Pi Network Gears Up for Version 23 Upgrade, But Market Demand Stays Flat

Despite gearing up for its version 23 upgrade, Pi Network’s PI token trades flat at $0.34. Weak inflows and bearish momentum raise the risk of a dip to $0.32 unless demand rebounds.

Pi Network is preparing to roll out a major upgrade, moving from protocol version 19 to 23. The new version, built on Stellar protocol 23, introduces new layers of functionality and control for the blockchain.

However, despite the technical milestone, market sentiment around PI remains subdued.

Stellar-Based Protocol 23 Comes to Pi, But Market Says ‘Not Yet’

Following the recent launch of a Linux Node, the PI Network is set to move from protocol version 19 to 23.

According to an August 27 announcement, the update will be phased in gradually, starting with Testnet1, which has already begun and will continue over the coming weeks. It will then extend to Testnet2 and eventually the Mainnet, moving the entire ecosystem to version 23, a variant of Stellar Protocol 23.

Despite this development, PI’s performance remains muted. At press time, the altcoin trades at $0.34, resting below its 20-day exponential moving average (EMA), which currently forms dynamic resistance above it at $0.36.

PI 20-Day EMA. Source:

TradingView

PI 20-Day EMA. Source:

TradingView

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When price trades above the 20-day EMA, it signals short-term bullish momentum and suggests buyers are in control.

On the other hand, when an asset’s price falls under this level, the market experiences increased sell-side pressure and weakening short-term support. This puts PI at risk of falling further over the next few trading sessions.

