Why did Jack Ma buy Ethereum?

On September 2, 2025, Hong Kong-listed company Yunfeng Financial announced that it had purchased 10,000 Ethereum on the open market, with a total investment cost of $44 million. This news quickly caused a stir in the technology and financial circles.

Behind Yunfeng Financial stand Jack Ma and David Yu, two highly influential figures in China's business world. When an iconic entrepreneur like Jack Ma extends his capital reach into the crypto world, what we may be witnessing is a turning point for an era of China's internet industry.

The amount of this investment is not huge compared to Jack Ma's business empire, but its symbolic significance far exceeds its financial value. It marks that the creators of China's first-generation internet are beginning to seriously turn their attention to the next generation of the internet, namely Web3. This is a carefully considered strategic layout, indicating that after more than twenty years of rapid growth, China's internet giants are searching for new continents.

The Ceiling of Internet Growth

In the years after Jack Ma's retirement, his presence gradually faded from the public eye. He no longer appeared frequently on Alibaba's annual meeting stage, nor did he loudly discuss the future of the internet. Instead, he traveled to various countries, researching agricultural technology and focusing on life sciences.

On the surface, these fields seem far removed from the e-commerce, payments, and cloud computing sectors he once dominated. But if you piece them together carefully, you will find an underlying thread: the search for new ways to create value.

Over the past two decades, the rapid growth of China's internet industry has been epic. From portals to social media, from e-commerce to payments, generations of entrepreneurs have built one business empire after another, leveraging demographic dividends and mobile technology.

But as the tide recedes, traffic peaks, and the industry falls into stock competition, the old models have lost their magic. Jack Ma knows very well that the era when scale effects and network effects could easily guarantee victory is over.

So, he began to ponder where the next "disruption" would occur.

As early as the Bund Financial Summit in 2020, he left a thought-provoking remark: "If we look at building the financial system thirty years from now with a future perspective, digital currency may be a very important core."

This statement was later proven to be his long-term prediction after careful observation. For him, Web3 is not just a label for a "new trend," but an opportunity to fundamentally reconstruct business logic. Blockchain, smart contracts, tokenization—these seemingly cold technologies are exactly the new answers he is seeking.

Money Never Sleeps: Jack Ma's Web3 Circle

In 2010, Jack Ma and David Yu, founder of Focus Media, jointly established Yunfeng Financial. Since then, this company has gradually become their shared capital platform. David Yu, as CEO, publicly holds 47.25% of the shares; Jack Ma indirectly controls about 11.15% through Yunfeng Fund. Because of this, Yunfeng Financial has always been regarded by the market as a "Jack Ma concept stock." This June, when Ant Digital Technologies frequently made moves in the RWA and stablecoin sectors, Yunfeng Financial's stock price also soared several times.

The real deep connection between this capital network and the crypto world comes from Yunfeng Financial's independent non-executive director—Xiao Feng.

Within the capital network built by Jack Ma and David Yu, Xiao Feng plays a key bridging role. Since 2019, he has served as an independent non-executive director of Yunfeng Financial, while also being the chairman of Hong Kong-licensed virtual asset trading platform HashKey Group. It is this unique dual identity that has opened a compliant gateway to the crypto world for Yunfeng Financial.

Xiao Feng's deep background in blockchain and digital finance makes him an important think tank for Yunfeng Financial's Web3 strategy. Although he does not directly participate in the company's daily operations, his professional judgment often has a decisive impact on major decisions involving digital assets. Market analysts generally believe that Yunfeng Financial's recent purchase of Ethereum was completed through the compliant trading channel of HashKey.

This "traditional finance + compliant exchange" model is forming a demonstration effect in the Hong Kong market.

In August this year, Huajian Medical IVD also purchased Ethereum through HashKey, with an initial investment as high as HK$149 million. Guotai Junan International has also opened virtual asset trading channels, with its settlement process relying on HashKey's support. Yunfeng Financial has disclosed plans to continue exploring strategic allocations in mainstream crypto assets such as Bitcoin and Solana, indicating that more Hong Kong-listed companies may follow this trend and enter the crypto market in bulk.

