Bullish on the surface but actually bearish? Netflix (NFLX.US) options market sends a cautious signal with $4.3 million

According to Jinse Finance APP, the options market volatility of streaming giant Netflix (NFLX.US) last Friday provided investors with a window into market sentiment. On that day, the total volume of derivatives trading reached 164,872 contracts, 44.8% higher than the average daily level over the past month. Of these, put options accounted for 76,931 contracts, while call options reached 87,941 contracts, with a put/call ratio of about 0.875. Although this figure is below 1, indicating a surface-level bullish sentiment, it is important to note that options trading includes both buying and selling operations, and the specific trading direction must be considered for analysis. Observing through the options flow screener commonly used by institutions, Barchart, the net trading sentiment on the day leaned bearish, involving nearly $4.3 million.

Specific trading details show that call options with a strike price of $1,200 expiring on September 19 were sold for $2.131 million, with a purchase price of $35.95. If Netflix's stock price does not break through $1,235.95 (strike price + option cost) by the expiration date, the seller will retain the premium; if it does break through, the seller will be required to deliver the stock at the agreed price. This operation suggests that some traders may be reducing their holdings of the underlying stock or using credit strategies to try to profit from stock price fluctuations.

Although the options data sends cautious signals, Netflix's stock price has fallen nearly 3% since August 18, with a 10% decline over the past six months, but still maintains a 79% increase over the past 52 weeks. For fundamentally strong leading companies, short-term pullbacks often breed contrarian opportunities.

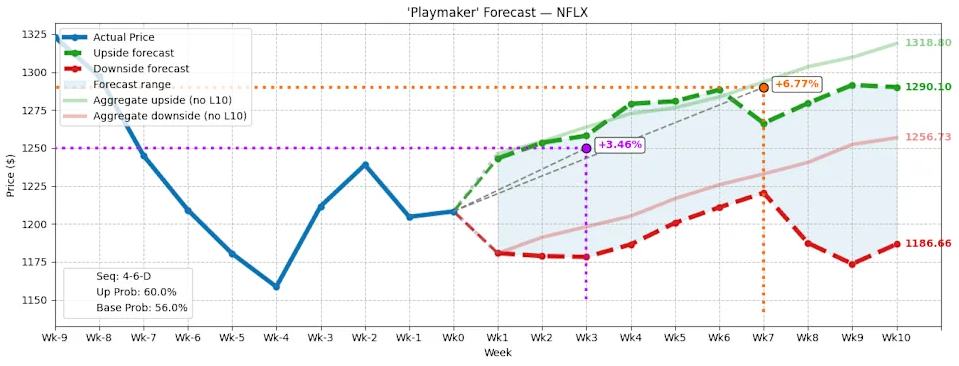

Quantitative models show that under a non-parametric statistical framework, the median natural volatility range for Netflix's stock price over the next 10 weeks is $1,256.73–$1,318.80. If market reversal signals are considered (four buys and six sells in the past 10 weeks, with an overall downward trend), the conditional deviation range may dip to $1,186.66–$1,290.10. It is worth noting that volatility may expand around the October 17 options expiration, and the trading environment may become more complex.

Given the current market conditions, two bull call spread strategies are worth noting: First, the $1,242.50/$1,250 spread expiring on September 19. If Netflix rises 3.46% to $1,250 within the next three weeks, the maximum profit can reach 150%. Second, the $1,280/$1,290 spread expiring on October 17, which requires a higher initial cost ($385), but offers a longer time buffer, with a maximum profit close to 160%. Both strategies reduce the cost of buying by selling higher strike call options, making them suitable for scenarios where a moderate stock price increase is expected.

Although this options anomaly is not a strong bullish signal, combined with the extent of the stock price pullback and long-term growth potential, it may provide a window for cautious investors to position themselves. It should be noted that the expansion of volatility from late October to early November may bring short-term risks, so strict stop-loss levels should be set when operating.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin's Bearish Momentum vs. Gold's Bullish Breakout: A Macro-Driven Reallocation in Late 2025

- In late 2025, Bitcoin faces bearish momentum while gold hits record highs, driven by institutional capital reallocation amid macroeconomic shifts and regulatory clarity. - Bitcoin’s 30% August correction to $75,000 and 3.68M BTC institutional accumulation highlight its equity-like volatility and susceptibility to Fed policy shifts. - Gold surges to $3,534/oz on 710 tonnes of central bank purchases and $19.2B ETF inflows, reinforcing its role as a safe-haven asset against inflation and geopolitical risks.

Ethereum ETFs Surpassing Bitcoin in Institutional Adoption: Why Ethereum is Now the Preferred Crypto Asset for Institutional Portfolios

- Ethereum ETFs outpaced Bitcoin in 2025 institutional inflows, driven by yield generation, regulatory clarity, and technological upgrades. - Ethereum’s 4.5–5.2% staking yields and CLARITY Act utility token reclassification attracted risk-averse investors over Bitcoin’s speculative profile. - Dencun/Pectra upgrades reduced gas fees by 94%, boosting Ethereum’s DeFi TVL to $223B and enabling a 60% portfolio allocation to Ethereum-based products. - Ethereum derivatives open interest surged to $132.6B (vs. Bit

The Dollar's Decline and the Rise of Digital and Physical Safe Havens

- U.S. dollar's share in central bank reserves fell to 57.74% in Q1 2025 from 71% in 2001, driven by diversification into gold and digital assets. - Central banks purchased 166 tonnes of gold in Q2 2025, with 76% expecting increased gold holdings by 2030 as geopolitical hedging strategy. - CBDCs and cryptocurrencies are reshaping portfolios, with BRICS digital systems challenging dollar dominance while U.S. stablecoins counter de-dollarization. - Investors now prioritize green bonds, emerging markets, and

Bitcoin News Today: Bitcoin at Crossroads: Red September, Fed Moves, and Halving Weigh on Market Fate

- Bitcoin trades near $108,500 amid bearish short-term momentum despite 2025 all-time highs above $120,000. - Technical indicators show oversold RSI below 30, but falling trend channels and key support at $101,300 signal negative near-term outlook. - "Red September" history, Fed rate cut expectations, and $751M ETF outflows heighten volatility risks as whale accumulation accelerates. - Long-term holders maintain confidence with declining exchange reserves, while halving anticipation and sub-cycle NVT metri