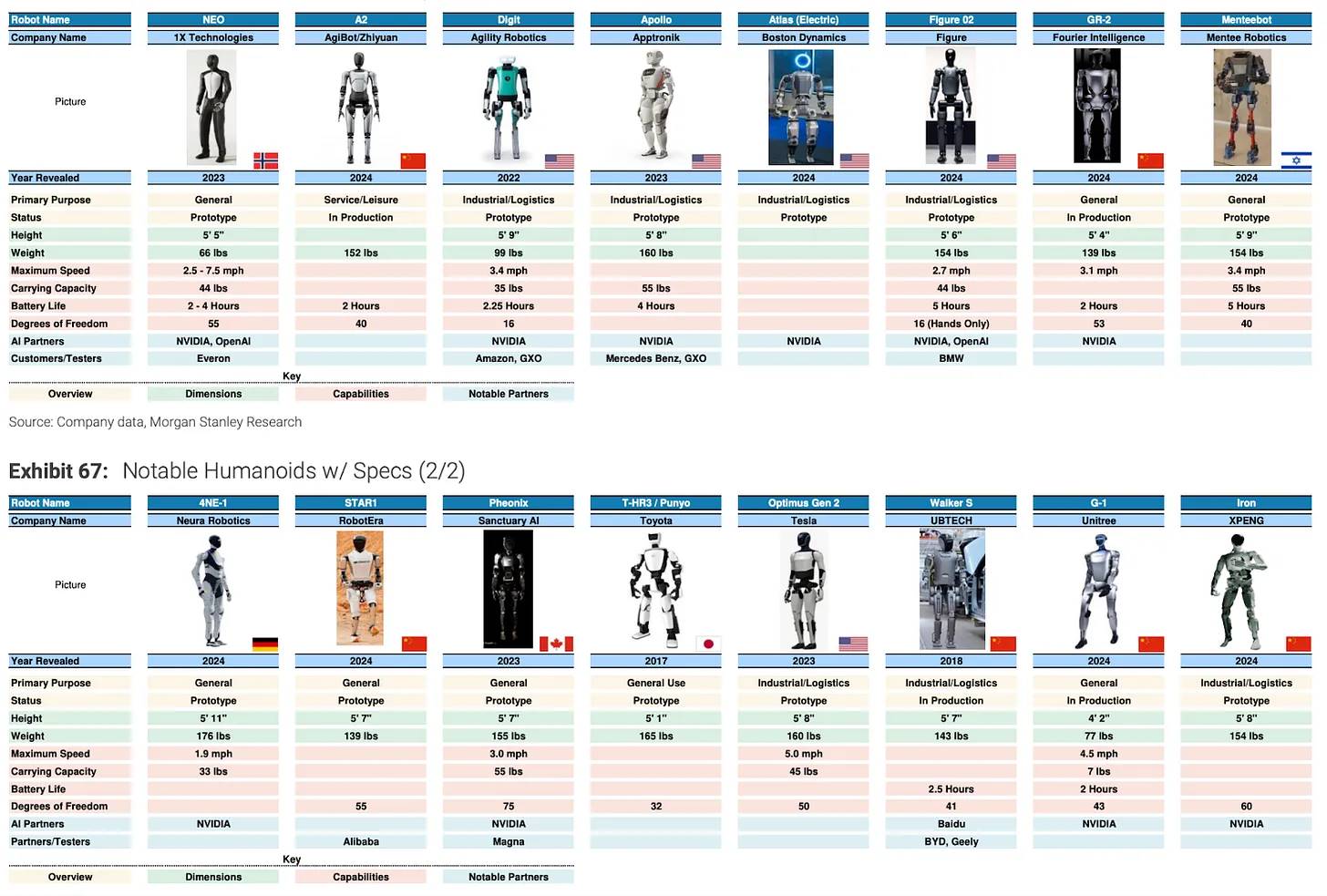

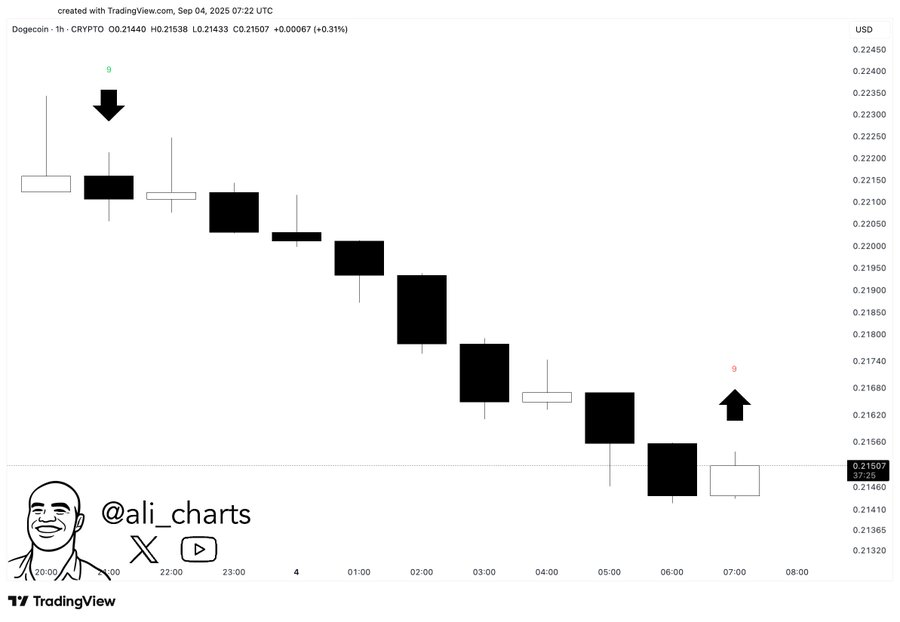

Dogecoin Bollinger Bands are compressing, signaling a likely volatility expansion. At $0.216, DOGE shows a BBW low similar to July’s pre-rally, with on-chain TVL at $20.23M and TD Sequential flashing a buy—setting