Avalanche blockchain activity surged 66% to 11.9 million transactions and 181,000 active addresses last week, driven primarily by DeFi trading, automated MEV/arb bots and whale memecoin speculation, with Nansen attributing ~60% to DeFi, ~25% to bots/MEV, ~10% to whales and ~5% to gaming/NFTs.

-

Avalanche transactions rose 66% to 11.9M across 181,000 active addresses

-

DeFi protocols (Trader Joe, Aave, Benqi) accounted for ~60% of activity; automated trading and MEV ~25%

-

Whale memecoin speculation and high-balance traders contributed ~10%, with notable single-token volumes (Black token $14M)

Avalanche blockchain activity surged 66% to 11.9M tx; learn what’s driving the spike and what traders should watch next. Read the full analysis now.

What is driving Avalanche’s recent transaction surge?

Avalanche blockchain activity is being driven mainly by decentralized exchange (DEX) trading, automated MEV and arb bots, and large whale speculation. Nansen data shows a 66% weekly increase to 11.9 million transactions across roughly 181,000 active addresses, concentrated in Trader Joe, Aave and Benqi activity.

How is the activity distributed across use cases?

Nansen research attributes approximately 60% of the recent surge to DeFi protocol interactions (Trader Joe, Aave, Benqi), ~25% to automated trading bots and MEV extraction, ~10% to whale trading and memecoin speculation, and ~5% to blockchain gaming and NFTs. These percentages reflect on-chain transaction classification over the last 7 days.

Growing decentralized trading and memecoin speculation from large investors are driving Avalanche’s blockchain activity, according to Nansen analysts.

Smart contract blockchain Avalanche recorded a consistent surge in blockchain activity. Analysts point to growing decentralized trading activities and returning large-address speculation around emerging memecoins as core drivers of the spike.

Avalanche’s transaction growth surpassed all other blockchains this past week, rising 66% to 11.9 million transactions across over 181,000 active addresses, signaling growing investor mindshare focusing on the chain.

The milestone followed a public-sector data initiative in which the US Department of Commerce adopted Avalanche, among other public blockchains, as a platform for publishing certain GDP-related data in late August. Nansen research analyst Nicolai Sondergaard cautions that the timing does not conclusively demonstrate direct government-driven volume.

“The transaction surge is driven by: 60% DeFi protocol activity (Trader Joe, Aave, Benqi), 25% Automated trading bots and MEV, and 10% Whale trading and memecoin speculation,” Sondergaard told analysts and industry observers. The remaining 5% of activity was linked to blockchain gaming and NFTs.

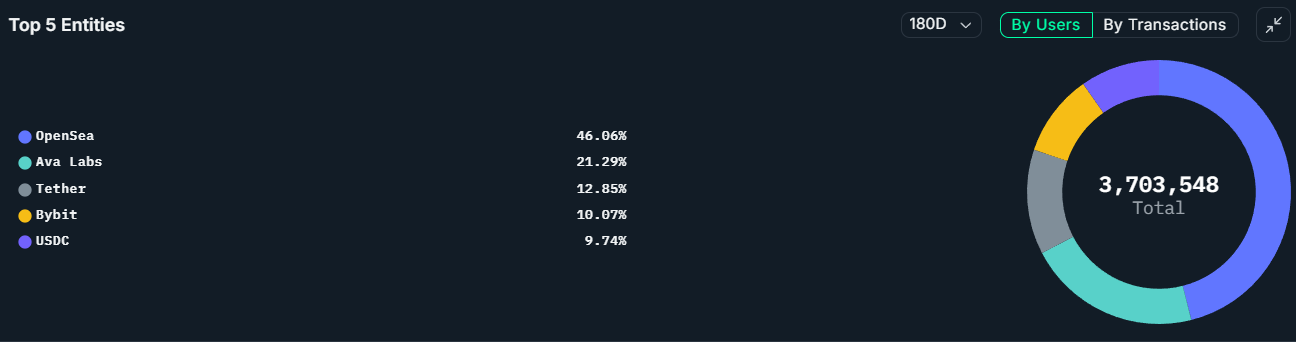

Avalanche, top 5 entities by blockchain users, 180 days. Source: Nansen

Avalanche, top 5 entities by blockchain users, 180 days. Source: Nansen

DEX trading: Which platforms and volumes moved Avalanche?

