US Federal Reserve to Host Payments Innovation Conference Amid RWA Tokenization Boom

Contents

Toggle- Quick Breakdown

- Federal Reserve Sets October Conference on Payments Innovation

- RWA Tokenization at Record Highs

- Ondo Finance and Chainlink Launch Tokenized US Stocks

Quick Breakdown

- The Federal Reserve will host a payments innovation conference on October 21, focusing on tokenization, DeFi, stablecoins, and AI.

- Tokenized real-world assets have surged to a record $27.8B, with Ethereum leading adoption.

- Ondo Finance, in partnership with Chainlink, has launched a platform for tokenized US stocks and ETFs.

Fed event to explore tokenization, DeFi convergence, and AI in payments as Ondo Finance launches tokenized US stock platform

The United States Federal Reserve is preparing to host a major conference on payments innovation and tokenization, marking a significant week for the growing real-world asset (RWA) sector.

Federal Reserve Sets October Conference on Payments Innovation

The Federal Reserve Board announced on Wednesday that it will hold a payments innovation conference on October 21. The event will gather regulators, financial institutions, and industry experts to discuss the evolving landscape of digital finance.

The agenda will cover key themes shaping the payments ecosystem, including tokenization of financial products and services, bridging traditional finance and DeFi, stablecoin adoption and business models and AI-driven payment solutions.

Governor Christopher Waller emphasized the Fed’s commitment to exploring both the opportunities and risks of new technologies, highlighting the need to enhance the safety and efficiency of payments.

RWA Tokenization at Record Highs

The timing of the conference coincides with a surge in tokenization activity on Wall Street following the passage of stablecoin legislation in July and tokenized asset markets have expanded rapidly.

Source

:

RWA.xyz

Source

:

RWA.xyz

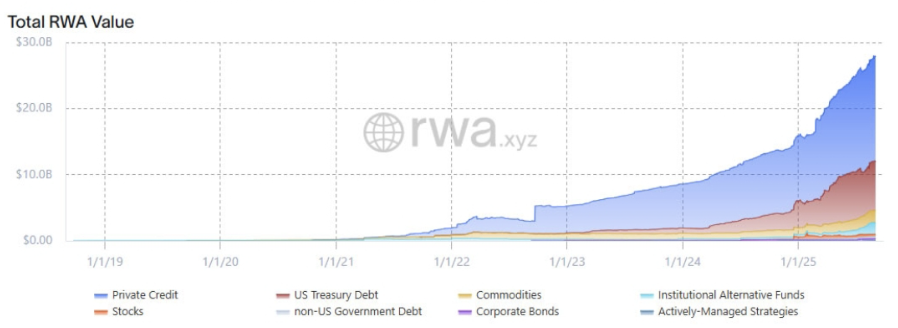

According to data from RWA.xyz, the total onchain value of tokenized real-world assets has climbed to an all-time high of $27.8 billion, up 223% since January. Tokenized private credit and US Treasury debt dominate the sector.

Ethereum remains the leading blockchain for RWA adoption, holding 56% market share across stablecoins and an even larger 77% share when including layer-2 networks.

Ondo Finance and Chainlink Launch Tokenized US Stocks

Adding momentum to the trend, Ondo Finance unveiled the Global Markets Alliance, a landmark initiative designed to standardize and expand global access to tokenized RWAs.

The platform, now live on Ethereum for non-US investors, was built in collaboration with crypto oracle provider Chainlink. Ondo Finance described the initiative as a step toward “Wall Street 2.0,” opening new access to traditional financial instruments via blockchain technology.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z partner's decade-long advice for Web3 founders: In the new cycle, just focus on three things

Is L2 really secured by Ethereum?

Dialogue with BlackRock CEO Larry Fink: AI and Asset Tokenization Will Reshape the Future of Investing

Pokémon Card Craze: The Cognitive Gap Between Crypto Players and Collectors