Analysis: The Federal Reserve is losing control over interest rates, with the 30-year US Treasury yield rising to nearly 5%

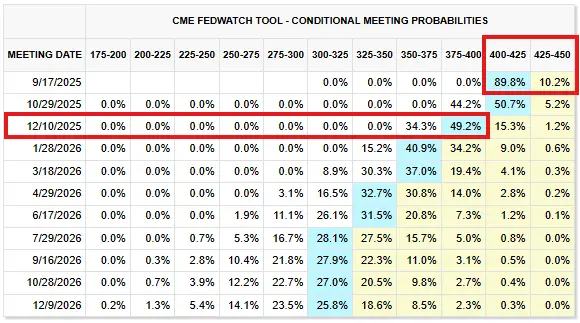

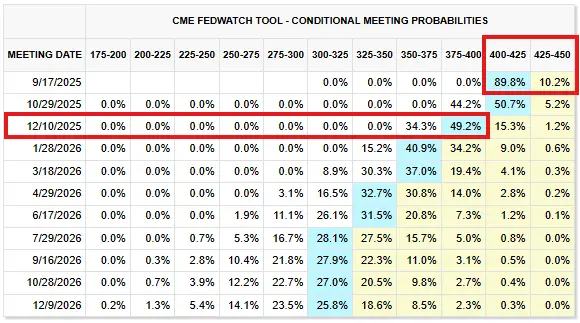

ChainCatcher reports that The Kobeissi Letter has released its latest market analysis, stating that the Federal Reserve will implement its first rate cut in 2025 in 15 days, but the 30-year US Treasury yield is now approaching 5.00%, a level last seen during the largest financial crisis in US history in 2008.

As the market prepares for rate cuts, interest rates are actually rising. The US deficit spending is already severely out of control, and the Federal Reserve is losing control over interest rates, having issued over $200 billions in bonds in just five weeks. We are at a stage where investors are simply unwilling to purchase US government bonds at current yields.

The "term premium" on US 10-year government bonds, which is the extra yield investors demand for holding long-term bonds—usually due to the "perceived risk" of holding these bonds—has approached its highest level since 2014. Meanwhile, with only two weeks left before the rate cut, the US core inflation rate has rebounded to above 3% and is on an upward trend. With an annual inflation rate of 3%, the US dollar will lose more than 25% of its purchasing power over the next 10 years.

Since 2020, it has already lost about 25%, and the inflation rate continues to rise. In two weeks, the Federal Reserve will cut rates and "blame" it on a weakening labor market. The unemployment rate among young Americans aged 16 to 24 is as high as 10%. The labor market is weakening, inflation is rising, and stagflation has arrived.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

All three major U.S. stock indexes closed lower.

All three major U.S. stock indexes fell, with the Dow Jones down 0.55%, while the Golden Dragon Index rose 0.52%.

The ruling on Trump's dismissal of Cook is not expected before September 4.