Crypto Trader Scores $250M Payday as Trump-Linked WLFI Hits Open Market

A trader who made $38 million trading last week's plasma (XPL) volatility secured another heft payday on Monday, profiting $250 million on the release world liberty financial (WLFI), a decentralized finance (DeFi) token linked to U.S. president Donald Trump's family.

Etherscan data shows that the wallet in question, belonging to a trader known on derivatives platform HyperLiquid and X as Techno Revenant, invested $15 million in the WLFI token sale last year before being distributed 1% of the total supply on Monday, worth around $250 million.

The nine-digit score comes after the trader made $38 million on HyperLiquid last week, trading XPL as it spiked and wiped out $130 million in open interest on the futures market.

WLFI began trading on Monday, spiking to 40 cents before retreating to 25 cents in a rollercoaster session that experienced more than $5 billion in trading volume.

While Techno Revenant calmly collected a $250 million payday, others were not as lucky as hackers ran a targeted phishing campaign against WLFI token holders.

Security experts labeled it a “classic EIP-7702 phishing exploit" as hackers exploited a loophole tied to Ethereum’s recent Pectra upgrade.

Read more: Holders of Trump’s Crypto Token Targeted by Hackers in Phishing Exploit

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

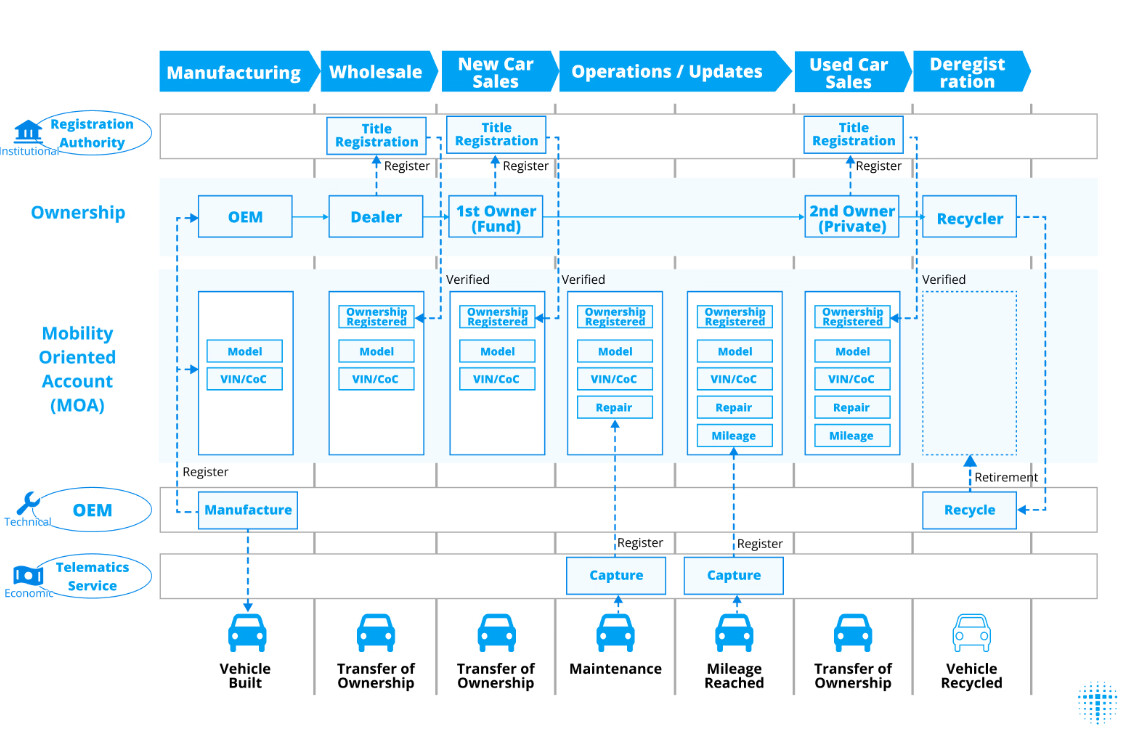

Avalanche, Toyota Blockchain Lab move on autonomous robotaxi infrastructure

Share link:In this post: Avalanche and Toyota Blockchain Lab unveil research on a new blockchain layer to boost trust and mobility. Investors can raise their funds and track their robotaxis via the blockchain. The VehicleOwnership token is a simple ERC-721 token representing a vehicle’s ownership right.

Ukraine’s central bank rejects crypto reserve option

Share link:In this post: • National Bank of Ukraine has no plans to add crypto assets to its reserves. • The move may undermine Ukraine’s integration with the EU, deputy governor says. • Digital asset reserves would go against IMF requirements as well, the NBU official warns.

Metaplanet’s board approves $3.8 billion for Bitcoin purchases

Share link:In this post: Metaplanet Inc. has secured shareholder approval for a proposal that will enable it to raise as much as $3.8 billion via preferred shares. Metaplanet has recorded a 468% yield in the second quarter of 2025 and a treasury of 18,113 BTC. Over 170 businesses around the world now have Bitcoin on their books, worth a total of over $111 billion.

Delphi Digital: What Can History Teach Us About How Interest Rate Cuts Affect Bitcoin's Short-Term Price Movements?

The article analyzes bitcoin's historical performance during Federal Reserve rate cut cycles, noting that it typically rises before rate cuts but falls back after the cuts are implemented. However, in 2024, this pattern was disrupted due to structural buying and political factors. The trend in September 2025 will depend on bitcoin's price performance before the rate cuts. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.