FARM +32.04% in 24 Hours Amid Volatile Market Conditions

- FARM stock surged 32.04% in 24 hours on Aug 30, 2025, reversing a 56.46% monthly drop but remaining down 98% annually. - Analysts attribute the spike to speculative trading or algorithmic activity amid persistent bearish sentiment. - A backtest of 64 prior 5%+ gains showed a 6.7% win rate and -1.91% average return, indicating high risk post-large one-day jumps.

On AUG 30 2025, FARM rose by 32.04% within 24 hours to reach $29.48, FARM rose by 14.21% within 7 days, dropped by 56.46% within 1 month, and dropped by 3928.03% within 1 year.

The stock has shown a dramatic upward swing in the last 24-hour period, buckling a broader downward trend that has persisted over the previous month and year. This sharp intraday gain of 32.04% contrasts with its one-month loss of nearly 57%, indicating a possible reversal in sentiment or a response to a specific event or catalyst. Analysts project that the short-term surge may reflect investor speculation or algorithmic trading activity triggered by the recent volatility.

Despite the 24-hour increase, FARM continues to trade at a level far below its annual peak, with the stock still down by over 98% compared to a year ago. The recent rise appears to be isolated, given the broader context of its declining one-month and one-year performance. The sharp correction suggests that market participants remain cautious, with bearish expectations likely still dominating the long-term outlook. However, short-term momentum has clearly gained momentum, even if the broader trend remains negative.

The technical indicators used in analyzing FARM’s price behavior include historical event-based patterns that assess market performance following sharp gains. These patterns are particularly relevant for understanding how the stock reacts post-event. The most recent 24-hour gain of 32.04% places FARM within a specific historical subset of large one-day price increases, which can be used to evaluate the likelihood of further price movement.

Backtest Hypothesis

An event-based backtest was conducted on Farmer Bros (FARM.O) for all trading days that closed with a gain of 5% or more. This included 64 such events from 2022-01-01 to 2025-08-30. The findings indicate a generally negative impact following these large gains, with an average event excess return of -1.91% compared to the benchmark. The maximum excess return recorded within a 30-day window was a modest +0.53% on Day 1, while the minimum return fell to -4.80% on Day 29. The win-rate—measured as the percentage of days with positive excess return—stood at just 6.7%, underscoring the low probability of sustained positive momentum after such sharp one-day gains. Overall, the impact classification for these events is described as moderately negative, suggesting that investors may face increased risk when holding the stock in the days following a large one-day increase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

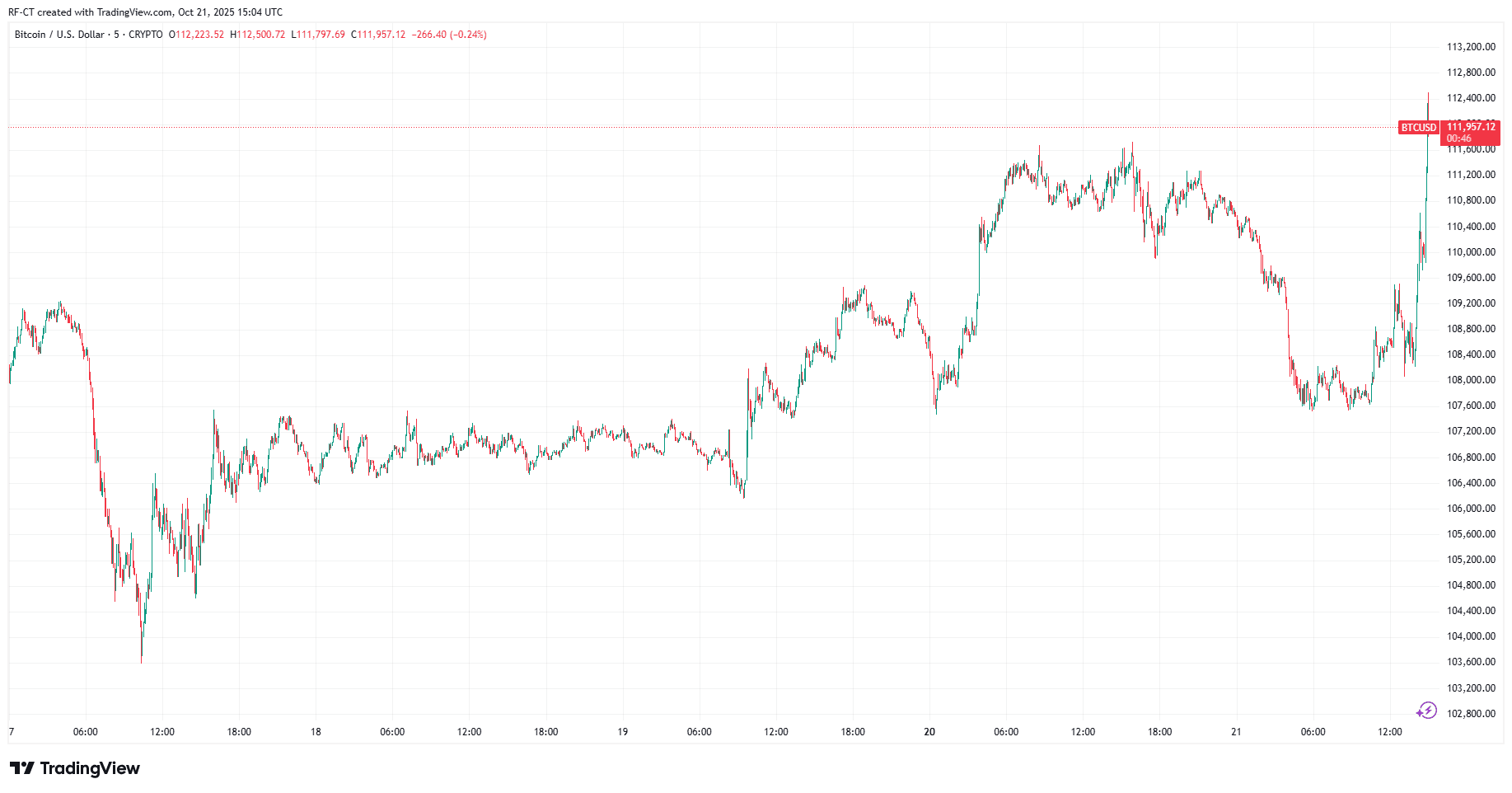

Bitcoin breaks through the $112,000 mark, Federal Reserve opens the door to cryptocurrencies: What happens next?

Bitcoin surged to over $112,000 after the US Federal Reserve indicated it would allow crypto companies to access its payment network. What does this mean for Bitcoin and the broader market?

Evernorth XRP Treasury: $1B Raise to Expand XRP Adoption

Quick Take Summary is AI generated, newsroom reviewed. Evernorth plans to raise over $1 billion through a SPAC merger to build the largest XRP treasury. Ripple, SBI Holdings, Pantera Capital, and other investors are backing the initiative. The treasury aims to increase XRP adoption, market stability, and institutional participation. Evernorth’s strategy shows how crypto and traditional finance can collaborate to boost digital asset utility.References BULLISH: RIPPLE-BACKED EVERNORTH WILL RAISE OVER $1 BILL

Google Cloud Boosts Etherlink Devs with $200K Credits and Web3 Support

Bitget Wallet introduces multichain gas abstraction for simpler crypto transactions