Bitcoin May Defy September Slump as Exchange Supply Hits Multi-Year Low

Bitcoin’s September weakness may continue, yet shrinking exchange reserves and potential Fed catalysts suggest a setup for a Q4 rebound.

September has traditionally been a difficult month for Bitcoin (BTC), with price charts often showing weakness. However, some experts predict a potential surge, pointing to falling exchange reserves as a signal of upward momentum.

The optimistic outlook comes despite Bitcoin’s recent struggles. The largest cryptocurrency has slipped 2% over the past week, reflecting broader market uncertainty.

Bitcoin Outlook: Seasonal Lows or Rally Ahead?

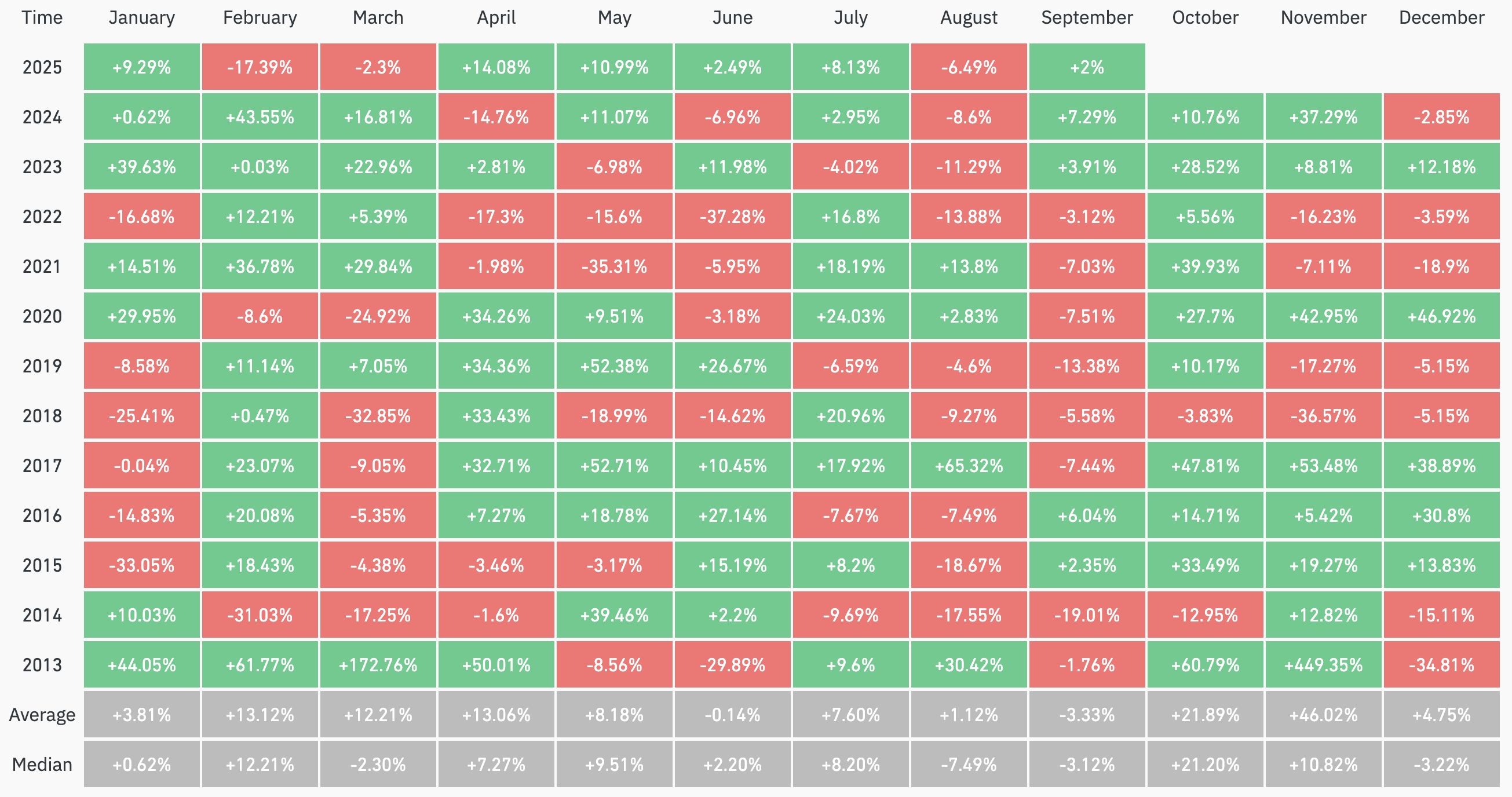

According to data from Coinglass, Bitcoin’s average return in September stood at -3.33%, making it the cryptocurrency’s worst month. BTC ended the month in red for six consecutive years between 2017 and 2022, making its prospects for this year also somber.

Bitcoin Monthly Performance. Source:

Coinglass

Bitcoin Monthly Performance. Source:

Coinglass

Notably, many experts agree on this perspective. An analyst has characterized the current market as resembling a ‘classic stock market top.’ This indicated potential vulnerability to further corrections.

Furthermore, analyst Timothy Peterson highlighted that Bitcoin’s value dipped 6.5% last month. The analyst predicted a price range of $97,000 to $113,000 by the end of September, reflecting a continuation of this trend.