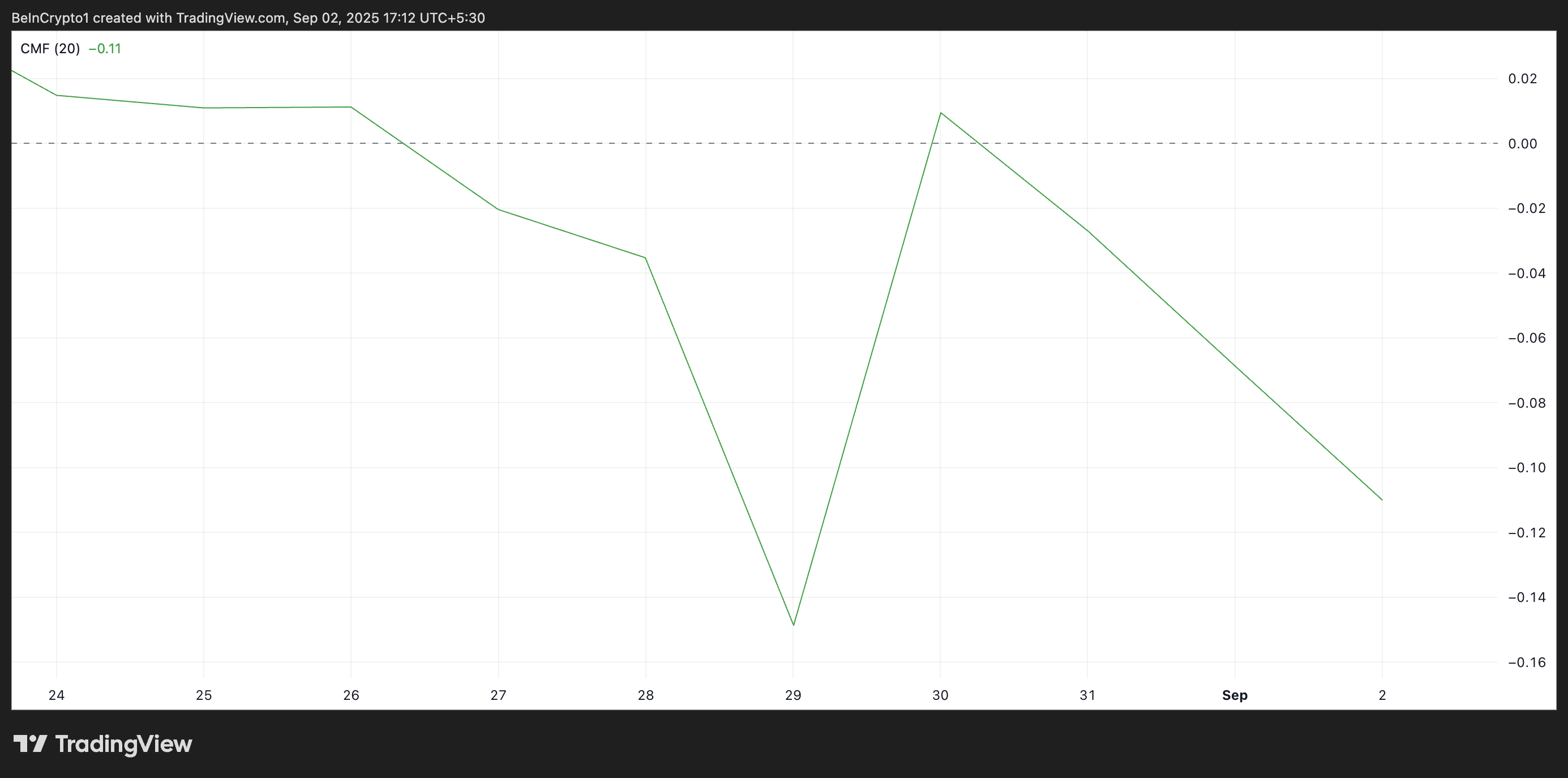

Furthermore, readings from the token’s Chaikin Money Flow (CMF) confirm this bearish outlook. At press time, this momentum indicator, which tracks money flows into and out of an asset, is below the zero line at -0.11.

PI CMF. Source:

TradingView

PI CMF. Source:

TradingView

A negative CMF reading like this signals that selling pressure outweighs buying activity. It indicates weak capital inflows and a lack of bullish conviction in the PI market.

PI Price Eyes All-Time Low

If sentiment remains poor, PI risks revisiting its all-time low of $0.32. A breach of this price floor could cause the altcoin to touch new lows in the near term.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

Conversely, if demand picks up, PI could regain momentum and attempt to climb above its 20-day EMA at $0.36. If successful, it could rally further toward $0.40.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

