Written by: Thejaswini M A

Translated by: Block unicorn

Preface

July 6, 2017. The HR department called.

Hayden Adams was laid off after a year as a mechanical engineer at Siemens. He had always felt he wasn’t quite suited for heat flow simulation work. Adams had not performed well in this position. The company was downsizing.

But 24-year-old Adams only felt relieved.

He had been struggling with whether engineering was the right career path. The layoff forced him to make a decision he had long avoided.

One day, his phone buzzed. A text from his college roommate arrived.

Karl Floersch was working at the Ethereum Foundation. For years, he had been preaching about blockchain technology. Smart contracts. Decentralized applications. These were revolutionary things.

Adams had always turned a deaf ear. He thought it was too abstract, too strange.

Now, unemployed and lost, he decided to listen.

The call lasted three hours. Floersch painted a picture of the future. Code without human oversight. Money flowing without banks. Applications serving millions without corporate control.

This conversation planted the seed for the birth of Uniswap.

But first, he needed to convince himself that switching from mechanical engineering to cryptocurrency was a reasonable choice.

Evangelist of Ethereum

Adams saw uncertainty, while Floersch saw opportunity.

Ethereum was still young at the time, young enough that a motivated person could become an expert within months. The barrier to entry was low because few people understood the technology.

Adams had concerns. He had no programming background, aside from basic courses. He had never built a website or written a smart contract. The prospect of switching from mechanical engineering to software development was daunting.

Floersch offered a framework: learn by building real projects. Adams shouldn’t just take online courses, but should pick a concrete project and work to complete it. Learning would happen naturally in the process of creating.

Floersch explained how Ethereum worked, the importance of decentralized applications, and the problems that needed to be solved. He described an emerging ecosystem where small teams could build applications serving millions without traditional corporate infrastructure.

Despite his doubts, Adams found himself becoming interested.

He made a decision. He would spend the next year learning to program and building something meaningful on Ethereum. By the end of the call, Adams was cautiously optimistic.

Underground Laboratory

Adams moved back to his childhood bedroom in the suburbs of New York.

His parents did their best to support him. Their son had studied mechanical engineering at Stony Brook University. He had worked at a well-known company. But now he wanted to learn programming and build applications on something called blockchain.

The learning curve was steep. Adams watched JavaScript tutorials on YouTube. He read the documentation for Solidity, Ethereum’s programming language. Concepts that were intuitive for computer science graduates required deep study for someone from a physical engineering background. He approached programming as he would any engineering problem. Every function had its use in a larger system. Every variable had meaning. Smart contracts were machines that transformed inputs into outputs according to predetermined rules.

Progress was slow. Adams built simple contracts for storing and retrieving data. He learned to deploy code to Ethereum’s test network. Each small success narrowed the gap between abstract concepts and practical implementation.

Floersch visited regularly, offering guidance and encouragement. During a visit at the end of 2017, he presented Adams with a specific challenge.

Ethereum co-founder Vitalik Buterin had written a blog post about automated market makers. The concept described a way of trading without traditional order books. Traders would no longer match buy and sell orders, but interact with liquidity pools managed by mathematical formulas.

No one had yet built a usable implementation.

Adams studied the concept. Market making involved complex systems with multiple participants, precise calculations, and real-time responses. The problem combined mathematical theory and practical engineering, which piqued his interest.

Floersch made a proposal. Build a working prototype with a user interface in a month, and he would showcase it at the upcoming Ethereum flagship conference, Devcon.

Adams accepted the challenge. He had thirty days to learn web development, implement the automated market maker logic, and create something worthy of being presented to the global Ethereum community.

The Protocol That Changed Everything

November 2, 2018. Adams was ready to deploy his smart contract to the Ethereum mainnet.

It had taken over a year to go from prototype to production. The initial one-month challenge proposed by Floersch had evolved into a comprehensive protocol through multiple iterations. The first demo at Devcon 2 proved the concept was feasible. But Adams wanted to build a system robust enough for real users with real money. The process included rewriting smart contracts, conducting security audits, and optimizing the user interface. Every improvement brought the system closer to production readiness.