‘It’s part of a seasonal pattern that has played out over many years,” Peterson added.

#Bitcoin – Two possible scernarios for BTC 1) Green: If 108k support holds, the price will soon continue heading higher.2) Red: If $108k support breaks, we might see a deeper retest of the upward-sloping trendline. pic.twitter.com/pyQTikXxfn

— Mags (@thescalpingpro) September 4, 2025

Meanwhile, many anticipate that while declines may come, the coin will bounce back next quarter. Based on past patterns, October and November are the strongest months for Bitcoin, so that could very well happen.

“Historically, Bitcoin has always bottomed out in September after the year of the halving. After that, it’s mostly smooth sailing. Despite me usually not looking at the past and using it as a signal for accuracy (I look at price action today). Looking at charts right now, this could actually very well play out again,” Crypto Nova wrote.

This view is supported by Benjamin Cowen, CEO of Into The Cryptoverse. He noted that September often marks a low point in post-halving years, typically followed by a rebound into a market cycle peak in the fourth quarter.

Nonetheless, some maintain a more optimistic view. Data shared by crypto analyst Rand showed a steady decline in BTC held on exchanges. Moreover, the exchange supply has plunged to a six-year low.

This signals reduced selling pressure. In addition, if demand increases, this shrinking supply can support a more bullish outlook for Bitcoin.

“Bullish supply shock,” Cade Bergmann added.

