Stablecoin Surge Could Fuel 100x Gains in Key DeFi Tokens by 2028

- Arthur Hayes predicts 51x, 34x, and 126x gains for ENA, ETHFI, and HYPE by 2028, driven by stablecoin dominance and global liquidity shifts. - He highlights Codex, a stablecoin infrastructure project, as pivotal for DeFi growth and financial inclusion in the Global South. - Despite speculative nature, his bold forecasts aim to shape investor sentiment, emphasizing stablecoin adoption's potential to create a "once-in-a-century" DeFi bull market.

Arthur Hayes, the co-founder of BitMEX, has outlined a bold forecast for three altcoins—Ethena (ENA), Ether.fi (ETHFI), and Hyperliquid (HYPE)—anticipating exponential gains by 2028. According to Hayes, these tokens could rise by 51x, 34x, and 126x respectively, driven by a shift in global liquidity dynamics and the growing dominance of U.S.-dollar pegged stablecoins. His analysis ties the potential for these gains to the increasing adoption of stablecoins, which he believes could capture up to $34 trillion in global deposits, particularly in the Global South [1].

Hayes highlights the role of infrastructure and culture-driven tokens in capitalizing on this market transformation. Projects like Ethena and Ether.fi, which focus on liquid staking and blockchain infrastructure, are positioned to benefit from the influx of capital into DeFi ecosystems. At the same time, tokens with strong cultural relevance, such as Hyperliquid, are expected to outperform in short-term rallies due to their appeal to speculative traders [1]. His projections are based on a macroeconomic framework in which U.S. monetary policy and the restructuring of the Eurodollar system play pivotal roles in reshaping global finance [2].

Currently, ENA trades near $0.64, with stable performance observed in recent weeks, while ETHFI is valued around $1.09 after experiencing a decline. In contrast, HYPE has broken past $50, marking a new all-time high and demonstrating strong market momentum. Hayes notes that these price movements reflect broader sentiment and liquidity trends, which could be further amplified as stablecoins become more integrated into mainstream financial systems [1].

Beyond individual tokens, Hayes emphasizes the role of Codex , a stablecoin infrastructure project he describes as a pioneering crypto bank. By providing real-time on-chain accounting and banking services for decentralized finance, Codex could facilitate greater integration of stablecoins into global financial systems, particularly in regions with limited access to traditional banking [1]. Hayes sees stablecoin-backed platforms as critical infrastructure that could enable new lending models and broader financial inclusion, especially in the Global South [2].

The former BitMEX CEO’s predictions have sparked considerable discussion within the crypto community, despite the speculative nature of the figures. He acknowledges that only 25% of his past predictions have proven accurate but maintains that bold forecasts help shape investor sentiment. His vision is centered on the idea that stablecoin adoption, combined with regulatory and technological shifts, could create a “once-in-a-century” bull market for DeFi [4]. While such a transformation depends on factors like the integration of stablecoin wallets into social media platforms and the potential for U.S. monetary policy to redirect global capital flows, Hayes remains confident in the long-term trajectory of DeFi infrastructure [3].

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Sees 2.25 Billion USDC Minted In September

Quick Take Summary is AI generated, newsroom reviewed. Solana recorded $2.25 billion USDC Mint during September 2025 Institutions prefer Solana for speed, liquidity, and regulatory clarity GENIUS Act rules boost compliance trust for institutional stablecoin adoption Public companies increasingly use Solana treasuries for staking and yield Circle expands USDC Mint globally under MiCA and e-money frameworksReferences $2.25B $USDC Minted on Solana This Month

Forward Industries to tokenize company stock and operate fully on Solana blockchain

Get Your Bitcoin and Ethereum via PayPal: P2P Payments Have Just Entered the Cryptocurrency Space

PayPal has launched peer-to-peer payments for Bitcoin and Ethereum, allowing users to send and receive cryptocurrencies directly through its platform more easily than before.

