Bitcoin price is testing the $110K–$112K support as MACD shows weakening momentum; sustained demand above $107K and rising Stock‑to‑Flow support the long‑term bullish case, but persistent taker selling and low on‑chain activity increase short‑term downside risk.

-

BTC testing $110K–$112K support with a bearish MACD cross

-

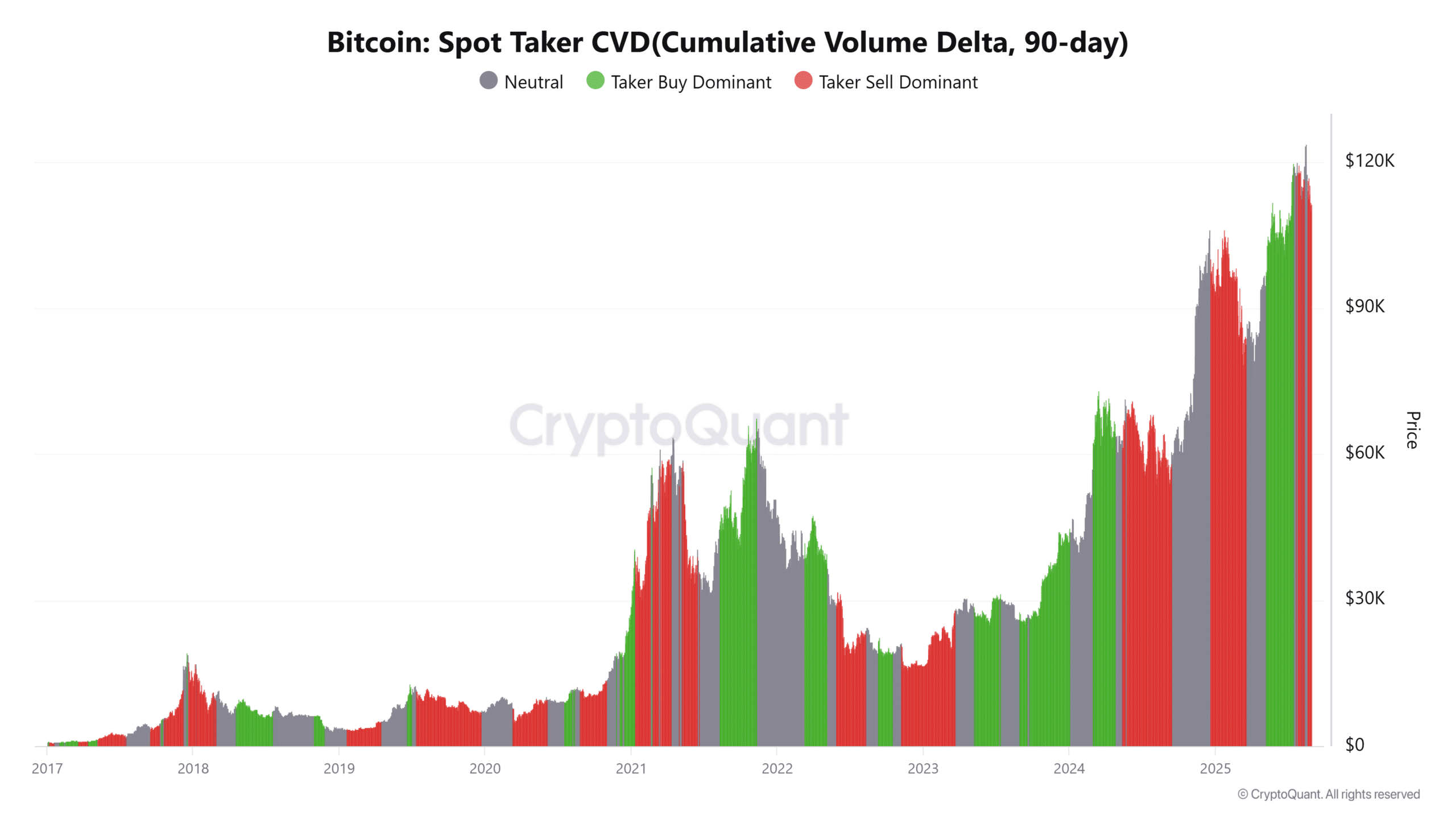

Spot Taker CVD shows sellers dominating flows over the last 90 days

-

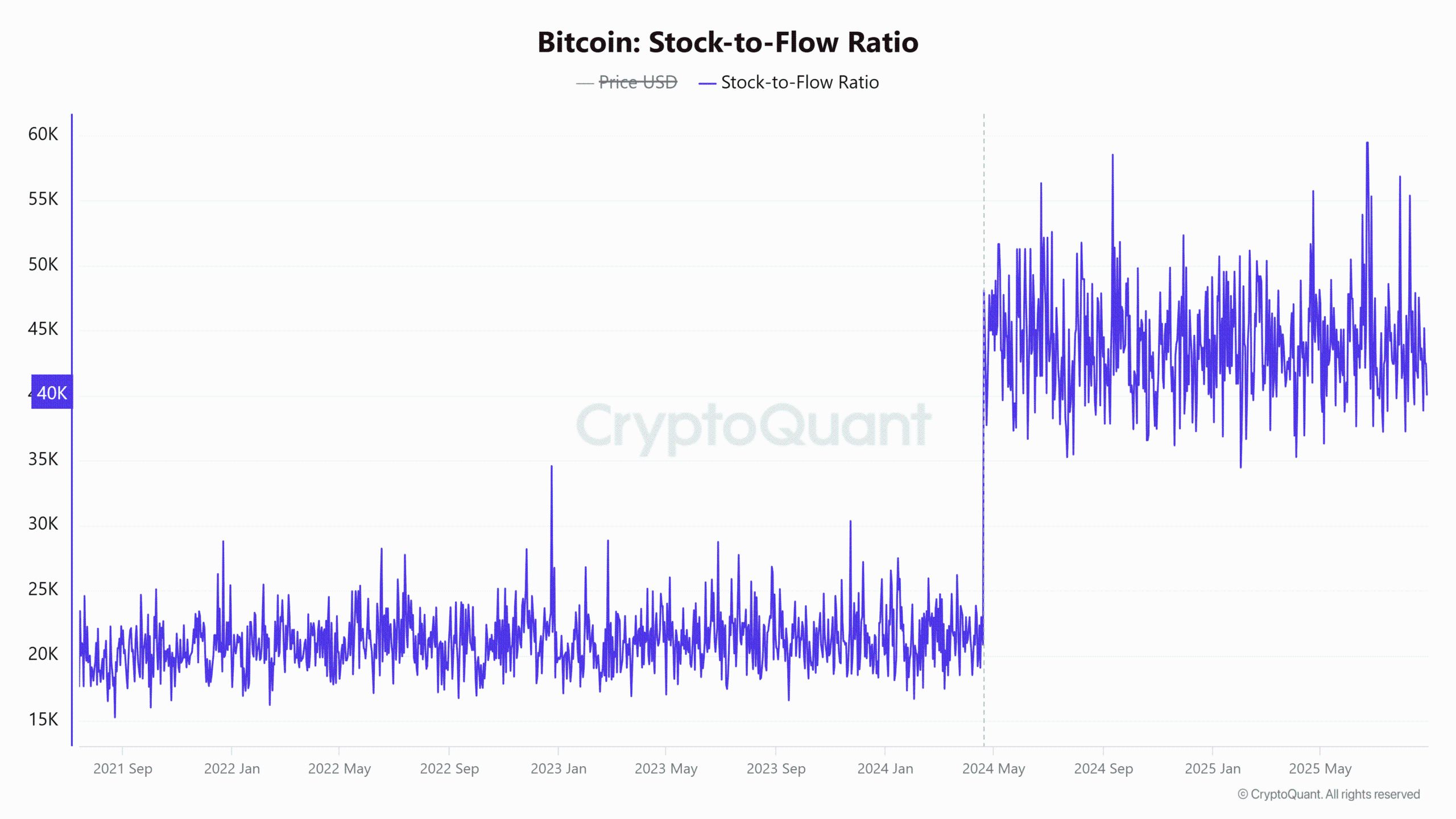

Stock‑to‑Flow doubled, reinforcing long‑term scarcity despite weak NVT activity

Bitcoin price retreats to $110K–$112K as MACD weakens; check demand zones and on‑chain metrics to gauge whether a move to $150K remains feasible — read analysis now.

Can Bitcoin hold critical zones as MACD points to weakening momentum?

Bitcoin price has retraced toward the $110K–$112K support band, sitting just above the 0.786 Fibonacci retracement. The MACD has produced a bearish cross, indicating fading momentum after a sustained rally. Sustaining above $111K would limit downside risk and reduce the chance of a test near $105K.

Source: TradingView (plain text)

Will persistent selling pressure keep dominating flows?

Spot Taker CVD over the past 90 days shows a net tilt toward sellers. Large taker activity has repeatedly capped rallies at resistance levels, producing heavy rejection. Low liquidity exacerbates the effect: when selling pressure remains, price moves downward with less absorbed demand.

What could flip the balance?

A meaningful reduction in taker selling or a sudden increase in buy-side aggression could spark outsized rebounds because available liquid supply is compressed. Monitor whale behavior and exchange flow metrics for early signs of shift.

Source: CryptoQuant (plain text)