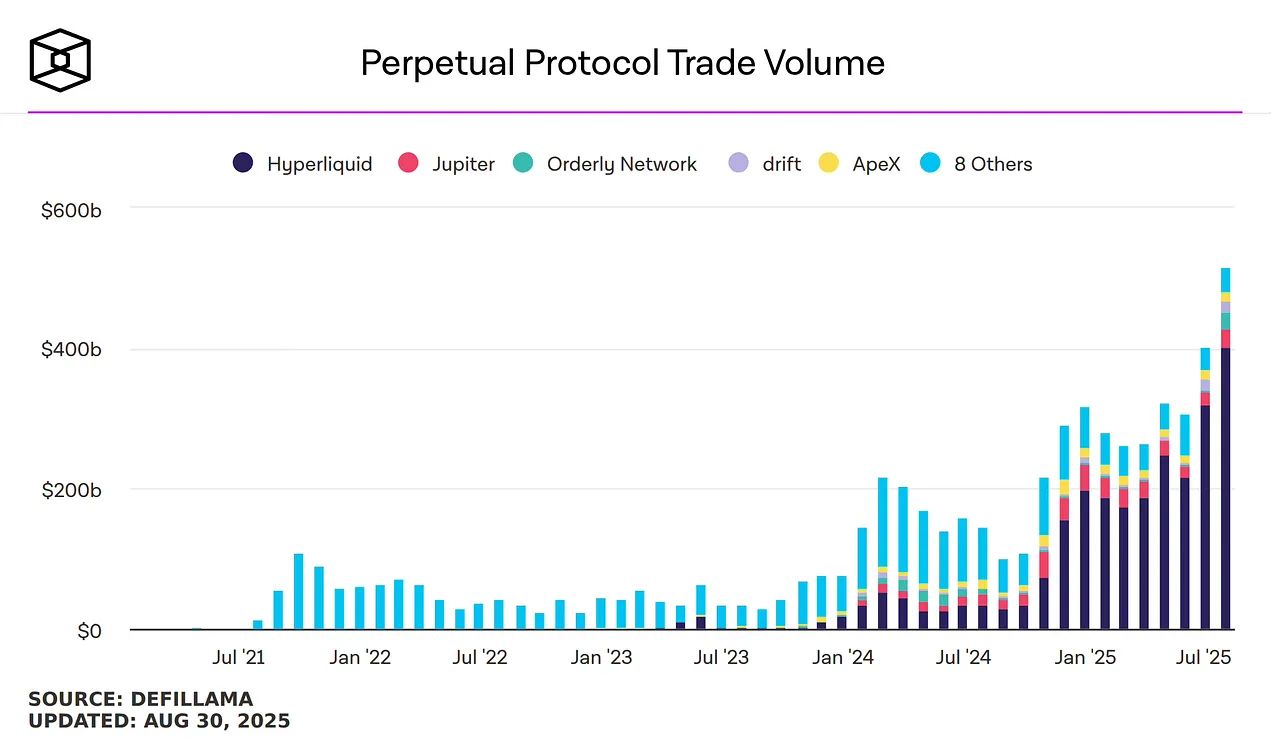

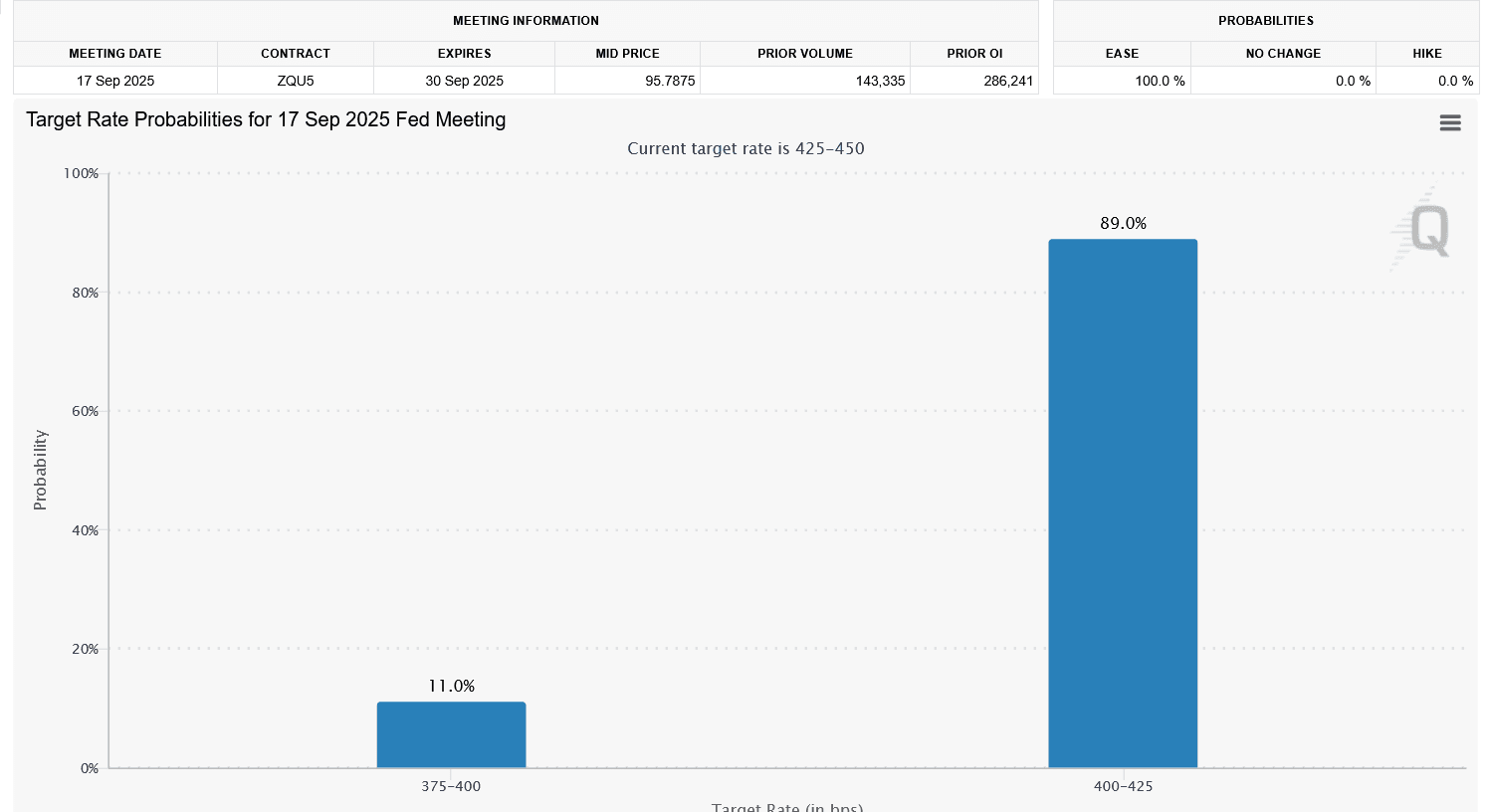

Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?

With the injection of new liquidity, three cryptocurrencies could become the biggest winners this month.

Bitcoin drop to $108K possible as investors fly to ‘safer’ assets

AiCoin Daily Report (September 6)

Hyperliquid airdrop project ratings: Which ones are worth participating in?

A wealth of valuable information on the best airdrops coming in the second half of 2025!