Nvidia Smashes Q2 Earnings but Faces China Sales Roadblock

Contents

Toggle- Quick Breakdown

- Q2 revenue hit $46.7B, net income topped $26.4B

- Nvidia Beats Wall Street in Record-Breaking Quarter

- Market Giant With Geopolitical Weight

- China Business on Pause Amid Export Curbs

Quick Breakdown

Q2 revenue hit $46.7B, net income topped $26.4B

- EPS beat expectations at $1.08 (GAAP) and $1.05 (non-GAAP)

- No H20 chip sales to China amid U.S. export controls

Nvidia Beats Wall Street in Record-Breaking Quarter

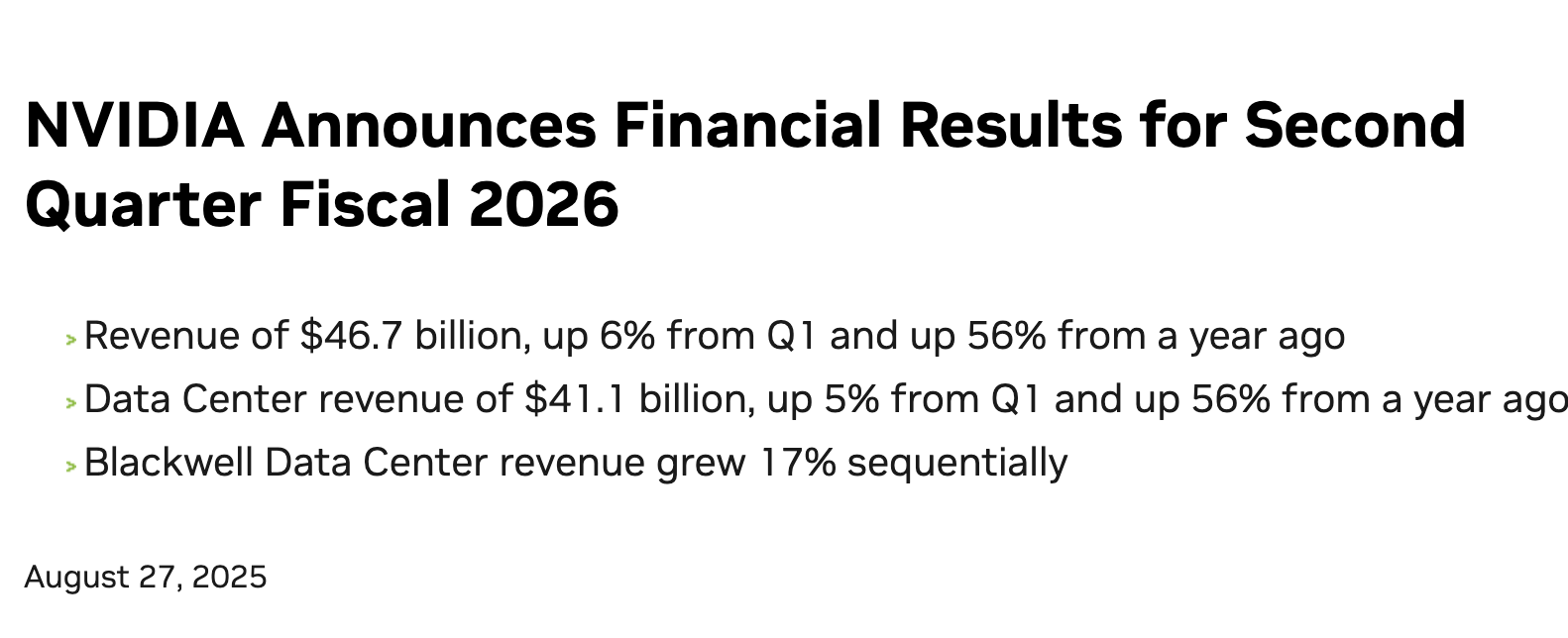

In an August 27 announcement , chipmaking giant Nvidia delivered another blowout quarter, surpassing analyst forecasts for both revenue and profit. For the second quarter of its fiscal year 2026, the company reported revenue of $46.7 billion, up 6% from the prior quarter and 56% higher year-over-year. Net income surged to $26.4 billion, with profit margins reaching an eye-popping 72.4%.