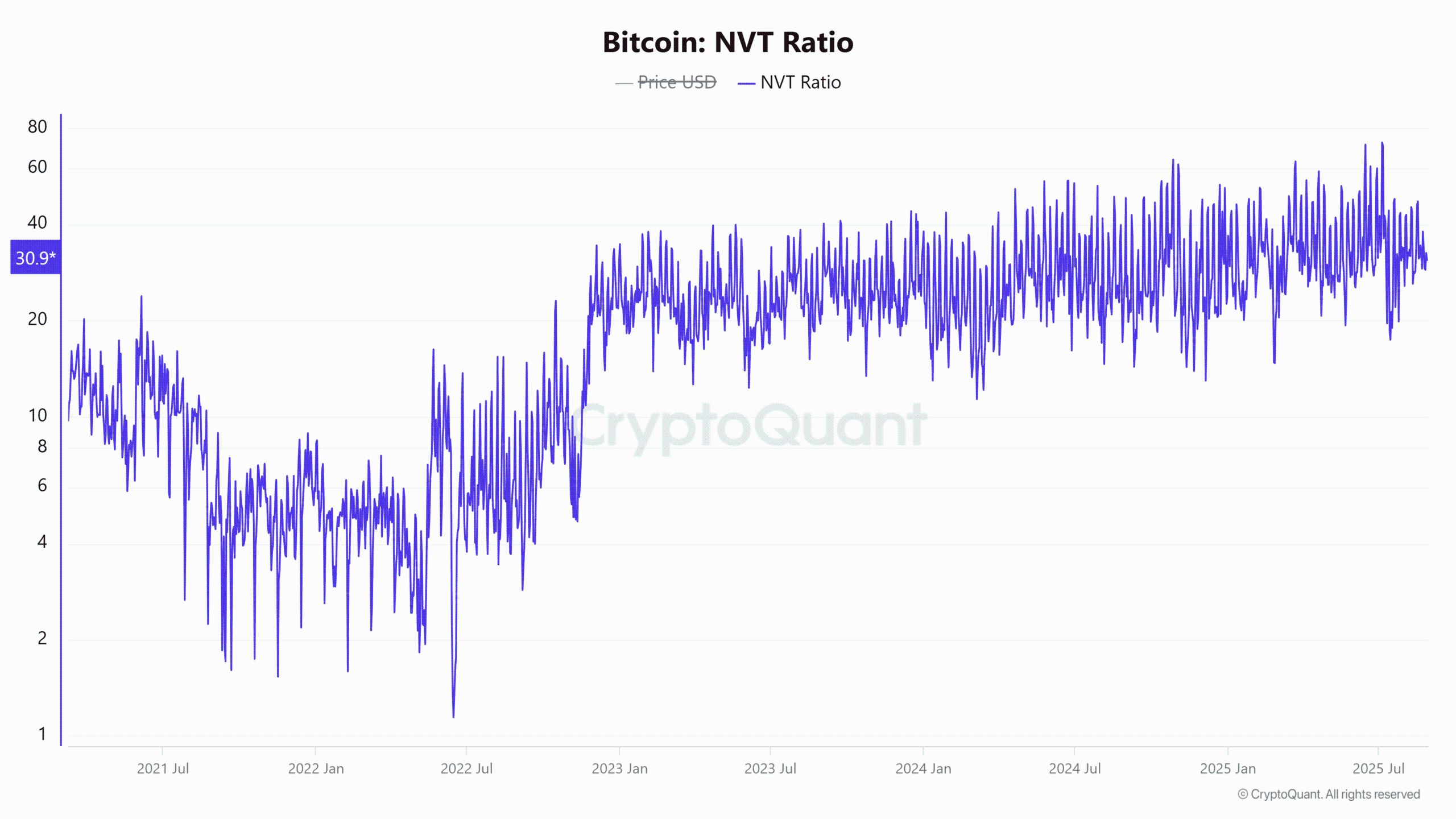

Does weakening NVT ratio point to declining network strength?

The NVT ratio fell roughly 4% to about 31, signaling transaction activity lagging market value. Lower capital rotation across the chain suggests weaker organic demand, creating potential overvaluation risk if on‑chain metrics do not recover. The ratio still sits in a neutral band, so renewed usage could restore confidence.

Source: CryptoQuant (plain text)

Is scarcity still the ultimate weapon in Bitcoin’s arsenal?

The Stock‑to‑Flow metric has risen about 100% to roughly 3.18 million, reinforcing Bitcoin’s scarcity narrative as new issuance tightens. Scarcity supports long‑term valuation arguments and historically aligns with recovery phases after corrections. Short‑term volatility, however, remains governed by flows and activity.

Source: CryptoQuant (plain text)

Can Bitcoin really stretch to $150K or will supply fragility trigger a correction?

Bitcoin’s outlook is bifurcated. If illiquid supply remains locked and large holders refrain from selling, scarcity could propel price toward $150K. Conversely, continued taker selling combined with weakening momentum could force deeper tests near $105K. The market’s capacity to absorb volatility will decide which scenario unfolds.

Frequently Asked Questions

How likely is a drop to $105K given current indicators?

With a bearish MACD cross and dominant taker selling, a test of $105K is plausible if demand above $107K fails to hold. Watch on‑chain flows and exchange balances for confirmation.

What on‑chain metrics should traders monitor right now?

Focus on Spot Taker CVD, NVT ratio, liquid supply levels and exchange inflows/outflows. These metrics signal whether selling pressure is structural or temporary.

Key Takeaways

- Short‑term caution: MACD and taker flows increase downside risk toward $105K.

- Scarcity intact: Stock‑to‑Flow surge supports longer‑term bullish case.

- Watch liquidity: Low liquid reserves mean small shifts in selling can produce outsized moves.

Conclusion

Bitcoin price faces a decisive moment where weakening momentum meets persistent seller dominance, even as Stock‑to‑Flow highlights structural scarcity. Traders should prioritize on‑chain flows and demand zones for confirmation. COINOTAG will continue monitoring indicators and provide updates as conditions evolve.