Bitmine Immersion accelerates ETH accumulation with $354.6M purchase

Bitmine Immersion has added 78,791 ETH to its treasury, bringing the total holdings to nearly 1.8 million ETH.

- Bitmine Immersion spent $354.6 million to acquire 78,791 ETH, raising total holdings to 1,792,960 ETH, valued over $8 billion.

- The company aims to hold 5% of Ethereum’s total supply.

- Tom Lee predicts ETH could hit $5,500 and potentially surge to $10,000–$16,000 by year-end.

- Strategic pivot from Bitcoin to Ethereum was announced in late June, backed by a $250 million capital raise.

Bitmine Immersion has added 78,791 Ethereum ( ETH ) to its holdings, spending approximately $354.6 million. The purchase brings the firm’s total Ethereum holdings to 1,792,960 ETH, valued at over $8 billion as ETH trades around $4,400. It also brings Bitmine closer to its stated goal of acquiring 5% of the total ETH supply .

This latest buy continues Bitmine Immersion’s aggressive Ethereum accumulation strategy. The publicly-traded company, under the leadership of Tom Lee , announced its strategic pivot from Bitcoin ( BTC ) mining to Ethereum accumulation in late June. That move was marked by a $250 million capital raise aimed at purchasing Ethereum as the company’s primary treasury reserve asset. The announcement led to a 3000% surge in BitMine’s stock price.

Bitmine Immersion leads institutional ETH accumulation

Bitmine Immersion’s pivot to ETH accumulation reflects the growing institutional interest in Ethereum this bull cycle. The trend contrasts sharply with the previous cycle, when ETH largely lacked significant corporate or institutional treasury backing.

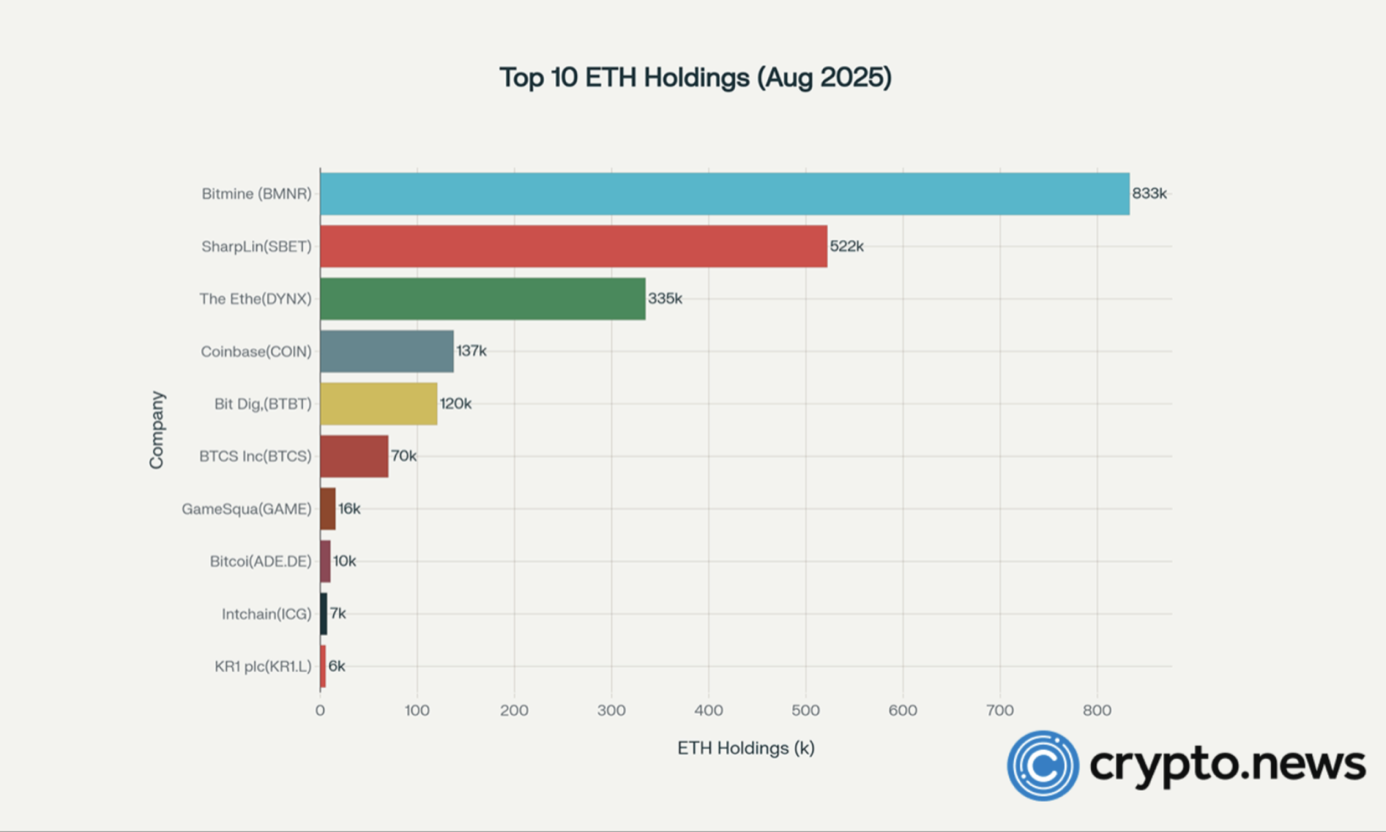

Alongside Bitmine, other publicly traded ETH treasury firms, including SharpLink Gaming (SBET) and BTCS Inc. (BTCS), are seeing similar momentum.

Source: crypto.news

Source: crypto.news

Analysts suggest that ETH treasury stocks may offer more compelling valuations and operational flexibility than ETFs, as these companies combine liquidity, efficiency, and potential upside through capital structures not available in passive ETF products.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor hints at next Bitcoin buy as BTC falls below $88K

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?