US banks moved $312B in dirty money, but critics still blame crypto

US banks were responsible for moving $312 billion for Chinese money launderers between 2020 and 2024, according to a new report.

In a US Financial Crimes Enforcement Network (FinCEN) advisory on Thursday, the watchdog analyzed over 137,000 Bank Secrecy Act reports from 2020 to 2024.

It found that over $62 billion per year on average has gone through the US banking system from Chinese money launderers.

Chinese money-laundering networks have formed a symbiotic relationship with Mexico-based drug cartels. The cartels need to launder US dollar drug proceeds, while Chinese gangs want US dollars to circumvent China’s currency control laws, it reported.

“These networks launder proceeds for Mexico-based drug cartels and are involved in other significant, underground money movement schemes within the United States and around the world,” said FinCEN Director Andrea Gacki.

Beyond drug money laundering, Chinese gangs are involved in human trafficking and smuggling, healthcare fraud and elder abuse. They are also involved in real estate money laundering to the tune of $53.7 billion in suspicious transactions, the report added.

Crypto still gets unfair rap

Despite this, crypto has often been singled out for money laundering and illicit purposes by pro-banking politicians such as the ranking member of the Senate Banking Committee, Senator Elizabeth Warren.

“Bad actors are also increasingly turning to cryptocurrency to enable money laundering,” she said earlier this year, demanding tougher regulations.

The latest figures reveal an often suppressed fact, that most money laundering has nothing to do with crypto.

Source: Nate Geraci

Source: Nate Geraci

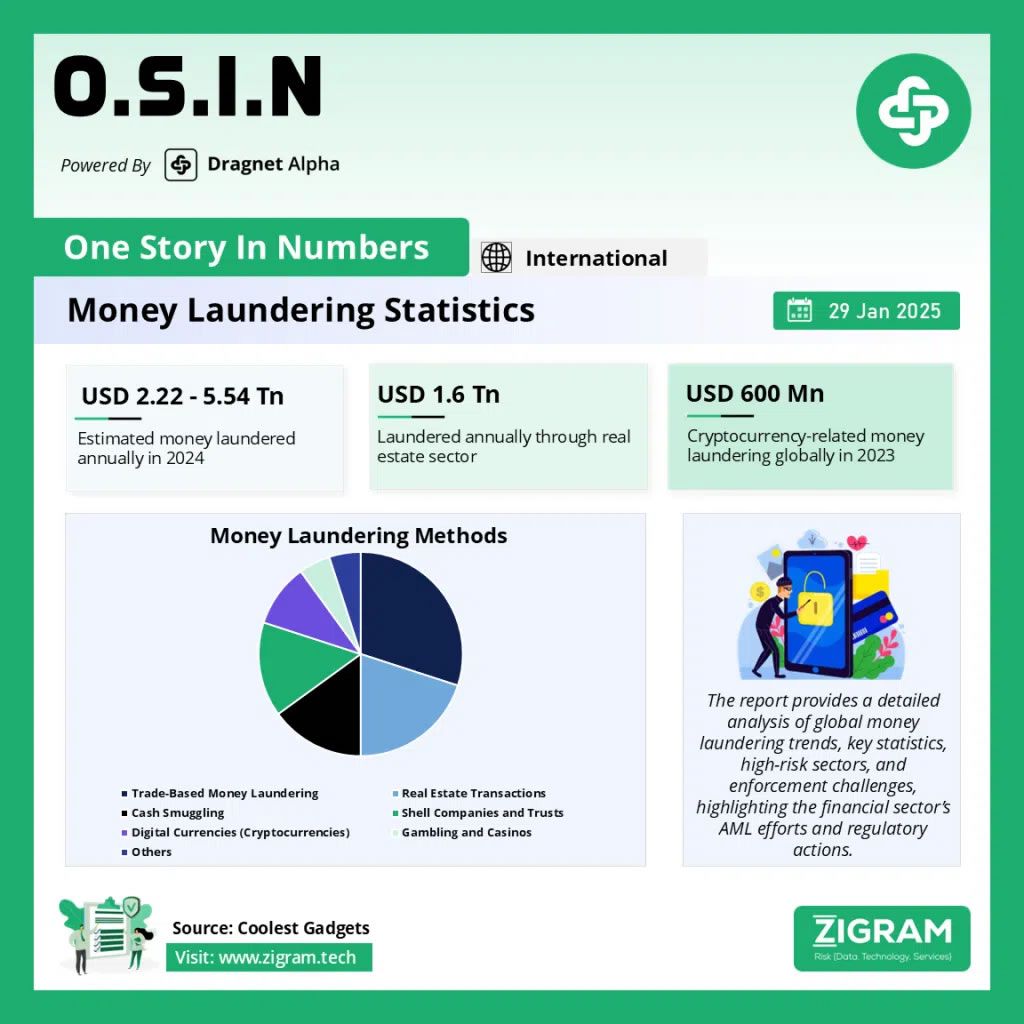

According to the United Nations Office on Drugs and Crime, the estimated amount of money laundered globally in one year is more than $2 trillion.

In comparison, the entire cryptocurrency space’s illicit crypto volumes totalled around $189 billion over the last five years, according to Chainalysis.

“Illicit activity is but a small fraction of the crypto ecosystem. We estimate that it is less than 1% of overall crypto volume,” TRM Labs head of policy and strategic partnerships, Angela Ang, told Cointelegraph.

“FinCEN's findings align with a broader pattern - these underground banking networks function as a shadow financial system for organized crime worldwide, operating at the seams of banking systems,” Ang said.

Money laundering through cash and banks dwarfs the amount laundered with crypto. Source: Zigram

Money laundering through cash and banks dwarfs the amount laundered with crypto. Source: Zigram

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BIGTIME +52.99% in 24 Hours Amid Market Volatility

- BIGTIME surged 52.99% in 24 hours to $0.05115, but remains down 1650.42% annually amid ongoing market struggles. - Traders analyze the sudden move, with analysts predicting short-term volatility but uncertain long-term stability without broader market shifts. - RSI and MACD indicators show mixed signals, reflecting indecision as buyers and sellers react to short-term swings.

TRB -170.58% in 1 Month Amid Major Technical Breakdown

- TRB plunged 230.84% in 1 month and 4800.76% in 1 year amid major technical breakdowns. - Bearish momentum intensifies as RSI hits oversold levels and MACD confirms weakening bullish trends. - Analysts warn of further downside below $30, with key support levels under pressure and bear market risks rising. - Backtesting strategies using RSI/MACD crossovers aim to evaluate short-term bearish signal effectiveness.

Is Palantir's Bear Flag a Buying Opportunity or a Warning Sign?

- Palantir's stock forms a bear flag pattern, signaling potential decline to $130–$135. - Analysts and traders debate technical signals, with conflicting bullish and bearish forecasts. - Mixed fundamentals and market sentiment highlight risks and opportunities for investors.

Injective (INJ) at a Pivotal Technical Crossroads: Is $12.30 the Final Barrier Before a $20 Rebound?

- Injective (INJ) hinges on $12.30 support to stabilize or trigger a deeper correction amid volatile altcoin markets. - Technical indicators show mixed signals: RSI near neutral, bearish MACD, and oversold Stochastic hinting at potential short-term reversals. - Institutional adoption (e.g., BitGo integration) and $14.10 breakout potential suggest $20 targets, but regulatory risks and weak CMF inflow temper optimism.