2-Day Surge of Nearly 10x: Is the Pokémon Card Trading Frenzy Driven by Genuine Demand or FOMO?

The rise of $CARDS, is it due to its own merits, or is it thanks to front-running?

As players in the crypto community keep an eye on Trump's health speculation saga, waiting for a potential gaming opportunity, a coin called $CARDS has surged nearly 10x from September 2 to date, attracting players' attention with a market cap that briefly exceeded $400 million.

$CARDS is the token of Collector Crypt, a physical Pokémon card trading platform on Solana. Collector Crypt announced the completion of its seed round financing in February 2023, with the specific amount undisclosed, and participation from GSR, Big Brain Holdings, FunFair Ventures, Genesis Block Ventures, Master Ventures Investment Management, StarLaunch, and Telos.

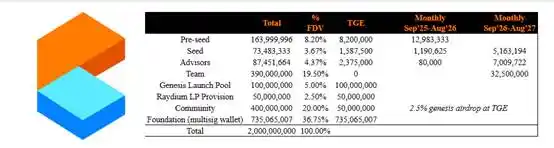

In addition, 20% of the tokens allocated to the community have 2.5% available for simultaneous claim. According to the official tokenomics released, if the tokens held by the project team are not included in the initial circulation (the project team claims they currently have no selling plans), the circulating supply of $CARDS is approximately 212 million.

At market price, tokens unlocked pre-seed, seed, and advisor at TGE are currently worth approximately $1.67 million.

The team has stated that there are currently no plans to sell tokens.

In fact, from the perspective of what the project itself has done, Collector Crypt's Pokémon card on-chain transactions are not that innovative.

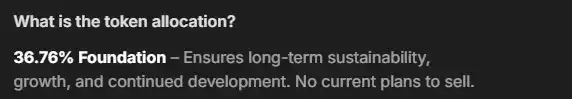

Courtyard.io on Polygon has also been running for over 2 years. Just last month, Courtyard set a new monthly sales record of approximately $78.43 million. Since February this year, Courtyard's monthly sales have consistently exceeded $40 million.

The rapid growth this year may be the reason behind Courtyard's significant funding. On July 28, according to Fortune, Courtyard completed a $30 million Series A funding round led by Forerunner Ventures, with participation from existing investors such as NEA and Y Combinator.

In August 2023, when Courtyard first caught the attention of a few NFT players, we reported on Courtyard. At that time, NFT players were already using Courtyard to acquire Pokémon cards and engage in on-chain staking.

In addition to Collector Crypt and Courtyard, other crypto projects in a similar line of business include Beezie, Drip, Emporium, and phygitals.

