XRP News Today: Gumi Bets Big on XRP for Blockchain Future, Diversifying Beyond Bitcoin

- Japanese gaming firm Gumi allocates ¥2.5B to buy XRP (Ripple's token) for blockchain strategy, complementing prior ¥1B Bitcoin investment. - The move aligns with SBI Holdings (major shareholder) and Ripple's joint blockchain payment initiatives, including RLUSD stablecoin deployment in Japan. - XRP's utility in cross-border remittances and liquidity solutions drives institutional adoption, with Gumi reporting holdings quarterly for transparency. - Despite short-term XRP price volatility, Gumi emphasizes

Gumi, a Japanese gaming company listed on the Tokyo Stock Exchange, has announced a strategic allocation of ¥2.5 billion ($17 million) to purchase XRP , Ripple’s native token, as part of its broader blockchain business strategy. The acquisition, to be executed in a phased manner from September 2025 to February 2026, complements the company’s earlier investment of ¥1 billion ($6.6 million) in Bitcoin in February 2025, which is being staked through protocols like Babylon to generate revenue. Gumi described the move as part of a dual-asset strategy, leveraging Bitcoin for stability and XRP for growth opportunities in blockchain-based financial services.

The decision reflects a broader trend of institutional interest in XRP, particularly in cross-border payments and liquidity solutions. Gumi emphasized that XRP offers functional utility beyond its store-of-value properties, aligning with its vision to integrate blockchain technologies into its financial infrastructure. The company stated that the token's role in international remittance networks and its association with SBI Holdings—its largest shareholder and a long-term partner of Ripple—made it a strategic fit for its balance sheet. SBI and Ripple are also collaborating on the introduction of the RLUSD stablecoin in Japan by early 2026, which Gumi said further supports the decision.

Gumi’s acquisition of XRP is part of a growing trend of corporate adoption of the token. Several other publicly traded firms, including Webus International , Trident Digital , and VivoPower International, have similarly announced XRP treasury strategies in 2025, citing the token’s potential for appreciation and utility in blockchain finance. The company will report the value of its XRP and Bitcoin holdings quarterly in its income statement, demonstrating a commitment to transparency in digital asset management.

In terms of financial rationale, Gumi believes that XRP’s use in remittances and liquidity provision positions it to benefit from the expansion of blockchain-based financial infrastructure, particularly in Asia. By aligning with SBI Ripple Asia—a joint venture focused on deploying blockchain payment systems in the region—the company aims to strengthen its competitive position in the payments sector. This strategy is distinct from Bitcoin’s role, which Gumi continues to use as a core asset for income generation and portfolio stability.

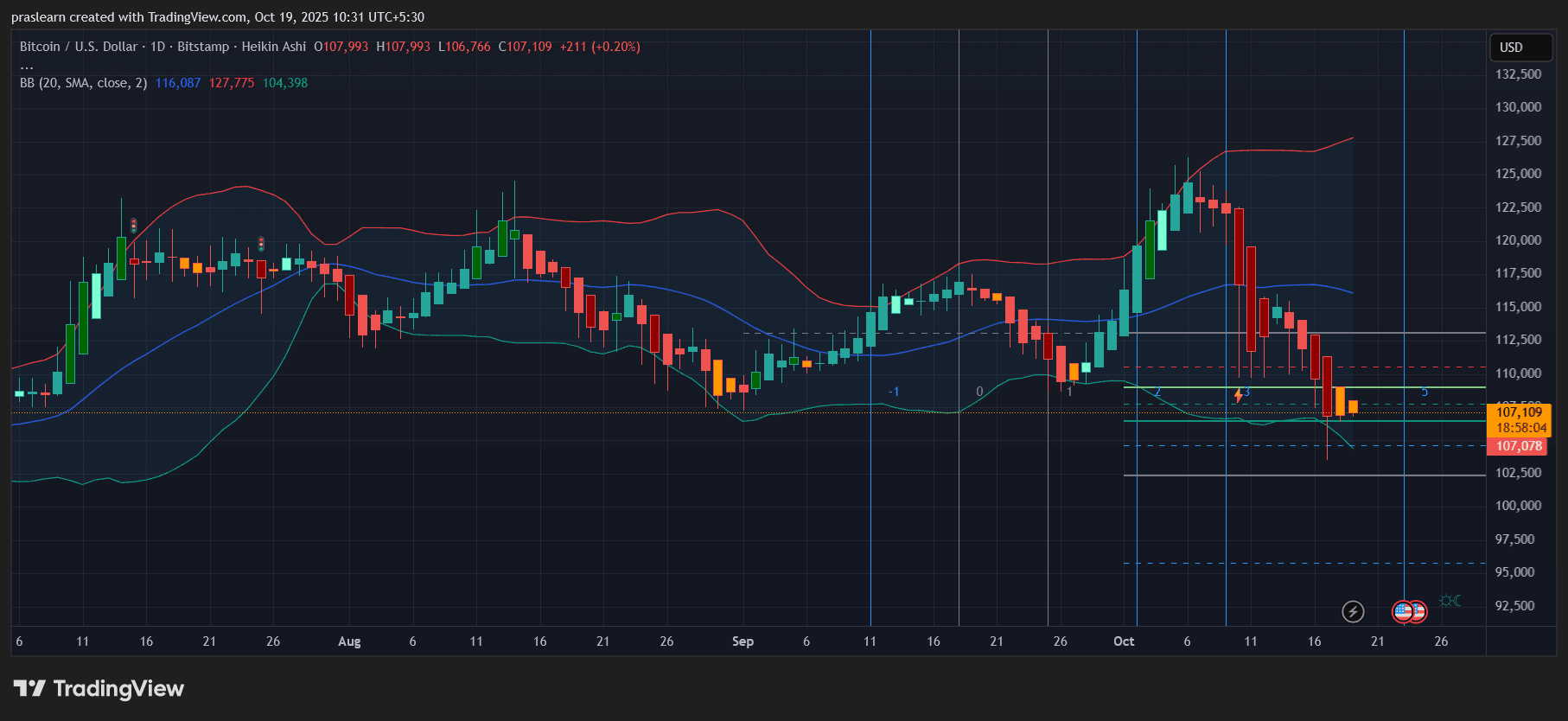

Market conditions at the time of the announcement saw XRP trading at $2.82, reflecting a 5% intraday decline as traders took profits after breaking key support levels earlier in the week. Despite the short-term volatility, Gumi’s strategy appears to focus on long-term appreciation potential. The company noted that it will continue to evaluate its holdings based on market conditions and the evolving landscape of blockchain-based financial services.

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is Bitcoin’s $100K Floor at Risk as the Fed Struggles to Find Its “Neutral” Rate?

Bitcoin Consolidates Near $107K: Analysts Have THIS Bitcoin Prediction...

JST buyback and burn proposal officially launched to drive TRON ecosystem value upgrade with a deflationary model

The proposal plans to use the net income of JustLend DAO and all excess profits exceeding 10 million US dollars in the USDD ecosystem to buy back and burn JST tokens.