Earnings Preview | UiPath's Q2 Revenue Expected to Grow, Focus on Key AI Product Development Progress

Summary: UiPath will release its fiscal 2026 Q2 results after the US stock market closes on September 4. The company has previously launched a new generation automation platform, major AI products, and entered into a partnership with Google, all of which may contribute to its performance.

Q1 Performance Review

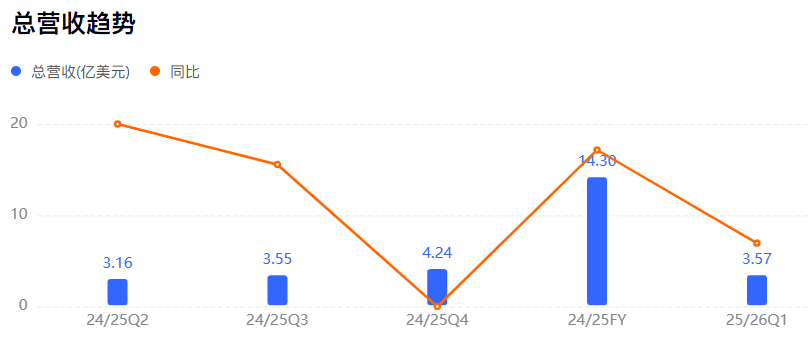

In the first fiscal quarter, UiPath reported revenue of $357 million, a year-on-year increase of 6%; annual recurring revenue (ARR) reached $1.693 billion, up 12% year-on-year; operating cash flow reached $119 million, and non-GAAP adjusted free cash flow was $117 million.

Q2 Outlook

UiPath expects Q2 revenue to be between $345 million and $350 million. According to Bloomberg data, analysts generally expect UiPath's Q2 sales to be $347 million, with earnings per share of $0.08.

Data source: Bloomberg

Data source: Bloomberg

Main Highlights

The impact of several key products on performance

UiPath has launched a new generation automation platform aimed at unifying AI, robots, and human employees into an intelligent system. CEO Daniel Dines described the platform's launch as "one of the most important and successful product launches in the company's history."

Additionally, UiPath has introduced UiPath Test Cloud, a revolutionary new approach to software testing that leverages advanced AI to enhance testers' efficiency throughout the testing lifecycle, achieving outstanding efficiency and cost savings.

At the Google Cloud Next 2025 conference, UiPath launched the generative AI-based UiPath Medical Record Summarization Agent, powered by Google Cloud Vertex AI and Gemini models.

Investors should pay attention to the boost these key products bring to the company's performance, as well as subsequent developments.

The impact of macroeconomics

Previously, UiPath CFO Ashim Gupta stated that the macroeconomic environment and foreign exchange headwinds have had "minimal" impact on the company. In the Q2 earnings report, attention should be paid to whether the outlook remains optimistic.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

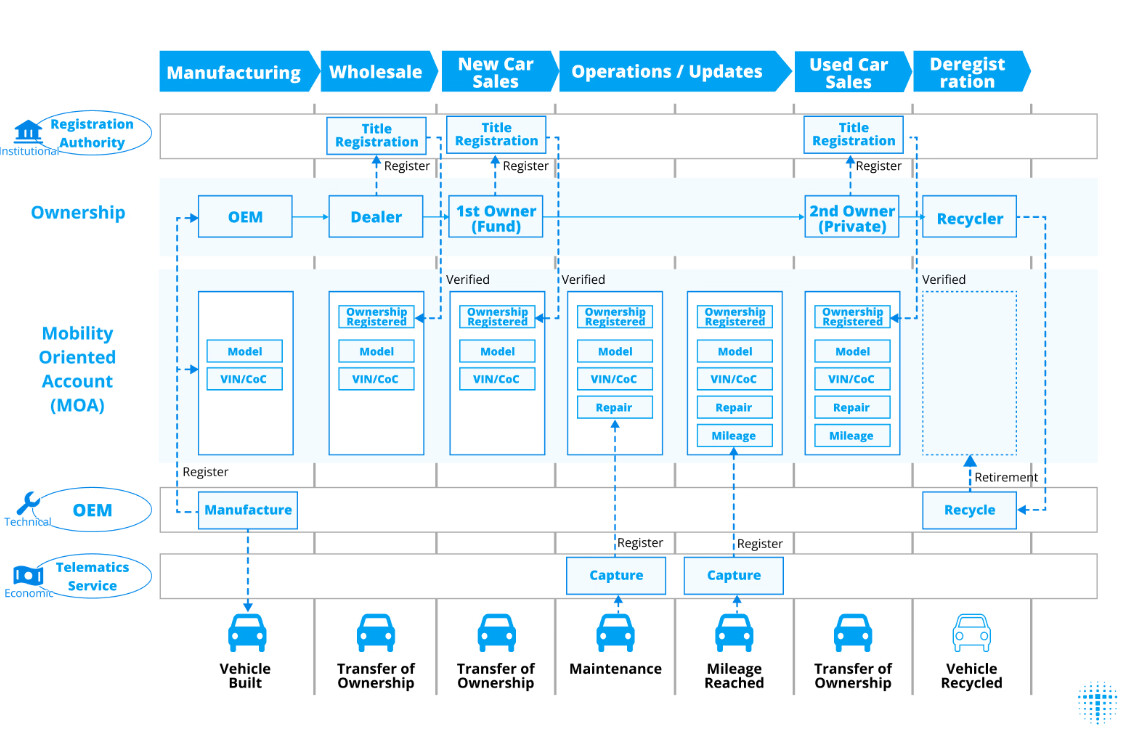

Avalanche, Toyota Blockchain Lab move on autonomous robotaxi infrastructure

Share link:In this post: Avalanche and Toyota Blockchain Lab unveil research on a new blockchain layer to boost trust and mobility. Investors can raise their funds and track their robotaxis via the blockchain. The VehicleOwnership token is a simple ERC-721 token representing a vehicle’s ownership right.

Ukraine’s central bank rejects crypto reserve option

Share link:In this post: • National Bank of Ukraine has no plans to add crypto assets to its reserves. • The move may undermine Ukraine’s integration with the EU, deputy governor says. • Digital asset reserves would go against IMF requirements as well, the NBU official warns.

Metaplanet’s board approves $3.8 billion for Bitcoin purchases

Share link:In this post: Metaplanet Inc. has secured shareholder approval for a proposal that will enable it to raise as much as $3.8 billion via preferred shares. Metaplanet has recorded a 468% yield in the second quarter of 2025 and a treasury of 18,113 BTC. Over 170 businesses around the world now have Bitcoin on their books, worth a total of over $111 billion.

After three months of farming, only received $10: Should we cancel airdrops?

The article reviews the evolution of cryptocurrency airdrops from their golden age to the current state of disorder, comparing high-quality early airdrops such as Uniswap with the low-quality airdrops seen today. It also explores the game dynamics between project teams and users. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still undergoing iterative updates.