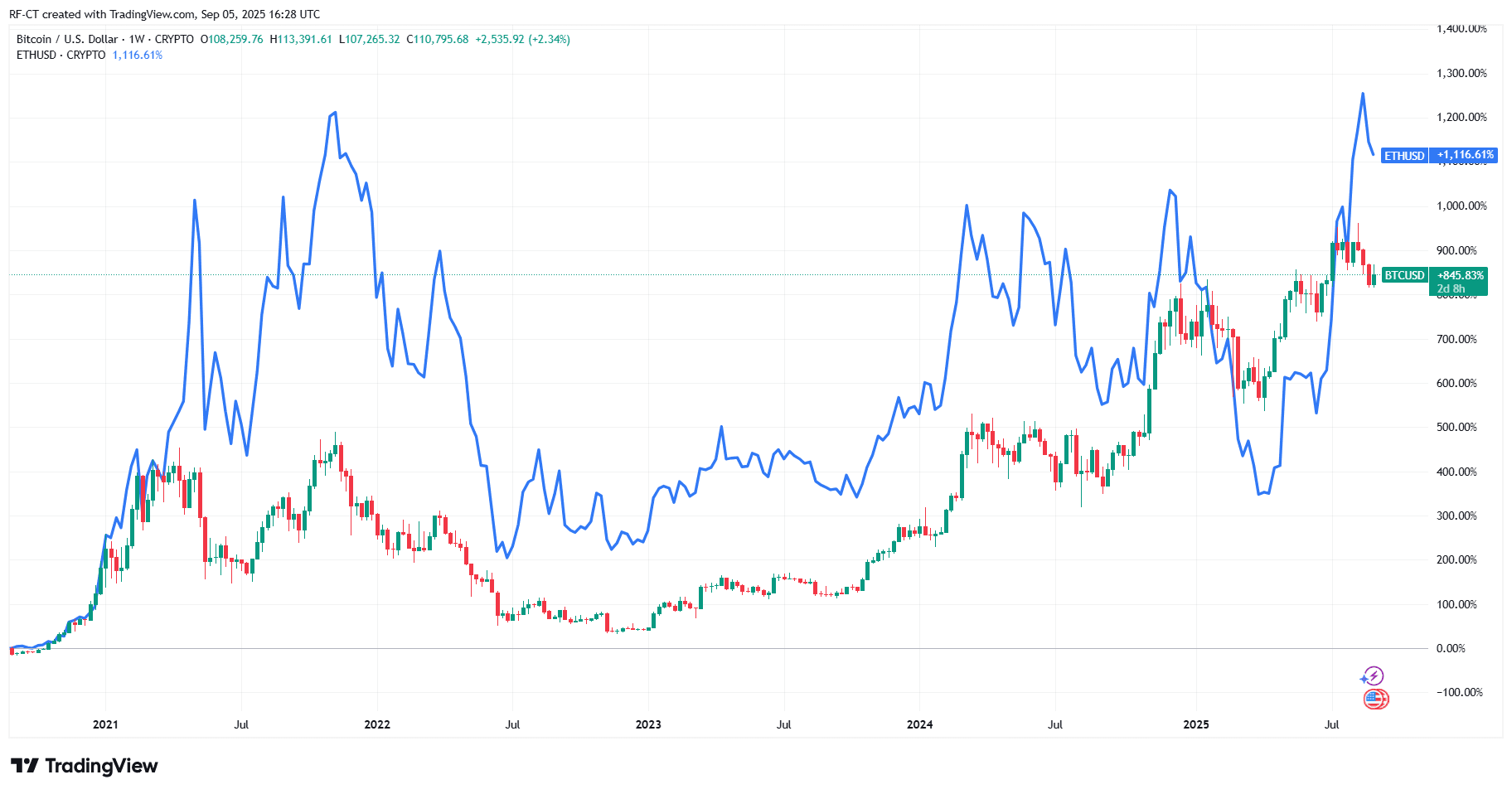

By TradingView - BTCUSD vs ETHUSD_2025-09-05 (5Y)

By TradingView - BTCUSD vs ETHUSD_2025-09-05 (5Y)

Conclusion: The Battle Is Far From Over

This isn’t a case of BTC or ETH, it’s BTC now, ETH later. Bitcoin’s dominance in ETF flows proves its safe-haven appeal, but Ethereum’s fundamentals and whale buying suggest it’s preparing for the next leg up. Traders should keep an eye on the ETH/BTC chart, it will tell us when Ethereum is ready to reclaim the spotlight.

By TradingView - BTCUSD vs ETHUSD_2025-09-05 (5D)

By TradingView - BTCUSD vs ETHUSD_2025-09-05 (5D)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Tether and Circle have minted a total of $12 billion worth of stablecoins in the past month

Tether and Circle have minted $12 billion in stablecoins over the past month; Figma holds $90.8 million in spot bitcoin ETFs; Russia plans to lower the entry threshold for crypto trading; Ethereum ICO participants have staked 150,000 ETH; REX-Osprey may launch a DOGE spot ETF. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Nonfarm payrolls disappoint! Rate cut expectations surge, gold and bitcoin soar

U.S. non-farm payroll data for August fell far short of expectations, with the unemployment rate hitting a new high. Market expectations for a Federal Reserve rate cut in September have risen significantly, causing sharp volatility in the cryptocurrency market. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

The rise of Sei's EVM rewrites the growth curve between performance and ecosystem

Sei once surpassed Solana in active users. By leveraging EVM compatibility and a high-performance architecture, Sei is propelling itself onto a new growth trajectory and becoming a focal point in the industry narrative.