a near-term technical target around $0.30 if momentum returns.

-

Bollinger Band Width (BBW) at multi-week lows — implies volatility expansion ahead.

-

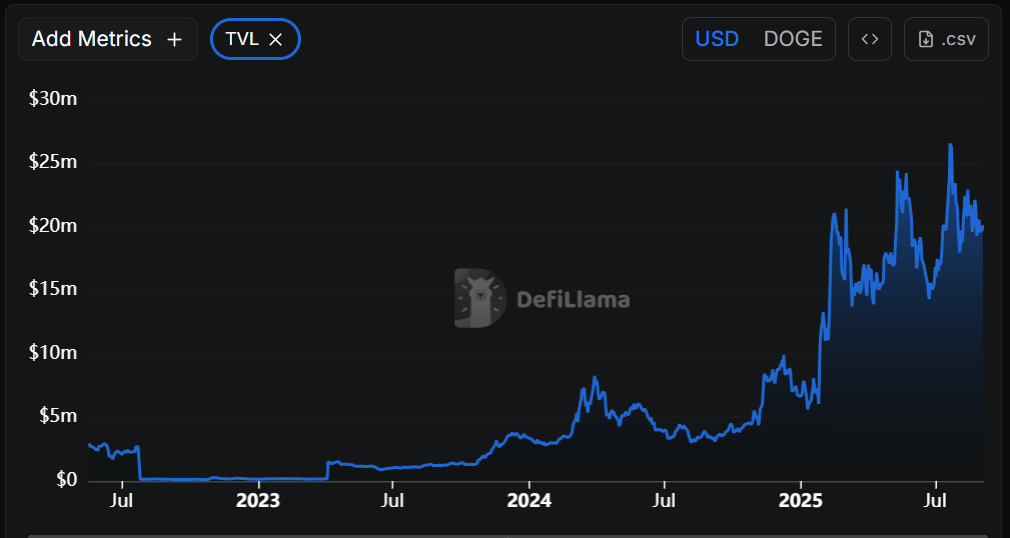

On-chain TVL is $20.23M while market cap remains near $32.6B, indicating steady ecosystem activity.