Vitalik Buterin suggested rewriting the contracts in Vyper and recommended applying for a grant from the Ethereum Foundation. The grant application process forced Adams to articulate his vision clearly.

The $65,000 grant gave him the funds to work on the project full-time. Adams used the money to audit the smart contracts, build a production-ready interface, and prepare for mainnet launch. Every detail mattered, as users would be trusting the system with real money.

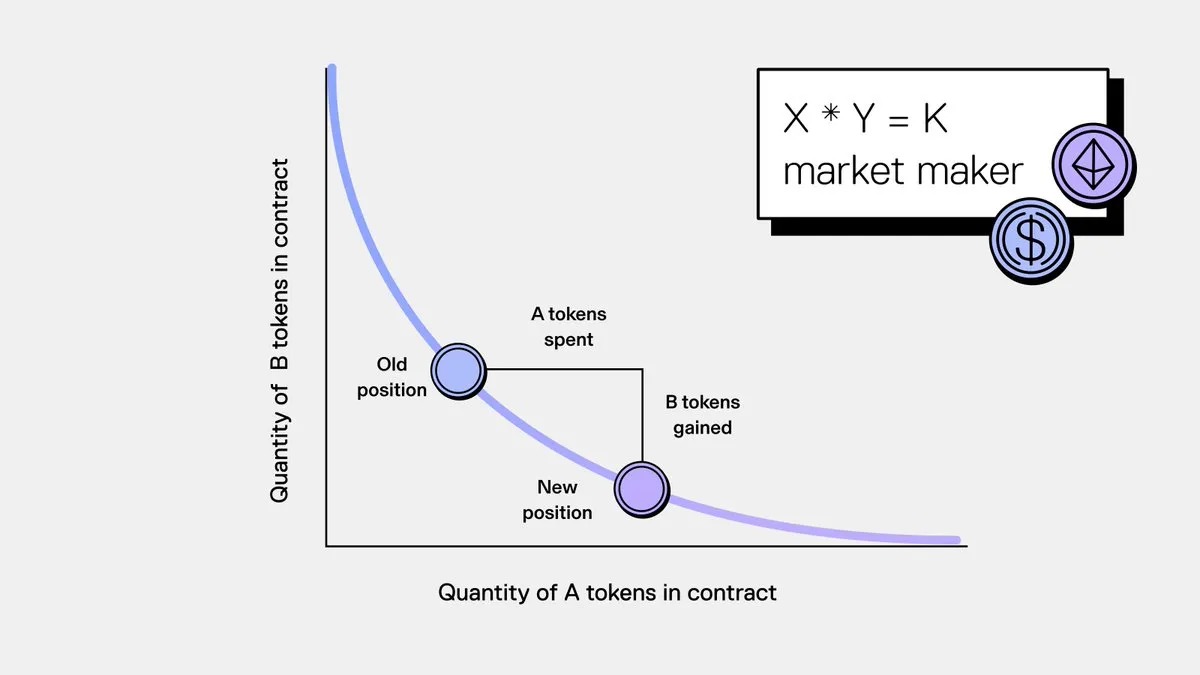

The core mathematical formula of Uniswap is x * y = k.

This constant product formula ensures that the product of the two token quantities in the liquidity pool remains unchanged during trades. As one token becomes scarce, its price rises proportionally.

Adams deployed the contract during Devcon 4 in Prague. Launching at Ethereum’s largest conference maximized attention from developers and early adopters. He announced the deployment to about 200 followers on Twitter.

Early reactions were mixed. Some developers praised its elegant design and permissionless architecture. Others questioned whether automated market makers could compete with traditional centralized exchanges. Trading volume in the first few weeks was limited, mostly to curious developers and DeFi enthusiasts.

Adams had anticipated this skepticism. Uniswap was not designed to be more efficient than centralized exchanges, but to provide trustless trading without intermediaries, permissionless token listings, and composable liquidity for other applications to build on. Centralized exchanges rely on market makers to actively participate and adjust liquidity during price swings. Automated market makers (AMMs) invert this model, automating the market-making function. This means market makers are no longer needed. Once a liquidity pool is deployed, the pool logic handles market making.

