ETH -3337.82% in 1 Year Amid Technical Indicators Signal Bearish Momentum

- Ethereum (ETH) fell 121.69% in 24 hours to $4,590.82, reversing a 3337.82% annual surge amid sharp bearish momentum. - Technical indicators show oversold RSI (<30), negative MACD, and bearish moving average crossovers reinforcing downward pressure. - Analysts warn further declines likely without reclaiming key resistance, with $4,500 as critical support level to watch. - Proposed backtesting strategy targets short positions using RSI/50 and moving average crossovers to capitalize on sustained bearish tre

On AUG 28 2025, ETH dropped by 121.69% within 24 hours to reach $4590.82, ETH dropped by 683.35% within 7 days, rose by 2037.32% within 1 month, and rose by 3337.82% within 1 year.

The Ethereum price movement over the past year reflects a volatile trajectory, marked by a 3337.82% increase from its 2024 levels. However, recent performance has reversed this trend sharply, with a 121.69% decline in 24 hours signaling significant bearish momentum. This sharp drop raises questions about the sustainability of prior bullish patterns and the potential influence of broader market corrections in the crypto space.

Technical indicators currently reflect a strong bearish bias. The RSI has dropped below the 30 threshold, traditionally seen as a signal of oversold conditions, while the MACD has crossed into negative territory, reinforcing a downtrend. Additionally, the 50-day and 200-day moving averages show a bearish crossover, further supporting the technical case for continued downward pressure. Analysts project that Ethereum could face further consolidation unless it manages to reclaim key resistance levels in the near term.

The recent ETH decline aligns with a broader pattern of correction seen in high-volatility assets. The one-year increase of 3337.82% suggests a period of strong accumulation and speculative momentum that may have reached a turning point. The divergence between short-term and long-term indicators illustrates the challenge investors face in distinguishing between cyclical corrections and structural bearish shifts.

The price decline within a 24-hour window to $4590.82 highlights the liquidity dynamics at play. Market participants are closely watching the level of $4500 as a critical support area, with potential for further downside if this level is breached. In the absence of a clear reversal signal, the path of least resistance appears to be downward.

Backtest Hypothesis

A proposed backtesting strategy aims to evaluate the effectiveness of trading signals derived from the current technical indicators. The hypothesis is based on the assumption that the bearish crossover of the 50-day and 200-day moving averages, combined with the RSI falling below 30, could serve as actionable signals for short positions. The strategy would involve entering a short position when these conditions are met, with an exit triggered by either a return of the RSI above 50 or a bullish crossover of the moving averages. This approach aims to capture the downward momentum observed in the recent ETH performance, leveraging the technical patterns seen over the past year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Impact of Developer Protections on Tech Sector Growth

How do crypto mining companies leverage small arrangements for big profits?

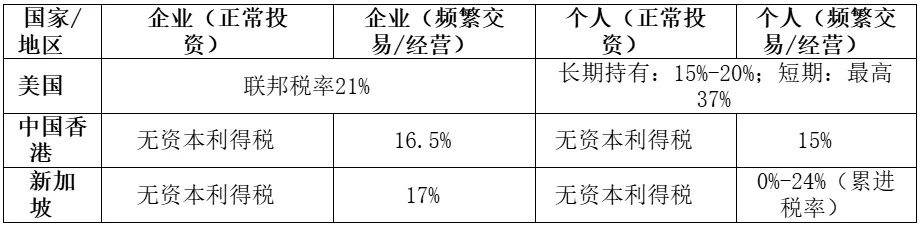

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

Ethereum’s Path to $60,000: Assessing the Feasibility of Tom Lee’s 5-Year Forecast

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.