What to expect from XRP Price in September

Ripple’s XRP enters September under heavy sell pressure, trapped in a descending channel. With rising exchange balances and bearish momentum, the token faces risks of deeper declines unless bulls spark a rebound.

Ripple’s XRP has been trading under persistent sell-side pressure, trending within a descending parallel channel since August 2.

While the altcoin has attempted several breakouts from this bearish structure, sentiment has remained overwhelmingly negative, preventing any sustained move higher. With exchange balances climbing and selling activity intensifying, XRP could be poised for further losses this month.

XRP Struggles to Break Free as Bears Keep Price Trapped in a Decline

A descending parallel channel forms when an asset consistently posts lower highs and lower lows within two parallel trendlines. This setup reflects a sustained decline in buy-side pressure, as sellers repeatedly overpower bullish attempts to push prices higher.

Readings from the XRP/USD one-day chart show that the altcoin has trended within this channel since August 2, reflecting the persistent selloffs that have weighed on its price.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

XRP Descending Parallel Channel. Source:

TradingView

XRP Descending Parallel Channel. Source:

TradingView

Over the past few weeks, the token has made several attempts to break above this bearish structure. However, each retest has been met with strong selloffs, preventing any successful breakout and keeping XRP confined within the downtrend.

XRP Faces Bearish Outlook as Exchange Holdings Swell

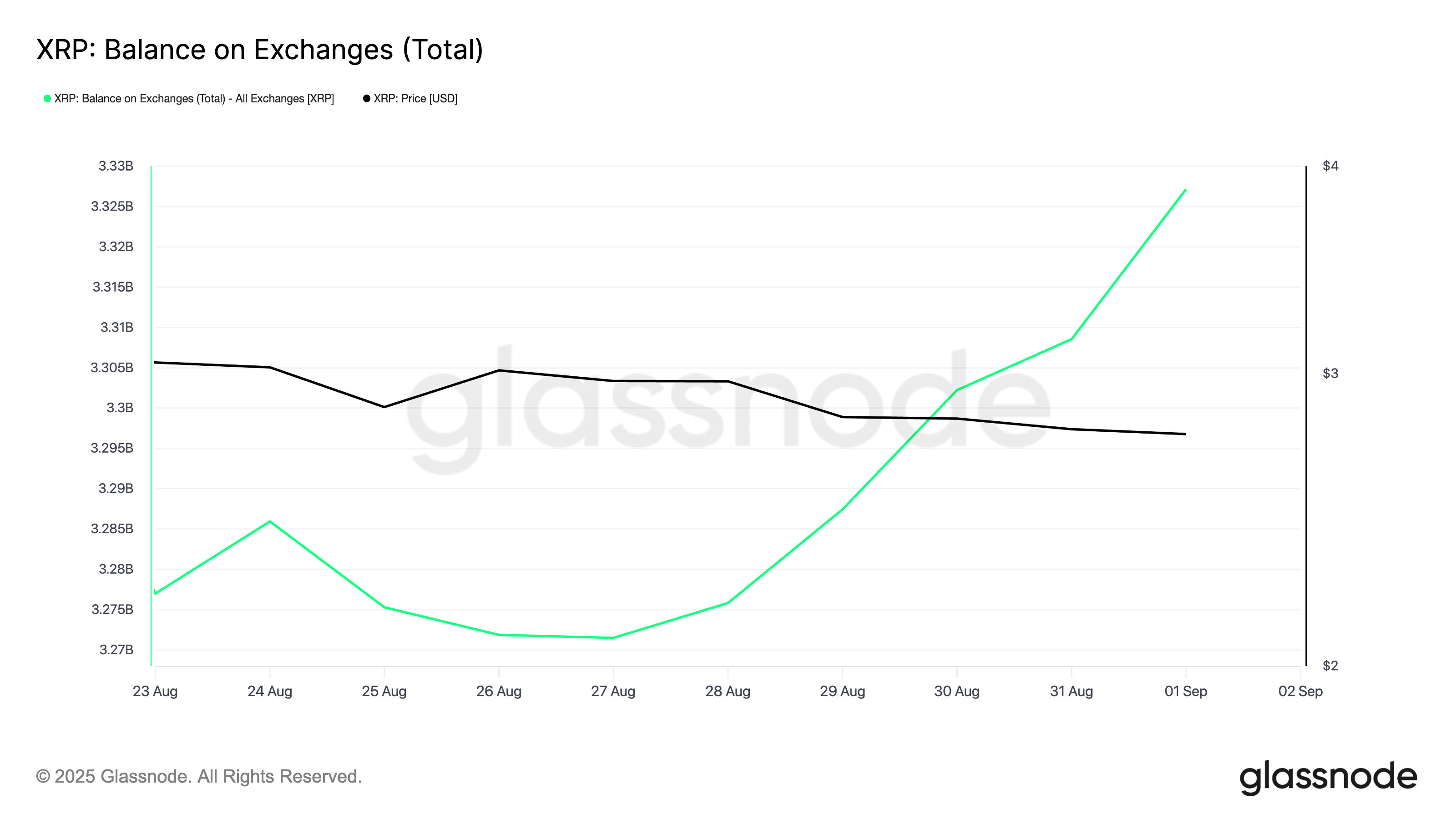

On-chain, XRP’s climbing balance on exchanges confirms the rising distribution among market participants. Per Glassnode, XRP’s exchange reserves have risen 2% since August 27, indicating an uptick in profit-taking among token holders.

