Winklevoss-Backed Treasury to List on Euronext Amsterdam via Reverse Merger

Contents

Toggle- Quick Breakdown

- Reverse Merger to Create Treasury N.V.

- Expanding Bitcoin Holdings

- Growing Bitcoin Treasury Market in Europe

Quick Breakdown

- Treasury to go public on Euronext Amsterdam through a reverse merger with MKB Nedsense.

- The Bitcoin treasury firm holds over 1,000 BTC and has raised €126M in private funding.

- Listing aims to give European investors greater access to regulated Bitcoin exposure.

Reverse Merger to Create Treasury N.V.

Treasury, a Bitcoin-focused investment firm supported by Winklevoss Capital and Nakamoto Holdings, is set to enter the public market in Europe. The company plans to merge with Dutch investment firm MKB Nedsense (NEDSE.AS) in a reverse takeover, according to filings confirmed by Reuters.

🚨BREAKING🚨

Winklevoss Twins Back New #Bitcoin Treasury Firm

Their startup Treasury wants to become Europe’s biggest BTC holder — and they’ve already stacked 1,000 BTC. 🚀🔥 pic.twitter.com/GMYQup4IlH— JR (@jrcryptex) September 3, 2025

Following shareholder approval, MKB Nedsense will be renamed Treasury N.V. and begin trading under the ticker TRSR. A vote is expected in the coming weeks, with trading projected to start in the fourth quarter of 2025.

Expanding Bitcoin Holdings

Treasury currently manages more than 1,000 BTC, positioning itself as one of the few European firms built solely around Bitcoin as a reserve asset. The company has already raised €126 million (approximately $147 million) in private funding and plans to leverage its public status to further expand its Bitcoin position.

The reverse merger places Treasury at a 72% premium over MKB Nedsense’s recent share price, with the stock anticipated to trade near €2.10 once the deal is complete.

Growing Bitcoin Treasury Market in Europe

The Treasury’s public debut comes as institutional-grade Bitcoin exposure remains limited in Europe, where regulated vehicles are still scarce compared to those in the U.S. The firm aims to capture demand from investors seeking direct access to Bitcoin through transparent, listed markets.

In a related move, Dutch cryptocurrency service provider Amdax recently revealed plans to establish a Bitcoin-focused treasury company, AMBTS B.V., with plans to list on Amsterdam’s Euronext stock exchange. The move signals a growing trend among European firms following in the footsteps of U.S. companies by incorporating Bitcoin into corporate treasury strategies.

Several European companies have already adopted Bitcoin as part of their treasury strategy. Notable holdings include Germany’s Bitcoin Group with 3,605 BTC, the UK’s Smarter Web Company with 2,395 BTC, France’s The Blockchain Group with 1,653 BTC, and the UK’s Satsuma Technology with 1,126 BTC.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

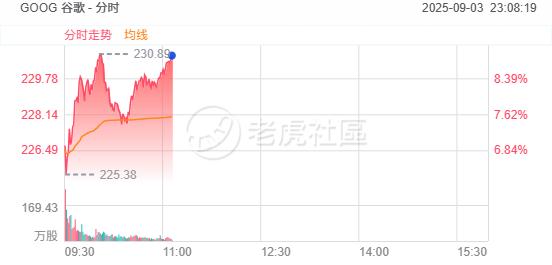

Google rises nearly 9%, hitting a new intraday all-time high

Ondo Finance announces launch of Ondo Global Markets

Trending news

MoreHong Kong Stocks Movement | Tianyue Advanced (02631) rises nearly 4% as R&D expenditure increases by approximately 34.94% year-on-year in the first half of the year; the company's clients have successfully entered the NVIDIA supply chain

Citi survey: By 2030, crypto assets are expected to handle one-tenth of global post-trade transactions