Tokens can be created without anyone’s permission. Therefore, as new tokens are launched on Ethereum, there should be a permissionless way to trade them. Centralized exchanges charge high listing fees and require lengthy approval processes. Uniswap allows anyone to create a market by depositing tokens and earn fees from subsequent trades.

By early 2019, daily trading volume was steadily increasing. The protocol processed millions of dollars in trades without employees, offices, or traditional business operations. Adams had built a system governed by mathematical rules rather than human decisions.

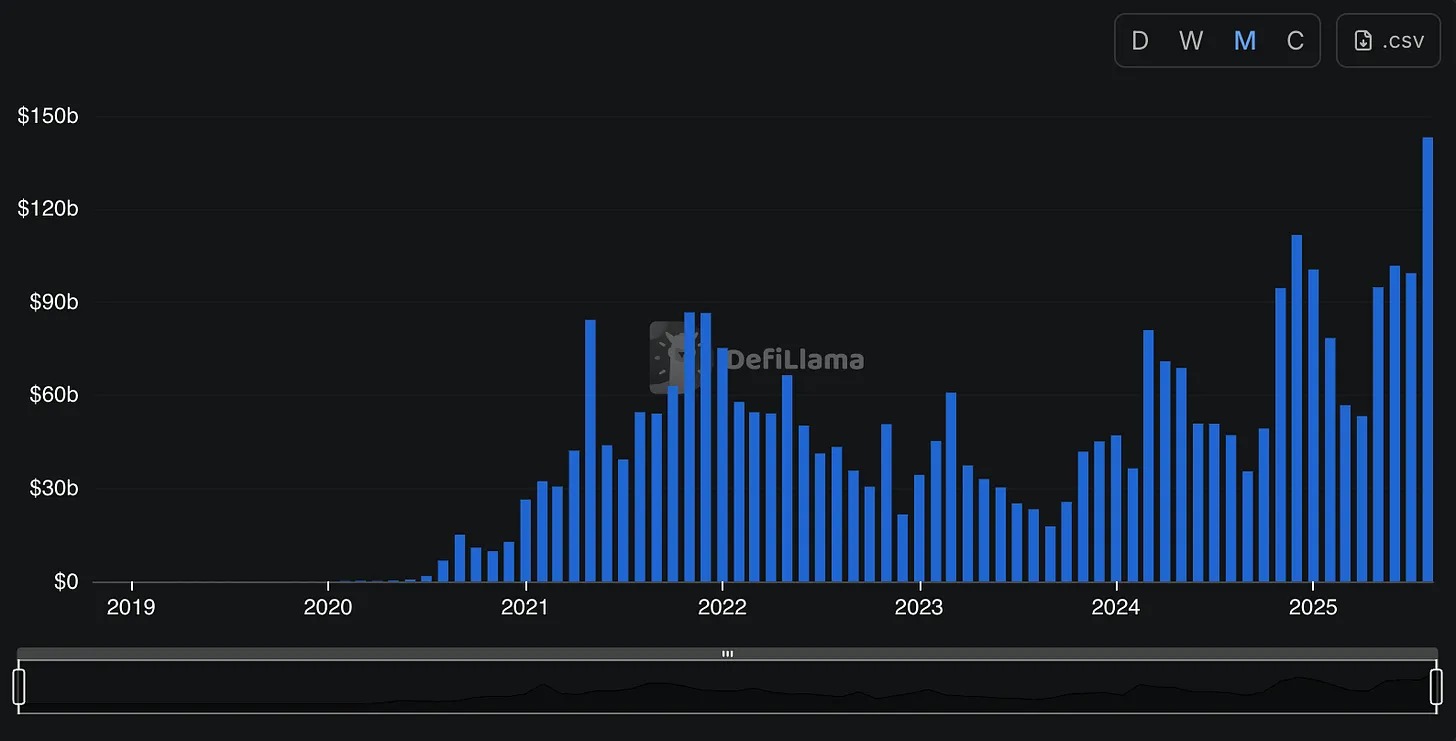

The summer of 2020 marked a turning point for DeFi (Decentralized Finance).

