Ozak AI: Can AI-Driven DePIN Outpace Ethereum’s 5-Year Growth in 6 Months?

- Ethereum delivered 243% total return (60.84% annualized) from 2020-2025 despite 2022 crash, driven by DeFi and smart contract adoption. - Ozak AI challenges Ethereum with AI-DePIN model, offering 200x-560x ROI potential through ARIMA analytics and decentralized infrastructure. - OZ token presale shows 400% growth to $0.005, with projections reaching $1 by 2026, outpacing Ethereum's 5-year growth by 16x. - Ozak AI's energy-efficient DePIN and financial analytics focus position it as a high-velocity altern

Ethereum’s five-year journey from 2020 to 2025 has been nothing short of transformative. Despite market turbulence—such as the 2022 crash that saw its price plummet to $1,577.45—the network’s resilience and innovations like the Ethereum Merge have driven a 243% total return over five years, translating to an annualized 60.84% growth. For a $10,000 investment, this means a $24,600 return by August 2025. Yet, as the crypto landscape evolves, a new contender, Ozak AI, is challenging the status quo with a bold proposition: a potential for extraordinary gains.

The Ethereum Benchmark: A Legacy of Resilience

Ethereum’s growth has been fueled by its role as the backbone of decentralized finance (DeFi) and smart contracts. From a 423.5% surge in 2020 to a 436.3% spike in 2021, Ethereum’s performance reflects its adoption as a programmable blockchain. However, its 5-year growth, while impressive, is now compared against the hypergrowth potential of AI-driven projects like Ozak AI.

Ozak AI: The AI-DePIN Disruption

Ozak AI’s core strategy and technological architecture position it as a high-velocity alternative to traditional blockchains. Early investors have already seen substantial returns, with the price now at $0.005 in stage four. Projections suggest a significant price increase by 2026, highlighting a notable contrast to Ethereum’s annualized growth.

What drives this potential? Ozak AI’s decentralized infrastructure integrates AI-powered predictive analytics, leveraging ARIMA models to forecast market trends with precision. Unlike Ethereum’s energy-intensive consensus mechanisms, Ozak AI’s DePIN (Decentralized Physical Infrastructure Network) optimizes resource allocation and reduces latency, enabling real-time data processing. Strategic partnerships with firms like SINT and Hive Intel further amplify its utility in financial market analysis and trading signals.

High-Velocity ROI: A Feasible Target?

The math is compelling. If OZ reaches a higher price by 2026, an investor who buys at current rates could see significant multiples in return over the coming months. This outpaces Ethereum’s five-year growth by a wide margin. The key differentiator lies in Ozak AI’s niche focus: AI-driven analytics for financial markets, a sector projected to grow annually. By solving real-world problems—such as optimizing trading strategies and reducing market inefficiencies—OZ’s utility could drive demand far beyond speculative hype.

Risks and Realism

Critics may argue that Ozak AI’s projections are overly optimistic. The project has already attracted significant investment and token sales, but it lacks the institutional adoption of Ethereum. However, its CertiK audit and transparent roadmap mitigate security concerns. Moreover, the AI-DePIN model’s scalability and lower energy costs could attract enterprises seeking efficient data solutions, creating a flywheel effect.

Conclusion: A New Era of ROI

While Ethereum’s growth is a testament to blockchain’s foundational potential, Ozak AI represents the next phase: AI-integrated infrastructure that accelerates value creation. By combining DePIN’s decentralized efficiency with ARIMA-driven analytics, Ozak AI is not just competing with Ethereum—it’s redefining the timeline for ROI. For investors seeking exponential returns, the question isn’t whether Ethereum’s growth can be outpaced, but how quickly Ozak AI will close the gap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Eyes Cross-Border Crypto Pump-and-Dump Enforcement, Could Include Bitcoin Cases

Michael Saylor’s Net Worth May Be Linked to MicroStrategy Stock Gains and Large Bitcoin Holdings

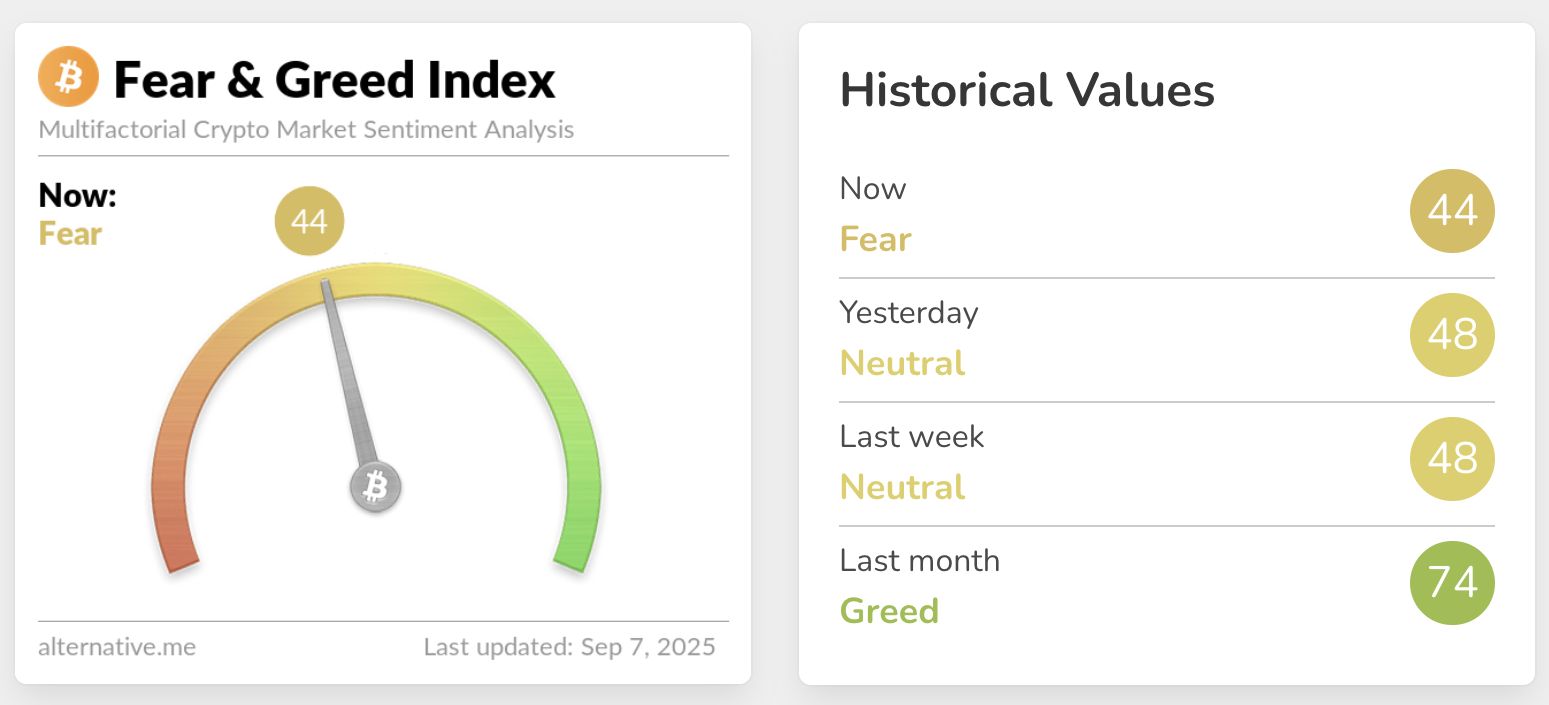

Traders Weigh Which Major Asset May Lead Next Move as Bitcoin Remains Indecisive and Sentiment Cools

Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels