Bank of England Deputy Governor Braden: Stablecoins Can Enable Faster and Lower-Cost Payments

ChainCatcher News, according to a report by Zhitong Finance, Bank of England Deputy Governor Sarah Breeden stated that as the Bank of England prepares to announce its stablecoin regulatory plan, stablecoins are expected to accelerate cross-border capital flows and reduce related costs. Breeden said she anticipates a gradually forming multi-currency world that includes stablecoins. She pointed out that the Bank of England's regulatory plan is being influenced by a landmark bill from the Trump administration aimed at normalizing stablecoins. Speaking at a conference in London, Breeden said that stablecoins, which have long been confined to the cryptocurrency market, are beginning to go mainstream. Given that stablecoins are an existing form of native digital currency, their secure application is expected to unlock faster and lower-cost settlement methods for cross-border transactions, while also supporting tokenized securities trading. The Bank of England plans to launch a consultation on the revised stablecoin regulatory scheme later this year. Previously, industry insiders warned that the Bank of England's initial regulatory stance was too strict, and the bank is now relaxing related measures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cybercriminals Use AI Voice Phishing Attacks Against Cryptocurrency Executives

Galaxy Digital to Issue Tokenized Equity on Solana

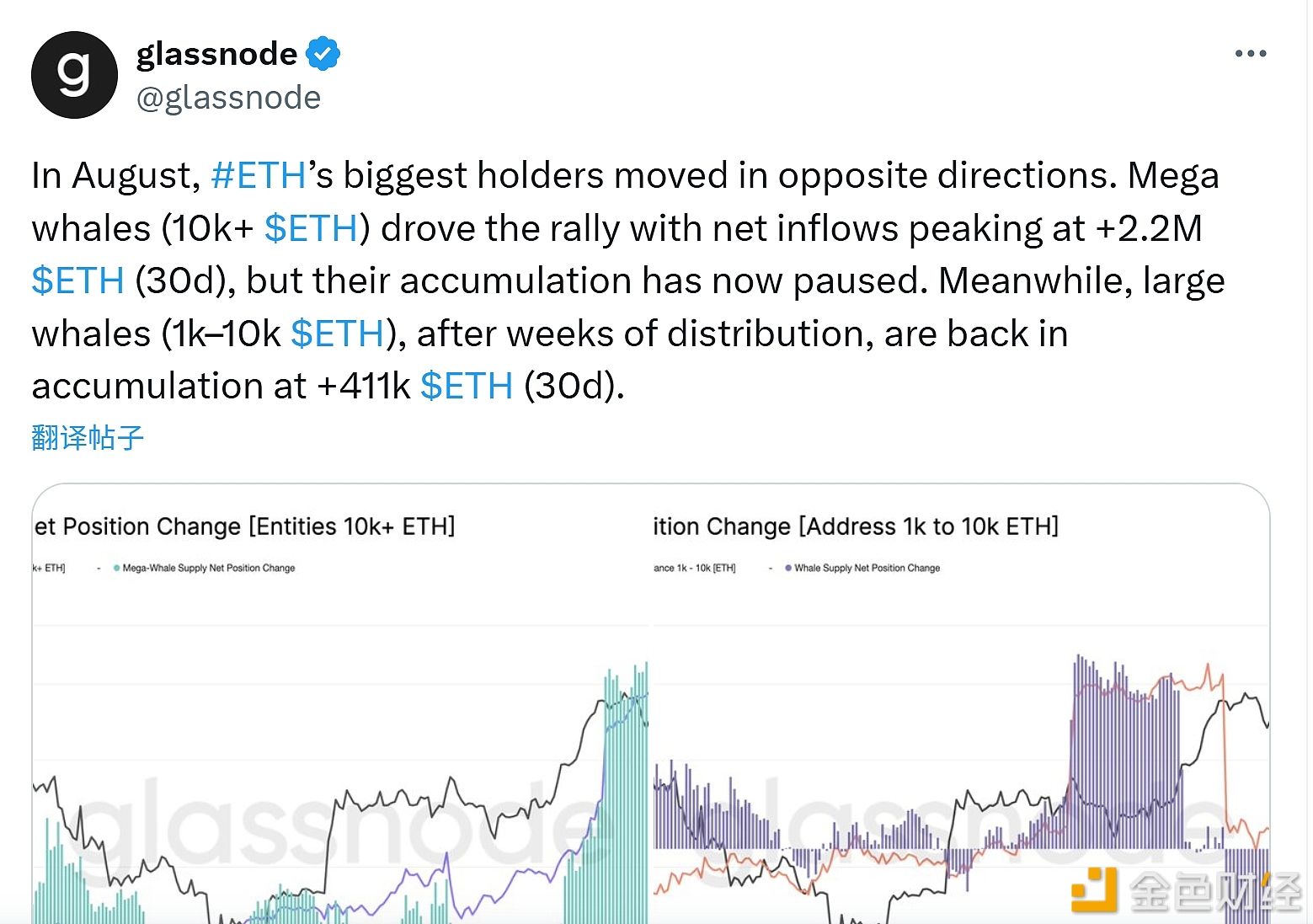

Glassnode: Whales holding over 10,000 ETH temporarily halt accumulation