U.S. Overtakes Most Markets in Global Crypto Adoption, Trails Only India — Chainalysis

Contents

Toggle- Quick Breakdown

- U.S. Jumps Two Spots Amid ETF Boom

- India Holds Top Spot, Fuels APAC Growth

- Regional Adoption Trends

- Bitcoin Still Dominates Inflows

Quick Breakdown

- U.S. climbs to second place in global crypto adoption, fueled by ETF inflows and regulatory clarity.

- India retains first place, helping Asia-Pacific record 69% year-on-year growth in crypto activity.

- Bitcoin dominates inflows, with over $4.6 trillion in fiat entries, reinforcing its role as the gateway to crypto.

The United States has climbed to second place in global cryptocurrency adoption, driven by regulatory momentum in Washington and soaring demand for exchange-traded funds (ETFs), according to Chainalysis’ 2025 Global Adoption Index released Wednesday.

U.S. Jumps Two Spots Amid ETF Boom

Chainalysis reported that the U.S. rose from fourth to second place in the latest rankings, largely due to the explosive uptake of spot Bitcoin ETFs and a clearer regulatory framework that has legitimized crypto within traditional finance. Data from Farside Investors shows U.S. spot Bitcoin ETFs have attracted more than $54.5 billion in inflows since January 2024, with the bulk of those investments arriving between June and July 2025.

Source

:

Chainalysis

Source

:

Chainalysis

Institutional appetite is also growing beyond Bitcoin. Bloomberg data revealed that advisers and hedge funds poured over $2 billion into spot Ether ETFs in the second quarter of this year.

India Holds Top Spot, Fuels APAC Growth

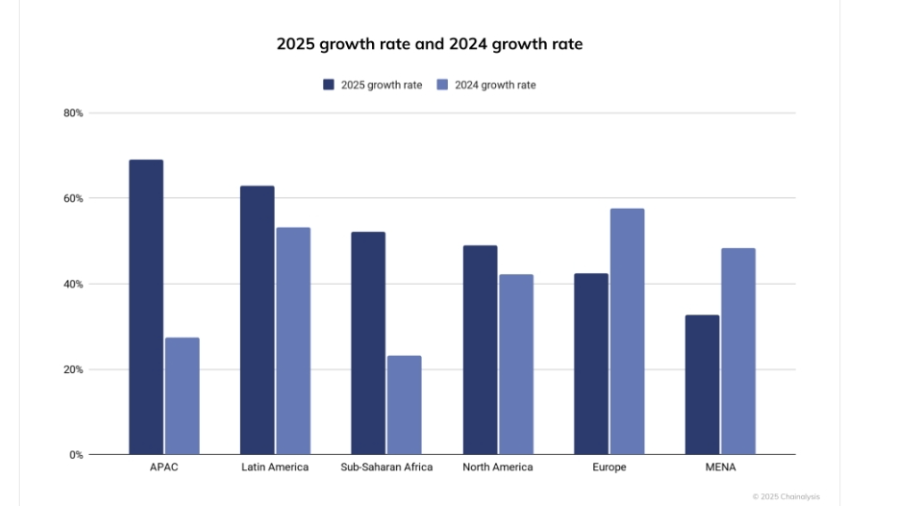

India maintained its lead for the third consecutive year, topping all four subindexes that make up the Chainalysis ranking. Its dominance, backed by a large tech-savvy population and massive remittance flows, propelled the Asia-Pacific region to become the fastest-growing in global adoption, with total value received up 69% year-on-year to $2.36 trillion.

Pakistan surged six places to secure third, while Vietnam and Brazil completed the top five. Meanwhile, Nigeria slipped from second to sixth despite regulatory improvements .

Regional Adoption Trends

Chainalysis highlighted strong growth in Latin America, with Brazil and Argentina entering the global top 20. On a per-capita basis, Eastern Europe stood out, with Ukraine, Moldova, and Georgia leading adoption, fueled by economic instability and banking distrust.

Bitcoin Still Dominates Inflows

Bitcoin remains the dominant entry point into digital assets , drawing more than $4.6 trillion in fiat inflows between July 2024 and June 2025. Other layer-1 tokens excluding Bitcoin and Ether topped $4 trillion, while stablecoins accounted for just under $1 trillion. Memecoins also registered $250 billion in inflows.

The U.S. led globally with $4.2 trillion in on-ramp volume, followed by South Korea at $1 trillion. In Europe, nearly half of fiat purchases flowed into Bitcoin, underscoring its continued dominance across developed markets.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like