Crypto News: Dollar Weaponization Is Fueling the Next Crypto Boom?

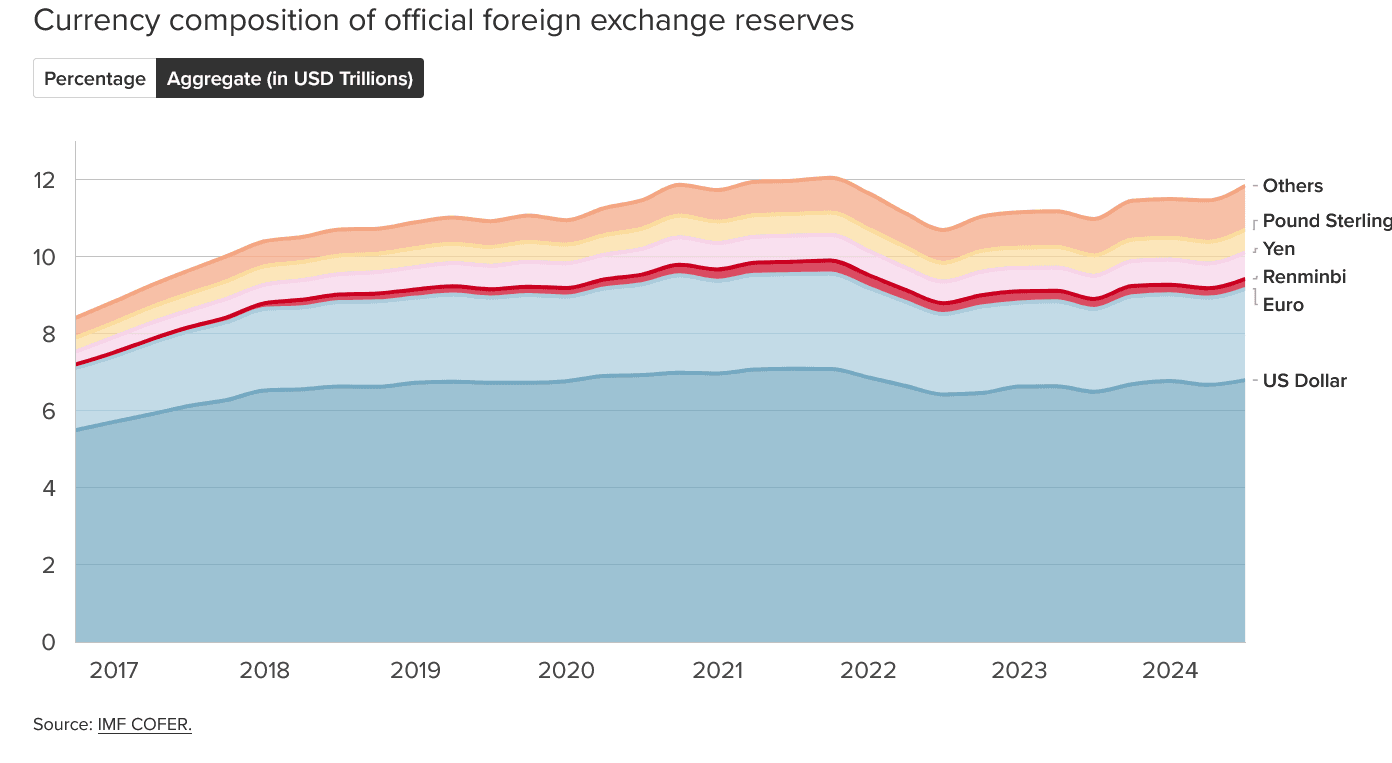

The crypto market is once again at a critical juncture, not just because of technical signals on the charts but also due to the geopolitical and monetary backdrop shaping global capital allocation. The aggressive weaponization of the U.S. dollar—through sanctions, asset freezes, and SWIFT restrictions—is no longer just a foreign policy tool; it is reshaping how central banks, investors, and even sovereign states view the dollar as a reserve asset. The aftershock is clear: diversification into gold, yuan, and increasingly, decentralized digital assets.