-

TD Sequential buy and a higher-low pattern point to a $0.30 target zone if price breaks above $0.21.

Dogecoin Bollinger Bands squeeze signals volatility ahead; monitor BBW and TD Sequential for breakout confirmation — read actionable setup and targets.

What is the Dogecoin Bollinger Bands squeeze and why it matters?

Dogecoin Bollinger Bands squeeze is a period of low volatility where the bands contract around the 20-day moving average. This contraction (low BBW) often precedes a volatility expansion and directional move; current BBW levels mirror those seen before July’s rally, making the setup notable for traders.

How does BBW signal a potential breakout for DOGE?

BBW (Bollinger Band Width) gauges the distance between upper and lower bands. A falling BBW indicates compression; historically, a sharp expansion after compression has led to strong directional moves. Trader Tardigrade observed a July contraction-to-expansion path that propelled Dogecoin from $0.18 to $0.30.

$Doge / daily #Dogecoin Bollinger Bands are starting to squeeze. The Bollinger Band Width (BBW) has dropped to a recent low, similar to the level just before the previous pump. pic.twitter.com/4OdcgrmewD

— Trader Tardigrade (@TATrader_Alan) September 3, 2025

Dogecoin traded near $0.216 at the time of writing, consolidating between $0.21–$0.25. Price currently sits near the lower Bollinger Band while BBW has reached lows not seen since July. If expansion follows the current contraction, history suggests a meaningful move could follow.

What do market indicators and on-chain metrics show?

On-chain and market metrics show steady activity: total value locked (TVL) reported at $20.23 million and chain fees/revenues around $2,976 in the last 24 hours, suggesting active usage. Market capitalization stands near $32.625 billion with a nearly identical fully diluted valuation, indicating stable supply expectations.

Source: DeFiLlama (data referenced as plain text)

Source: DeFiLlama (data referenced as plain text)

TD Sequential indicators (per Ali Charts observation) recently flipped to a buy signal, and price action shows a higher-low structure. Analysts note that a daily close above $0.21 would validate bullish patterns — including a potential cup-and-handle — with a short-term target near $0.30 if momentum sustains.

Source: AliCharts (observation referenced as plain text)

Source: AliCharts (observation referenced as plain text)

How to monitor Dogecoin’s setup for traders?

Track BBW, daily closes relative to $0.21, and TD Sequential counts. Watch volume on any breakout and confirm with on-chain metrics such as TVL and fee activity to validate sustainability of a move.

| Price | $0.216 (at time of writing) | Near consolidation support |

| Market Cap | $32.625B | Large-cap stability |

| TVL | $20.23M | Steady on-chain activity |

| BBW | Multi-week low | Precedes volatility expansion |

| Technical target | $0.30 | Conditional on breakout above $0.21 |

Frequently Asked Questions

How soon can a breakout occur after a BBW low?

Breakouts can occur within days to weeks after a BBW low; historical precedent for Dogecoin shows the July contraction expanded into a rapid rally within several trading sessions, but exact timing varies.

What technical levels should traders watch?

Traders should watch a daily close above $0.21, BBW reversal to expansion, and TD Sequential confirmations. Volume supporting the move increases probability of sustained gains.

Key Takeaways

- BBW contraction: Low BBW signals potential volatility expansion; pay attention to band widening.

- On-chain support: TVL at $20.23M and steady fees back ecosystem activity; use these to validate moves.

- Trigger and target: A confirmed close above $0.21 with volume could target $0.30; manage risk with stops below recent lows.

Conclusion

Dogecoin’s Bollinger Bands squeeze and TD Sequential buy present a technically clean setup that mirrors July’s pre-rally conditions. Traders should monitor BBW, price action above $0.21, and on-chain metrics (DeFiLlama, Ali Charts observations referenced) before committing. COINOTAG will update as new confirmations appear.