Will the price of bitcoin crash to $75,000?

If bitcoin fails to hold the $100,000 support level, the sell-off could intensify rapidly.

Bitcoin price has fallen below $108,000 , once again presenting traders and long-term holders with a pressing question: will the price crash all the way down to $75,000? With the latest inflation data dampening hopes for aggressive rate cuts and whale-driven sell-offs shaking market confidence, the world’s largest cryptocurrency is once again at a crossroads. The answer depends not only on technical levels but also on the upcoming jobs report and the Federal Reserve’s policy decision in September.

Bitcoin Price Prediction: Inflation and Fed Uncertainty

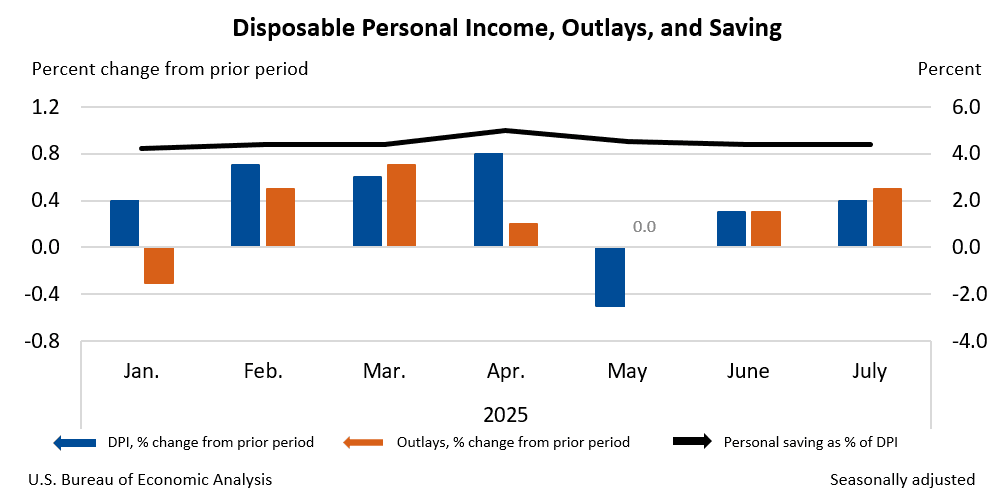

Bitcoin price has slipped to $107,383 as traders digest the latest US Personal Consumption Expenditures (PCE) data. Core inflation climbed 2.9% year-over-year in July, the highest since February, dampening expectations for rate cuts. Although the market still sees an 87.6% probability of a 25-basis-point rate cut at the September FOMC meeting, the overall tone remains cautious. Risk appetite is fragile, and cryptocurrencies are reacting more sensitively to macro data than earlier this year.

The weekend sell-off was driven by more than just macro factors. Analysts point out that whale distribution and liquidation of leveraged positions accelerated the decline. This combination of weak sentiment, fragile liquidity, and macro headwinds sets the stage for Bitcoin’s next move.

