Shiba Inu and the Psychology of Risk: How the Reflection Effect Shapes Crypto Volatility

- Shiba Inu (SHIB) exemplifies crypto volatility driven by the reflection effect, where investors invert risk preferences between gains and losses. - Despite ecosystem upgrades like Shibarium and token burns, SHIB's price remains dominated by emotional sentiment over fundamentals. - The reflection effect manifests in sharp price whipsaws (e.g., 11.35% surge followed by 3.9% drop in August 2025), reflecting herd behavior and social proof. - Investors are advised to use DCA, technical indicators, and strict

The Shiba Inu (SHIB) token, a quintessential meme coin, has become a case study in the intersection of behavioral economics and cryptocurrency markets. Its price swings—from a 43,220,000% surge in 2021 to a 6.65% monthly decline in 2025—reflect not just market forces but the deep-seated psychological biases of investors. At the heart of this volatility lies the reflection effect, a behavioral finance concept that explains how individuals invert their risk preferences when facing gains versus losses. For SHIB , this dynamic has turned a token with no intrinsic utility into a barometer of investor sentiment, where fear and greed dictate price action more than fundamentals.

The Reflection Effect: A Behavioral Lens on Crypto Trading

The reflection effect, first articulated by Daniel Kahneman and Amos Tversky, posits that people tend to be risk-averse when holding gains but risk-seeking when facing losses. In crypto markets, this manifests as panic selling during downturns and speculative buying during rallies. For SHIB, this pattern is stark. In August 2025, the token surged 11.35% in a single day, only to drop 3.9% the next. Such whipsaws are not anomalies but symptoms of a market driven by emotional responses rather than rational analysis.

Consider the data: SHIB's Fear & Greed Index in August 2025 stood at 64 (moderate greed), with 69% of sentiment bearish. This paradox—greed coexisting with pessimism—highlights the reflection effect in action. Investors who bought during dips, hoping to “recover losses,” often ignored the token's lack of real-world utility. Meanwhile, those securing profits during rallies did so out of fear of a reversal, not confidence in SHIB's long-term value.

SHIB's Ecosystem: A Bridge Between Speculation and Utility

While SHIB's price is dominated by sentiment, its ecosystem has evolved to include utility-driven projects like Shibarium, a Layer 2 blockchain processing 1.5 billion monthly transactions. Automated token burns have reduced SHIB's supply by 56 billion tokens, creating a deflationary narrative. Yet, these developments have not curbed the token's volatility. Why? Because the reflection effect amplifies short-term sentiment, overshadowing long-term fundamentals.

For example, Shibarium's growth and partnerships with firms like NVIDIA and Alibaba Cloud are positive signals. However, when the broader crypto market dipped in February 2025 due to the Bybit security breach, SHIB's price plummeted alongside Dogecoin (correlation of 0.82), despite its ecosystem upgrades. This illustrates how macroeconomic events and meme coin sentiment override utility-driven narratives in speculative assets.

Strategic Implications for Investors

For investors navigating SHIB's volatility, understanding the reflection effect is critical. Here's how to approach it:

Discipline Over Emotion: The reflection effect thrives on impulsive decisions. During sharp declines, resist the urge to panic sell; during rallies, avoid locking in profits prematurely. Instead, use technical indicators like moving averages (e.g., SHIB's 50-day and 200-day averages) to identify trends.

Dollar-Cost Averaging (DCA): Given SHIB's volatility, DCA can mitigate the emotional toll of timing the market. By investing fixed amounts at regular intervals, investors reduce the risk of buying at peaks or selling at troughs.

Focus on Long-Term Utility: While SHIB's price is sentiment-driven, its ecosystem's growth—such as Shibarium's transaction volume and token burns—could create value over time. Investors should weigh these factors against short-term price swings.

Position Sizing and Risk Management: Given SHIB's -14.1% projected ROI for 2025, allocate only a small portion of a portfolio to speculative assets. Use stop-loss orders to limit downside risk.

The Bigger Picture: Behavioral Biases in a Crypto-Driven World

SHIB is not an outlier. The reflection effect is a universal force in crypto markets, where retail investors often act as a herd. For instance, whale activity—such as a $32,000 purchase in August 2025—can trigger a cascade of retail buying, driven by social proof rather than fundamentals. This dynamic is exacerbated by the lack of regulation and the influence of social media, which amplify emotional responses.

Institutional investors, by contrast, tend to allocate to stable assets like Bitcoin and Ethereum , avoiding the volatility of meme coins. Retail investors, however, are drawn to the allure of “outsized returns,” even when the odds are stacked against them. This divergence underscores the importance of behavioral awareness in crypto investing.

Conclusion: Navigating the Emotional Rollercoaster

Shiba Inu's journey from meme to speculative asset—and its tentative steps toward utility—reveals the power of investor psychology in shaping market outcomes. The reflection effect, by distorting risk preferences, turns SHIB into a mirror of its holders' emotions. For investors, the key is to recognize these biases and act accordingly.

In a market where sentiment often trumps substance, SHIB serves as a cautionary tale and an opportunity. Those who approach it with discipline, a focus on fundamentals, and a clear strategy may find a way to navigate its volatility. But for the rest, the reflection effect remains a reminder: in crypto, the greatest risk is not the market—it's ourselves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin valuation indicator hints at macro top as ‘death cross’ appears

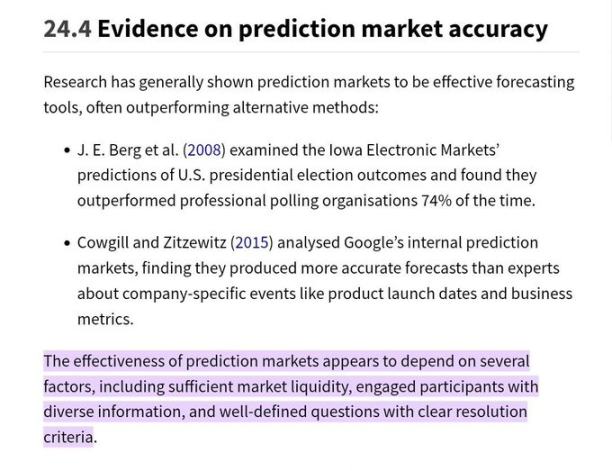

If the next major opportunity comes from prediction markets, how should we choose the most promising platform?

A platform with sound mechanisms, ample liquidity, and a vibrant, trustworthy community is more likely to provide value in terms of profitable trading opportunities and accurate predictions.

Dark Forest Adventure Round: A New Era of On-Chain Economy with AI Agents

Building an on-chain gaming financial market to empower AI agents for sustainable profitability.

The Art of War in Crypto: Winning the Psychological Battle Is the Best Marketing

Today's crypto marketing is not just about advertising; it's a series of psychological battles.