Bitcoin's Price Volatility and Institutional Influence: Is $100,000 a Looming Threshold?

- Bitcoin's 2025 price near $111,000 reflects institutional adoption (59% of portfolios) and structural supply constraints from corporate BTC accumulation. - Institutional infrastructure (ETFs, custody solutions) and $118B ETF inflows have reduced volatility by 75% since mid-2025. - $100,000 threshold gains significance as regulatory clarity (CLARITY Act) and macroeconomic factors (U.S. debt) reinforce Bitcoin's store-of-value narrative. - Institutional buyers control 18% of supply with 10.4% increased lon

Bitcoin’s journey in 2025 has been defined by a paradox: heightened institutional adoption coexisting with persistent volatility. As the asset transitions from speculative curiosity to institutionalized asset class, the interplay between market sentiment and demand dynamics is reshaping its price trajectory. With Bitcoin trading near $111,000 in late August 2025, the question of whether $100,000 represents a psychological threshold—or a floor—requires a nuanced analysis of structural shifts in the market.

Institutional Adoption: A Catalyst for Stability and Growth

Institutional investors have become the cornerstone of Bitcoin’s maturation. By Q2 2025, 59% of institutional portfolios included digital assets, often at 10% or more, driven by regulated products like BlackRock’s iShares Bitcoin Trust (IBIT), which amassed $18 billion in assets under management by Q1 2025 [1]. This adoption is underpinned by infrastructure advancements, including secure custody solutions and the approval of U.S. spot Bitcoin ETFs, which have normalized Bitcoin’s role in conservative portfolios [1].

The supply-demand imbalance further amplifies institutional influence. Corporate entities, led by MicroStrategy’s accumulation of 632,457 BTC (valued at $71 billion), have created a structural scarcity. Institutional withdrawals now exceed daily mining production by a significant margin, tightening liquidity and reinforcing price resilience [1]. Meanwhile, ETFs control 6% of Bitcoin’s total supply, with inflows surging to $118 billion by August 2025 [2].

Volatility and Sentiment: A Tug-of-War

Despite institutionalization, Bitcoin’s volatility remains a defining feature. In 2025, its average volatility of 32.9%—moderately correlated with U.S. stocks (0.39)—reflects its dual identity as a high-beta asset and a hedge against fiat debasement [2]. However, realized volatility has dropped by 75% from historical levels by mid-2025, attributed to deeper liquidity and institutional participation [1].

Market sentiment has shifted from retail-driven speculation to institutional-led consolidation. On-chain metrics like SOPR (Spent Output Profit Ratio) neutrality and controlled profit-taking signal a market in balance, not panic [2]. Contrarian buying by large holders—controlling 23.07% of the supply—has acted as a stabilizer, even during a 28% bear market correction [2]. This dynamic suggests that institutional demand is increasingly decoupling Bitcoin’s price from short-term retail sentiment.

The $100,000 Threshold: A Psychological and Structural Hurdle

Bitcoin’s proximity to $100,000 raises questions about its role as a psychological benchmark. While the asset has already breached $109,000 earlier in 2025, its ability to sustain above $100,000 depends on macroeconomic and regulatory tailwinds. The U.S. federal debt reaching $36.2 trillion and the inclusion of Bitcoin in 401(k) accounts have bolstered its appeal as a store of value [1]. Regulatory clarity, such as the CLARITY Act, has further legitimized institutional participation, unlocking access to an $8.9 trillion capital pool [2].

Analysts like Tiger Research project a Q3 2025 price target of $190,000, driven by record global liquidity and structural adoption [2]. However, the $100,000 level may serve as a short-term consolidation point rather than a ceiling. With institutional buyers controlling 18% of the supply and long-term holders increasing their stakes by 10.4%, the market is primed for a bullish phase—if macroeconomic stability persists [2].

Conclusion: Balancing Optimism and Caution

Bitcoin’s 2025 narrative is one of institutional empowerment and volatility moderation. While the $100,000 threshold is a symbolic milestone, its significance lies in the broader structural forces at play: regulatory tailwinds, supply-side constraints, and a shift toward institutional-led markets. For investors, the key is to balance optimism about Bitcoin’s long-term potential with caution against its inherent volatility. As Bitwise forecasts a 28.3% compound annual growth rate to $1.3 million by 2035, the path to $100,000 is less a question of if and more a question of how the market navigates the next phase of institutional integration [1].

Source:

[1] Institutional Bitcoin Investment: 2025 Sentiment, Trends, Market Impact

[2] 25Q3 Bitcoin Valuation Report

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (August 28)

The Impact of Developer Protections on Tech Sector Growth

How do crypto mining companies leverage small arrangements for big profits?

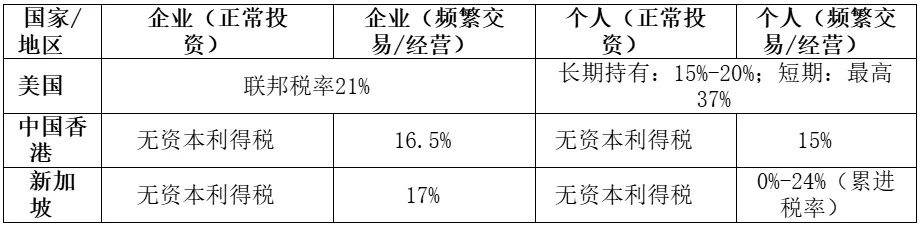

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.