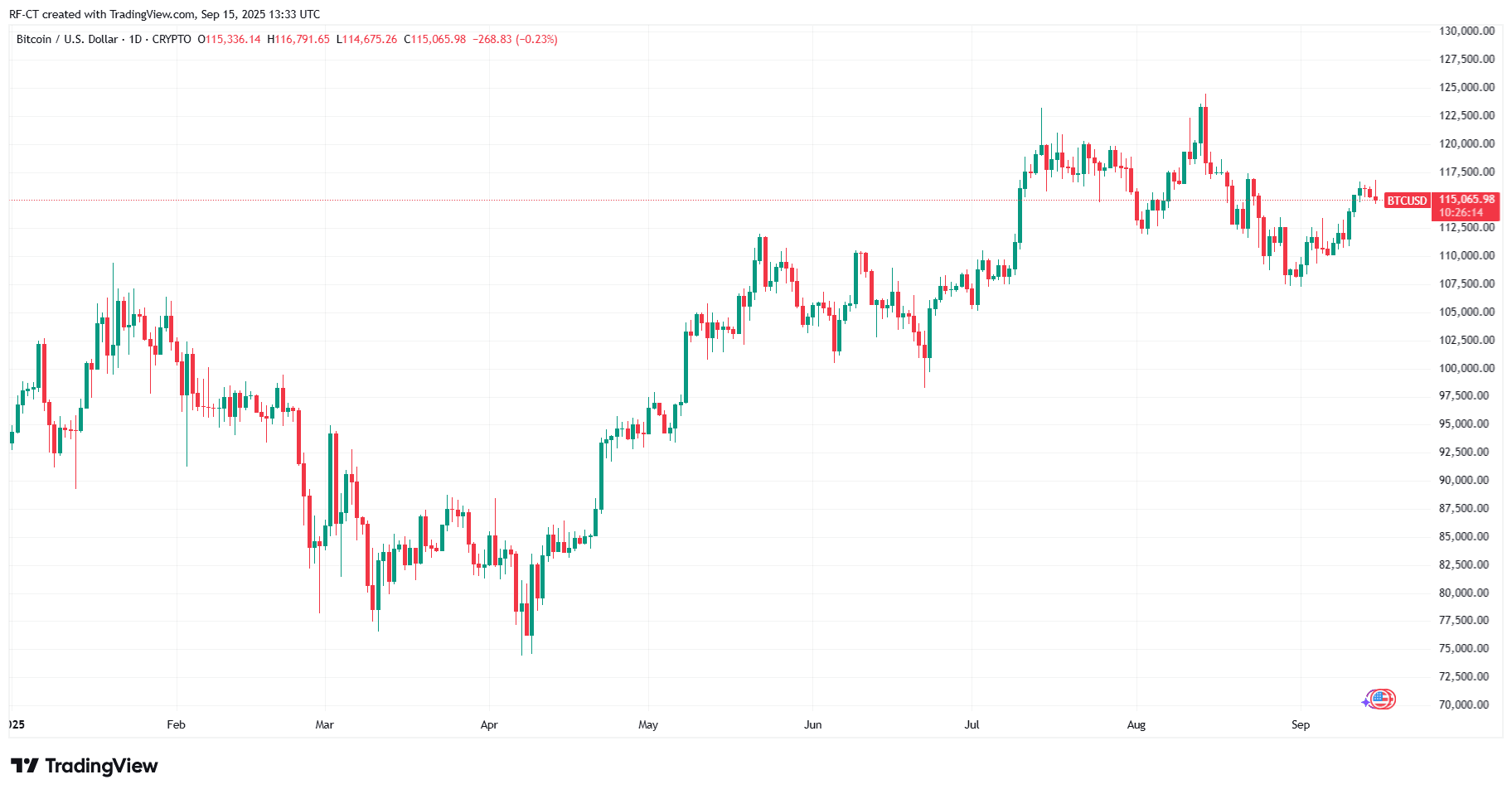

Bitcoin eyes long liquidations as gold passes $3.7K for first time