Decentralized exchange trading accounted for the largest share of transaction volume. Trader Joe was the primary driver, recording more than $333 million in Avalanche Wrapped Ether (WETH.e) volume over the past seven days.

Key on-chain actors included Nansen-listed high-activity traders executing multiple six-figure trades. Aave contributed notable flash loan flows (~$624,000 through DEX aggregators), while Benqi saw increased deposits (~$650,000) attributed to trading bot strategies.

Automated trading and high-balance whale addresses accounted for the remainder. The BLACK token registered about $14 million in trading volume, and several whale addresses accumulated positions up to roughly $95,000 in single-token holdings during the observed week.

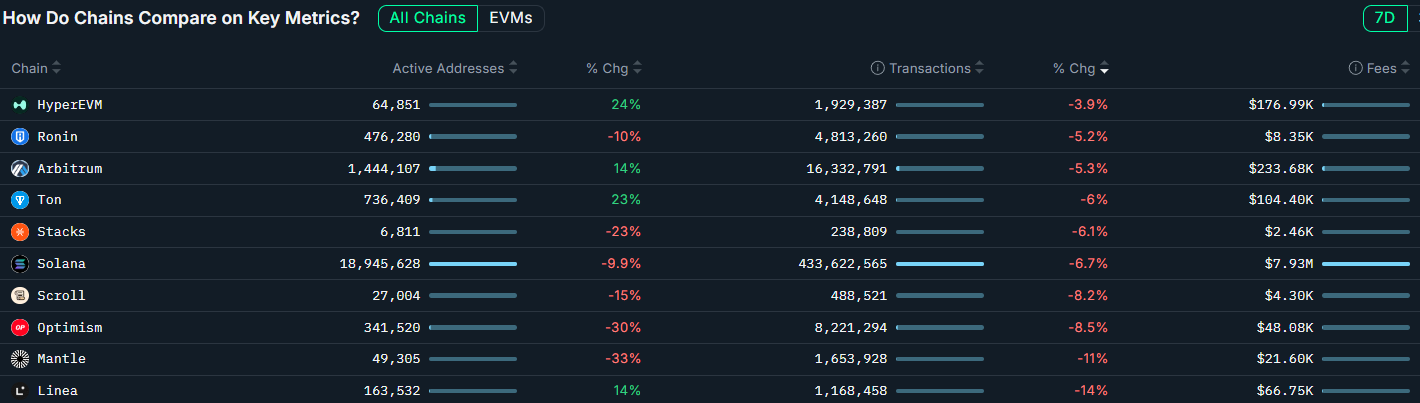

Top blockchains by key metrics, change in weekly transactions. Source: Nansen

Top blockchains by key metrics, change in weekly transactions. Source: Nansen

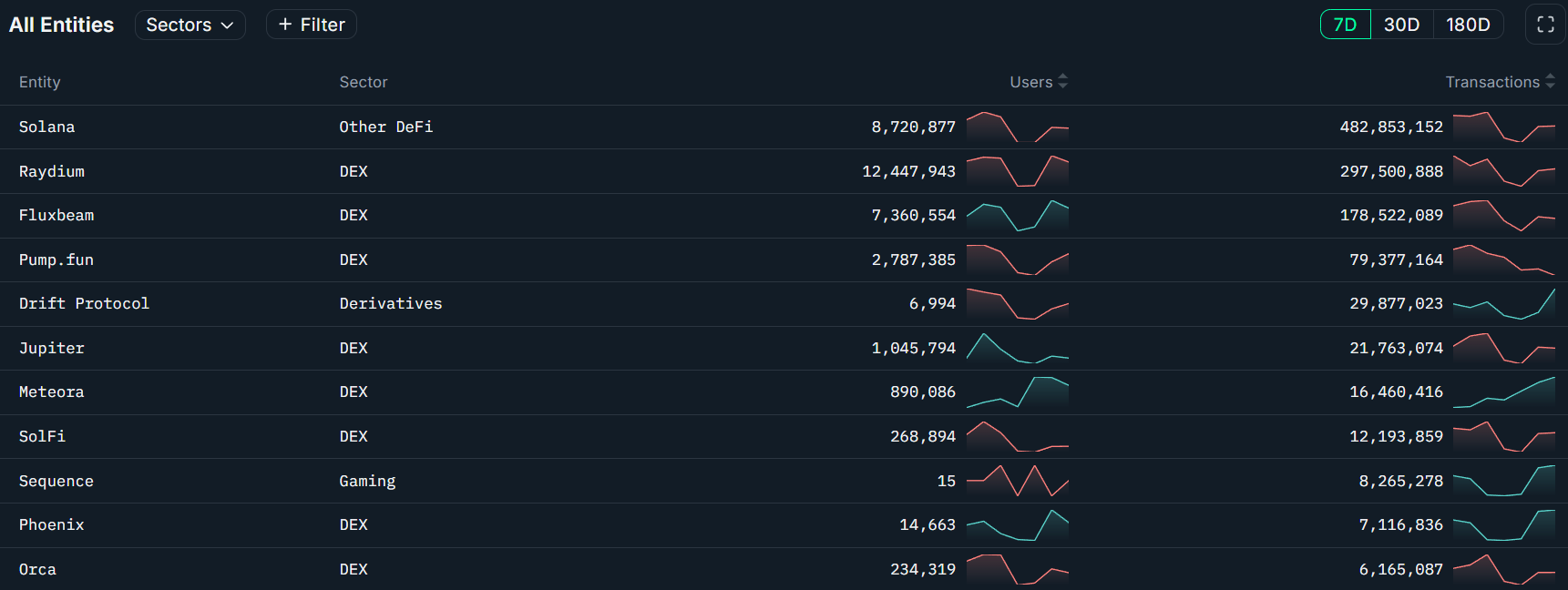

By comparison, Solana showed a 6.7% decrease in weekly transactions, with Nansen reporting 433 million transactions across 18.9 million active addresses in the same period. Solana activity also remained DEX-driven, led by Raydium and Fluxbeam DEX activity metrics.

Solana top entities by weekly transactions. Source: Nansen

Solana top entities by weekly transactions. Source: Nansen

Why does this matter for traders and institutional observers?