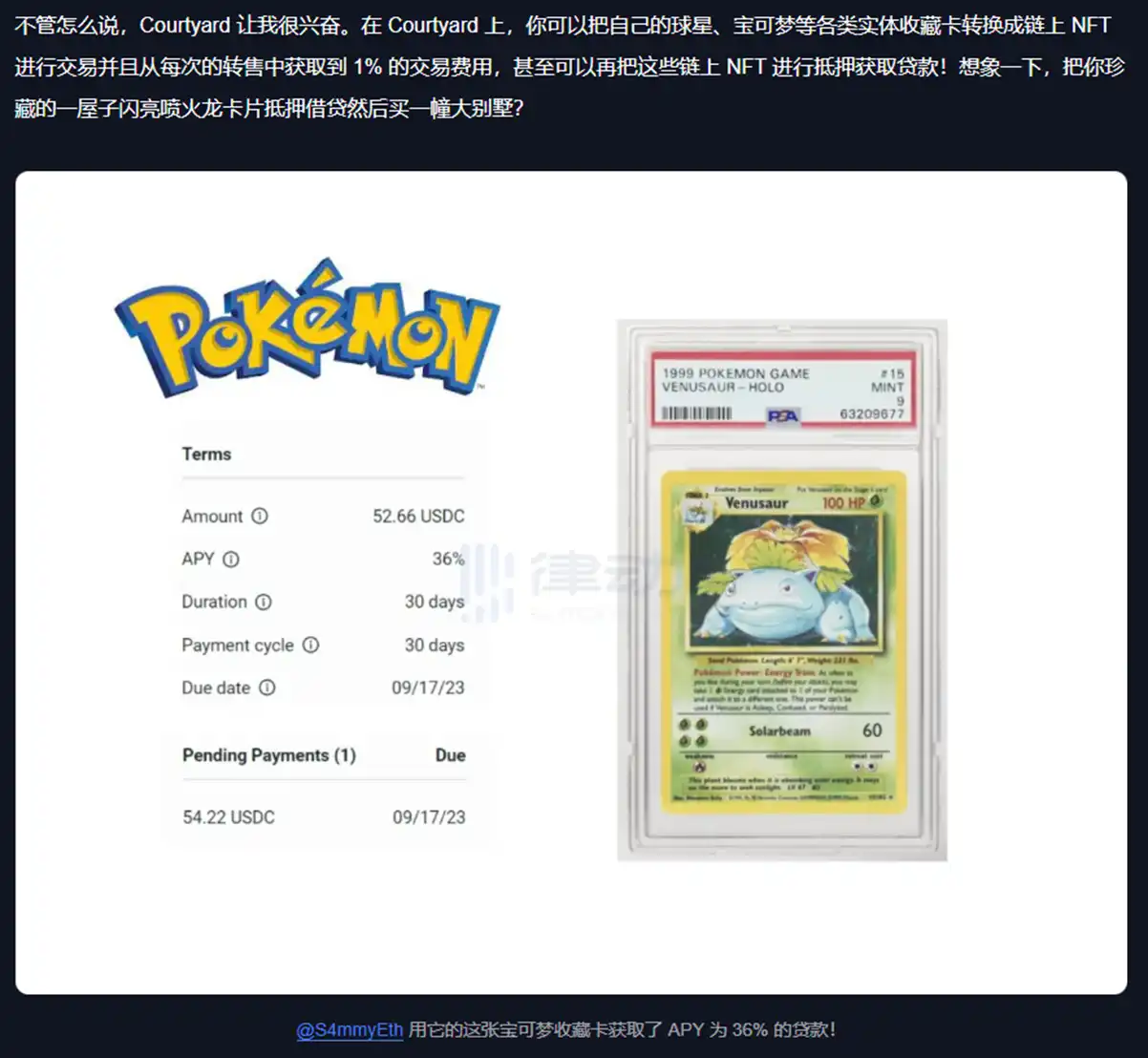

However, Collector Crypt is the only one among these projects that has issued a token, giving $CARDS an edge. Of course, Collector Crypt itself is quite competitive; last month, its monthly trading volume reached about $44 million, not far behind Courtyard.

You might wonder if there is really so much genuine demand for on-chain Pokémon card trading?

The answer is no. Whether it's Collector Crypt or Courtyard, their actual revenue-generating business is the gambling-like "blind box" mechanics.

The image above shows Collector Crypt's Pokémon card gashapon machine system. For about $60, there is an 80% chance of receiving a card worth $30 to $60, a 15% chance of a card worth $60 to $110, a 4% chance of a card worth $110 to $250, and a 1% chance of a card worth $250 to $2000.

What to Do If You Draw a Low-Quality Card? No worries, you can sell it back to Collector Crypt at an 85% discount and continue drawing.

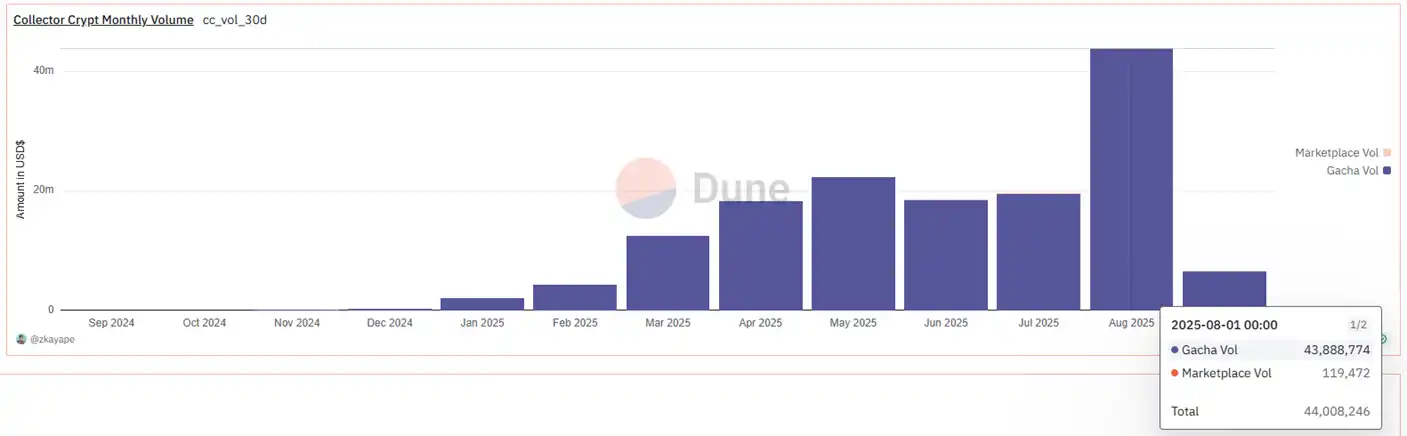

Collector Crypt's lottery system was officially launched in January this year, achieving approximately $2 million in sales in that month. By March, it had grown to $12.55 million in monthly sales, then to $22.31 million in May, and last month it reached $43.89 million. However, in the previous month, the trading volume in the Collector Crypt card market was only about $120,000.

On the bar chart of Collector Crypt's total monthly sales, the share from the card trading market is almost invisible.

Although there is no direct lottery revenue data, we can indirectly sense how lucrative the lottery business is from a previous interview with Courtyard. In an interview with Fortune last month, Courtyard was mentioned to repurchase lottery cards from customers at 90% of their value and then resell them in the form of new lottery packs to make money, with the same card selling an average of 8 times per month on the platform.

However, the entry of "chead" pow and gake has greatly changed the price trend. After they both tweeted in support of $CARDS, everyone started to believe.

So, let's summarize $CARDS:

- The business narrative is not new, but the revenue is quite impressive, making it an absolute leader in this sector on Solana.

- The demand is real, but it is not for Pokémon card trading itself; rather, it is a gambling-like demand for "lottery," as is the case with other projects in the same sector.

- Other projects in the same sector have not yet launched their tokens, so there are currently no competing concepts on the market.

- The number of token holders is not large, and the current rise is more due to "chead" pumping.

There is something real, but after the emotion-driven rally, whether $CARDS can continue to sustain momentum still needs time to tell.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How does Pieverse seize the x402 opportunity to solve the BNB Chain payment bottleneck?

Bitwise Clients Buy $69.5M in Solana

Quick Take Summary is AI generated, newsroom reviewed. Bitwise clients bought $69.5 million in Solana, signaling strong institutional confidence. Solana institutional demand continues to rise amid increasing DeFi and Web3 adoption. The Bitwise Solana investment strengthens the firm’s role in institutional crypto expansion. Growing Solana price momentum suggests sustained investor interest and market optimism.References JUST IN: Bitwise clients buy $69.5 million worth of $SOL.

TWINT wants to open platform for stablecoins and tokenized deposits