Ethereum’s Resilience Amid Crypto ETF Outflows and Macroeconomic Shifts

- Ethereum overtook Bitcoin in 2025 as institutional ETF inflows surged to $30.17B AUM, driven by 4-6% staking yields and Dencun/Pectra upgrades. - Price突破 $4,000 was fueled by fractal patterns, MACD golden cross, and 200,000 ETH ($515M) accumulation by institutional whales. - Despite macro risks like Fed rate uncertainty, Ethereum's deflationary model and Layer 2 cost reductions (94%) solidified its role as a crypto market cornerstone.

Ethereum’s institutional adoption in 2025 has emerged as a defining force in the cryptocurrency market, outpacing Bitcoin in ETF inflows and capturing a significant share of institutional capital. Despite macroeconomic headwinds, including Federal Reserve rate uncertainty and inflationary pressures, Ethereum’s structural advantages—such as 4–6% staking yields, regulatory clarity, and technological upgrades like the Dencun and Pectra hard forks—have solidified its appeal to institutional investors [1]. By Q2 2025, Ethereum ETFs held $30.17 billion in assets under management (AUM), accounting for 68% of institutional growth in the crypto sector, while Bitcoin’s dominance eroded to 57.3% [1].

The recent surge in Ethereum’s price, which surpassed $4,000 in 2025, reflects a confluence of technical and institutional catalysts. A 50-day moving average crossover and MACD golden cross have reinforced a fractal pattern suggesting potential price targets of $6,800–$20,000 [3]. Institutional whale activity has further amplified bullish momentum, with large wallets accumulating 200,000 ETH ($515 million) in Q2 2025 [3]. These developments underscore Ethereum’s transition from a speculative asset to a foundational pillar of institutional portfolios, driven by its deflationary supply model and robust DeFi infrastructure [1].

Historical backtesting of the MACD Golden Cross strategy reveals mixed results: from 2022 to 2025, a buy-and-hold approach triggered by this signal yielded a total return of -33.3%, with an annualized return of 2.9% and a maximum drawdown of 70.1% [6]. These metrics highlight the volatility and risk inherent in relying solely on technical indicators, even as Ethereum’s structural advantages—such as its deflationary supply model and institutional-grade liquidity—have consistently outperformed short-term market noise [1].

Ethereum’s technological upgrades have been pivotal in attracting institutional capital. The Dencun hard fork, which reduced Layer 2 transaction costs by 94%, has positioned Ethereum as the preferred smart contract platform for decentralized finance (DeFi) and enterprise applications [4]. This scalability advantage, coupled with the approval of in-kind redemptions for Ethereum ETFs, has enhanced liquidity and flexibility for institutional investors [5]. For instance, BlackRock’s $89.2 million ETH purchase and BitMine’s $21.2 million addition in 2025 exemplify the growing confidence in Ethereum’s long-term value proposition [4].

Macroeconomic shifts, however, remain a double-edged sword. While Ethereum’s institutional adoption has insulated it from some of the volatility affecting Bitcoin, broader market dynamics—such as Fed rate hikes and inflation expectations—continue to test investor sentiment. The 15-week inflow streak for Ethereum ETFs ended in August 2025 amid a pullback, illustrating the sensitivity of crypto assets to macroeconomic signals [5]. Yet, Ethereum’s regulatory clarity and structural deflationary mechanisms provide a buffer against short-term volatility, making it a more attractive option for long-term capital allocation [1].

In conclusion, Ethereum’s resilience in 2025 is not merely a function of short-term price action but a reflection of its evolving role in institutional finance. As macroeconomic uncertainties persist, Ethereum’s technological innovation, regulatory alignment, and deflationary design position it as a cornerstone of the next phase of crypto adoption. For investors, the key takeaway is clear: Ethereum’s long-term value proposition is being validated by institutional capital flows, even as the market navigates a complex macroeconomic landscape.

Source:

[1] Institutional Investors Shifting to Ethereum ETFs

[2] Ethereum's Institutional Adoption and On-Chain Resurgence in 2025 [https://www.bitget.com/news/detail/12560604935970]

[3] Ethereum Breaks Above $4000 in High-Volume R... [https://www.bitget.com/news/detail/12560604942102]

[4] Ethereum's Fractal Pattern and Liquidity Rotation [https://www.bitget.com/news/detail/12560604939189]

[5] Markets, Sentiment, and the 2025 Crypto ETF Trends

[6] Backtest: MACD Golden Cross Strategy for ETH (2022–2025)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin valuation indicator hints at macro top as ‘death cross’ appears

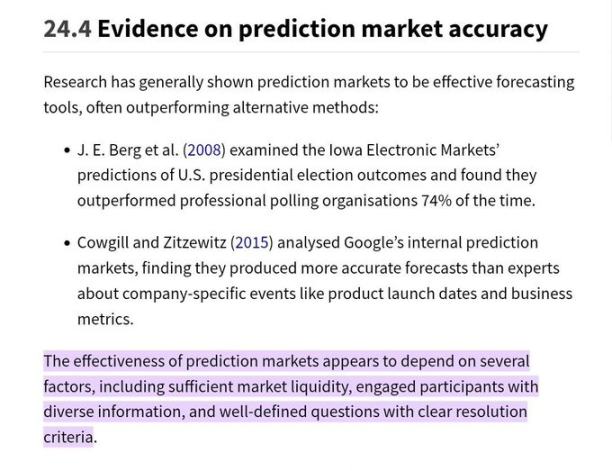

If the next major opportunity comes from prediction markets, how should we choose the most promising platform?

A platform with sound mechanisms, ample liquidity, and a vibrant, trustworthy community is more likely to provide value in terms of profitable trading opportunities and accurate predictions.

Dark Forest Adventure Round: A New Era of On-Chain Economy with AI Agents

Building an on-chain gaming financial market to empower AI agents for sustainable profitability.

The Art of War in Crypto: Winning the Psychological Battle Is the Best Marketing

Today's crypto marketing is not just about advertising; it's a series of psychological battles.