Trump-Backed American Bitcoin Spikes 60% After Nasdaq Listing

American Bitcoin surged on its Nasdaq debut, backed by the Trump family, with plans to expand mining and build BTC reserves.

American Bitcoin, a mining firm supported by the Trump family, began publicly trading on the Nasdaq today. Its stock price briefly jumped 60% but retained very high gains.

The firm plans to pursue a digital asset treasury (DAT) strategy, producing its own BTC to prevent shareholder dilution.

American Bitcoin and the Trumps

Trump’s crypto empire has been heavily diversifying over recent months, backing American Bitcoin Corp, a new crypto mining operation in March.

After the firm, which is based on a Hut 8 partnership, received a huge funding deal, the community has been hotly anticipating its Nasdaq listing.

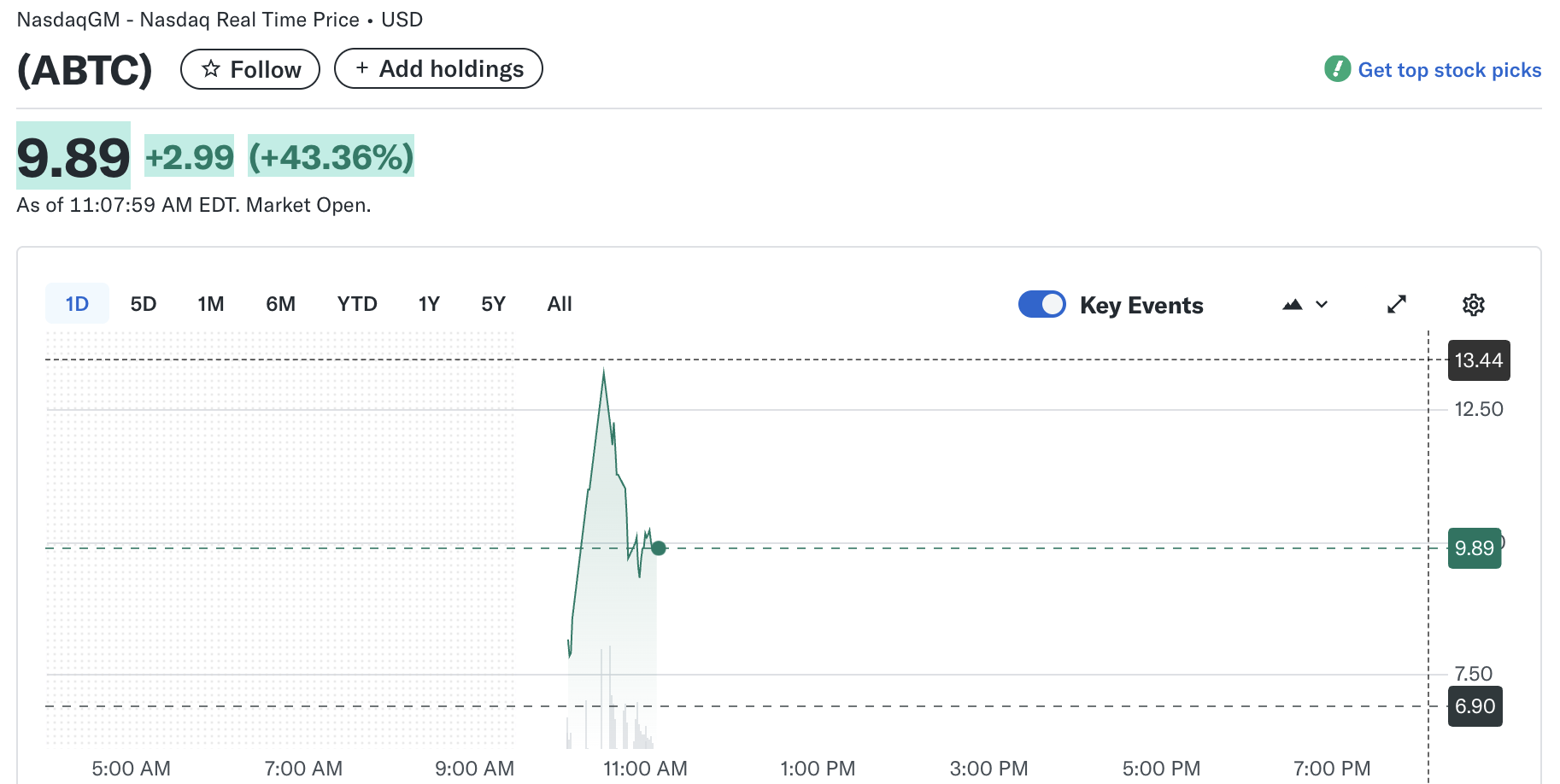

This stock is now live, and it’s off to a hot start with a 60% price spike. This early peak quickly diminished somewhat, but it’s still holding strong at gains over 40%:

American Bitcoin Price Performance. Source:

American Bitcoin Price Performance. Source:

Both of President Trump’s most crypto-connected sons, Eric and Don Junior, have heavily promoted the American Bitcoin listing. The firm has been incubating these plans, including a merger with Gryphon Digital Mining, for several months, but the Trumps are clearly treating this as a major new era.

I have put a tremendous amount of love and energy into @AmericanBTC over the past 12 months. It is a huge honor to be listed on the @Nasdaq and begin trading today! #ABTC

— Eric Trump (@EricTrump) September 3, 2025

Accordingly, some new public statements have given us additional information about the Trumps’ plans for American Bitcoin. As today’s press release describes, the firm doesn’t plan to make all its income from Bitcoin mining. It’s also planning to pursue the digital asset treasury (DAT) strategy, offering investors exposure to BTC:

“With the backing of the public markets, we believe American Bitcoin is now positioned to set the standard in Bitcoin accumulation. By combining Bitcoin mining [and] opportunistic market purchases…we have created a vehicle designed to drive rapid, efficient Bitcoin-per-share growth,” claimed Asher Genoot, Executive Chairman of American Bitcoin and CEO of Hut 8 Corp.

In other words, the plan is very clear: Hut 8 and Gryphon’s mining infrastructure and resources will power BTC accumulation without the need for massive stock sales. This will hopefully avoid shareholder dilution concerns, also allowing the Trumps to maintain substantial control over American Bitcoin.

Although some BTC miners have been pivoting to AI, the press release doesn’t mention this sort of activity. Some outlets reported that Hut 8 will explore this revenue stream independently of the partnership, but American Bitcoin will focus on mining and accumulation.

After the WLFI listing earlier this week, American Bitcoin’s public launch will mark the Trumps’ second major crypto endeavor in a few days. The first event reportedly boosted the family’s wealth by $5 billion, and Nasdaq trading will surely increase it even further.

This raises some ethical concerns, but it’s not a significant escalation from the family’s other crypto entanglements. For now, American Bitcoin is just another piece in the Trump empire.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Witness the Dynamic Shifts in Bitcoin and Altcoin ETFs

In Brief Bitcoin and altcoin ETFs witness dynamic shifts in inflows and outflows. XRP and Solana ETFs attract notable investor attention and activity. Institutions explore diversified crypto ETFs for strategic risk management.

Peter Schiff Clashes With President Trump as Economic and Crypto Debates Intensify

Bitcoin Cash Jumps 40% and Establishes Itself as the Best-Performing L1 Blockchain of the Year

Bitcoin Price Plummets: Key Reasons Behind the Sudden Drop Below $88,000