In this emerging ecosystem, Jack Ma and David Yu are responsible for capital decisions, while Xiao Feng provides professional guidance and compliant channels, forming an efficient strategic alliance among the three parties. This structure not only lowers the threshold for traditional capital to enter the Web3 world, but also provides strong support for Hong Kong to consolidate its position as Asia's digital asset center.

From Ant Group's stablecoin ambitions to Yunfeng Financial's strategic allocation of ETH, Jack Ma's capital map is quietly shifting toward blockchain and the decentralized world. Once again, he stands at the intersection of a new financial wave, confirming his intuition with the words he spoke years ago: "The opportunities of the future lie in transforming traditional industries with new technologies."

The Opportunity Window of RWA

Among the countless application scenarios of Web3, RWA (Real World Asset) tokenization is quickly taking the spotlight. RWA refers to bringing assets such as real estate, bonds, carbon credits, and even artworks—assets that have long been dormant in traditional systems—onto the blockchain, releasing liquidity in the form of tokens.

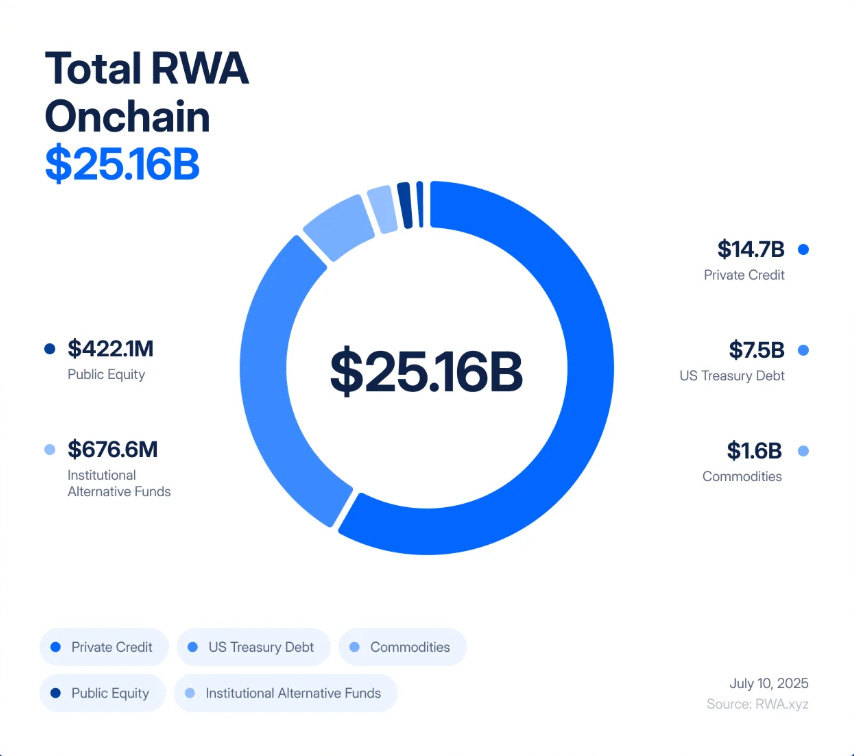

In just a few years, this market has grown from a test field worth tens of millions of dollars to a vast blue ocean of $25 billion. Boston Consulting Group even predicts that by 2030, the scale of tokenized assets could reach $16 trillion, a figure that could rival traditional finance.

For China's internet giants, this is undoubtedly the best entry point into the Web3 world. After twenty years of internet development, they have accumulated massive supply chains, payment networks, and physical assets, and RWA tokenization is the key to reactivating these stock assets.

Yunfeng Financial's actions are a reflection of this logic. What the outside world sees is their high-profile purchase of Ethereum; but the announcement makes it even clearer that Ethereum is not simply a financial reserve, but is to be embedded in "insurance business settlement models" and "innovative systems compatible with Web3." In other words, in their eyes, ETH is no longer just an asset, but the cornerstone of next-generation financial infrastructure.

