The Evolution of the Monetary System: From Gold to Stablecoins

Although stablecoins rely on sovereign credibility like traditional fiat currencies, they are able to separate trust in sovereignty from trust in corporate power.

Although stablecoins, like traditional fiat currencies, rely on sovereign credibility, they are able to separate trust in sovereignty from trust in corporate power.

Written by: Jacob Wittman, Plasma Legal Advisor

Translated by: AiddiaoJP, Foresight News

What is Money?

In July 1944, as World War II was nearing its end, representatives from more than 40 countries gathered in a small town in New Hampshire to answer a seemingly simple question: What is money, and who controls it? The Bretton Woods Conference was not the first time global leaders had discussed this issue, nor would it be the last. The debates about gold, the US dollar, and exchange rates built the architecture of the modern global financial system.

For thousands of years, every major monetary transformation has revolved around a fundamental question: What gives money its value? Debates about the value of money often involve its sovereignty and scarcity.

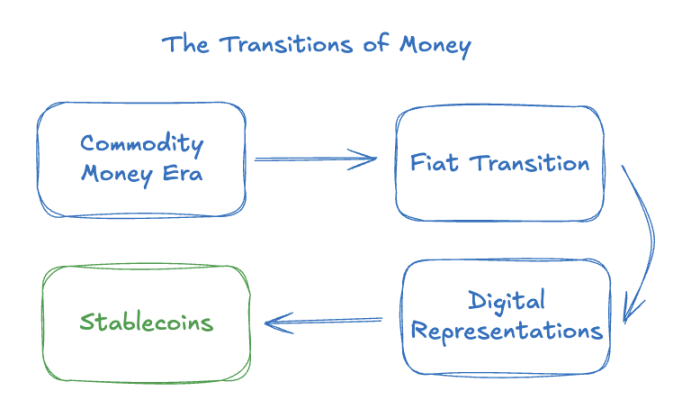

Every monetary transformation is less about the physical form of money and more about trust, power, and the rules of the game. Stablecoins are the latest direction in this round of transformation, as trust and power are becoming decentralized. We believe stablecoins are currently the most influential form of money.

The Era of Commodity Money

The earliest known forms of money were commodities such as gold, silver, shells, and salt. These items had intrinsic value or were widely recognized as valuable, a value derived from their physical scarcity. For example, the supply of gold is limited and must be mined, a process that is both difficult and expensive.

Scarcity brings credibility. If you hold a gold coin, you can trust it as a good "store of value" because no government or banker can simply print more gold out of thin air.

On the island of Yap in Micronesia, money took the form of huge limestone disks, some weighing several tons, quarried from Palau. Their value depended on size, difficulty of transport, and origin. Since ownership was tracked by community consensus rather than physical movement, these stones demonstrate that the power of money comes from shared belief, not intrinsic value.

But this form also brought limitations. Commodity money was heavy, difficult to transport, and inefficient in a rapidly growing global economy. These physical constraints limited payment efficiency and hindered economic growth. Long-distance trade required a system that could transcend the weight of metals and capital constraints.

The Shift to Fiat Currency

Ultimately, the combination of globalization and industrialization pushed commodity money to its breaking point. Governments intervened and introduced fiat currency. Paper money was initially redeemable for gold or silver and gradually became widely accepted as money itself. The Bretton Woods system institutionalized this ecosystem by pegging the US dollar to gold and other world currencies to the US dollar.

This monetary system operated for roughly 25 years. However, by the late 1960s, US gold reserves could no longer support the dollar’s global dominance. In 1971, President Nixon suspended the dollar’s convertibility to gold, ushering in the era of unbacked fiat currency.

In the next stage of money, value came from sovereign credibility rather than material scarcity. The US dollar has value because the US government says so, and because markets and foreign governments believe it. Trust shifted from being physically backed to being supported by politics and policy.

Such a profound transformation gave nations powerful tools. Monetary policy became a core lever for economic management and grand geopolitical strategy. But fiat currency also brought vulnerabilities such as inflation, currency wars, and capital controls. In some cases, flexibility and stability are at odds. Today, the core issue surrounding most modern monetary constructs is not who can create money, but whether those in power are trustworthy and can maintain its value and utility over the long term.

The Digital Representation of Money

The rise of computers and the consumer internet posed an important question at the intersection of electrical engineering and finance: Can money be represented digitally in the digital world?

Projects like Mondex, Digicash, and eGold were early attempts at this question in the 1990s and early 2000s. They promised new ways to make electronic payments and store value. Ultimately, these projects failed due to regulatory pressure, technical flaws, and a lack of trust and product-market fit.

Meanwhile, electronic banking, credit cards, payment networks, and settlement systems became widespread. Importantly, these were not new assets. They were new representations of fiat currency, more scalable and better suited to the modern world. But they still followed the same institutional trust and policy frameworks, and crucially, relied on closed technological systems and operational networks run by rent-seeking intermediaries.

The Rise of Stablecoins

Stablecoins leveraged this dynamic but shifted power away from corporations by using open, permissionless infrastructure. Fiat-backed stablecoins are hybrid by design. They inherit the credibility and efficiency of fiat currency while leveraging programmability and global accessibility.

By pegging stablecoins to reserve assets redeemable at face value, they maintain predictable value by borrowing the credibility of sovereign nations like the United States. Issuing them on public blockchains enables instant settlement, 24/7 operation, and frictionless cross-border transfers.

We believe that the emerging regulatory framework for stablecoins (an inherent component of their “moneyness” today) should align with our core principles regarding how stablecoins should serve users:

- Permissionless: Individuals should control their own digital assets without burdensome account restrictions arbitrarily imposed by intermediaries.

- Borderless: Geography should not determine whether someone can pay or get paid, nor should it dictate the time required to send or receive payments.

- Privacy: Consumers should be free to participate in commerce without fear of unwarranted surveillance by governments, the private sector, or other consumers.

- Credibly Neutral: Global capital flows should be free from discrimination, allowing people from all backgrounds to save and spend dollars as they wish.

Conclusion

Stablecoins are the next step in the evolution of money. Like traditional fiat currencies, they rely on sovereign credibility, but unlike the electronic forms of fiat currency that preceded stablecoins, they separate trust in sovereignty from trust in corporate power. The best monetary assets are built upon the best monetary technologies and networks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens