BTC Strategies in the Era of High-Performance Public Chains: The Transformation of Solana and On-Chain Capital

The competition in the era of high-performance public blockchains is ultimately not just a race for TPS, but about who can build a more vibrant and efficient on-chain economic ecosystem.

The popularity of high-performance public chains has never been as high as it is today. The congestion and high fees on the Ethereum network have shifted the market’s attention to emerging public chains such as Solana, Avalanche, and Base. These chains have won the favor of developers and users thanks to higher TPS and lower transaction costs, with Solana standing out in particular—not only because of its speed and low fees, but also because its unique technical architecture offers brand new possibilities for on-chain strategies.

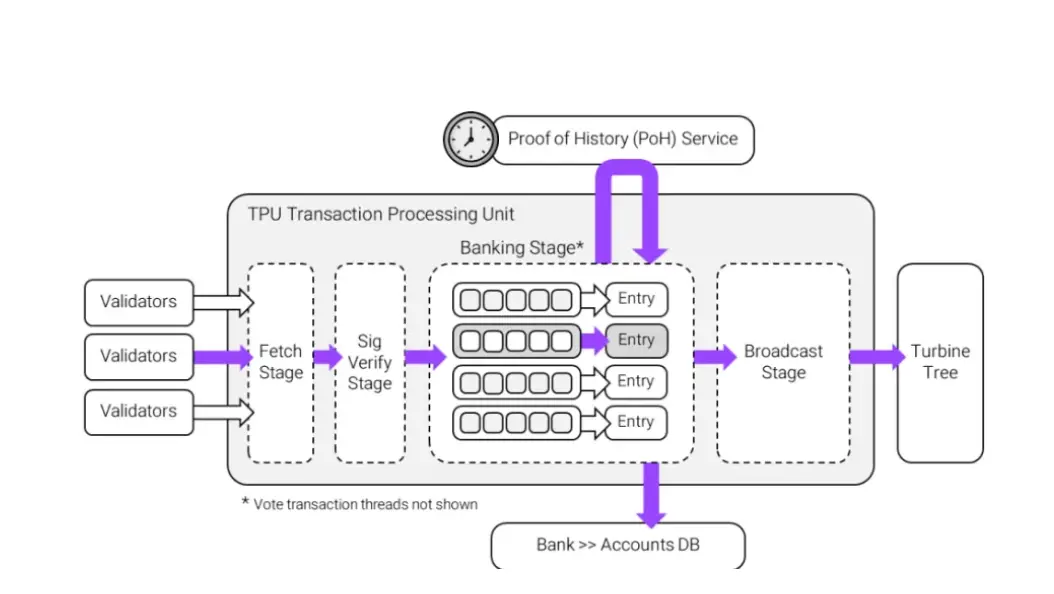

Solana’s core innovations lie in Proof-of-History (PoH) and the Sealevel parallel execution engine. PoH essentially timestamps each transaction, arranging on-chain operations in order and reducing the time nodes spend on repeated confirmations. To use an analogy: imagine a group of friends lining up to buy tickets—if everyone has to ask, “Who’s in front of me?” the line moves slowly; PoH is like everyone holding a queue number, so they proceed in order, greatly improving efficiency. Sealevel allows non-conflicting transactions to execute simultaneously, similar to a supermarket checkout where A buys apples and B buys milk—both can check out at the same time; but if both want the last bottle of apple juice, they have to queue. In this way, Solana can process a large number of transactions in parallel in most cases, greatly increasing throughput, but during peak periods, transaction rollbacks may still occur, requiring developers to consider conflict control in smart contract design. The editor’s view is that while the speed and low cost of high-performance chains are attractive, the complexity brought by transaction parallelism poses new challenges for strategy design.

However, high performance is only a basic condition; what truly determines the vitality of a public chain is the activity level of on-chain assets. Here lies a key issue: BTC, as the largest digital asset by market cap, has long been “dormant” on high-performance chains. Whether it’s cbBTC on Solana or wrapped BTC on other chains, most can only serve as a medium of exchange or basic collateral, unable to directly generate returns or participate in complex strategies. Liquidity is fragmented and usage efficiency is low—it’s like using a Ferrari just for commuting, which is a waste.

The complexity of cross-chain operations further exacerbates this problem. Users who want to transfer BTC from Ethereum to Solana to participate in high-frequency trading strategies face high cross-chain fees, long confirmation times, and various technical and security risks. Traditional cross-chain bridge solutions either rely on centralized custody or are extremely complex technically, making it difficult for ordinary users to use them smoothly.

Against this backdrop, liquid staking tokens (LST) offer new options for Bitcoin holders. Multiple LST solutions have emerged in the market, among which Lombard’s LBTC is a typical 1:1 BTC-backed product, usually offering an annual yield of about 1%. The technical feature of such products is the use of a non-rebasing design: the number of tokens held by users remains unchanged, but the underlying BTC corresponding to each token gradually increases with staking rewards. For example, 1 LBTC at the beginning may correspond to 1.01 BTC after a period of time, thus achieving capital appreciation.

In terms of security mechanisms, such products usually adopt a multi-institution custody model, using multi-signature technology and proof of reserves to ensure fund safety. LBTC uses a custody alliance composed of 14 digital asset institutions to diversify risk. However, any custody solution carries counterparty risk, so users need to weigh convenience against self-sovereignty.

In terms of technical implementation, products like Lombard are exploring cross-chain functionality. Based on protocols such as LayerZero, some LSTs have already achieved bridging from Ethereum to Solana: by verifying transactions with light nodes, using decentralized relay networks to transmit messages, and combining oracles to provide price data for asset mapping. In theory, users can complete cross-chain transfers within a few minutes.

As more LST products are deployed on different chains, the strategic options for BTC holders are indeed expanding. They can use such tokens as collateral in DeFi protocols, participate in DEX trading, or engage in lending operations. This development trend shows that Bitcoin is evolving from a pure store of value to a more active DeFi asset, but it also introduces new technical and market risks.

Market Impact and Future Trends

From a more macro perspective, this change has threefold significance. First is the improvement of capital efficiency—BTC is no longer a static asset, but dynamic capital that can participate in multiple yield strategies simultaneously. Second is the validation of technical feasibility—proving that high-performance chains can indeed support complex financial strategies, with perpetual contracts, liquidity mining, lending, and other operations running smoothly in the Solana environment. Finally, it provides a replicable template for the entire industry, demonstrating how to realize the yield and activation of cross-chain assets while ensuring security.

Of course, this process is not without risks. The security of cross-chain bridges is always a challenge, as many past hacking incidents have been related to cross-chain operations. The stability of high-performance chains under extreme market conditions also needs further verification—Solana has previously experienced outages due to network overload. The uncertainty of the regulatory environment cannot be ignored either, as countries’ regulatory stances on LST products are still evolving.

However, from the development trend, the activation of core assets such as BTC in multi-chain ecosystems has become an irreversible trend. The demand from traditional financial institutions for yield-generating digital asset products continues to grow, and the technical infrastructure is constantly improving. The development of new technologies such as zero-knowledge proofs and account abstraction will further lower user barriers and enhance the security and convenience of cross-chain operations.

Market data also supports this view. Currently, the total global BTC market cap is about $1.2 trillion, but the BTC assets participating in DeFi account for less than 1% of the total supply. If this proportion can rise to 5%-10%, the corresponding market size will reach $60 billion-$120 billion. The liquid staking market on Ethereum has already validated the feasibility of this model, with a total value locked exceeding $40 billion, providing a good reference for the development of BTC LSTs.

The competition in the era of high-performance public chains is ultimately not just a TPS race, but about who can build a more active and efficient on-chain economic ecosystem. Technical performance is the foundation, but asset activity, cross-chain interoperability, and user experience are the key factors that determine the winner. The successful launch of LBTC on Solana not only provides strong support for Lombard’s upcoming token issuance, but also demonstrates a feasible path for the entire industry from technological innovation to commercial value realization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Less than a month left! Countdown to U.S. government "shutdown" ticking again

It's not just about the money! Issues such as the Epstein case and federal agents could become "landmines" that may trigger a U.S. government shutdown crisis...

QuBitDEX is the title sponsor of the first Taiwan Blockchain Online Summit (TBOS), creating Asia's largest online industry event.

The first Taiwan Blockchain Online Summit (TBOS) will be held in September 2025, in collaboration with TBW, MYBW, and others, focusing on decentralized applications and the migration from Web2 to Web3, aiming to create the largest online Web3 event in Asia. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

GBP/USD exchange rate plunges 1.4% as UK fiscal concerns intensify