Blockchain Could Make the Philippine Budget Unbreakable and Unignorable

- Philippine Senator Bam Aquino proposes storing the national budget on blockchain to enhance transparency and accountability in government spending. - The initiative builds on BayaniChain's existing system using Polygon's PoS network to record budget documents like SAROs and NCAs on a public blockchain. - Global trends see nations like the U.S., Vietnam, and India adopting blockchain for tamper-proof governance, with the Philippines aiming to become Asia's blockchain capital. - Success depends on legislat

Philippine Senator Bam Aquino has proposed a legislative initiative to store the country’s national budget on a blockchain to enhance transparency and accountability in government spending. Speaking at the Manila Tech Summit 2025, Aquino emphasized how blockchain-based budgeting could make every peso’s allocation visible to the public. He highlighted that the measure would integrate the government’s budget and transactions into a blockchain platform, a move he described as a potential first in the world [1]. The senator plans to file the bill within weeks, though no formal proposal has been submitted at the time of reporting [2].

The initiative builds upon the Department of Budget and Management's (DBM) existing blockchain-based system, which already records select financial documents. Known as BayaniChain, the local infrastructure firm behind the DBM’s blockchain platform, has developed a system where key budget documents, such as Special Allotment Release Orders (SAROs) and Notices of Cash Allocation (NCAs), are published and verified on a public blockchain [2]. This system uses Polygon’s Proof-of-Stake network as its consensus and transparency layer, offering a scalable and secure framework for on-chain budget management. Paul Soliman, CEO of BayaniChain, stated that while the technology is not a complete solution to corruption, it creates an immutable record that ensures accountability from government officials.

Aquino’s proposal aligns with a growing global trend of government agencies exploring blockchain for transparency and fraud prevention. In July, the Philippine government launched a blockchain-based document validation system on the Polygon network, despite a partial outage on the same day. The initiative was spearheaded by the Blockchain Council of the Philippines (BCP), which has partnered with the Department of Information and Communications Technology since 2023 to drive local blockchain adoption. BCP founder Donald Lim expressed confidence that the Philippines could emerge as the blockchain capital of Asia [1].

Meanwhile, similar initiatives are gaining traction internationally. The U.S. Department of Commerce has announced plans to publish economic data, including GDP figures, on a blockchain. The initiative, which is part of broader efforts to modernize data infrastructure, aims to provide a tamper-proof record of official statistics. Officials from the Bureau of Economic Analysis (BEA) and the National Institute of Standards and Technology (NIST) have cited the immutability and transparency of blockchain as key advantages for government data integrity [4]. The U.S. is not the only nation advancing such measures—Vietnam recently launched a national blockchain platform to verify digital transactions, while India has digitized land records on the Avalanche blockchain [1].

In the Philippines, the push for on-chain governance is supported by both public and private stakeholders. Local media and technology experts have welcomed the initiative, viewing it as a significant step toward reducing corruption and increasing public trust in government operations. However, the success of the proposal will depend on legislative support and the technical feasibility of scaling existing blockchain systems to handle the full national budget. With the potential to make the Philippines a global leader in blockchain-based governance, the proposed measure could also serve as a model for other countries seeking to leverage decentralized technologies for transparency and accountability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Are bubble fears warranted as AI tokens slide deeper after a ‘key divergence?’

Spot Bitcoin ETF Outflows Impact Market Dynamics

How the Best New Meme Coins Change Hands: Apeing Steps Forward While Bonk Stays Steady and Floki Wobbles

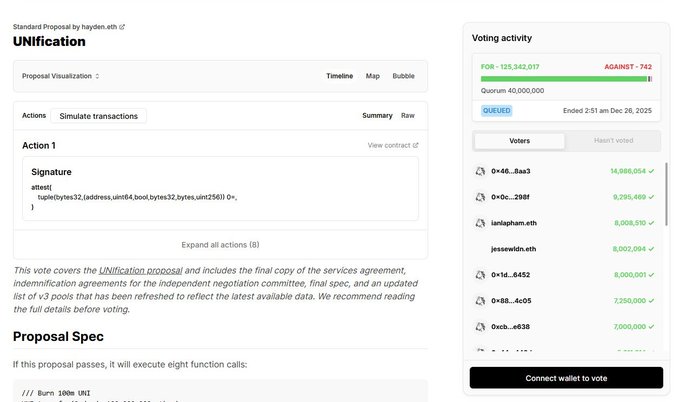

Uniswap’s fee switch goes live – Will UNI’s price head to $8.4 or $4.5?