XRP Balance on Exchanges. Source:

Glassnode

XRP Balance on Exchanges. Source:

Glassnode

XRP’s balance on exchanges measures the total amount of tokens held in exchange wallets at any given time. When it rises, it signals that investors are transferring tokens from private wallets to exchanges, often with the intention of selling.

As of this writing, 3.32 billion XRP valued at $9.3 billion are held on exchange wallet addresses. A high exchange balance like this means more liquidity is readily available for trading, which can drive prices lower if XRP demand fails to keep up.

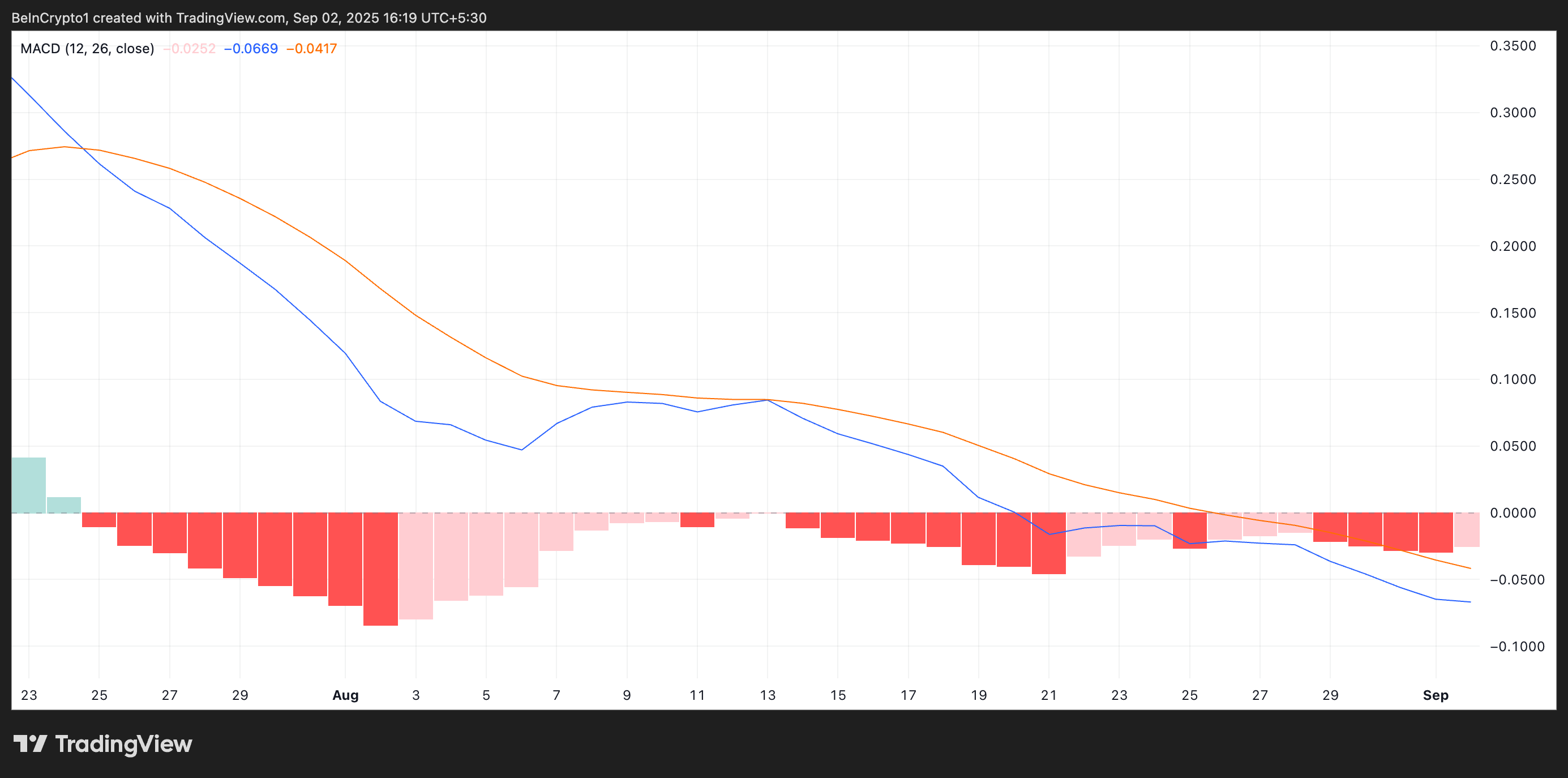

Furthermore, the setup of the altcoin’s Moving Average Convergence Divergence (MACD) indicator supports this bearish outlook. At press time, XRP’s MACD line (blue) rests below the signal line (orange), and has been so positioned since July 25.

XRP MACD. Source:

TradingView

XRP MACD. Source:

TradingView

The MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

When an asset’s MACD line rests below the signal line, buying pressure has declined, further supporting the case for continued XRP decline in the short term.

$2.63 Support in Focus as Bears Dominate

XRP risks falling to $2.63 if the sell-side pressure strengthens. If the bulls are unable to defend that support floor, it could give way to a deeper decline toward $2.39.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, XRP could witness a rebound and climb above $2.87 if buying returns to the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mt. Gox Repayment Delayed to 2026, Impacting BTC Plans

A New $300 Billion Blue Ocean: Three Main Threads of the Stablecoin Ecosystem

The stablecoin sub-sector is moving from concept to reality, shifting from speculation to practical application.

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins are absorbing liquidity in the style of “narrow banks,” quietly reshaping the global financial architecture.

$263 million in crypto capital enters the market: U.S. midterm elections become a new battleground for policy competition

This time, there are more super political action committees, and some of them have taken a clearer stance in aligning themselves with Republican candidates.