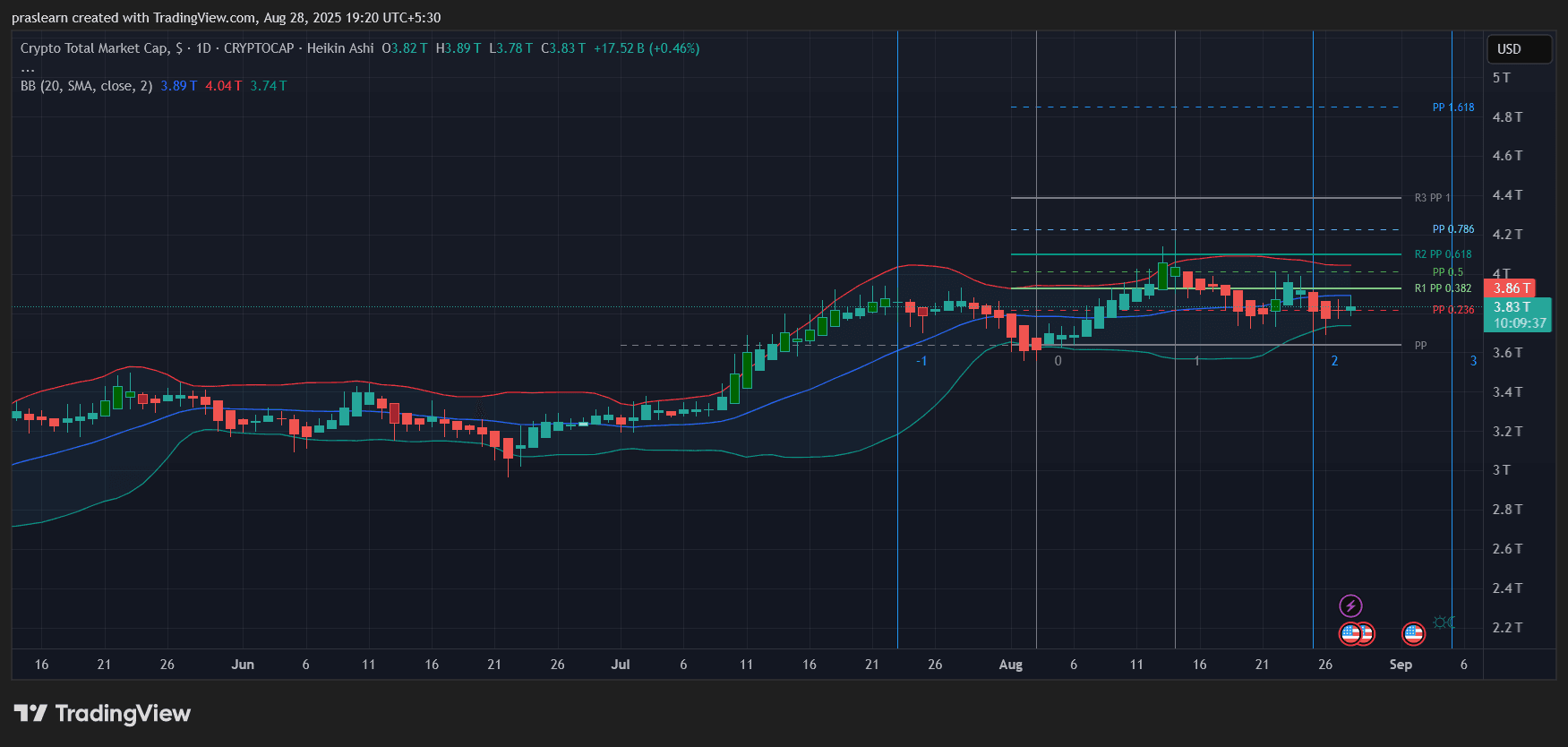

On the daily chart, total crypto market capitalization stands at $3.83 trillion, showing a narrow consolidation within the Bollinger Bands. While price has held the mid-band near $3.89T, resistance remains around the $4T zone. This technical setup is converging with a fundamental story: crypto may be entering a phase where dollar overreach acts as a tailwind.