Source:

Nvidia

Source:

Nvidia

“NVIDIA NVLink rack-scale computing is revolutionary, arriving just in time as reasoning AI models drive orders-of-magnitude increases in training and inference performance. The AI race is on, and Blackwell is the platform at its center.”

said Jensen Huang, founder and CEO of NVIDIA

Earnings per share (EPS) came in at $1.08 on a GAAP basis and $1.05 on a non-GAAP basis, both ahead of Wall Street’s estimates. Despite the strong results, Nvidia shares slipped 3.3% in after-hours trading on Wednesday according to Tradingview data, suggesting investor caution about the company’s future growth trajectory.

Market Giant With Geopolitical Weight

Nvidia now holds the title of the world’s most valuable publicly traded company, boasting a market capitalization of over $4.4 trillion. Beyond its dominance in AI and computing hardware, Nvidia’s strategic role in global supply chains has made it a centerpiece of U.S. industrial and foreign policy.

China Business on Pause Amid Export Curbs

A key focus of the earnings call was Nvidia’s sales to China, particularly its H20 processor, a lower-powered version of its flagship H100 chip tailored to meet U.S. export restrictions. Nvidia confirmed that no H20 shipments were made to Chinese customers in Q2.

The restrictions stem from U.S. national security concerns. In January, the Trump administration imposed stringent controls on H20 exports to China, including licenses and fees worth $5.5 billion, effectively stalling sales.

While the administration reversed course in August, greenlighting resumed shipments, it came with a costly trade-off: Nvidia must surrender 15% of revenue from any H20 sales to China back to the U.S. government.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

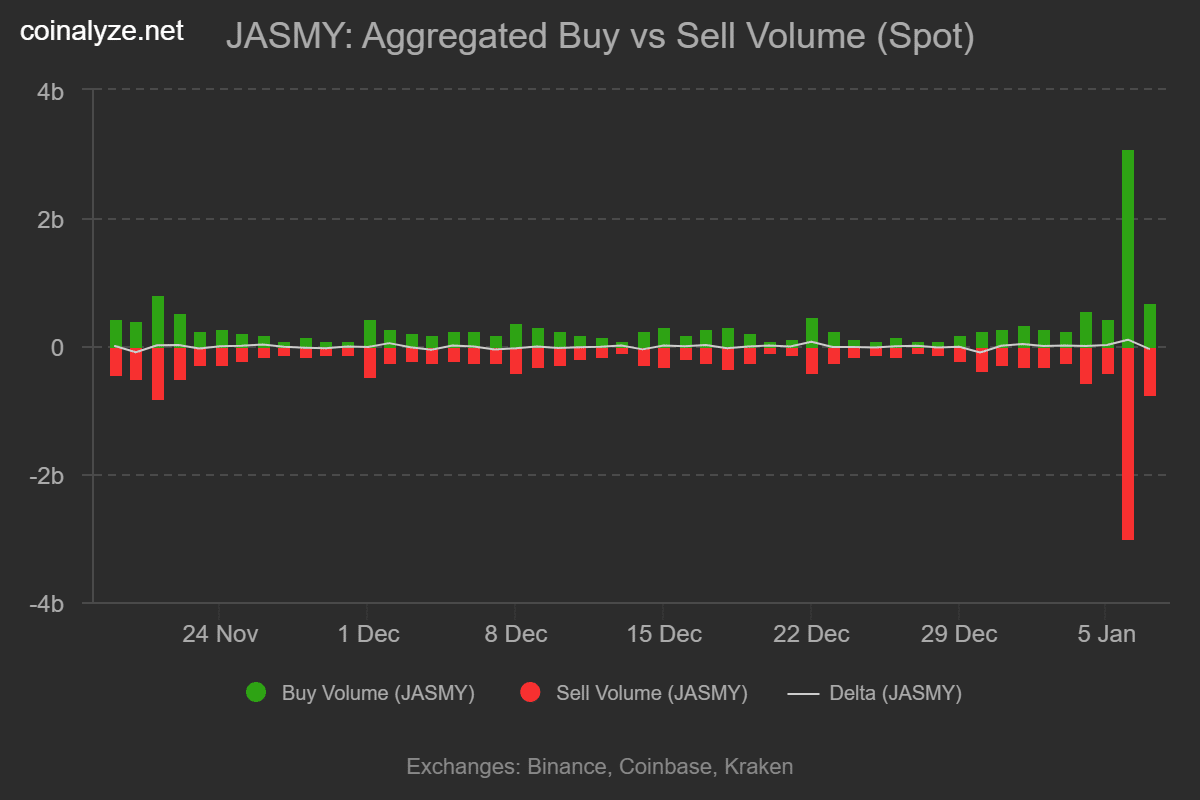

JasmyCoin surges 12%, breaks its range – Can this rise continue?

Metals Experience Profit-Taking Ahead of Crucial Data Release