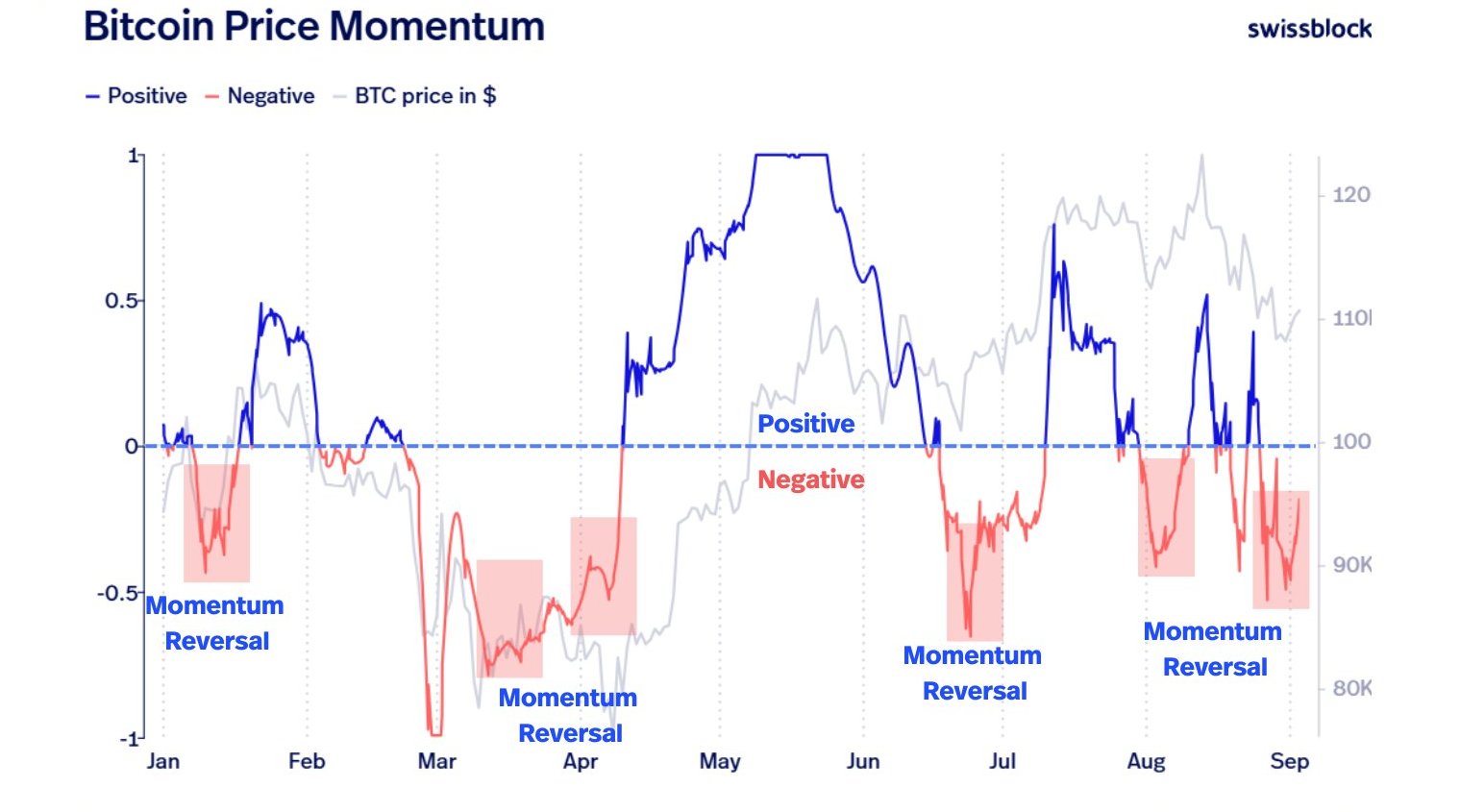

Rand also emphasized that momentum appears to be reversing from negative to positive, signaling a potential shift in market sentiment. With just under two weeks until the market expected Fed rate cuts, the analyst suggested the policy shift could provide the catalyst for a stronger recovery in September.

Bitcoin Momentum. Source:

X/CryptoRand

Bitcoin Momentum. Source:

X/CryptoRand

Lastly, market watchers are also eyeing key dates. Analyst Marty Party pointed to September 6 as a potential trigger, tied to market maker activity.

“Bitcoin market makers have cooked on the 6th of each month. IMO: Sept 6th is a move. That’s the event window till Sept 17th FOMC,” he said.

#Bitcoin is only 1.7% of global unbacked fiat. That means 98.3% of the currency supply is still waiting to be disrupted. WE ARE SO EARLY. pic.twitter.com/Bh2Zi2v89p

— Carl ₿ MENGER

(@CarlBMenger) September 3, 2025

Now, Bitcoin’s price remains under pressure, with experts divided on whether September will mark a bottom or a continued decline. The coming weeks, particularly around the forecasted Fed decision, will be critical in determining whether the cryptocurrency can defy its seasonal weakness and capitalize on the current supply dynamics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The New Order of AI Generative Development: Deconstructing the Vibe Coding Ecosystem

Vibe Coding is an early-stage project with clear structural growth, strong potential for platform moat, and diverse, scalable application scenarios.

Solo: Building a Web3 Trusted Anonymous Identity Layer Based on zkHE Authentication Protocol

Solo is building a "trusted and anonymous" on-chain identity system based on its original zkHE architecture, which is expected to break through the long-standing challenges...

A Brief Analysis of Berachain v2: What Upgrades Have Been Made to the Original PoL Mechanism?

Berachain is a distinctive Layer1 blockchain project, with its most recognizable innovation being the adoption of P...

XRP Holds Above Key Donchian Base After 11 Straight Monthly Candles