- POL (Prev. MATIC) is trading at around $0.28.

- Daily trading volume has surged by over 117%.

With the bleeding assets, the crypto market cap has settled at $3.73 trillion. The overall market sentiment has flipped to the fear zone, as the Fear and Greed Index value holds at 39. The majority of the tokens are losing momentum, with the red candlesticks lighting up, including the assets like Bitcoin (BTC) and Ethereum (ETH).

Among the altcoins, POL (prev. MATIC) has captured the attention by trending and securing a spot in the gainers list, posting a 2.15% gain. The asset opened the trading day at the bottom range of $0.2668. The bullish wave has triggered the POL price to rise toward the $0.2944 mark. The asset has tested and broken the key resistance levels to affirm the uptrend.

At the time of writing, POL traded within the $0.2820 range, with a market cap of $2.94 billion. Moreover, the daily trading volume of the asset has exploded by over 117%, reaching $731.47 million, as per CMC data . Notably, in the last 24 hours, the market has experienced a liquidation of $1.69 million worth of POL.

Will POL’s Price Stabilize Here?

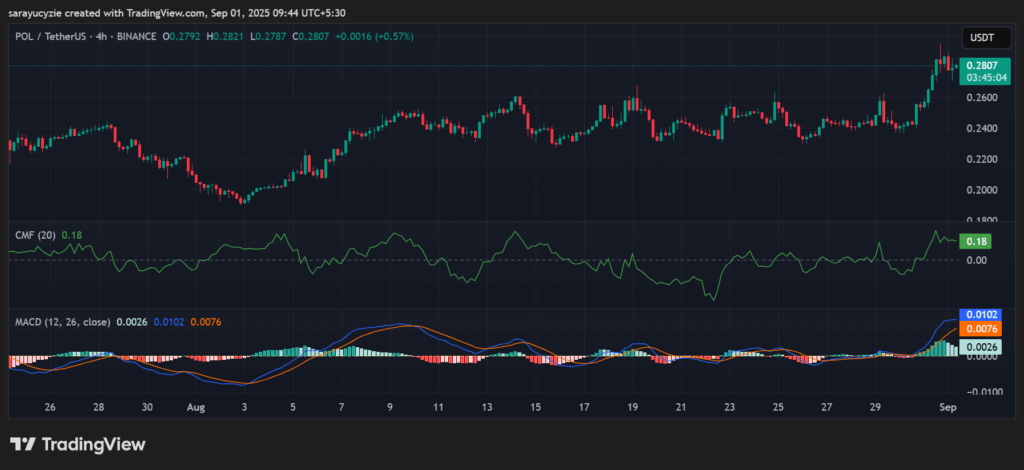

The technical analysis of POL exhibits bullish pressure in the market, with the Moving Average Convergence Divergence (MACD) line settled above the signal line. It indicates the positive momentum and may confirm an uptrend. In addition, the Chaikin Money Flow (CMF) indicator found at 0.18 suggests moderate buying pressure in the market. Also, the asset’s capital is flowing into the asset, but not extremely strongly.

POL chart (Source: TradingView )

POL chart (Source: TradingView )

With the formed green candles, the asset’s bulls are activated. The POL price might climb to the nearest resistance at the $0.2827 range. Further upside correction could trigger the golden cross to take place, and send the price above $0.2835. Contrarily, if the asset’s bulls run out of power, the bears appear and find support at the $0.2813 mark. An extended correction on the downside likely pulls the price of POL back below $0.2805.

POL chart (Source: TradingView )

POL chart (Source: TradingView )

Furthermore, the asset’s active market sentiment is bullish, as the daily Relative Strength Index (RSI) is at 63.61. There is a possibility for more upside, and it may approach the overbought zone above 70. POL’s Bull-Bear Power (BBP) reading of 0.0180 implies a slight bullish dominance. The value is weak and close to neutral, with no strong trend dominance. The positive value confirms an uptrend, and the negative value validates a bearish grip.

Highlighted Crypto News

MemeCore Explodes 100% as Bulls Target $1 Breakout