Technical Analysis: Bollinger Bands Show Pressure

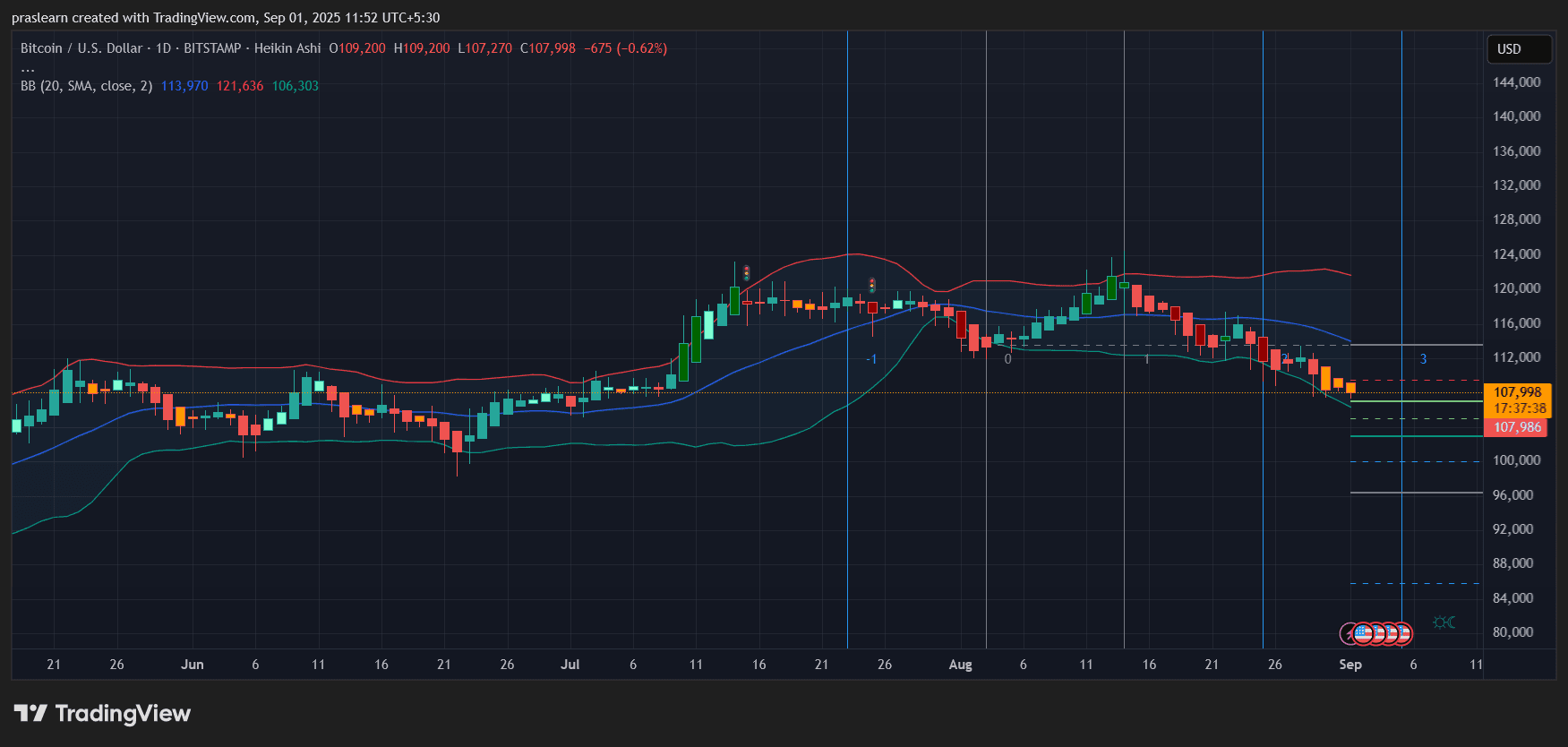

BTC/USD Daily Chart - TradingView

BTC/USD Daily Chart - TradingView From the daily chart, Bitcoin price is trading below $108,000, near the lower Bollinger Band at $106,300. This indicates the market is oversold, but Bitcoin’s price hugging the lower band suggests sellers remain in control.

The middle band (20-day SMA) is at $113,970 and now acts as resistance. For bulls to regain control, BTC needs to break above this level. Until then, momentum favors continued downward pressure.

Key Support and Resistance Levels

- Immediate support: $106,300 (lower Bollinger Band)

- Psychological support: $100,000 (the real dividing line pointed out by analysts)

- Next downside targets: $95,000, then $90,000 if $100,000 fails to hold

- Resistance: $113,970 (20-day SMA) and $121,600 (upper Bollinger Band)

The chart structure shows a descending pattern since mid-August, with consecutive red candles and lower highs. This confirms that sellers are controlling the short-term trend.

Bitcoin Price Prediction: Will Bitcoin Price Fall to $75,000?

A Bitcoin price crash to $75,000 would mean a further 30% drop from current levels. For this to happen, two conditions must be met:

Macro shocks, such as higher inflation or a hawkish Fed turn, causing risk sentiment to fade.

A decisive break below the $100,000 support, triggering mass liquidations and a liquidity squeeze.

While these risks are real, the probability of an immediate crash to $75,000 appears low. CME’s FedWatch tool still expects rate cuts, and crypto investors have historically bought near major psychological support levels. A short-term drop to $95,000–$90,000 is more realistic, while a collapse to $75,000 would require a prolonged macro bear cycle or a systemic event in the crypto market.

Short-Term Outlook

Currently, the $BTC price path depends on two upcoming events:

This week’s Non-Farm Payrolls (NFP) report: Strong jobs data could be negative for $Bitcoin, while weak data may provide relief. The September 16-17 FOMC meeting: A dovish Fed rate cut could trigger a rebound, while a hawkish surprise may accelerate the downside.

Until then, traders should expect heightened volatility around the $100,000 level. Bulls must defend this line at all costs, or the door to a deeper correction will open.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The New York Times: Trump family’s crypto fundraising is even worse than Watergate

When presidents start issuing tokens, politics is no longer a means of governing the country but becomes a game to boost their own market value.

Anthony Pompliano Claims Gold Lost Value Against Bitcoin

Adam Back Predicts Bitcoin Price Surge Based on Market Trends

Bitcoin ETFs Experience $1.2 Billion in Weekly Outflows