DeFi Summer brought explosive growth to blockchain-based financial applications. Uniswap was at the center of this movement, providing the infrastructure for a new generation of programmable money.

Adams witnessed trading volume surge from millions to tens of billions of dollars per month. The protocol processed more volume than many traditional financial institutions, while remaining decentralized and permissionless.

Success attracted the attention of venture capital. Adams founded Uniswap Labs to formally build a team and accept institutional investment. The company raised $11 million in a Series A round led by Andreessen Horowitz, providing resources to accelerate development.

The second version, launched in May 2020, brought major improvements. The new contracts supported direct trading between any ERC-20 tokens, not just those paired with Ethereum. They included price oracles for use by other protocols in various applications. Flash loans allowed users to temporarily borrow tokens within a single transaction.

These innovations led to use cases Adams had never anticipated. Other developers built lending protocols, derivatives platforms, and yield farming strategies on Uniswap’s infrastructure. The protocol became a composable foundation amplifying innovation across the entire DeFi ecosystem.

In September 2020, the launch of the UNI governance token marked another milestone. Adams and his team distributed 400 tokens to every address that had ever used Uniswap, creating one of the largest airdrops in crypto history. This retroactive distribution rewarded early users and aligned their interests with the protocol’s long-term success.

The third version, launched in May 2021, introduced concentrated liquidity. Liquidity providers could concentrate their capital within specific price ranges, increasing capital efficiency for certain strategies by up to 4000 times. This innovation attracted professional market makers while maintaining accessibility for individual users.

The concentrated liquidity feature fundamentally changed how market makers operated on Uniswap. Previously, liquidity was spread across all possible price ranges, resulting in low capital efficiency. V3 allowed providers to define precise liquidity positions within expected trading ranges. This made positioning more strategic and risk management more robust. Liquidity providers could set stop-loss mechanisms to manage impermanent loss by concentrating positions within expected trading ranges, making the market more complex and professionalized.

Uniswap V3 attracted professional market makers seeking advanced strategies and individual users benefiting from greater accessibility and capital efficiency.

Each iteration expanded Uniswap’s capabilities while preserving its core principles. The protocol remained permissionless, trustless, and censorship-resistant. Anyone could trade any token without providing personal information or seeking intermediary approval.

Adams built something traditional finance considered impossible: a fully automated exchange handling tens of billions of dollars in daily volume without human supervision.

On October 10, 2024, Uniswap Labs announced the launch of Unichain, an Ethereum Layer 2 network designed specifically for DeFi applications.

This blockchain marked Adams’ evolution from protocol developer to infrastructure provider. Building a dedicated network allowed Uniswap to optimize the entire tech stack for automated market making.

Unichain launched on February 11, 2025, adopting Rollup-Boost technology. Trusted execution environments enabled private mempools and fair transaction ordering. This technological innovation addressed a longstanding challenge in decentralized trading: Maximum Extractable Value (MEV).

On traditional blockchain networks, savvy traders can observe pending transactions and front-run ordinary users by paying higher gas fees. This practice extracts value from regular traders, increasing their transaction costs. Unichain’s private mempool hides transaction details before processing, while the trusted execution environment ensures transactions are ordered by arrival time, not by how much users pay in fees.

The network processes transactions in 200-millisecond sub-blocks. The speed boost allows Uniswap to compete with centralized exchanges for latency-sensitive trading strategies. These technological advances reduce the value extracted by savvy traders from ordinary users, creating a fairer trading environment.

Today, Uniswap processes over $2-3 billion in daily trading volume across multiple blockchain networks. The fourth version, launching in 2025, introduces hooks, allowing developers to customize pool behavior for specific use cases. The protocol continues to evolve while maintaining simplicity and accessibility.

Adams has always remained focused on his original mission: making value exchange as simple and accessible as information exchange.

From a childhood bedroom to tens of billions in daily trading volume, Uniswap has proven that decentralized systems can compete with traditional institutions.

This is the story of Uniswap. See you in our next article.