Metaplanet’s Bitcoin strategy faces fundraising crunch as stock sinks: Report

Metaplanet, the Tokyo-listed firm aggressively accumulating Bitcoin, is facing mounting pressure as its share price tumbles, threatening the fundraising model it has used to build one of the largest corporate Bitcoin treasuries globally.

The company’s stock has dropped 54% since mid-June, despite Bitcoin

BTC$109,069gaining around 2% during the same period. The decline has put its capital-raising “flywheel” under stress, a mechanism dependent on rising share prices to unlock funding through MS warrants issued to Evo Fund, its key investor.

With shares down sharply, exercising these warrants is no longer attractive for Evo, squeezing Metaplanet’s liquidity and slowing its Bitcoin acquisition strategy, according to a Sunday report by Bloomberg.

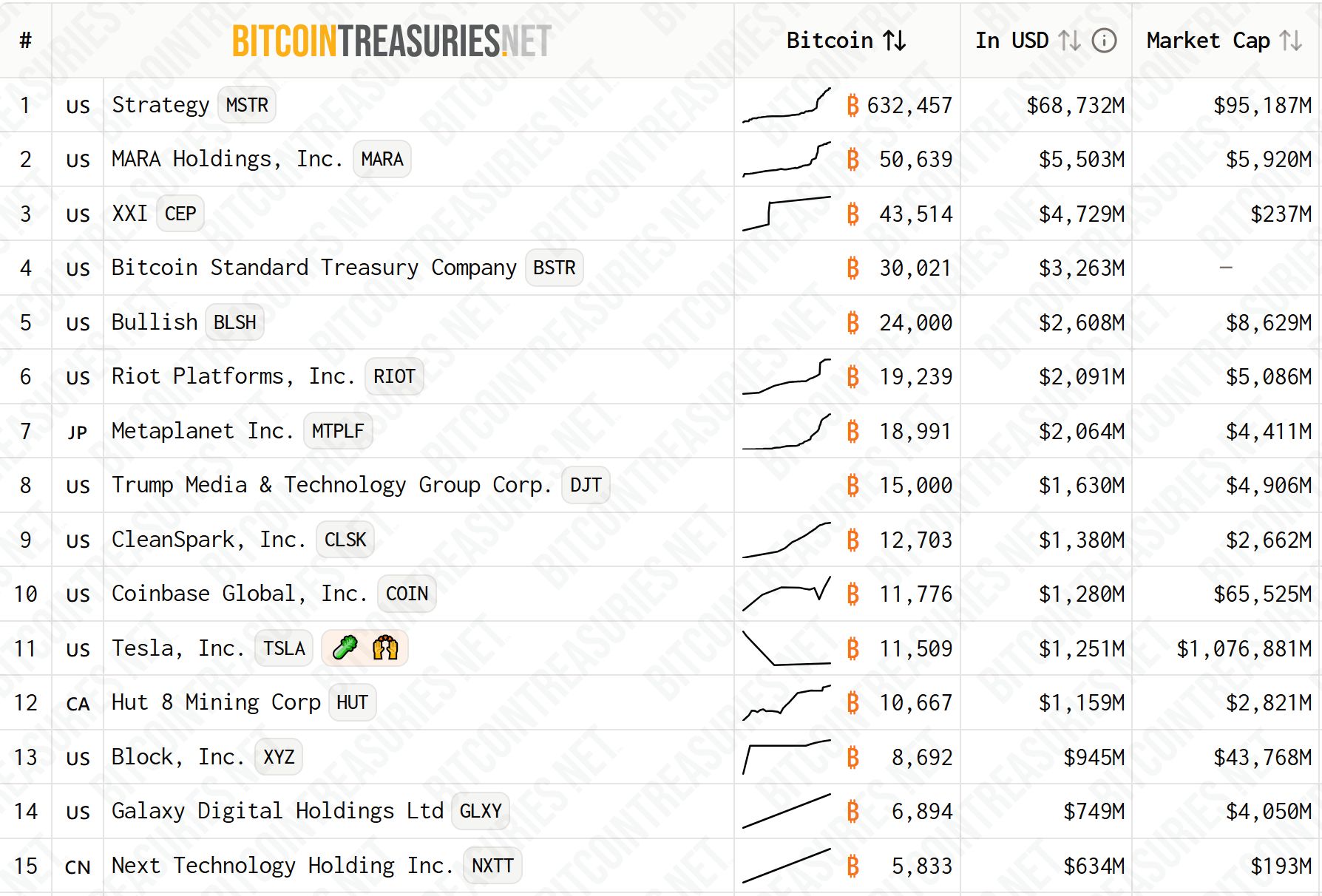

Led by former Goldman Sachs trader Simon Gerovich, Metaplanet currently holds 18,991 BTC, making it the seventh-largest public holder, according to BitcoinTreasuries.NET. The firm has ambitions to grow its stack to 100,000 BTC by the end of 2026, and 210,000 BTC by 2027.

Top 15 Bitcoin treasury companies. Source: BitcoinTreasuries.NET

Metaplanet turns to overseas markets

With its “flywheel” strategy losing momentum, Gerovich is turning to alternative fundraising. On Wednesday, Metaplanet announced plans to raise approximately 130.3 billion yen ($880 million) through a public share offering in overseas markets.

Additionally, shareholders will vote on Monday on whether to approve the issuance of up to 555 million preferred shares, a rare instrument in Japan, which could raise as much as 555 billion yen ($3.7 billion).

In an interview with Bloomberg, Gerovich called the preferred shares a “defensive mechanism,” allowing capital infusion without diluting common shareholders if the stock falls further. These shares, expected to offer up to 6% annual dividends and initially capped at 25% of the firm’s Bitcoin holdings, may appeal to Japanese investors starved of yield.

Falling Bitcoin premium puts Metaplanet’s strategy at risk

However, analysts are cautious. “The Bitcoin premium is what will determine the success of the entire strategy,” said Eric Benoit of Natixis. That premium, the difference between Metaplanet’s market cap and the value of its Bitcoin holdings, has fallen from over 8x in June to just 2x, increasing the risk of dilution.

The company has suspended Evo’s warrant exercises from Sept. 3 to 30, paving the way for the preferred stock issuance. Whether this shift can stabilize Metaplanet’s funding strategy remains to be seen.

Meanwhile, Metaplanet has been upgraded from a small-cap to a mid-cap stock in FTSE Russell’s September 2025 Semi-Annual Review, earning inclusion in the FTSE Japan Index. The move follows the company’s strong Q2 performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.