Higher transaction counts and concentrated DEX liquidity signal increased trader interest and potential short-term volatility around memecoins and high-beta alt assets. Institutional and public-sector attention can raise market visibility, but on-chain attribution indicates the surge is primarily market-driven rather than policy-driven.

Frequently Asked Questions

How sustained is Avalanche’s transaction growth?

Current data shows a week-over-week spike of 66%, but sustainability depends on continued DEX flows, bot activity incentives, and memecoin issuance. Monitoring weekly metrics and major protocol flows provides the best short-term signal.

Are government data initiatives causing the volume spike?

Public-sector adoption for publishing GDP data coincided with the surge, but Nansen analysts report insufficient evidence to attribute the transaction increase directly to government activity; on-chain classification points to market participants as the primary drivers.

Key Takeaways

- Surge magnitude: Avalanche transactions rose 66% to 11.9M, with ~181,000 active addresses.

- Main drivers: ~60% DeFi (Trader Joe, Aave, Benqi), ~25% bots/MEV, ~10% whale memecoin trading.

- Implication: Increased liquidity and volatility for Avalanche-based tokens; monitor DEX flows and whale wallets.

Conclusion

The recent Avalanche blockchain activity spike reflects renewed trader interest and automated-market strategies more than direct institutional or government usage. Nansen on-chain metrics point to DeFi and MEV as primary drivers, with memecoin speculation and high-balance whales adding volatility. Market participants should watch DEX liquidity and large-address flows for short-term signals.