Before this, Yunfeng Financial had already cooperated with Ant Digital Technologies to jointly invest in the institutional-level RWA public chain Pharos; they also launched the "Carbon Chain" initiative, putting high-quality carbon credit trading data fully on-chain, attempting to build a bridge between green finance and blockchain.

Image

From carbon trading to RWA public chains, from securities license upgrades to ETH reserves, Yunfeng Financial is piecing together a grand blueprint, rooted in traditional finance while reaching toward the decentralized world.

Image

Path Choices for Transformation

The Web3 transformation chosen by Jack Ma adopts a more prudent strategy: relying on existing financial institutions, laying out from the infrastructure level within a compliant framework.

The first step of this path is to put Yunfeng Financial on stage. As a Hong Kong-listed financial holding company, Yunfeng Financial holds key licenses in securities, insurance, asset management, and more. For any institution wanting to enter Web3, licenses are a "protective talisman." In today's tightening global regulatory environment, compliance often determines how far a project can go.

The second step is to choose RWA as the entry point. Compared to cryptocurrencies lacking anchors, RWA is backed by tangible assets such as real estate, bonds, and carbon credits, making it easier for financial institutions and regulators to accept. By tokenizing physical assets and putting them on-chain, this model maintains close ties with the real economy while opening up new channels for asset circulation.

The third step is to make moves at the infrastructure level. Whether investing in the public chain Pharos or directly purchasing Ethereum as a reserve, both reflect an emphasis on long-term value. Ethereum is now the most active smart contract platform, gathering the world's largest developer and application ecosystem. For Jack Ma, holding Ethereum is equivalent to holding a ticket to enter the Web3 world.

"Financial institutions + compliance + infrastructure"—this is the triangular fulcrum depicted by Jack Ma. Compared to other paths, this approach has several natural advantages. It fully leverages the resource advantages of traditional finance while effectively controlling regulatory risks; it lays out the direction of future technological development in advance, and avoids direct conflict with existing systems.

For China's internet giants seeking new growth curves, this is undoubtedly a highly valuable reference model. In the process of seeking new growth curves, they can gradually achieve transformation to the Web3 world through similar prudent paths.

Although Yunfeng Financial is not the first Chinese company to include crypto assets in its financial strategy, with Jack Ma's backing, it has undoubtedly become the most globally watched case after overseas treasury companies such as MicroStrategy and Bitmine. If MicroStrategy represents Wall Street's radical experiment and Bitmine demonstrates the capital transformation of mining companies, then Yunfeng Financial's move marks the public debut of Chinese capital on the Web3 track.

Over the past twenty years, Chinese internet companies have excelled at innovating at the application layer. Leveraging demographic dividends and a huge market, they have achieved great success in e-commerce, social networking, and mobile payment models. But in terms of underlying technology and infrastructure, there is still a gap between China and the United States. The competition in the Web3 era will focus more on underlying protocols and infrastructure. Whoever masters the operating system of the next-generation internet will win the right to speak in the future.

Jack Ma's latest layout is a direct response to this shift in the landscape. By investing in RWA public chains and reserving Ethereum, he is actually stockpiling strategic ammunition for future competition. This not only opens a new path for Yunfeng Financial, but also provides a model for Chinese internet giants still on the sidelines. It is foreseeable that in the coming years, more and more Chinese companies will enter the Web3 track in various ways.

For Chinese internet companies, Web3 is both a challenge and an opportunity. It offers a chance to reshuffle the deck, a chance to stand on the same starting line as global competitors under a new technological paradigm.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Opinion: L2 is supposed to be secured by Ethereum, but this is no longer true

Two-thirds of L2 assets have left Ethereum's security protection.

When Slow Assets Meet a Fast Market: The Liquidity Paradox of RWA

Illiquid assets wrapped in on-chain liquidity are repeating the financial mismatches of 2008.

XRP Ledger Activates Credentials Amendment for Compliance and Identity

Solana Emerges as Top Crypto Performer Amid Altcoin Rotation