The Mechanics of Dollar Weaponization

Dollar dominance rests on one fact: nearly all global transactions denominated in dollars eventually pass through New York settlement. That choke point gives Washington unparalleled leverage to freeze assets, sanction firms, or exclude entire nations from SWIFT. From Iran in 2012 to Russia in 2022 , the U.S. has repeatedly used this tool with devastating effect.

But here’s the thing: the very strength of this system is also its weakness. If reserve managers and corporations come to believe their assets are not safe in dollars, they will accelerate diversification. The recent survey showing 85% of central bankers now factor sanctions risk into asset allocation tells us the shift is already well underway.

Crypto News: Technical View of the Crypto Market

Total crypto market cap in USD

: TradingView

Total crypto market cap in USD

: TradingView

Looking at the daily chart:

- Bollinger Bands: Price is consolidating between $3.74T (lower band) and $4.04T (upper band). A breakout above $4T could trigger a move toward $4.2T and even $4.5T if momentum follows.

- Pivot Levels: Immediate resistance sits near R1 ($3.9T–$3.95T), with a stronger barrier at R2 ($4.1T). Support is clear around $3.7T.

- Trend Structure: After a July rally, the market pulled back but has stabilized without breaking below its mid-range. This suggests accumulation rather than exhaustion.

If the market closes above $3.9T with volume, it confirms a bullish continuation phase. A failure here risks a retest of $3.7T.

De-Dollarization and the Case for Crypto News

As more central banks diversify away from the dollar, alternatives like gold and local currency swaps gain traction. Yet, these options are limited by liquidity, convertibility, and settlement speed. That’s where crypto market comes in. Bitcoin and other digital assets offer borderless, censorship-resistant settlement outside the control of Washington or Brussels.

Gold is immovable, yuan has convertibility issues, but Bitcoin settles globally, instantly, and without central oversight. If sovereign actors increasingly view dollar reserves as vulnerable, crypto assets stand to benefit in the same diversification basket as bullion.

Forward Outlook: Can Crypto Capitalize on the Shift?

The intersection of technical signals and macro trends points to an inflection point:

Short-term (1–2 weeks): Expect sideways action between $3.7T–$4T until a decisive breakout. Traders should watch for volatility compression in the Bollinger Bands, which often precedes sharp moves.

Medium-term (1–3 months): If de-dollarization narratives strengthen and capital continues flowing into alternative assets, total crypto market cap could climb toward $4.5T.

Long-term (6–12 months): Persistent dollar weaponization may accelerate adoption of decentralized assets not tied to U.S. jurisdiction, potentially pushing crypto into a structural bull phase.

Conclusion

Dollar weaponization was meant to secure U.S. leverage in global finance, but its overuse may be setting the stage for the rise of parallel systems. The data shows gold, yuan, and regional settlement corridors absorbing the first wave of diversification—but crypto stands next in line.

With the crypto market consolidating just below the $4T mark, the technicals are hinting at a breakout. The fundamentals, meanwhile, are quietly shifting in its favor. If the dollar continues to be wielded as a weapon, crypto could increasingly become the safe haven for both retail and institutional capital.

$BTC, $Crypto

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Face a Rollercoaster: What Happened in the Past 24 Hours?

In Brief Bitcoin price dropped by 2.4%, influencing overall crypto market sentiment. The top 10 cryptocurrencies saw a general decline over the past 24 hours. Market seeks stability amid cautious investor behavior and potential short-term volatility.