Venture Capitalists Bet Big on Programmable Stablecoins as Market Hits $280B

Contents

Toggle- Quick Breakdown

- Investors Pump Nearly $100M Into M0 and Rain

- M0 Secures $40M to Build Custom Stablecoin Infrastructure

- Rain Raises $58M to Power Regulated Stablecoins for Banks

- Programmable Money Gains Global Momentum

Quick Breakdown

- M0 and Rain raised nearly $100M to expand programmable stablecoin infrastructure.

- M0 builds custom stablecoins, while Rain enables banks to issue regulated tokens and manage cross-border payrolls.

- Global pilots in Kazakhstan, India, and TradeOS highlight the growing real-world adoption of programmable money.

Investors Pump Nearly $100M Into M0 and Rain

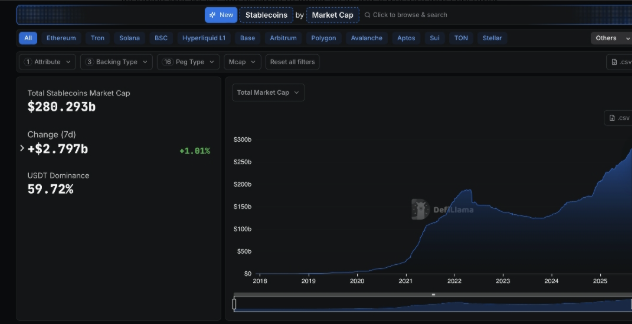

Venture capital firms are doubling down on the future of programmable stablecoins, with two major startups, Switzerland-based M0 and US-based Rain securing nearly $100 million in Series B funding this week. The funding surge comes as the global stablecoin market capitalization climbed to a record $280 billion, according to DefiLlama data.

Source

:

DefiLlama

Source

:

DefiLlama

M0 Secures $40M to Build Custom Stablecoin Infrastructure

Founded in 2023, M0 raised $40 million in a round led by Polychain Capital and Ribbit Capital. The platform enables developers to issue application-specific stablecoins with rules directly embedded into their design. M0’s infrastructure has already been integrated into MetaMask and Playtron, with the latter launching a “Game Dollar” for in-device purchases on its handheld gaming system.

Rain Raises $58M to Power Regulated Stablecoins for Banks

Meanwhile, Rain closed a $58 million Series B, led by Sapphire Ventures with participation from Dragonfly, Galaxy Ventures, and Samsung Next. The company specializes in giving banks and enterprises the tools to issue regulated stablecoins and manage programmable money flows.

Rain’s technology is already powering real-time payrolls in over 100 jurisdictions through its partnership with Toku. The firm has also expanded across Solana, Tron, and Stellar, supporting programmable spending programs and card services.

Programmable Money Gains Global Momentum

The concept of programmable money digital currency embedded with rules on how, when, and where it can be spent is increasingly being tested worldwide. In Kazakhstan, the digital tenge has been piloted for milestone-based rail project funding and VAT refund automation.

The Monetary Authority of India expanded its digital rupee pilot in May to include programmability and offline capabilities. In April, Plaza Finance launched the first programmable derivative tokens on Base, introducing bondETH and levETH, a new class of on-chain financial instruments designed to offer innovative Ethereum investment strategies in the DeFi space.

With programmable money accelerating beyond payments into areas like infrastructure, taxation, and trade, investors appear convinced that M0 and Rain are building the rails for the next generation of finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dive into Abraxas Capital’s Bold Portfolio Moves

In Brief Abraxas Capital strategically closed parts of its short positions for profit in recent market shifts. The fund’s portfolio strategies show different risk profiles, focusing on maximizing gains. Recent transactions demonstrate effective risk distribution strategies, maintaining the fund's profitability.

Bank of England to Lift Stablecoin Limits Once Economic Risks Subside

Vitalik Buterin Applauds Brevis’ Pico Prism: Real-Time Ethereum Block Proving in Seconds

Australia Targets Crypto ATMs Amid Surge in Money Laundering and Scams