Profit Takers Hurt Solana Price — Here’s Why a Respite Might Be Far Away

The Solana Price has cooled after August’s sharp rally. With profit-taking active and money inflows drying up, the current move looks fragile. Resistance near $218 must break cleanly for any upside, but without whale support, a deeper pullback remains possible.

The Solana Price has cooled after a strong August. Over the past seven days, it has traded flat, and in the last 24 hours, it slipped 1.1%. By contrast, monthly gains still stand near 26%, and three-month gains are about 35.8%.

For traders reading this to see if the SOL Price can repeat those August-style gains, the answer may be disappointing. On-chain data shows profit booking is heavy, and another metric has quietly turned bearish. Together, these raise doubts over how fast Solana can move higher from here.

Two Metrics Hint At Active Selling

On-chain data shows that the percentage of supply in profit is still very high for Solana. As of September 3, nearly 95% of Solana holders were in profit, close to the six-month peak of 96.59% on August 8. Even at press time, the reading sits around 87%, still an overheated level. When such a high percentage sits on gains, the temptation to sell rises.

Solana Traders Have An Incentive To Sell:

Glassnode

Solana Traders Have An Incentive To Sell:

Glassnode

History backs this. The last time profit supply dropped hard, falling under 54% on August 2, Solana Price was about $158.53. From there, SOL Price climbed all the way to $214.51 by August 28 — a gain of roughly 35%. This indicates that Solana mostly rallies when fewer holders hold onto their profits. Otherwise, every move higher tends to get sold into strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Profit Booking Into Strength Continues:

Glassnode

Profit Booking Into Strength Continues:

Glassnode

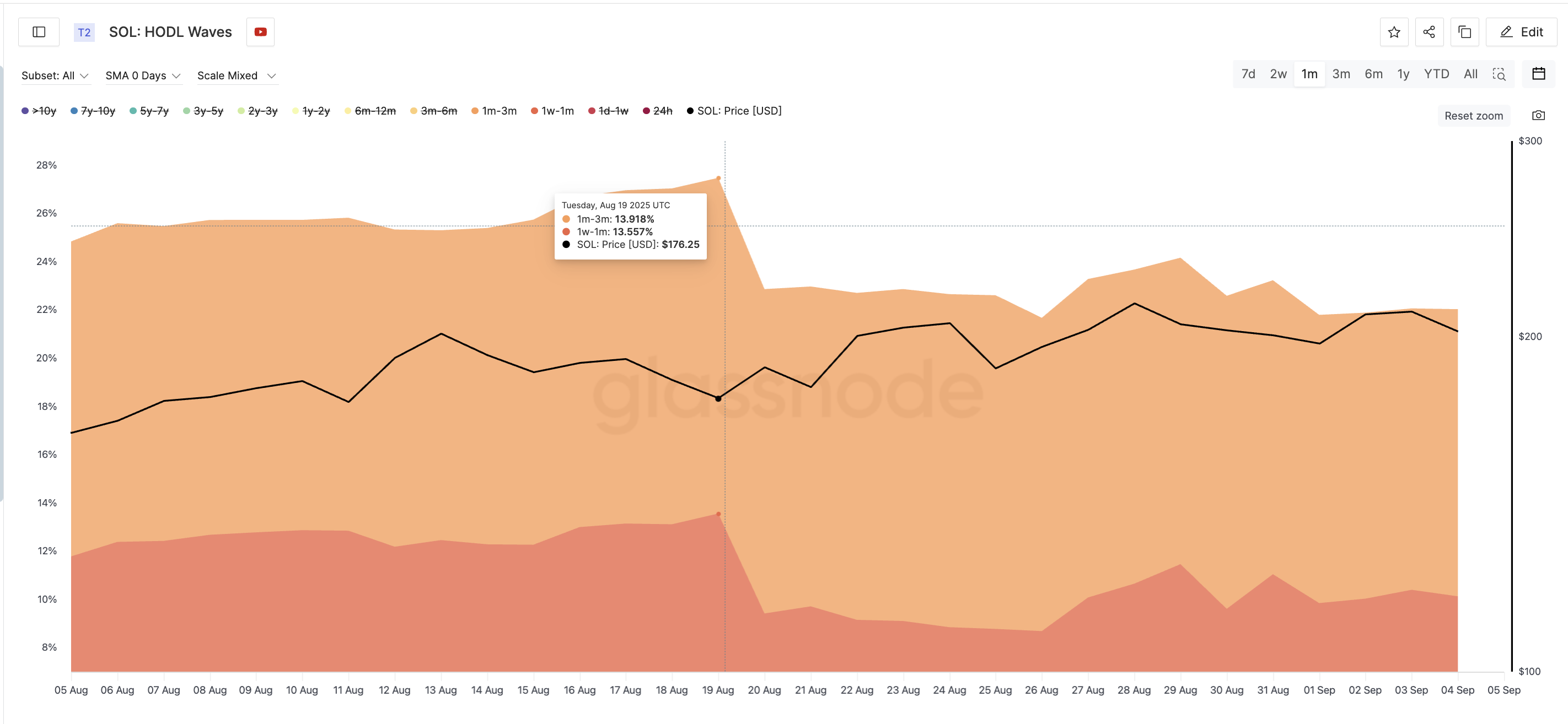

The HODL Waves metric, which tracks how long coins are held before moving, confirms this. Short-term holders — those who held between 1 week–1 month and 1–3 months — peaked on August 19, when Solana Price traded near $176.

Together, they controlled about 27% of the supply. Since then, their share has dropped to around 22%. These cohorts are selling into strength, showing profit-taking is active in real time.

Weak Money Inflows Reveal the Solana Price Fragility

On the price chart, the SOL Price faces heavy resistance at $218. A clean candle close above the latter would confirm a breakout and mark a new high, invalidating the bearish view.

However, the problem of money flow keeps the optimism low. The Chaikin Money Flow (CMF), which measures whether buying pressure or selling pressure dominates, has weakened sharply. On July 22, when the Solana Price hit a local high, CMF stood at 0.31, showing strong inflows. Since then, price has made higher highs, but CMF has dropped to –0.01.

Solana Price Analysis:

TradingView

Solana Price Analysis:

TradingView

This divergence means whales and institutions are not adding fresh money into SOL. Without these large inflows, profit-takers face little resistance when selling. The lack of offsetting demand leaves rallies fragile and makes a deeper pullback more likely than a respite if key supports fail.

On the downside, strong support sits at $194, with further levels at $186 and $173 if selling deepens. At present, the Solana Price is holding steady, but unless CMF improves, any respite looks far off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH price fluctuates sharply: Event review and in-depth outlook

I spent eight years of my youth sinking into the crypto "casino"

Bitcoin price dips below 88K as analysis blames FOMC nerves

Crypto: How Europe Wants to Enforce Its Version of the SEC